Last week’s US authorities public sale of confiscated Silk Road bitcoins has left a lingering thriller: who received the 2 greatest blocks of 27,000 and 20,000 cash?

The winners of the 2 earlier US Marshals Service (USMS) bitcoin auctions at all times wound up asserting themselves inside days of their profitable bids.

The first public sale winner was, famously, enterprise capitalist Tim Draper, who claimed all of the 30,000 bitcoins on the market. The second public sale noticed the lion’s share go to a syndicate organised by Bitcoin Investment Trust, though Draper once more picked up some cash.

The third and most up-to-date USMS public sale had three winners, however solely one in every of them has come ahead to this point. That’s New York change itBit, which claimed 3,000 coins, the smallest tranche on the public sale block.

Now blockchain-watchers consider they might have recognized a second winner, who claimed the biggest quantity of cash – 27,000 BTC – on sale.

A Cumberland Mining thriller

In following the path of the thriller winner, members of r/bitcoin unearthed a two month-old tweet from an account bearing the title ‘Cumberland Mining’ that merely listed a bitcoin address. That tackle later acquired 27,000 cash from the stockpile identified to be managed by the USMS.

The Cumberland Mining Twitter account comprises simply one tweet, however follows 5 accounts, together with Israeli change Bits of Gold, the London-based change Coinfloor and credit-card funds enabler Simplex. Its avatar is an image of the character Steve Youngblood of the comedy troupe the Upright Citizen’s Brigade.

At least two bitcoin notables amongst these following the Cumberland Mining account are Fred Ehrsam, the Coinbase co-founder, and Phil G Potter, a supervisor of the Bitfinex change.

The thriller deepens. A website that seems to belong to Cumberland Mining & Materials LLC reveals little data. The single-page web site comprises a big inventory picture of a mine trolley, and the one description of the corporate’s actions is that it gives “solutions for bitcoiners”. A contact electronic mail is listed.

A verify with Delaware’s Department of Corporations exhibits that Cumberland Mining & Materials LLC was integrated there simply over a 12 months in the past, on 25th February 2014. It is listed as being resident within the United States and it’s in ‘good standing’, in keeping with the state enterprise registrar.

Cumberland Mining has filed no annual reviews and it has paid $300 for its annual tax assessment, the standard rate the state requires from restricted legal responsibility firms. The state doesn’t require LLCs to file an annual report.

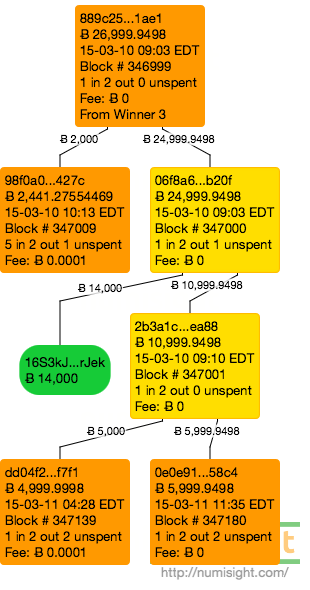

Marshals switch system

Independent analyst Danno Ferrin, who constructed a device to trace the motion of funds on the blockchain, has discovered that the Marshals Service used the identical technique for transferring cash to all three public sale winners.

The USMS acknowledged in auction instructions that cash could be transferred to winners within the sequence that their profitable bids have been acquired – first come, first served, in different phrases.

In the third public sale, the primary winner was itBit, the second winner received 20,000 BTC and the third winner – linked to Cumberland Mining – snagged 27,000 cash.

That technique, detailed on Ferrin’s Crypto Crumbs blog, exhibits the Marshals first sending a “test” transaction of zero.05 BTC to an tackle managed by a winner.

A short while later – 30 minutes within the case of the primary winner and two hours for the second winner – the total quantity of cash received is transferred to the winner’s specified tackle.

But when it got here to the third winner, believed to be Cumberland Mining, the test transaction was despatched close to the top of the workday, at four:30pm on ninth March. The Marshals then apparently left for the day, solely transferring the full amount of 27,000 cash the next day at 7:45am Eastern Daylight Time.

‘Cumberland’ cash on the transfer

According to Ferrin’s blockchain evaluation, the Cumberland Mining tackle started to “peel” cash off to be despatched to different addresses.

The winnings have been divided into three chunks of two,000 BTC, 5,000 BTC and 14,000 BTC. They have been damaged up inside hours of receiving the public sale winnings from the US Marshals.

The 2,000 BTC chunk has gone to an tackle identified to be managed by Bitfinex for buyer deposits, Ferrin advised CoinDesk in an interview.

