This post is included in Bitcoin Magazine’s “The Primary Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

Click here to download a PDF of this post.

“Economics I think is sort of like accounting — you know, it doesn’t immediately have any morals. You could go into welfare economics, you try to think of some human values or you go into variations.” – John F. Nash Jr., The University of Scranton, November, 2011.

This quote from John Forbes Nash Jr. is drawn from a lecture Nash offered on “Ideal Money and the Motivations of Savings and Thrift”, some 61 years after the publication of his very first video game theory paper merely called “The Bargaining Problem” (1950).

“The Bargaining Problem” is substantial since it is thought to be one of the very first examples where an axiomatic technique is presented into the social sciences. Nash presents “The Bargaining Problem” as a brand-new treatment of a classical financial issue — concerning it as a nonzero-sum, two-person video game, where a couple of basic presumptions and “certain idealizations” are made so that worths are discovered for the video game.

The genealogy from “The Bargaining Problem” to Nash’s later deal with Ideal Money is developed, where in “The Bargaining Problem” Nash remarks upon the energy of cash:

“When the bargainers have a common medium of exchange the problem may take on an especially simple form. In many cases the money equivalent of a good will serve as a satisfactory approximate utility function.” John F. Nash Jr., The Bargaining Problem (1950).

Nash’s bargaining proposition is basically inquiring about the fairest method to divide $1 in between individuals in a monetary deal or agreement, where each side has a variety of interests and choices and where there should be contract, otherwise both sides will get absolutely nothing. The axioms which are presented for a Nash deal go on to specify a unique service.

Nash Equilibrium versus Nash Bargaining

In The Essential John Nash (2007), Harold Kuhn explains Nash’s subsequent “Non-Cooperative Games” (1950) paper, and what later on ended up being called Nash stabilities, as a “clumsy, if totally original, application of the Brouwer fixed point theorem”. Yet it was Nash’s balance concept which bestowed him a public profile through a Nobel reward in the financial sciences. Nash’s life was later on dramatized in the Hollywood movie A Beautiful Mind.

In “Non-Cooperative Games”, Nash’s theory is based upon the “absence of coalitions, in that it is assumed each participant acts independently, without collaboration or communication with any of the others”. In Adam Curtis’s tv documentary The Trap (2007), Nash explains his stabilities as social modification:

“…this equilibrium which is used, is that what I do is perfectly adjusted in relation to what you’re doing, and what you’re doing or what any other person is doing is perfectly adjusted to what I am doing or what all other people are doing. They are seeking separate optimisations, just like poker players.” John F. Nash Jr., The Trap (2007, Adam Curtis), F*ck You, Buddy.

The distinction in between Nash balance and Nash bargaining is that axiomatic bargaining (or reaching a Nash deal) presumes no balance. Instead, it specifies the preferred homes of an option. Nash bargaining is considered cooperative video game theory since of its nonzero-sum particular and the presence of agreements. Nash extended the axiomatic treatment of The Bargaining Problem in “Two-Person Cooperative Games” (1953), presenting a danger technique in which there is an umpire to implement agreements — while doing so discounting “strategies” as not including unique qualities and rather concentrating on official representation of an identified video game.

Ideal Money and Asymptotically Ideal Money

Just before the turn of the century, John Nash begins composing and lecturing on a progressing thesis called Ideal Money. It presumed various versions for many years, however Nash specified it as cash inherently totally free of inflation or inflationary decadence. Nash isn’t a lot important of Keynes the financial expert or individual, however of the psychology of what’s ended up being called Keynesianism; Nash concerned it a Machiavellian plan of consistent inflation and currency decline. Nash thought if reserve banks are to target inflation, they ought to target a no rate for “what is called inflation”:

“It is only really respectable that there should not be an arbitrary or capricious pattern of inflation, but how should a proper and desirable form of money value stability be defined?” John F. Nash Jr., “Ideal Money and Asymptotically Ideal Money”, 2010.

In “Ideal Money”, Nash go back to the axiomatic technique he initially develops in his inchoate video game theory. Ideal Money for that reason ends up being important of Keynesian macroeconomics:

“So I feel that the macroeconomics of the Keynesians is comparable to a scientific study of a mathematical area which is carried out with an insufficient set of axioms.” John F. Nash Jr., “Ideal Money and Asymptotically Ideal Money”, 2008.

