Crypto’s newest bull run started last Friday, October 25, after a considerable plunge in rates simply days previously that had actually some prognosticators fretted about a go back to late 2018 and early 2019’s bleak crypto winter season. Since the recent spike, rates have actually held fairly consistent, recommending this rally is not simply a flash in the pan. That being the case, a take a look at bull runs of times previous and what this might indicate for the market today remains in order.

Also Read: After Breaking New Records Bakkt Announces Crypto Consumer App

What Goes Down Must Bounce Back Up, Right?

With BTC plunging practically $1,000 from October 22-24, some crypto sages were poised on their soapboxes in the Twitter town square prepared to reveal the coming cryptocalypse. As seen just recently however, rates have actually revitalized with gusto and supported around the market as a whole. 2017’s November and December mega rally was preceded by a quick plunge in rates throughout the market in simple days also, triggering some to see present conditions as a consolidation signal comparable to those times.

There is no lack of theories and speculation regarding where things might go next, or why the vibrant relocations of recently happened. Bitcoin core rates increased over $2,500 from around $7,300 to the $10,000 mark in a matter of a couple days, and other leading market cap cryptocurrencies experienced substantial favorable relocations also, and stay strong.

Past Bull Markets – Similarities and Differences

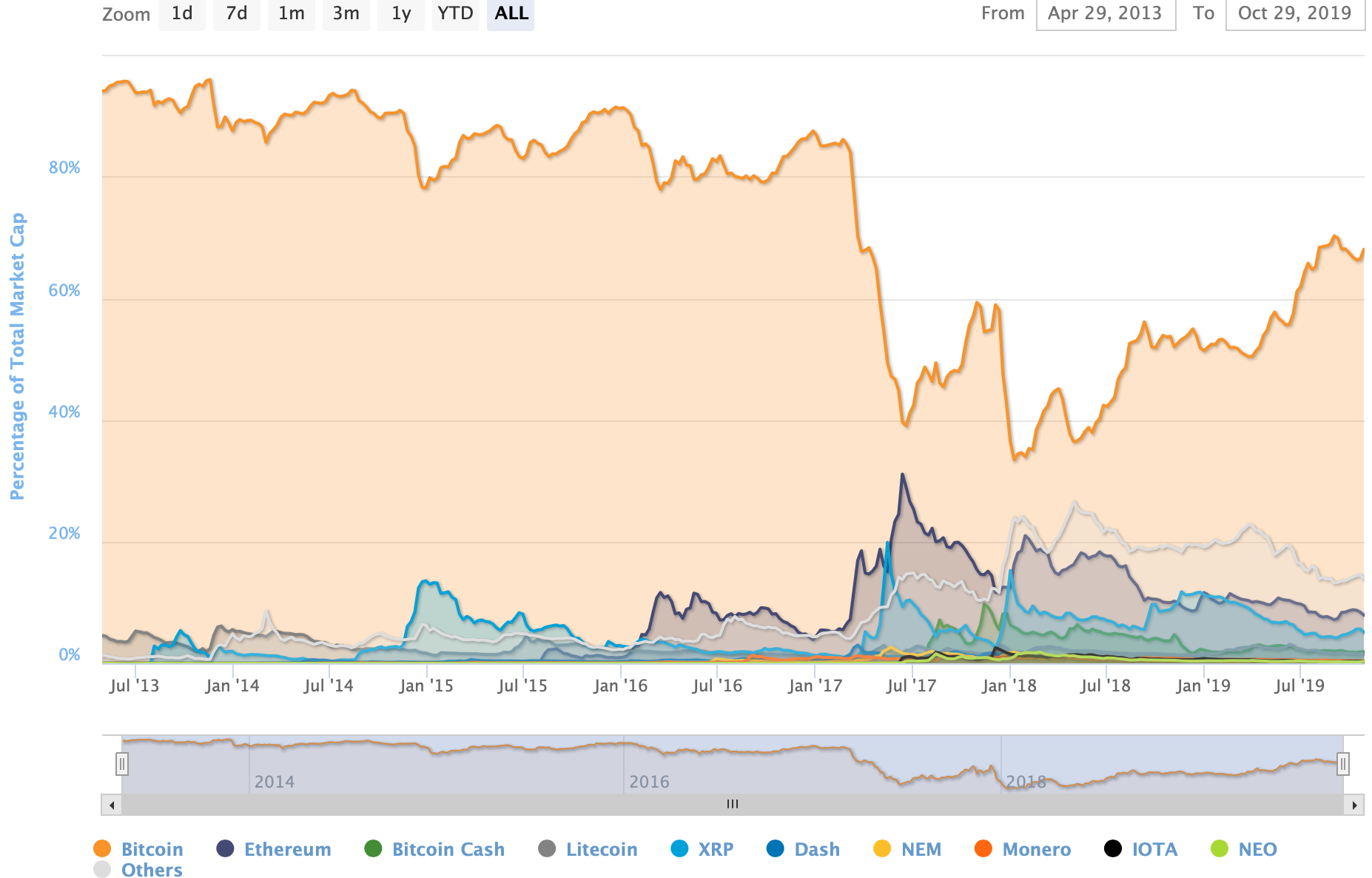

As zealous as those in the crypto video game may be to call each and every bullish signal the start of hyperbitcoinization and each small dip a stunning death knell, the markets inform a more steady and practical story from a macro viewpoint. Prices and portions of market capitalization of leading cryptos naturally follow more steady shapes, long-lasting. The variety of leading properties at the extremely leading expands where capitalization is worried, while the market as an entire narrows and ends up being more concentrated on choose properties.

