Nick Szabo invented them however has reservations about what they’ve turn out to be. Vitalik Buterin adopted them however now regrets utilizing their title. Dangerous when coded badly, and highly effective when used intelligently, good contracts have turn out to be a essential part of the cryptoconomy. Their code serves as the bond that glues the tokenized ecosystem collectively. Now, simply so as to add additional complexity, the SEC has begun monitoring good contracts and their creators carefully.

Smart Contracts, Legal Liability and the SEC

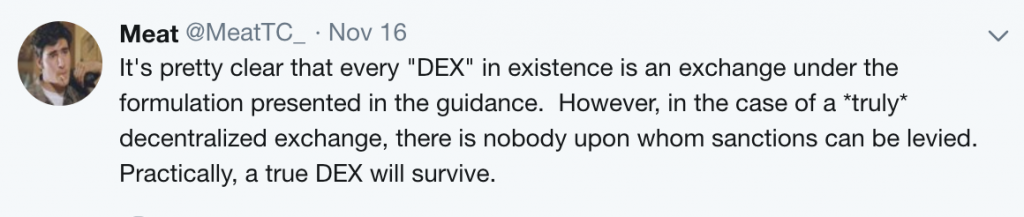

Smart contracts, defined the U.S. Securities and Exchange Commission (SEC), “provide the means for investors and market participants to find counterparties, discover prices, and trade a variety of digital asset securities.” In its Statement on Digital Asset Securities Issuance and Trading, revealed Nov. 16, the SEC referred to good contracts 5 instances, significantly in reference to Etherdelta, whose creator was prosecuted for working an unregistered securities trade that ran on good contracts he’d coded. What this ruling means for builders, shifting forwards, is a matter of some debate and nice concern.

Smart contracts, defined the U.S. Securities and Exchange Commission (SEC), “provide the means for investors and market participants to find counterparties, discover prices, and trade a variety of digital asset securities.” In its Statement on Digital Asset Securities Issuance and Trading, revealed Nov. 16, the SEC referred to good contracts 5 instances, significantly in reference to Etherdelta, whose creator was prosecuted for working an unregistered securities trade that ran on good contracts he’d coded. What this ruling means for builders, shifting forwards, is a matter of some debate and nice concern.

Code has usually been likened to free speech, with advocates adamant that builders shouldn’t be held liable for a way their code is used. In the case of Etherdelta, the prosecution of Zachary Coburn was comparatively easy, since he’d personally developed the good contracts that powered the platform. In future, nevertheless, the SEC might not make a distinction between the developer of a bit of code and the finish consumer. If the creator of a sensible contract used to facilitate decentralized buying and selling will be recognized, that particular person may conceivably be held chargeable for securities violations. As the SEC’s report notes:

An entity that gives an algorithm, run on a pc program or on a sensible contract utilizing blockchain expertise, as a method to deliver collectively or execute orders, may very well be offering a buying and selling facility. As one other instance, an entity that units execution priorities, standardizes materials phrases for digital asset securities traded on the system, or requires orders to evolve with predetermined protocols of a sensible contract, may very well be setting guidelines.

More Code Brings Greater Complexity

Morally, code is neither “good” nor “bad”; the guidelines governing the operation of a sensible contract are merely a consequence of the habits mandated by its creator. These guidelines, and their permeation into each side of the cryptoconomy, have pressured a rethink of the method cryptocurrencies and their protocols are understood. With the emergence of sidechains reminiscent of Rootstock, federated chains reminiscent of Blockstream’s Liquid Network, and cross-chain merchandise reminiscent of WBTC, the code that controls the cryptocurrency markets is turning into ever extra labyrinthine and layered.

Morally, code is neither “good” nor “bad”; the guidelines governing the operation of a sensible contract are merely a consequence of the habits mandated by its creator. These guidelines, and their permeation into each side of the cryptoconomy, have pressured a rethink of the method cryptocurrencies and their protocols are understood. With the emergence of sidechains reminiscent of Rootstock, federated chains reminiscent of Blockstream’s Liquid Network, and cross-chain merchandise reminiscent of WBTC, the code that controls the cryptocurrency markets is turning into ever extra labyrinthine and layered.

As the cryptocurrency business’s reliance on good contracts will increase, regulators are going to have some troublesome selections to make. Who needs to be held liable when an entity conducts a securities violation, for instance – the dealer, the operator of the decentralized platform or the developer who coded the good contract? Even the father of good contracts, Nick Szabo, has acknowledged that, regardless of being wholly digital, they’re in the end an settlement that mirrors a standard contract, writing: “‘Smart contract’ like ‘contract’ connotes a deal between people, but a deal intermediated and incentivized by dynamic machine-interpreted rules instead of the statically recorded human-interpreted rules of a traditional contract.”

For U.S.-based builders who want to stay free to code with out worrying about authorized liabilities, the solely resolution could also be to stay nameless. This is the strategy being favored by the group behind the forthcoming Grin cryptocurrency, which makes use of Mimblewimble privateness tech. It’s also the strategy taken by a sure S. Nakamoto 10 years in the past upon launching his cryptocurrency. The SEC can’t prosecute whom it doesn’t know.

Do you suppose good contract builders needs to be held legally liable for his or her code? Let us know in the comments part below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.