CoinDesk is happy to announce the newest quarterly State of Bitcoin report, sponsored by Gem.co, a bitcoin platform for builders.

This article runs by means of some key findings from the brand new report, which focuses on occasions within the bitcoin ecosystem because the starting of 2015.

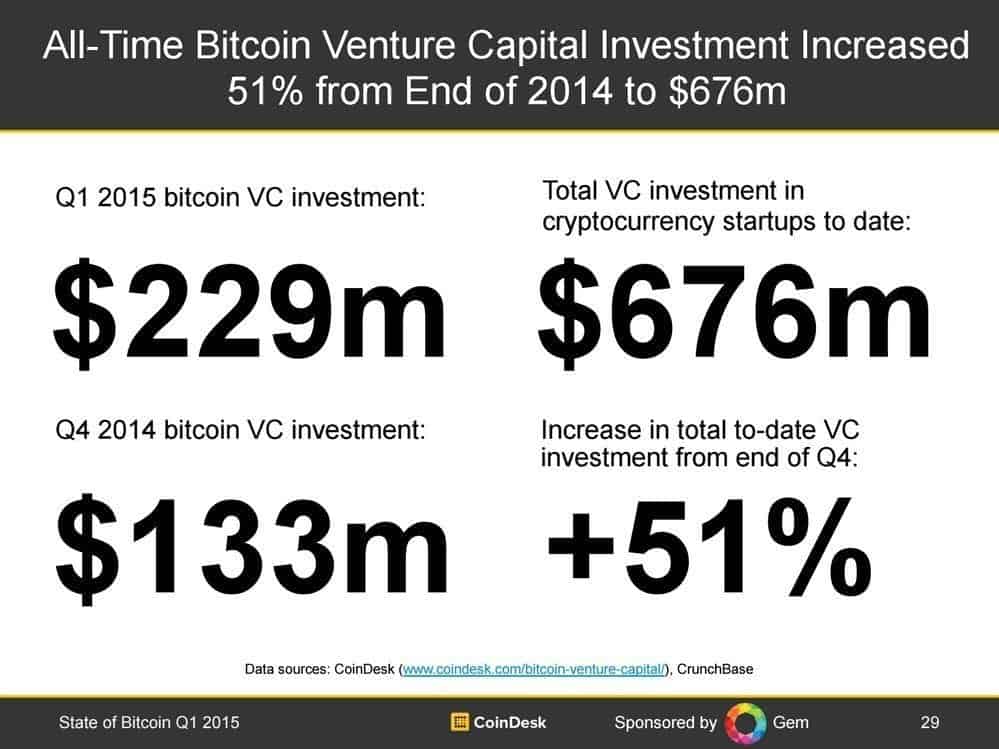

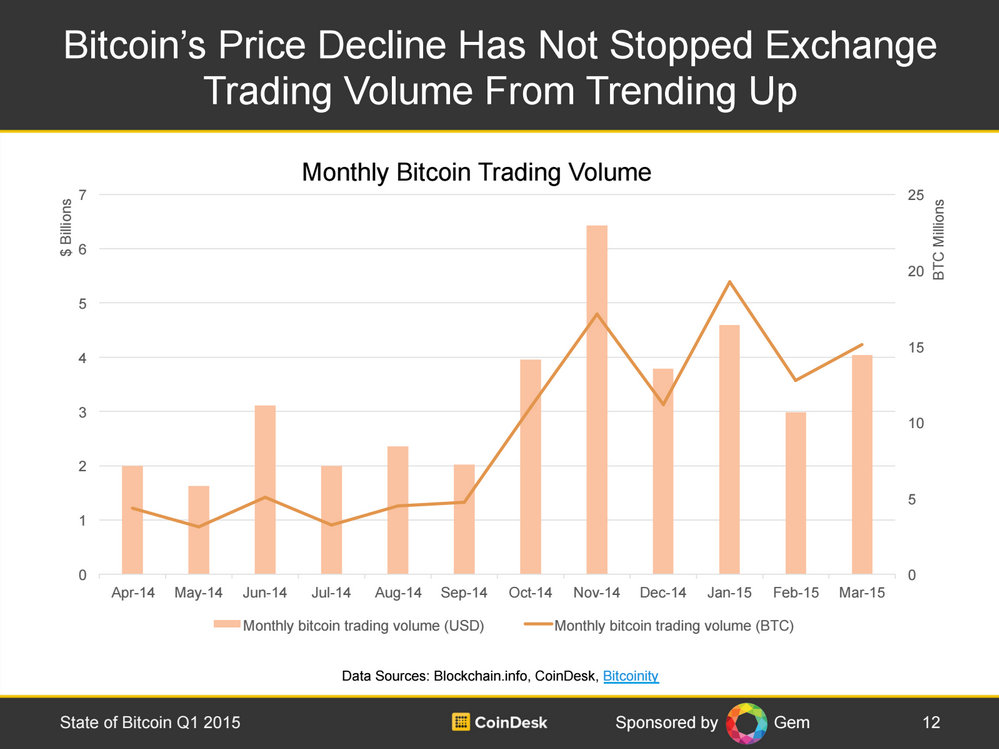

All-time bitcoin startup VC funding reaches $676m

The first quarter of 2015 noticed a record-breaking quantity of enterprise capital invested in bitcoin startups: $229m.

