Everyone has become aware of the 4-year cycle that Bitcoin is going through, however have you ever considered the concept that Bitcoin might be going through a larger cycle? And could this larger cycle show the method people embrace brand-new innovations? And is it possible we have seen something comparable before with another innovation like the internet? In this post, we will be diving into a brand-new theory that recommends that Bitcoin is moving through a bigger 16-year cycle which can assist us anticipate the instructions of the Bitcoin cost in the coming years.

The Regular 4 Year Cycle

Bitcoin tends to go through 4-year cycles which are divided into 2 parts, the uptrend and the drop. A routine 4-year cycle includes a 3-year uptrend followed by a 1-year drop also referred to as a bearish market. So far Bitcoin has actually finished 4-year cycles and they’ve revealed unbelievable precision which captures the attention of the marketplace individuals.

The DOTCOM Cycle

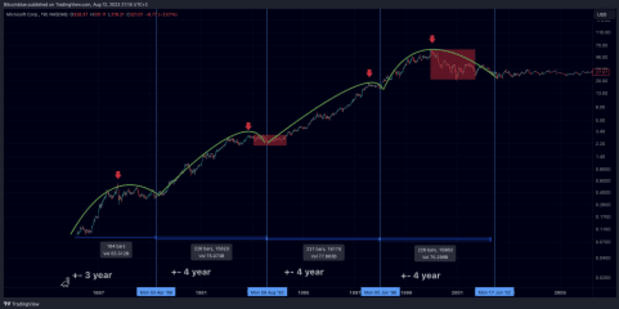

One can’t overlook the resemblances in between the marketplace structure of the S&P500 throughout the DOTCOM cycle and the Bitcoin cycle. The routine monetary markets also went through clear 4-year cycles with most of the cycle remaining in an uptrend and the drop, also referred to as a bearish market, soon lived. From my viewpoint, the DOTCOM cycle began around 1986 as this was the minute that Microsoft went public, among the greatest business of the DOTCOM cycle. The initially 3 4-year cycles of Bitcoin look extremely comparable to the very first 3 4-year cycles of the S&P500 beginning with 1986.

This truly surged my interests as both durations are based upon the adoption of an entirely brand-new innovation that moves the method our society views and utilizes details. The desktop computer and the internet altered our lives entirely to the point that it’s practically unimaginable to be inapplicable to the internet for more than 24 hr. In the future it will also be unimaginable to not own and utilize any Bitcoin, we’re simply still in the early stage of its adoption.

So could the structure of the DOTCOM cycle assist us to identify a prospective course for Bitcoin? First of all, I want to stress the truth that market cycles in my truthful viewpoint are among the very best methods to utilize rough cost forecasts and establishing when to go into and when to leave a specific market. But I truly wish to stress the word “rough”. There goes a stating, “history

doesn’t repeat itself but it sure does rhyme”, and I believe this uses to cycles too. Nothing is ever a 100% duplication of anything that occurred previously, however it can provide us a rough price quote of what may occur.

As you can see in the structure of the DOTCOM cycle, the very first 3 4-year cycles are extremely comparable, a long booming market followed by a brief however often shallow bearish market or correction. It’s just that the last 4-year cycle is various, the tables are turned upside down. It begins with a velocity in the cost which doesn’t last that long and is followed by a multi-year long bearish market. Could Bitcoin do something comparable, frustrating the ones who anticipate a routine 4-year cycle and surprise the bulk with a multi-year-long bearish market?

Microsoft is following a comparable course. It begins with 3 4-year cycles that are right-translated, followed by a 4-year cycle that is left-translated, so an extended bearish market in a possession that has actually remained in a strong booming market for several years.

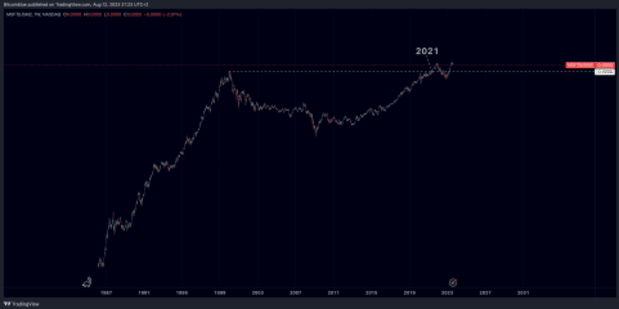

Microsoft topped in the year 2000, marking a long-lasting top in the cost at roughly $60. And it wasn’t till 2015 that that level was broken once again. It took 15 years from that high to entirely recuperate and exceed that level once again. If we were to take the cash supply into factor to consider it really takes longer for Microsoft to recuperate and break the high 21 years later on in May 2021.

