This week Dhruv Bansal the co-founder of Unchained Capital, a cryptocurrency based mostly monetary services lending agency launched a analysis examine referred to as ‘Bitcoin Data Science: Hodl Waves’ half one. Bansal and his workforce analyzed the BTC community’s ledger of Unspent Transaction Outputs (UTXO) over just a few years and found how when BTC misplaced a big share of worth — transactions occurred much less as a result of of recent traders and distinct holding intervals materializing.

Also Read: Indian Exchange Takes Central Bank to Court Over Bank Ban

Unchained Capital’s ‘Hodl Wave’ Research

The money to crypto lending service Unchained Capital had analyzed the Bitcoin core (BTC) blockchain and the community’s UTXOs just a few years in the past and determined to publish the agency’s information. Blockchains use a ledger mechanism referred to as Unspent Transaction Outputs or UTXOs and this information is timestamped. This means blockchain researchers can determine when UTXOs have been final utilized in a transaction which has given the corporate a wealthy set of information all through the years.

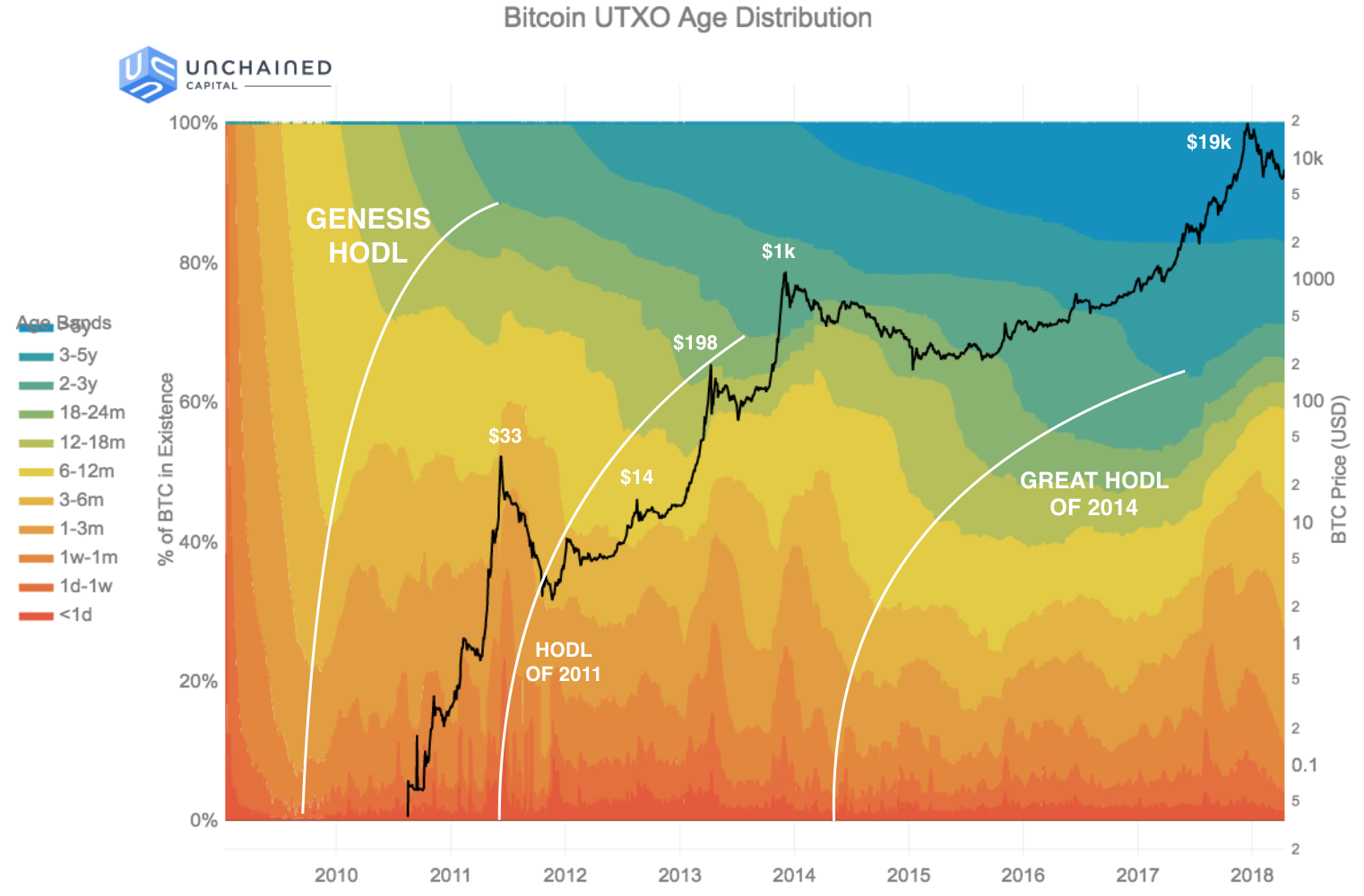

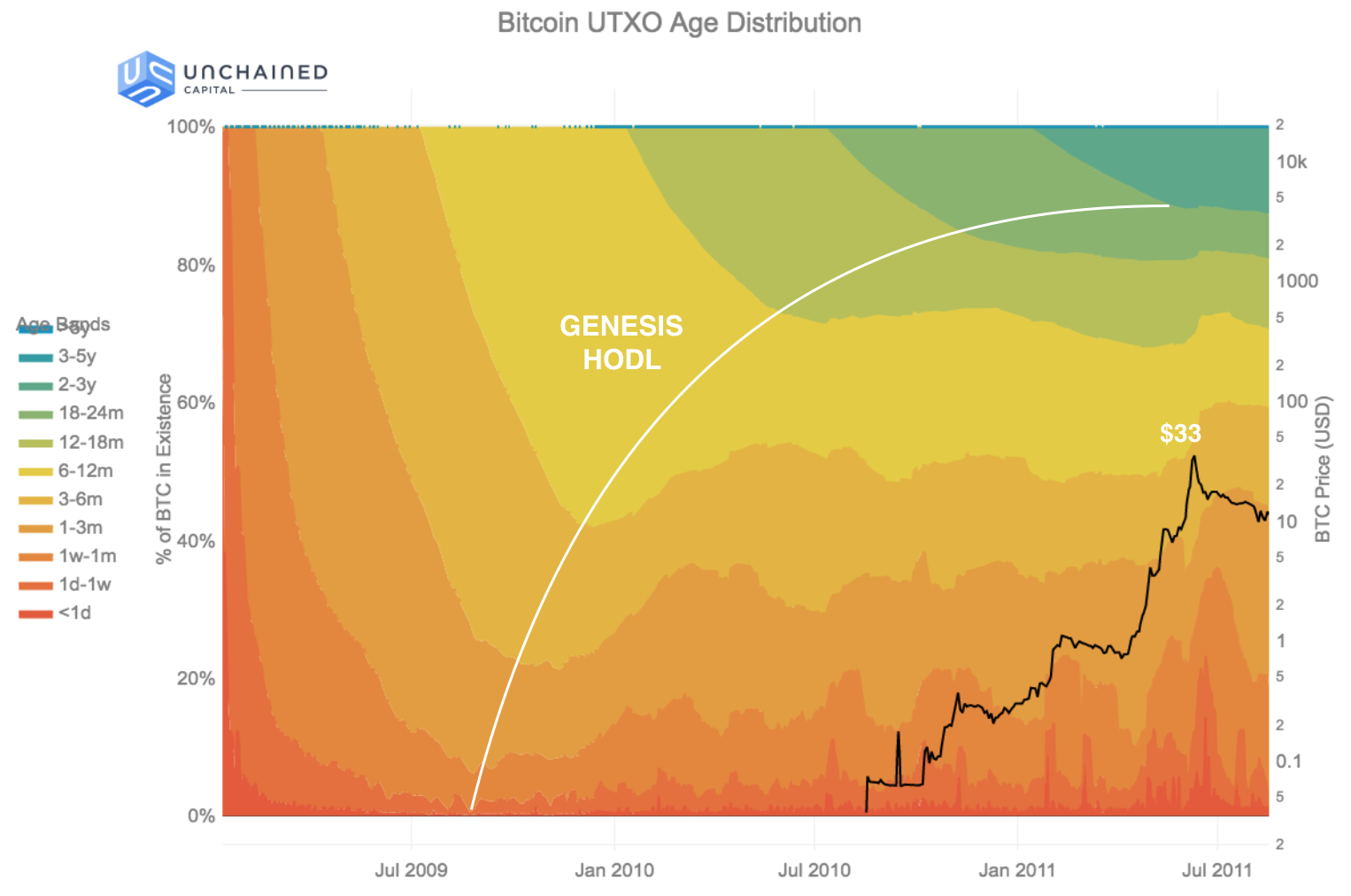

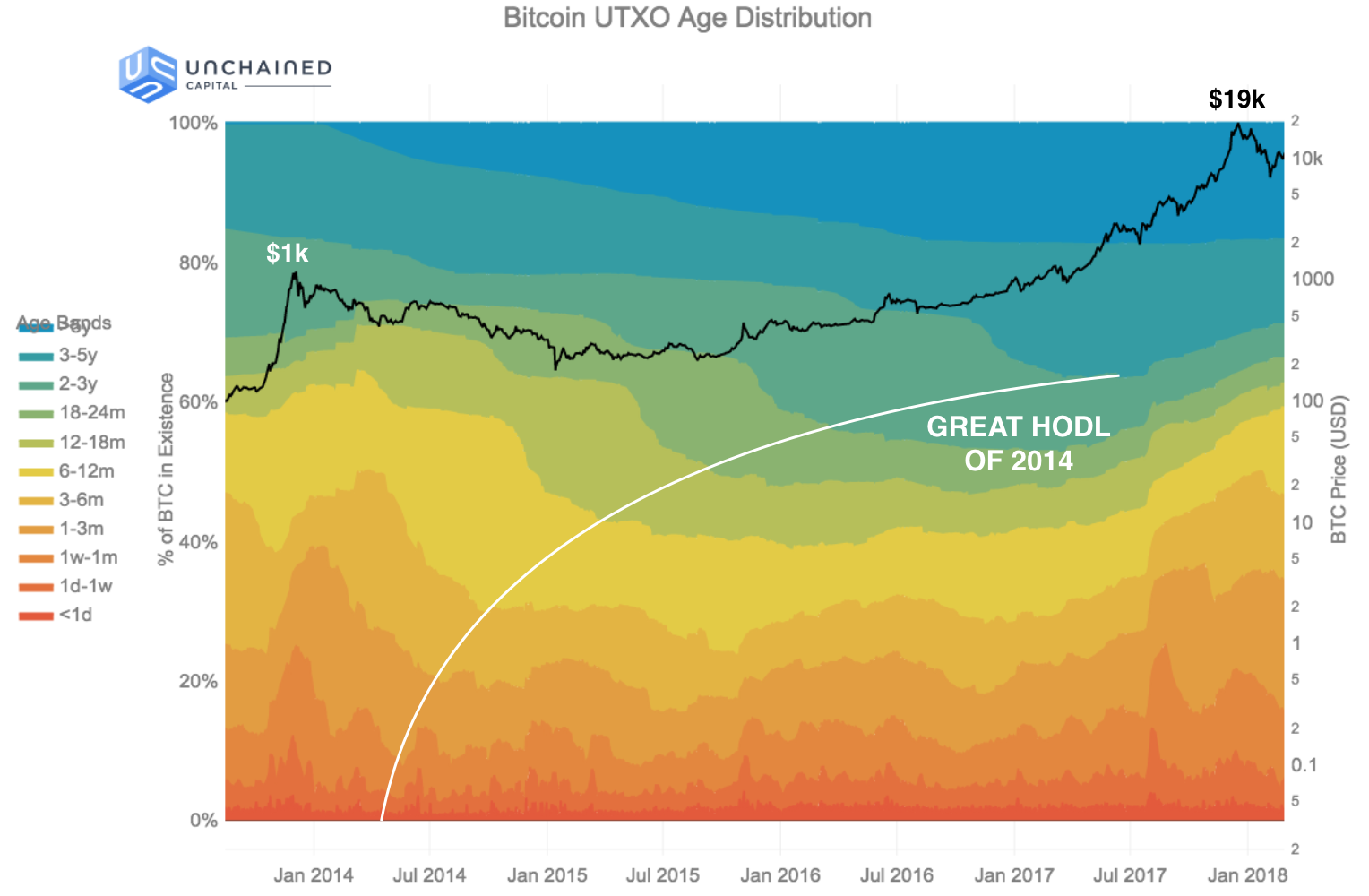

Unchained Capital created a coloured coded chart which calculates waves of age distribution throughout the digital currency’s UTXOs and their age distribution set again to the genesis block in 2009.