If 2017’s escalate into green was a crypto-wide gamble taking everybody along for the exciting trip, recent spikes have actually been a more skilled bet, leaving legions of cleaned up altcoins out to dry. As far as hypothesized causes for the newest bull pattern goes, there are a couple of preferred descriptions – and lots of being shot down with equivalent conviction.

BTW China‘s management is anti-privacy,pro-surveillance&pro-control.Stop pretending Xi‘s speech (where #blockchain was a placeholder for any hip tech) stated “we like #bitcoin“.It insults even #CT‘s intelligence.Reason for pump was Bearish placing& #tether printing air-money 😉

— DK (@dke82) October 25, 2019

This newest rally might have been motivated by a tether printing spree, Chinese federal government recommendation of blockchain, Bakkt’s growing futures market, around the world financial catastrophe or any other number and mix of elements.

Similarities throughout bullish patterns have stars, specialists and financial experts trying to draw sound connections. For example, Bitcoin’s April 2018 rally was credited to institutional interest and “flights to decorrelation” by specialists, bearing resemblance to present speculation and forecast focusing around international financial chaos and the bitcoin futures market. Last spring and summer season saw bitcoin core leaping back to $10,000 in June, signaling a booming market that was associated by lots of, as soon as again, to a mix of tech market hubbub such as Facebook’s groundbreaking Libra statement, federal government financial policies and futures markets.

Regarding the present rally, Binance CEO Changpeng Zhao referenced favorable signals from stocks in the Chinese blockchain market, tweeting on October 28:

Those gains in stock exchange will overflow to crypto quickly… Told ours people to scale up system capability, waiting.

Also of interest to speculators is a breakaway space on the Chicago Mercantile Exchange’s (CME) futures chart following recently’s increase. Trader @TheCryptomist predicted the space would be filled prior to BTC heads back up-wards towards $12,000.