Nash specifies the missing out on axiom:

“The missing axiom is simply an accepted axiom that the money being put into circulation by the central authorities should be so handled as to maintain, over long terms of time, a stable value.” John F. Nash Jr., “Ideal Money and Asymptotically Ideal Money”, 2008.

In 2002, in the Southern Journal variation of Ideal Money, Nash understands a perfect cash can’t be totally totally free of inflation (or too “good”), as it will have issues flowing and might be made use of by celebrations who want to securely transfer a shop of wealth. Nash then presents a consistent and continuous rate of inflation (or asymptote) which might be contributed to financing and loaning agreements.

Indeed, Nash explains the function of Ideal Money in a cooperative video game and microeconomic context:

“A concept that we thought of later than at the time of developing our first ideas about Ideal Money is that of the importance of the comparative quality of the money used in an economic society to the possible precision, as an indicator of quality, of the contracts for performances of future contractual obligations.” John F. Nash Jr., “Ideal Money and Asymptotically Ideal Money”, 2008.

Bitcoin as an Axiomatic Design

If Nash’s view of economics was that it does not have any instant morals — and that values, presumptions, axioms, variations, or idealizations can be presented to figure out a nonzero-sum or identified video game which supplies well-being for all individuals — then it deserves thinking about if these axioms exist in the Bitcoin system, considered that Nash, together with Satoshi, were both important of the approximate (or undetermined) nature of centrally handled currencies.

- Pareto Efficiency

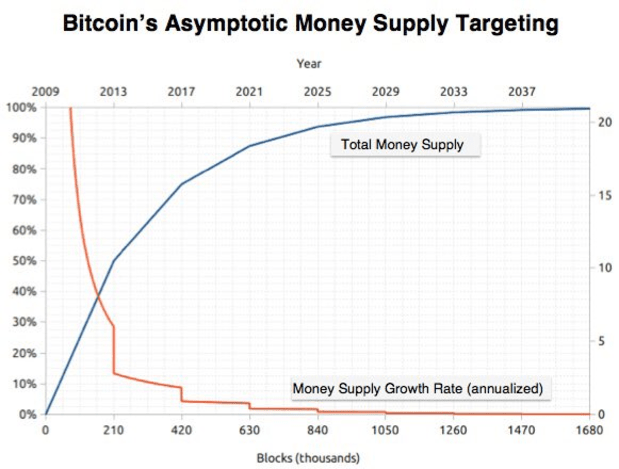

The existence of Pareto effectiveness is possibly the most demonstrative Nash bargaining axiom (see illustration) in Bitcoin with regard to the cumulative supply density and circulation: The bulk of coins are mined fairly early in the Bitcoin life expectancy (loosely following the Pareto 80/20 power law).

- Scale Invariance

The scale invariance exists through the problem modification system which keeps bitcoin supply “steady and constant” (an expression both Nash and Satoshi usage). No matter how popular or out of favor bitcoin ends up being to mine, the scale invariance ought to indicate gamers can form sensible expectations on the worth of bitcoin, and that their underlying choices shouldn’t alter concerning this. The internal divisibility of bitcoin also indicates the worth a coin is revealed in (whether the U.S. dollar or other currency) shouldn’t matter over much shorter or instant timespan — simply as space temperature level can be revealed as Celsius or Fahrenheit without impacting the real temperature level. These distinctions ought to end up being clear just over the longer term or in intertemporal deals.

The modification system also keeps overall bitcoin supply at simply under 21 million, due to a negative effects of the system information structure, and for that reason presents the asymptote.

- Symmetry

Nash’s proportion axiom exists in the pseudonymity and decentralization of the Bitcoin network, which attends to equality of bargaining ability (an expression Nash presents in “The Bargaining Problem”) through not needing to show first-person identity in taking part in the core or main network. It indicates there isn’t a centralized or relied on primary accountable for minting the coins, a “grand pardoner” in Nash’s words. In relation to Nash bargaining, 2 gamers ought to get the very same quantity if they have the very same energy function, and are for that reason equivalent. Alvin Roth (1977) summarizes this as the label of gamers not mattering: “If switching the labels of players leaves the bargaining problem unchanged, then it should leave the solution unchanged.”