Q1’s deal exercise was led by 21 Inc and Coinbase, corporations that obtained $116m and $75m respectively. These are the 2 largest bitcoin funding rounds made thus far.

With a funding complete of $121m, 21 Inc has now surpassed Coinbase because the best-capitalized startup in bitcoin. However, little or no info is obtainable in regards to the agency past its affirmation that it meets the definition of a ‘common’ bitcoin firm* (Slide 27).

Since 2012, a complete of $676m (Slide 29) has been invested in bitcoin startups, with a 51% enhance from the top of 2014.

The quantity of nations that obtained VC funding additionally grew from 18 to 22 within the first quarter of 2015.

The 4 new nations are Barbados, France, Kenya and Switzerland. Remittance platform BitPesa additionally grew to become the primary bitcoin startup based mostly in Africa to obtain VC funding.

Since the beginning of our State of Bitcoin experiences, now we have aimed to quantify the well-worn assertion that ‘bitcoin is like the the early Internet’ by evaluating ranges of VC curiosity between the 2.

Our last report indicated that complete VC funding for bitcoin corporations in 2014 properly exceeded the $250m invested in first-sequence Internet startups in 1995.

Looking forward (Slide 30), this yr’s complete VC funding in bitcoin startups is at present projected to surpass the $638m invested in first-sequence Internet startups in 1996.

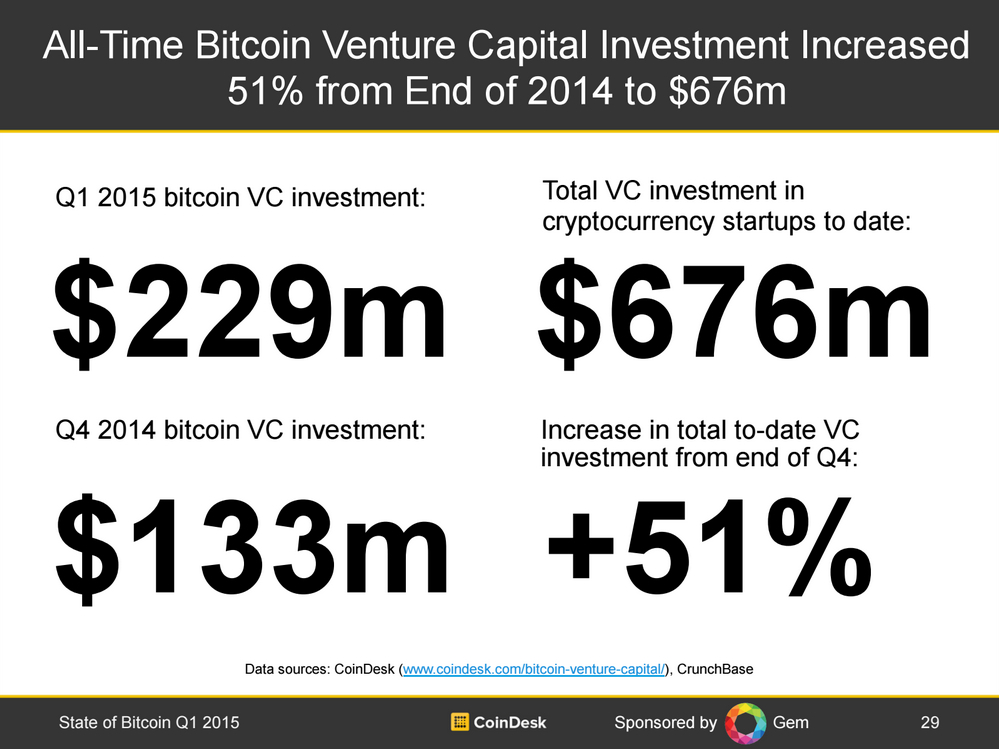

Bitcoin’s value stabilizes after rocky begin

Overall, the bitcoin ecosystem confirmed strong progress within the begin of 2015, regardless of the worth plunge within the first half of January. Bitcoin’s value shocked many by breaking under $200, thought-about to be an necessary psychological marker.

On 14th January, the CoinDesk BPI dropped to $177, and is down 24% in 2015 (Slide 11).

