Barely every week passes when Tether isn’t in the information. For a so-called steady coin, Tether and its acolyte Bitfinex are on the heart of a whole lot of instability throughout the cryptoverse. After it emerged over the weekend that Tether had kissed goodbye to its auditor, critics of the opaque firm started to wonder if they might ever be granted a look on the firm’s books. Months of guarantees have ended with a whimper now that auditor Friedman LLP has exited stage left.

Tether, Friedman, and the Audit That Never Was

The Tether story is sort of a kids’s traditional that’s been retold so many instances as to obfuscate many seeds of fact. What is past dispute is that tethers – tokens with a set $1 worth – are extensively used as a method of surrogate fiat currency by tens of millions of crypto merchants and a number of other main exchanges. Most folks haven’t any drawback with this association, nor do they dispute that Tether, and Bitfinex – the change whose house owners maintain a controlling stake in the corporate – is worthwhile.

With Coinbase recording $1 billion of income a 12 months, Binance raking in $300 million and Coincheck immediately compensating victims of the $400 million NEM hack in Japanese yen, exchanges aren’t in need of cash. It is the secretive manner in which Tether operates that has given grounds for concern. Last 12 months, after lingering rumors that the corporate didn’t possess the USD to cowl the USDTs it was merrily issuing, Tether reluctantly agreed to conduct a public audit. Traders waited for the report back to be issued, however as delays mounted up, commenters ventured that the audit would by no means be printed. It seems they have been proper.

All Talk, No Action

Friedman LLP has confirmed through an announcement that its relationship with Tether has come to an finish, however gave few specifics as to the rationale behind the parting of the way, preferring to trot out platitudes about remaining “committed to the process”. The largest worry can be for it to transpire that Tether lacks the USD to cowl the USDT tokens it’s readily issuing; as many as $500 million every week of them have been launched to the crypto markets this 12 months. But even when it emerged that Tether/Bitfinex had the property however was issuing tethers with out rhyme or purpose, it might nonetheless be a purple flag.

In concept, issuing batches of tethers in accordance with fiat currency deposits right into a Tether checking account should be a simple. Conducting an audit of that course of ought to also be a easy enterprise. The audit was introduced again in May 2017 with speak of Friedman LLP conducting “a comprehensive balance sheet audit”.

“Given the excruciatingly detailed procedures Friedman was undertaking for the relatively simple balance sheet of Tether, it became clear that an audit would be unattainable in a reasonable time frame,” proffered Friedman on Saturday. The complexity of this job is extensively disputed, not least by Tether’s most vocal critic.

Weighing Up the Need for a Balance Sheet

Most folks aren’t as single-minded as outstanding Tether critic Bitfinexed; they simply wish to know that every thing’s in order after which they’ll return to buying and selling crypto with confidence that the rug’s not about to be swept from below their ft. It’s onerous to inform what a Tether collapse or cessation of service would do to the markets, but it surely wouldn’t be fairly and the stoop may final months. In the vacuum created by Tether’s awkward silence, stablecoin different Trusttoken has been touting itself because the pure successor.

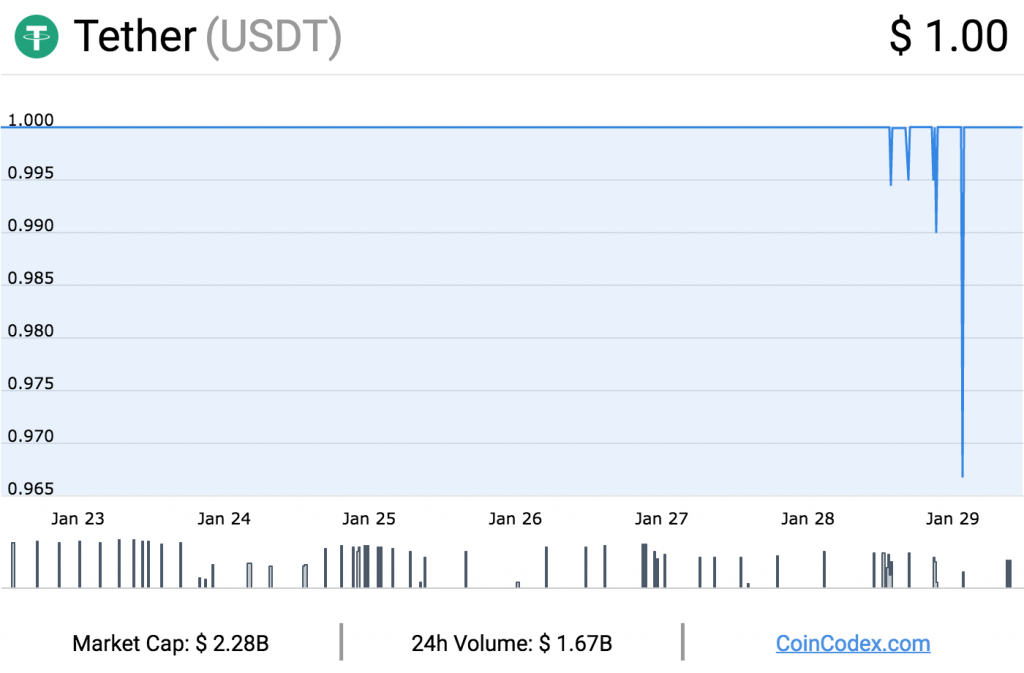

Some crypto-economists imagine that the very idea of a stablecoin is unworkable and is destined to failure, whether or not as a consequence of authorities regulation or incapacity to take care of a steady value. Tether, for instance, wobbles by round 2%, with purchase orders for the token exceeding $1 throughout main bitcoin slumps, and dipping below $1 this weekend because the Friedman information broke. Whether Tether rivals can overcome these goals stays to be seen. Given the uncertainty the Tether imbroglio has sown, any successive stablecoin might want to take nice pains to make sure that its books are audited and transparency comes as normal.

Do you suppose Tether’s failure to offer an audit is trigger for concern? Let us know in the comments part below.

Need to know the worth of bitcoin? Check this chart.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.