Both of these charts, Microsoft and the S&P500, truly show the magnitude of a correction after an extended bull-market. It’s challenging to think of from one’s viewpoint an extended bearish market of a possession you’ve experienced mainly increasing. Is it possible that we’re visiting, in rough terms, something comparable with Bitcoin?

Confluence Between Cycles

So let’s take a look at what these cycles are anticipating for Bitcoin and how we possibly might get ready for these results. First of all, it’s intriguing to keep in mind that a person date is anticipating the exact same result in the routine 4-year cycle, the 16-year cycle.

A routine 4-year cycle would recommend that we’re remaining in an uptrend till 2025, followed by a 1- year decrease. This is a normal 4-year cycle which we’ve seen 3 times in the history of Bitcoin.

The 16-year cycle would recommend that we would follow a comparable course as the DOTCOM bubble as pointed out above. Bitcoin would peak within the very first half of the cycle, so by the most current at the end of 2024, this would be followed by a multi-year-long decrease entering into 2026 to form brand-new lows.

How To Spot A Top

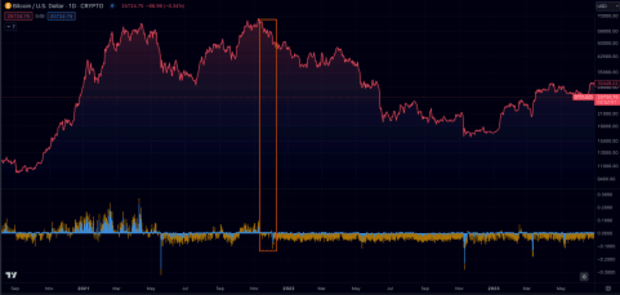

One of the very best signs a Bitcoin trader can utilize are the Bitcoin financing rates. The financing rates are revealing generally whether the bulk of the marketplace individuals on acquired markets are shorting or yearning for Bitcoin. I’ve discovered this indication extremely helpful to identify a top in the Bitcoin cost as in a healthy booming market when the financing rates are unfavorable, the cost tends to trend up. In a bearish market, when the financing is favorable, the cost tends to decrease. So we can utilize this metric to area which market conditions the marketplace is selling and if anything has actually altered. One of the very first signals when Bitcoin went into a bearish market in 2022 was that the cost of Bitcoin was decreasing with unfavorable financing rates, which does typically not occur in a healthy booming market.

Another method to search for the cycle top is timing, whenever Bitcoin remains in the duration of topping for let’s state the 16-year cycle and we break below a swing-low, opportunities increase that a cycle top remains in. This would then be revoked by breaking back above that particular level, to re-claim this level. To see the duration of a prospective cycle top, one can take a look at the Bitcoin cycles development bars. Once the yellow dot goes into the red zone, it suggests that based upon that particular cycle we remain in the topping duration. Again, it is essential to discuss that cycles can assist to provide a rough price quote of possible results, they typically don’t unfold extremely precisely and there is space

Further Considerations

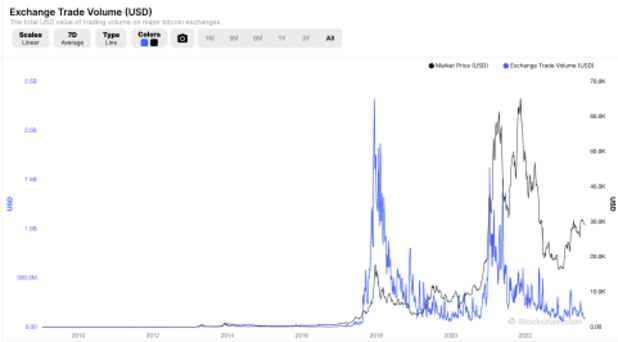

There are more elements at play here that affect the cost of Bitcoin aside from these cycles. The truth that the Federal Reserve began to print substantial quantities of cash in 2020, truly surged the threat cravings for numerous financiers to search for a safe house like the monetary markets and Bitcoin. It’s extremely clear that the minute the Federal Reserve began to inject cash into the economy, the cost of Bitcoin and the monetary markets began to increase till the cash printer stopped once again in 2022 and the cost of Bitcoin went into a 1-year decreasing stage. These essential modifications in the economy will probably have an effect on Bitcoin and the method these cycles might unfold.

This is a visitor post by Jeroen van Lang. Opinions revealed are completely their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.