South Korea’s high monetary regulator just lately advised 23 different nations’ regulators that the kimchi premium has fizzled for the reason that nameless buying and selling of cryptocurrencies was banned within the nation. Now, the federal government is introducing a brand new guideline to forestall native crypto exchanges from shopping for cryptocurrencies at international exchanges.

Kimchi Premium Disappearing

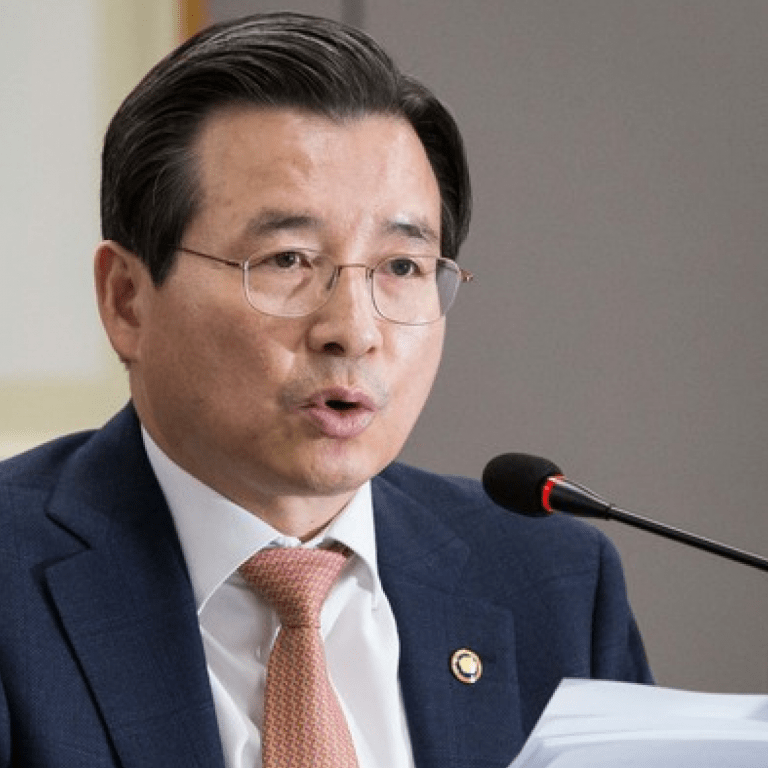

Kim Yong-beom, the vice chairman of South Korea’s high monetary regulator, the Financial Services Commission (FSC), attended a gathering of the Financial Stability Board (FSB) in Basel, Switzerland, earlier this week.

Kim Yong-beom, the vice chairman of South Korea’s high monetary regulator, the Financial Services Commission (FSC), attended a gathering of the Financial Stability Board (FSB) in Basel, Switzerland, earlier this week.

The FSB is a global physique that screens and makes suggestions concerning the world monetary system. Its members are monetary regulators and central bankers from 24 nations in addition to the International Monetary Fund, the Bank of International Settlements, the World Bank, the European Central Bank, and the European Commission.

The FSB is a global physique that screens and makes suggestions concerning the world monetary system. Its members are monetary regulators and central bankers from 24 nations in addition to the International Monetary Fund, the Bank of International Settlements, the World Bank, the European Central Bank, and the European Commission.

According to the FSC’s assertion issued this week, Kim advised different world regulators that “The so-called kimchi premium stood at 0.6 percent on June 19,” Yonhap described. In comparability, he famous that “On Jan. 7, a speculative rally in bitcoin in South Korea prompted investors to pay premiums of 46.7 percent compared with international prices.” The vice chairman was additional quoted by the information outlet:

Currently, there are small value gaps in cryptocurrency between native and worldwide markets.

At the time of this writing, the worth of BTC on Bitfinex is $5,875 whereas its received value on Bithumb equates to $5,947.

Government Believes Real-Name System is Working

The South Korean authorities launched the real-name system for cryptocurrency accounts on the finish of January, successfully “banning the use of anonymous bank accounts in transactions to prevent virtual coins from being used for money laundering and other illegal activities,” the publication described. “The real-name trading system was also part of the government’s latest measures to curb speculative investment into virtual money.”

The South Korean authorities launched the real-name system for cryptocurrency accounts on the finish of January, successfully “banning the use of anonymous bank accounts in transactions to prevent virtual coins from being used for money laundering and other illegal activities,” the publication described. “The real-name trading system was also part of the government’s latest measures to curb speculative investment into virtual money.”

However, since its introduction, the system has typically been criticised as a result of only some banks determined to supply to transform present “virtual” crypto buying and selling accounts to real-name ones. The conversion price is low and the banks that do supply this service select to solely present it to the nation’s largest crypto exchanges: Bithumb, Upbit, Coinone, and Korbit. Other exchanges proceed to make use of company accounts, which the regulators say are vulnerable to cash laundering.

Nonetheless, the FSC stated:

The frenzied shopping for of bitcoin and different cryptocurrencies seen in January this 12 months in South Korea has been fizzling for the reason that authorities banned nameless buying and selling of cryptocurrencies.

Stepping Up Monitoring

At a current P2P mortgage evaluation assembly with the Ministry of Justice and the National Police Agency, Kim identified that the real-name system “applied only to exchanges that receive virtual accounts at banks,” Hankook Ilbo reported. He added that almost all of crypto exchanges are nonetheless utilizing company accounts.

Then the FSC stated Wednesday that “it will step up monitoring of money transfers between local and foreign cryptocurrency exchanges,” the Korea Times reported, including:

The new guideline, which goals to forestall native cryptocurrency exchanges shopping for digital cash at international exchanges to launder cash, will come into pressure on July 10 for one 12 months.

The monetary regulator revealed that it plans “to closely keep tabs on bank accounts used by cryptocurrency exchanges for parking their expenses.”

What do you consider the Korean authorities’s methods? Let us know within the comments part below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.