Tether Holdings, the company that provides tether (USDT), has plans to introduce an overseas Chinese yuan stablecoin called CNHT. Tether’s digital dollar existence within the crypto economy has actually been huge in current months, seeing considerable need from China. Bitfinex shareholder Zhao Dong has actually described in a current interview that Tether is also preparing to launch stablecoins backed by bulk products like gold, rubber, and petroleum.

Tether Dominance in the East and Plans for a Digital Yuan Called CNHT

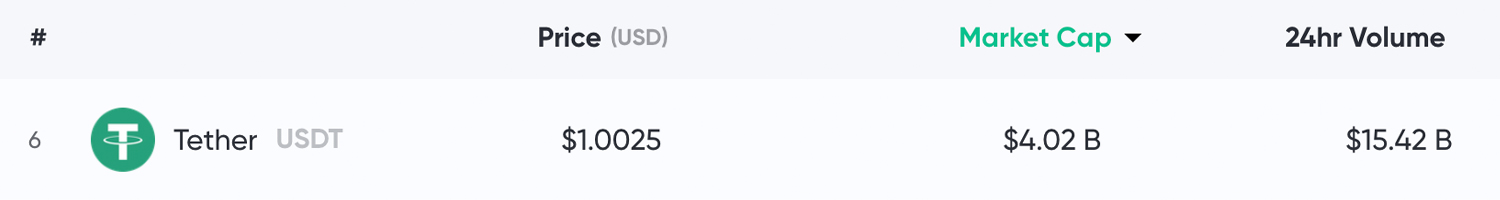

Bitfinex shareholder and over the counter (OTC) trader Zhao Dong has actually exposed that Tether is preparing to launch a cryptocurrency backed by the Chinese renminbi. Tether has actually recorded a market capitalization of over $4 billion to date. When the job very first introduced in beta in November 2014, the business stated the flagship tether tokens would ultimately represent 3 currencies: “UStether (United States+) for United States dollars, Eurotether (EU+) for euros and Yentether (JP+) for Japanese yen.”

A terrific example of tether’s frequency can be seen today as the majority of the top 10 cryptocurrencies have actually dropped below their 200-day averages. Today, tether represent more than 75% of all BTC trades, 49% of ETH swaps, 40% for XRP, and 57% of all BCH trades. In July, cryptocurrency press reporter Anna Baydakova talked about the need for tether (USDT) with Chinese importers in Russia. According to Baydakova, the importers claim to be buying $30 million a day of tethers and in between the Russian and Chinese border, USDT is the king of cryptos. The report detailed that previous to 2018, BTC was utilized by the importers, however ever since they have actually switched to using the stablecoin.

“According to a number of Moscow OTC traders, it has at least one real-world usage case – as the go-to remittance service for regional Chinese importers,” Baydakova composed at the end of July.

Not too long after Baydakova’s report on August 21, Zhao Dong talked about the possibility of a Tether item that represented an overseas yuan called CNHT. The popular Bitfinex financier exposed the intend on the Chinese messenger and social networks platform Wechat. Zhao Dong also declared that when the stablecoin launches, his OTC company Renrenbit will support the freshly minted CNHT. “Personally, I believe the overseas yuan stablecoin might enhance the flow of overseas renminbi and internationalize it. Regulators might more than happy to see it continue and prosper,” he stated on Wechat. Zhao Dong also informed the publication Chainnews the exact same info in regard to Tether introducing a digital renminbi.

Tether’s Multi-Chain Operation

The news follows the current migration of tethers from Omni Layer to the Ethereum chain. Over the recently, ERC20-based tether deals turned their Omni equivalent and last month tether users paid $260,000 in ETH gas to press the ERC20 variations. On Thursday, there were 100,000 ERC20 tether deals compared to the 39,000 Omni tether deals. The Chinese yuan-backed tethers won’t be the business’s very first time releasing another fiat stablecoin after the USD variation. In August 2016, the company began releasing euro-based tethers by means of Omni called EURT. At the time, the euro variations were traded on Omnidex versus USDT and on other exchanges like Openledger and Coinsbank. Just like USDT’s present migration from Omni to Ethereum, Tether Holdings moved the EURT job to the Ethereum chain in January 2018. “Following the prevalent success of our Bitcoin-based USD tether, released by means of the Omni Layer Protocol, we have actually introduced and released both United States Dollars and Euros as Ethereum-based Tether, suitable with the ERC20 requirement,” the site tether.to described.