Top Performers and Future Moves

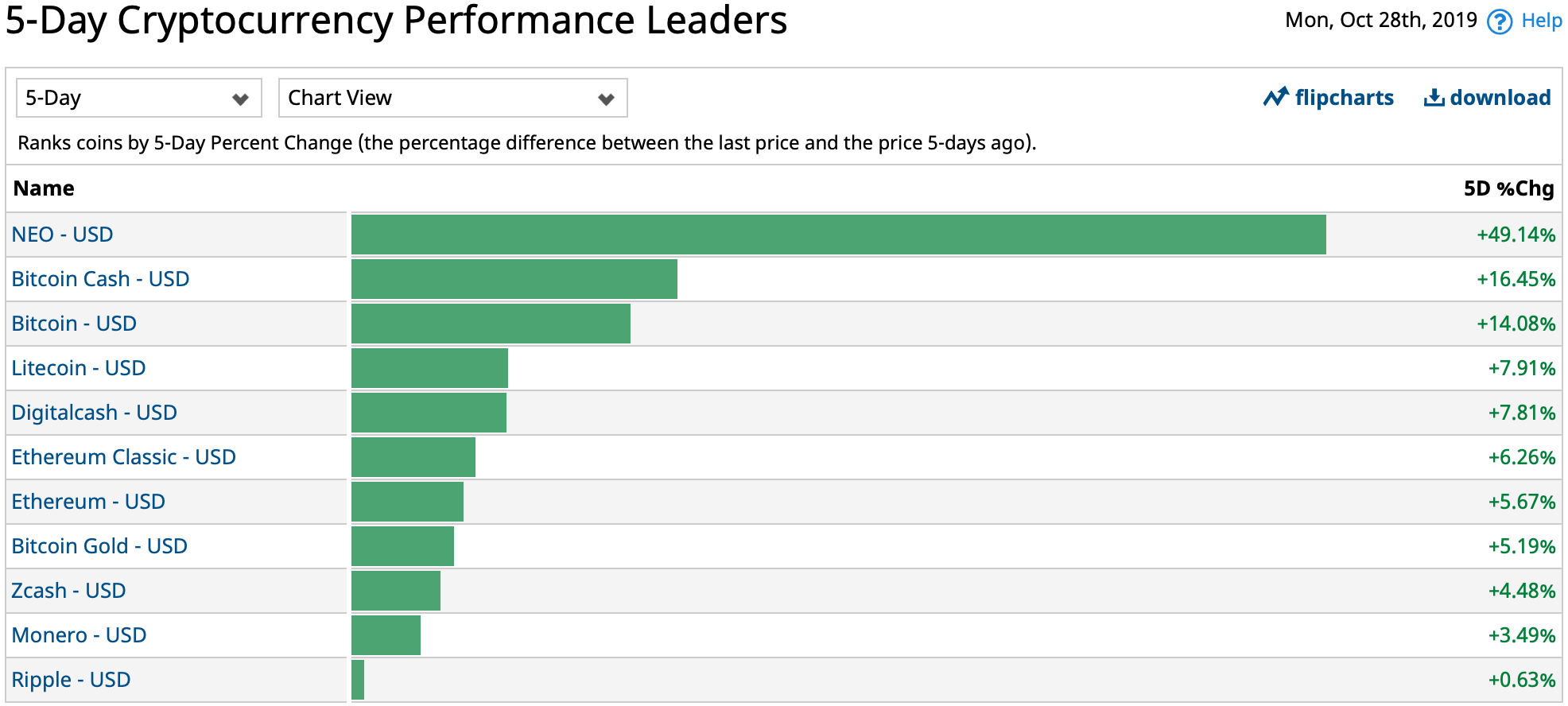

As far as rate efficiency in the context of the newest rally goes, barchart.com paints a photo of the last 5 days, with NEO, BCH and BTC leading the pack. NEO has actually seen a near 50% gain in rate, BCH over 16% and BTC 14% at press time.

If the crypto market informs us anything, it’s that no forecast or position is spiritual, no matter how vaunted the status of the speaker, or how statistically sound the projection might appear to be. Crypto speculation is constantly open up to being rushed to smithereens versus the unforgiving rocks of market truth. Still, when zoomed out far enough, even volatility can handle a calmer look. Steady development and continual interest in the crypto area is a consistent story in the meantime.

What are your ideas on the recent crypto market relocations? Let us understand in the comments area below.

Image credits: Shutterstock, reasonable usage.

Did you understand you can purchase and offer BCH independently utilizing our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitscoins.net market has thousands of individuals from all around the world trading BCH today. And if you require a bitcoin wallet to firmly save your coins, you can download one from us here.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.