The evaluation notes that 6,000 BTC was what remained after the three chunks have been transferred out. This sum appeared to have the take a look at transaction quantity and different transaction charges deducted from it.

Ferrin believes that the Cumberland Mining tackle was performing on behalf of a syndicate of three winners, therefore the cash being peeled off. The the rest of 6,000 BTC with the charges deducted have been held by the syndicate organiser, presumably Cumberland itself.

He wrote:

“Within three blocks transactions for 2,000 BTC, 14,000 BTC, and 5,000 BTC were peeled off of the awarded amount. The remaining sum of nearly 6,000 BTC was short the test transaction amount and the fees paid to receive the initial sum. Because of this I feel the 6,000 distribution remained with the administrator of the syndicate.”

Ferrin additionally famous that the transactions occurred in fast succession, going down in three consecutive blocks.

“It’s like he had a lineup of payments to make, or a plan of where to put the bitcoin,” Ferrin mentioned.

Ferrin cautions that whereas he stands by his principle that the large winner within the third public sale was a syndicate with as much as 4 members, together with the organiser, the transactions may additionally present a single winner sweeping cash to chilly storage and depositing a small quantity to Bitfinex.

“There is a chance that this is just one winner instead of a syndicate, but the speed with which the three transactions were peeled off and the nice round numbers make it feel like they are [transactions] to specific entities that were known prior to Tuesday,” he mentioned.

Cumberland’s skilled buying and selling hyperlinks

While little is understood about Cumberland Mining’s actions, it seems to have hyperlinks with a number of firms within the bitcoin area. Ferrin found the general public PGP keys of people with Cumberland Mining electronic mail addresses whereas looking for data on the corporate.

The keys are listed on public PGP keyservers, the place people utilizing the PGP electronic mail encryption system record and confirm their addresses.

These data additionally present that the keys have been ‘signed’, or had their identities verified, by executives within the bitcoin area. The public key for W. Eric Saraniecki, which has a cumberlandmining.com domain-name, and which is listed as a Cumberland Mining & Materials LLC consumer, has been signed by Mark Lamb, the chief government of London-based change Coinfloor. It has additionally been signed by Shaul Kfir, the chief expertise officer at Digital Asset Holdings and a former director of expertise at Bits of Golds, in keeping with Kfir’s LinkedIn profile. Mike Paleokrassas, a senior dealer at SecondMarket, can be listed among the many signatories.

Other people with Cumberland Mining electronic mail addresses seem to have histories as skilled merchants. A Cumberland tackle belongs to a person named Chadwick Miller, for instance. On Twitter, Chadwick Miller lists himself as a bitcoin fanatic, with a hyperlink to bitcoinbank.com in his profile.

In a 2012 interview with a web site referred to as Poker Tips, Miller says he labored for a “Chicago-based trading firm” after graduating from Indiana University. An particular person named Chadwick Miller from Indiana is listed as a political donor by the Center for Responsive Politics, which maintains an open database of donations. Miller lists DRW Trading Group as his employer.

Why ‘privateness hygiene’ issues

DRW Trading is the large proprietary buying and selling fund headquartered in Chicago. Its chief government Don Wilson co-founded the bitcoin agency Digital Assets Holdings final 12 months, which introduced Wall Street star Blythe Masters as its chief government yesterday.

Another signatory of Saraniecki’s public key, Joshua Charnin-Aker, has a reputation that corresponds to a ‘weather trader‘ employed at DRW Commodities. Saraniecki himself has a reputation that matches a New York-based “commodities trader” quoted in a New York Times article about shopping for property within the metropolis.

CoinDesk has contacted the e-mail listed on Cumberland Mining’s web site and the people listed on the keyserver for remark, however has acquired no response. The exception was SecondMarket, the place Brendan O’ Connor, a managing director who supervises Paleokrassas, requested a telephone name to state that the agency would not touch upon firms it might or will not be doing enterprise with.

If the cash have been received by itBit and the mysterious Cumberland Mining, what of the 20,000 BTC that has gone to an as but unnamed winner? Ferrin has no guesses, though he pressured the significance of not re-using bitcoin addresses to take care of transaction anonymity.

“This winner had excellent ‘privacy hygiene’,” he mentioned.

Image through Shutterstock

Correction: A earlier model of this text referred to as Simplex a brokerage. It truly permits digital currency firms to just accept credit score card funds.

Source link

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.

1 thought on “Secretive Mining Firm Revealed as Possible US Marshals Auction Winner”

I must say you have very interesting articles here.

Join to get latest updates on Bitcoins