The factor for the modification over to the ERC20 requirement was associated to “much lower network deal charges and much quicker verification times (15-30 seconds) compared to tether on Omni.” As far as USD-backed tethers are worried, there’s approximately 2.5 billion USDT on the Omni network and 1.5 billion USDT that utilize the Ethereum network. Additionally, in between the EOS and Tron networks, there’s $350 million USDT distributing on both chains. Tether has also exposed USDT will be hosted on the Algorand platform and report has it tethers will also be utilized on Blockstream’s Liquid procedure. Today there’s around 4,008,269,411 USDT out there and $15.42 billion in worldwide trade volume. Tethers are presently the most traded cryptocurrency by volume worldwide.

Bulk Commodity Tethers and the PBOC Digital Renminbi

The growth of Tether moving coins from Omni to Ethereum, the ongoing issuance of tethers, and the present need for the stablecoin is all taking place while the New York Attorney General (NYAG) examines the business. The NYAG workplace implicated Tether and Bitfinex of losing countless dollars worth of commingled business and consumer funds. Ifinex, the 2 companies’ moms and dad business, has actually called the claims “misinforming” and “incorrect.” The crypto-based business also tried to get the case released on the premises of jurisdictional overreach, however up until now Ifinex hasn’t succeeded. Besides fiat-based tethers, the business is talking about the possibility of minting coins backed by bulk products according to a Bitkan interview with Zhao Dong. Tethers might be backed by products like gold, petroleum, and rubber the Bitfinex financier and Renrenbit creator stated.

In the middle of Zhao Dong exposing the principle of bulk commodity backed tethers and an overseas digital renminbi, a senior authorities at the People’s Bank of China (PBOC) revealed that the nation’s state-backed cryptocurrency was “close to being out.” The PBOC coin might position an issue for Tether if the Chinese federal government whimsically chooses to prohibit using any fiat-backed tethers. Tethers might fulfill the exact same fate BTC saw in 2017, when the reserve bank and monetary regulators put a stop to exchanges trading BTC versus the yuan. Deputy director of the PBOC Mu Changchun informed journalism that the state-operated crypto was coming quickly and stated the offering would be a two-tier system. The very first system the cryptocurrency will utilize will be connected to the reserve bank and the subset of smaller sized banks below the PBOC. The 2nd tier will be consisted of a system that disperses the digital yuan to the retail market. Rumor has it the PBOC crypto may be called “Globalcoin” and the Chinese digital fiat has a great deal of resemblances to Facebook’s Calibra job.

Because of the PBOC’s efforts, some digital currency advocates think Tether’s production of CNHT is not a great concept and might disturb Chinese regulators. Founding partner at Primitive Crypto Dovey Wan said: “I wear’t see sufficient need for CNHT and alike, as regional Chinese will still trade USDT with CNY, if it’s CNH it will be the exact same as USD — Not sure what’s the product advantage of having CNHT for Tether, plus pissing off the Chinese regulator.” The creator of cryptocurrency trading platform Lbank had the exact same viewpoint. “This is a useless dumb effort — There’s no such need from regional traders, neither need from abroad. It just allows trade in between the Chinese yuan and U.S. dollar in the digital world, while its provider is not a Chinese company,” Lbank’s He Wei commented.

What do you think of Tether releasing overseas digital yuan called CNHT? What do you think of the possibility of Tether minting tokens that represent bulk products like gold and petroleum? Let us understand what you think of this topic in the comments area below.

Image credits: Shutterstock, Pixabay, markets.Bitscoins.web, Tether.to, and Wiki Commons.

You can now quickly buy Bitcoin with a charge card. Visit our Purchase Bitcoin page where you can purchase BCH and BTC safely, and keep your coins protected by keeping them in our totally free Bitcoin mobile wallet.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.