New data suggests that many financial professionals believe their industry is being reshaped by blockchain technology.

A survey conducted by market intelligence provider Greenwich Associates shows that a number of financial institutions are actively reviewing solutions using distributed ledgers.

Few respondents indicated that their institutions were actively deploying blockchains at this time. Seventeen percent of 92 survey-takers said that they are “currently using” some form of implementation. Yet more could begin utilizing the technology in the near future – of 87 respondents, 47% said that they were “reviewing” the option.

The survey, entitled “Bitcoin, the Blockchain and Their Impact on Institutional Capital Markets”, included feedback from 102 individuals with focuses on areas like exchange, consulting, financial tech and buy-side and sell-side investments. The interviews were conducted in May and June.

Of those, 84% were based in the Americas, with 11% and 5% based in Europe and Asia, respectively. Many questions included in the survey only garnered data from a portion of the field.

Easing settlement pain

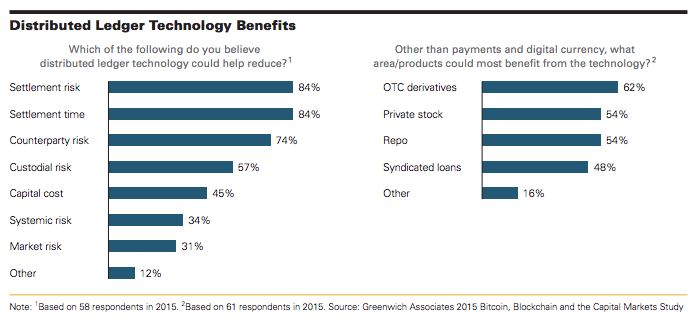

When asked about the problems the technology could be used to alleviate, settlement risk and time were most cited.

Respondents also indicated that counterparty risk and custodial risk could also be reduced through the use of distributed ledgers.

The data suggests that bitcoin and the blockchain are on the radar of many in financial circles. Ninety-one percent of respondents said they were aware of bitcoin, with 70% stating their familiarity with distributed ledger tech more broadly.

Little love for bitcoin

It appears that a number of respondents don’t have much interest in bitcoin itself.

Fifty-six of those in the survey pool indicated more familiarity with specifics startups in the space, naming Digital Asset Holdings (27%), Ripple Labs (25%) and Coinbase (23%) over “bitcoin” (16%).

The report authors state that, for Wall Street, the underlying distributed ledger seems to hold the biggest draw rather than bitcoin the currency.

“It is not Bitcoin itself that has the potential for changing the institutional capital markets, however. The blockchain, the technology that allows bitcoin to exist and be transferred safely without an intermediary, presents a much bigger opportunity for financial services firms.”

New York via Shutterstock

BanksBlockchain TechnologyResearchWall Street

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.