- Independence of Irrelevant Alternatives (IIA)

Finally, there is Nash’s most questionable bargaining axiom: the Independence of Irrelevant Alternatives. In easy terms, this indicates including a 3rd (or non-winning prospect) to an election in between 2 gamers shouldn’t change the result to the election (3rd parties end up being unimportant). If peer-to-peer is describing a two-player video game, with the Bitcoin software application serving as a third-party arbitrator or umpire to “the game” with the software application developed to a set of worths or axioms, then it’s possible that IIA exists in Bitcoin’s evidence-of-work. This speaks with a social group choice context: The evidence-of-work states it resolves the issue of the decision of representation in bulk decision-making, and that Nash’s axiomatic bargaining (in both “The Bargaining Problem” and “Two-Person Cooperative Games”) clearly addresses official representation in determinative video games.

Characteristics and Benefits of Cooperation

Generally speaking, there are thought to be 3 conditions needed for a cooperative video game:

- Reduced individuals, as there is less space for spoken problems, i.e., 2 gamers.

- Contracts, where individuals have the ability to settle on a reasonable joint strategy of action, enforceable by an external authority such as a court.

- Participants have the ability to interact and team up on the basis of relied on details and have complete access to the structure of the video game (such as the Bitcoin blockchain).

In regard of a nonzero amount video game and the cash choice, John Nash reviews how cash can help with transferable energy by method of “lubrication”, and makes this observation:

“In Game Theory there is generally the concept of ‘pay-offs’, if the game is not simply a game of win or lose (or win, lose, or draw). The game may be concerned with actions all to be taken like at the same time so that the utility measure for defining the payoffs could be taken to be any practical currency with good divisibility and measurability properties at the relevant instant of time.” John F. Nash Jr., “Ideal Money and the Motivation of Savings and Thrift”, 2011.

The benefits of cooperation lower the requirement for mediation or conflict resolution as agreements and contracts end up being more credible; less border friction in trading; a nonzero-sum result (win-win bargaining or well-being economics); more instinctive, casual decision-making; and the possibility for union development which John Nash eventually specifies as a world empire context. The latter makes resolutions to tough issues like net absolutely no (or any other issue needing multilateral coordination) more sensible. Nash compares his Ideal Money proposition to old-fashioned sovereigns:

“Any version of ideal money (money intrinsically not subject to inflation) would be necessarily comparable to classical “Sovereigns” or “Seigneurs” who have actually supplied useful media for usage in traders’ exchanges.” John F. Nash Jr., “Ideal Money and the Motivation of Savings and Thrift”, 2011.

Nash also shows in 2011 on a “game” of agreement signatures, as if Ideal Money is the agreement:

“It is as if there is another player in the game of the contract signers and this player is the Sovereign who provides the medium of currency in terms of which the contract is to be expressed.” John F. Nash Jr., “Ideal Money and the Motivation of Savings and Thrift”, 2011

Concluding Remarks

It’s possible to explain the Bitcoin system as a cooperative video game in a non-cooperative setting, and while it might be that the axioms present in Bitcoin are not restricted to simply those needed for a Nash deal, it would appear there are components in the system style that offer Bitcoin a deterministic attribute. At the really least, they consist of specific morals as Nash said as preferable in his Scranton lecture.

Finally, John Nash initially developed his bargaining service in 1950. It is possibly fitting for that reason he supplies an easier context to framing the concern of cash as that of “honesty” in one of his last lectures on the subject provided to the Oxford Union soon before his death in 2015.

References

A Beautiful Mind – S Nasar

“The Bargaining Problem” – J Nash

“Non-Cooperative Games” – J Nash

“Two-Person Cooperative Games” – J Nash

The Essential John Nash – H Kuhn & S Nasar

Nash Bargaining Solution – Game Theory Tuesdays – P Talwalkar

This post is included in Bitcoin Magazine’s “The Primary Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

Click here to download a PDF of this post.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.