With 2024 currently underway, the anticipation in crypto circles is striking a fever pitch as everybody braces for Bitcoin’s cutting in half – an occasion that might improve its market landscape. It should have to be checked out as traditionally this occasion stimulated transformative waves throughout the crypto scene. Knowing what we have actually gained from previous halvings, we’re set to guide ahead with a eager eye, ensuring our relocations are formed by those insights. But is this upcoming cutting in half any various? Let’s figure it out.

From Digital Gold to Rare Platinum: Bitcoin’s Story of Increasing Scarcity and Value

Bitcoin style is everything about making BTC less and less readily available with time, keeping inflation in check. There’s a set cap of 21 million Bitcoins to ever exist, and we’ve currently struck the 19.62 million mark. The shortage of Bitcoin, with its strictly restricted release into the marketplace, is a significant reason individuals call it “digital gold” – as both these properties have that “hard to come by” quality.

Thinking of the Bitcoin blockchain as a ticking clock, we can see that halving happens every 210,000 blocks, or about every 4 years, with the benefit for mining brand-new blocks getting sliced in half. It’s been in this manner given that Bitcoin’s kick-off in 2009, beginning at 50 BTC per block and heading down to 3.125 BTC in 2024.

The Stock-to-Flow ratio, which compares existing supply to brand-new coins being available in, programs Bitcoin will get rarer than a platinum album. By 2032, after the 2024 and 2030 halvings, Bitcoin’s shortage will skyrocket, so it will be much more of a gem than gold.

Bitcoin’s Post-Halving Growth Patterns

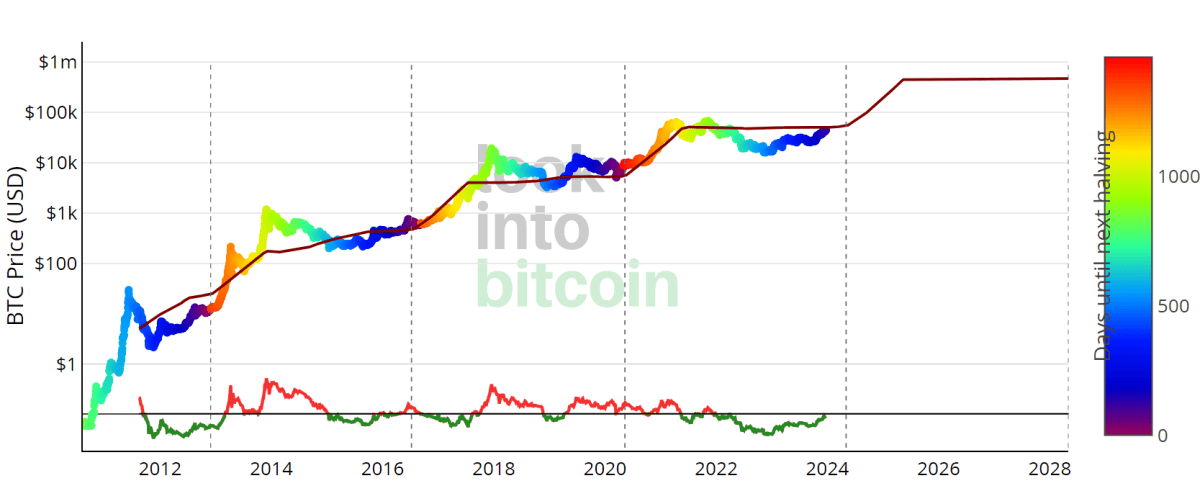

Let’s take a walk down Bitcoin’s memory lane. After each halving, Bitcoin’s cost has actually escalated. Post the 2012 halving, simply 100 days later on, the marketplace cap took off by 342%. Even more excellent, the peak cost hit a incredible $1,152 the next year, an 8,761% leap. Flash forward to 2016: benefits cut in half from 25 to 12.5 BTC, and the cost skyrocketed to $17,760 the list below year, a 2,572% dive. The newest halving in 2020 saw the benefit drop to 6.25 BTC, and Bitcoin’s cost didn’t dissatisfy, striking $67,549 the next year, marking a strong 594% development.