“This chart is fascinating because it displays the macroscopic shifts that have occurred in bitcoin’s ownership through history. Spikes in the bottom, warmer-colored age bands (<1 day, 1 day — 1 week, 1 week — 1 month) indicate large amounts of bitcoin suddenly transacting,” explains Unchained Capital’s analysis. “The steady growth of the top, color-colored age bands (2–3 years, 3–5 years, >5 years) shows bitcoin that’s not being transacted with, idling between rallies — The interaction between these two patterns illustrates the behavior of bitcoin’s investors during market cycles.”

It will not be attainable to make charts such because the one above for conventional asset courses. It’s solely bitcoin and different public blockchains that meticulously observe these information all through their complete histories. This allows post-hoc analyses of large-scale market habits.

Essentially, Bansal and his workforce discovered a sample after each rally that they name the ‘Hodl Waves.’ Unchained Capital says mainly the wave is created when a considerable amount of BTC transacts in the direction of market worth spikes, after which the UTXOs age with new house owners. The agency’s chart reveals a visible depiction of waves forming distinct patterns of curves. “[The] pattern of nested curves caused by each age band becoming suddenly much fatter (taller) at progressively later times from the rally,” Bansal states.

The Genesis Wave to the Largest Wave in Blockchain History

The first wave started in the course of the Genesis interval between January 2009 by way of June 2011, when the value was 0-$33 USD per coin. Unchained Capital says this wave was not attributable to a worth rally, however as a result of BTC had no important worth on the time. Early adopters and Satoshi held on to their cash, as a result of they weren’t value a lot for an excellent time frame.

The subsequent wave started between June 2011 ($33) to the December rally of 2013 ($1K).

“Right after the rally to $1k, more than 60% of BTC had been spent within the last 12 months. This was the most “recent” second for BTC’s cash provide in historical past — the second at which the common final time of use of a Bitcoin was lowest,” explains the examine. “Who sold? Once more, it was the investors who purchased in the prior 2–3 years, through the $33 peak and the $198 peak.”

The largest ‘Hodl Wave’ was between the 2013 rally at $1K, all the way in which to December of 2017 spike previous $19Ok. Last yr when BTC jumped to $1K per coin, near 60 % of BTC was older than twelve months. One yr later in the course of the $19Ok prime, solely 40 % of BTC was older than a yr. “During 2017, 20% of bitcoin in existence was transacted with for the first time in years,” explains the corporate. The researchers imagine the three essential causes for this impact was as a result of Bitcoin Cash onerous fork and Segregated Witness tender fork, preliminary coin choices (ICOs), and capturing good points.

At the second after the large spike and following ‘Crypto Winter’ a brand new wave is forming which reveals BTC fractions older than 12 months have dropped to 40 %.

“After every great rally, there’s been a great Hodl. As the data shows us, there is already the development of another generation of holders settling in for the long haul,” Bansal concludes.

Beginning in January 2018, the class of bitcoin which can be 6–12 months outdated rebounded from a low of seven.76% to 14.63%, a doubling of its inhabitants.

Bansal and the analysis groups’ examine has an interactive chart which reveals a much more in-depth take a look at these waves. The Unchained Capital’s analysis paper might be present in its entirety right here.

What do you consider the ‘Hodl Wave’ analysis achieved by Unchained Capital? Do you discover statistics like these fascinating? Let us know your ideas within the comments below.

Pictures through Shutterstock, and Unchained Capital’s analysis examine photos.

Do you agree with us that Bitcoin is the perfect invention since sliced bread? Thought so. That’s why we’re constructing this on-line universe revolving round something and all the things Bitcoin. We have a retailer. And a discussion board. And a on line casino, a pool and real-time worth statistics.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.