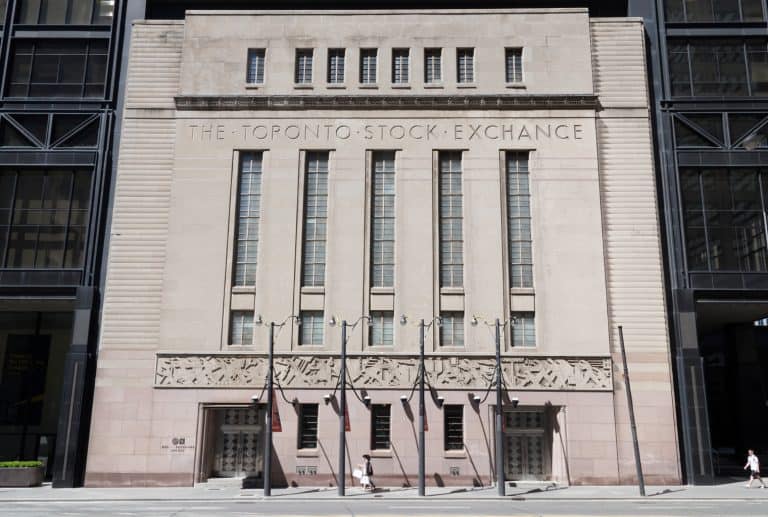

The Bitcoin Fund, handled by 3iq, has actually finished a going public and has actually started trading on the Toronto Stock Exchange (TSX). It has actually been a long roadway for 3iq and The Bitcoin Fund considering that their filing was initially declined. After a hearing, a commissioner with the Ontario Securities Commission ruled in their favor.

The Bitcoin Fund Trading on TSX Exchange

Canadian mutual fund supervisor 3iq Corp. revealed on Thursday that The Bitcoin Fund has actually finished a going public (IPO) and combined with 3iq Bitcoin Trust. Consequently, The Bitcoin Fund now has 1,491,800 exceptional class A units representing the overall property of roughly US$14 million. The class A units are offered to all financiers, the fund’s prospectus notes. 3iq, which serves as the financial investment supervisor and portfolio supervisor of the fund, elaborated prior to trading started:

The class A units will start trading today on the Toronto Stock Exchange under the sign QBTC.U.

Founded in 2012, 3iq presently focuses on digital possessions, disruptive innovations and the blockchain area. The Toronto Stock Exchange (TSX), an entirely owned subsidiary of the TMX Group, is Canada’s biggest stock market and the world’s 9th biggest exchange by market capitalization.

The Bitcoin Fund’s financial investment goals are to offer financiers with “direct exposure to the digital currency bitcoin and the everyday cost motions of the U.S. dollar cost of bitcoin” and “the chance for long-lasting capital gratitude,” 3iq in-depth. Investing in The Bitcoin Fund is “suitable just for financiers who have the capability to soak up a loss of some or all of their financial investment,” the business highlighted. This closed-end fund “will not hypothesize with regard to short-term modifications in bitcoin costs,” according to the fund’s prospectus, which can be discovered here.

How The Bitcoin Fund Calculates BTC’s Price

The Bitcoin Fund’s prospectus information that its bitcoin will be valued based on the MVIS Cryptocompare Institutional Bitcoin Index (MVBTC), which is kept by MV Index Solutions GmbH (MVIS).

Cryptocompare individually revealed on Thursday that the MVIS Cryptocompare Institutional Bitcoin Index has actually been certified to 3iq Corp. for The Bitcoin Fund. This index plans to offer financiers with a way to track the efficiency of bitcoin on chosen leading exchanges, consisting of Binance, Bitflyer, Bitstamp, Coinbase, Gemini, Itbit, and Kraken, Cryptocompare explained.

3iq Corp. initially submitted an initial prospectus for the IPO of The Bitcoin Fund with the Ontario Securities Commission (OSC)’s Investment Funds & Structures Projects branch (IFSP) in October 2018. However, the IFSP personnel raised a variety of issues after evaluating it, arguing that the fund was not in the general public interest of Canadians. This led to the IFSP director turning down the fund’s prospectus in February in 2015. 3iq then asked for a hearing and an evaluation of this choice. OSC Commissioner Lawrence P. Haber later on ruled that the personnel’s issues “do not call for rejecting an invoice for The Bitcoin Fund’s prospectus,” and its IPO filing was consequently authorized.

What do you think about The Bitcoin Fund’s IPO on the TSX Exchange? Let us understand in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.