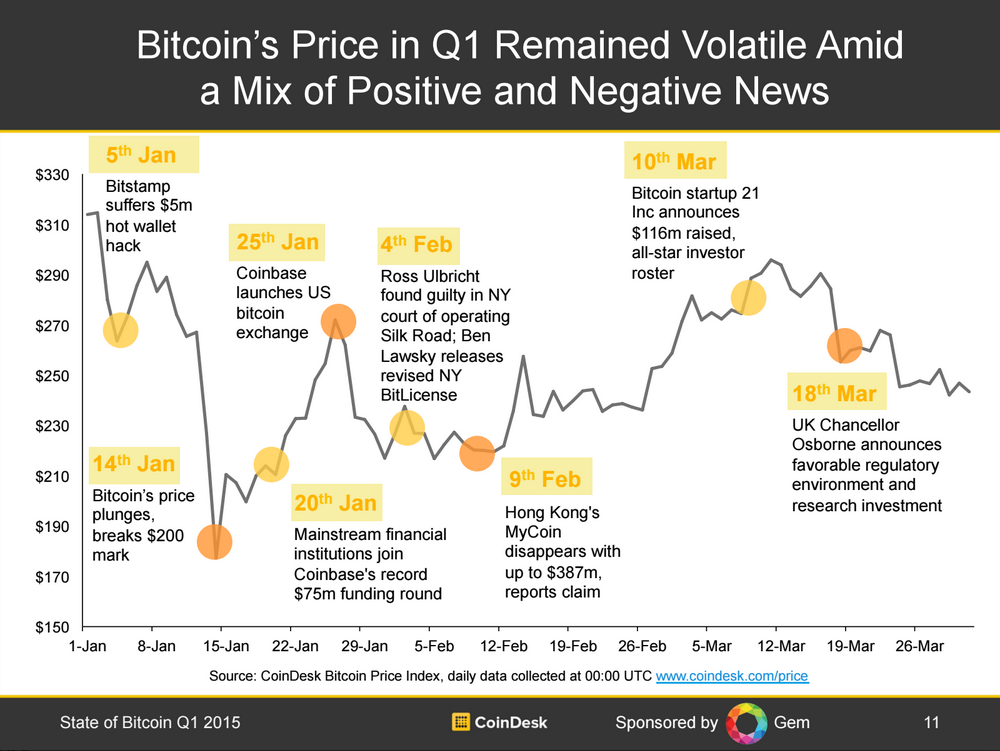

Although bitcoin noticed a big decline in the beginning of 2015, its value has since stabilized round $250. In flip, the upward development in month-to-month buying and selling quantity has not been negatively impacted by bitcoin’s value decline (Slide 12).

This may very well be a mirrored image of expanded alternatives to commerce on each bitcoin’s upward and downward volatility.

Bitcoin’s value motion seems to be attracting much less consideration. For instance, the quantity of price-related tales within the 10 hottest articles on CoinDesk has dropped considerably, from seven in Q3 2014 to solely two on this quarter (Slide 21).

Bitcoin struggles to realize mainstream shopper traction

The price of progress within the quantity of bitcoin-accepting retailers continued to taper off this quarter (Slide 47). Discussions across the slowdown of service provider adoption counsel the basic downside shouldn’t be an absence of service provider curiosity in bitcoin, however relatively the shortage of shopper adoption.

There had been 1 million new bitcoin wallets created in Q1, representing 14% progress quarter-over-quarter. The complete quantity of Blockchain wallets handed three million in February.

The tempo of pockets progress is sort of fixed over the previous yr, resulting in some concern in regards to the credibility of these numbers and questions on what number of wallets are actively used for bona fide transactions.

CoinDesk is forecasting 12 million complete bitcoin wallets by the top of 2015 (Slide 53).

Technology

The know-how underpinning bitcoin is starting to be deployed in lots of non-currency functions like property rights, smart contracts, notary services and voting.

Companies each in and outdoors these industries are looking for to know how the properties of the blockchain may assist reshape these providers and enhance effectivity (Slide 61).

A brand new update to Bitcoin Core Protocol was efficiently launched this quarter with new efficiency-enhancing options, reminiscent of a consensus library and headers-first syncing (Slide 72).

Positive indicators from Wall Street and regulators

Wall Street’s curiosity in bitcoin expanded this quarter as extra monetary providers executives moved to bitcoin startups (Slide 77).

Leading monetary institutes like Citi and UBS are additionally beginning programmes to discover the use of blockchain know-how. These developments could have bitcoin corporations safe partnerships with conventional finance.

The newest revision to the New York BitLicense laws was launched this February (Slide 80). While there have been some optimistic developments, some of the necessities are nonetheless being considered as ‘redundant and duplicative’.

The UK Treasury additionally announced a brand new cryptocurrency regulatory framework this quarter. The proposal is generally being viewed as optimistic and in-line with the UK’s hallmark ‘gentle contact’ strategy to monetary regulation.

If you discovered the 2015 State of Bitcoin report helpful, you possibly can view extra of CoinDesk’s Research Reports here.

We’d wish to thank all our readers for making CoinDesk the world’s main supply of bitcoin information, evaluation and perspective, and we welcome your feedback and concepts for our future experiences.

Sincerely, the CoinDesk group

Note: You can entry CoinDesk’s full spreadsheet of all bitcoin enterprise capital offers here.

Disclaimer: This article shouldn’t be considered as monetary recommendation or an funding suggestion. Please do your individual intensive analysis earlier than making funding selections.

* A pure-play bitcoin startup is primarily centered on one specific operate, reminiscent of serving as a pockets or alternate. A common bitcoin startup fulfils a number of parts of the bitcoin worth chain. For instance, Coinbase is all of the next: a pockets, cost processor, alternate, and subsequently meets the definition of a common.

Source link

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.