If we play armchair mathematicians for a bit, we can take a look at how Bitcoin’s development rate reduced after previous halvings – by 70.64% from cutting in half one to 2 and by 76.91% from 2 to 3 – and typical out those reductions to land at a development rate reduction of 73.78%. We then slap this onto the 594.03% development post the 3rd halving and – voila – we get a speculative development rate of 155.79% after the 2024 halving. This implies Bitcoin might possibly strike around $111,807 in between one to one and a half years after the upcoming halving. But let’s be clear: this all is simply speculation and certainly not something to base your financial investment choices on.

Miners’ Survival of the Fittest

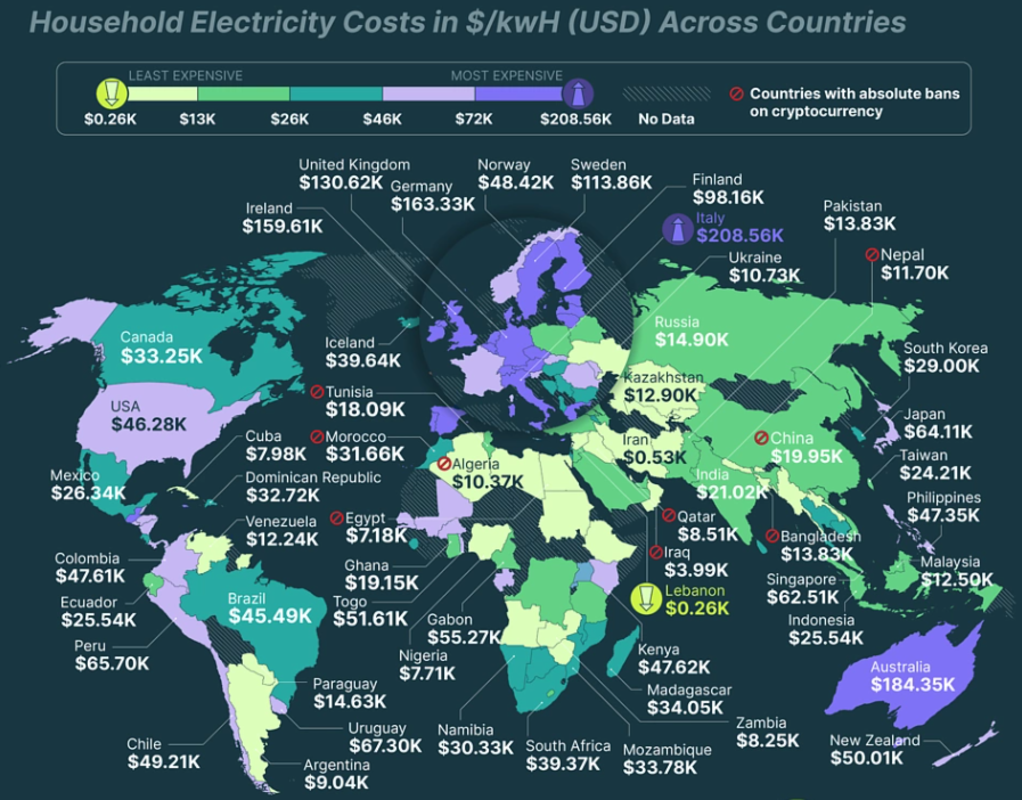

For Bitcoin miners, the 2024 cutting in half will be an uphill struggle. With benefits slashed in half, miners running with out-of-date devices and dealing with high electrical energy costs will be captured in between a rock and a tough location. In Italy, for example, mining a single Bitcoin can reach as much as a high-end Lamborghini Huracán or a Porsche 911 Turbo S, with expenses skyrocketing up to $208,560.

The 2024 cutting in half will change the mining landscape into a scene similar to ‘The Hunger Games,’ where just the greatest miners, equipped with the most effective innovation and access to inexpensive energy, will make it through. This cutting in half will resemble the supreme arena, a test of method and strength, where just those geared up with smart cost-efficient methods will become victors in the competitive battlefield.

Closing Thoughts

So, the 2024 Bitcoin halving is poised to seriously shake things up, with significant modifications in mining operations and a possible huge swing in Bitcoin’s cost. The upcoming cutting in half occasion socializes compelling financial theories with innovative tech strides, all involved that apparent crypto attraction. Whether you’re mining, hodling, or simply enjoying from the sidelines, get your popcorn – this will decrease in the books!

This is a visitor post by Maria Carola. Opinions revealed are totally their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.