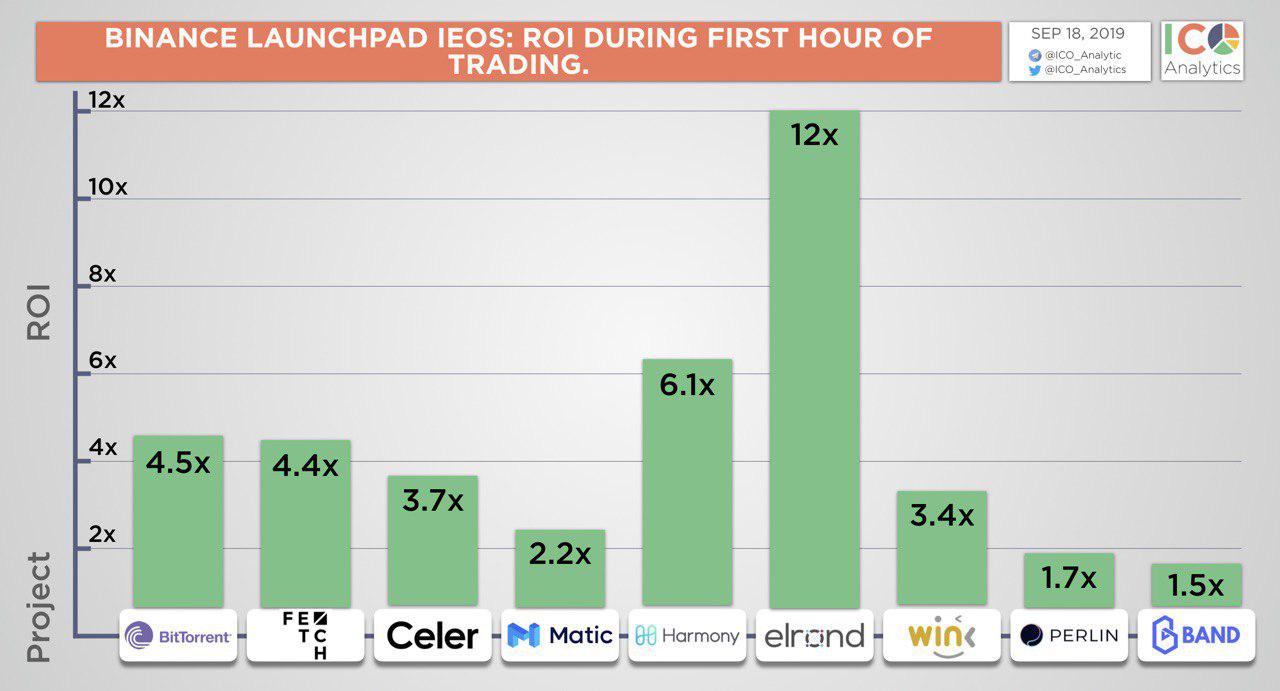

2019 was implied to be the year of the IEO. Or was it the STO? Whatever the case, it’s had its share of both, with combined outcomes. While the number of effectively finished token sales and the number of IEO launchpads has actually increased substantially, secondary market need has actually been underwhelming. As emerging tasks study the efficiency of this year’s preferred fundraising automobiles, they’re confronted with a quandary: stick to an evaluated formula, or shun the three-letter designs for something brand-new.

The Jury’s Out on IEOs

It’s hard to understand what to make of this year’s preliminary exchange offerings (IEOs). Compared to their forefathers – the tasks that ICO’d 2 years earlier – IEOs are plainly much better in specific aspects. Greater openness, as mandated by exchanges, has actually avoided exit rip-offs and forced tasks to really deliver code and construct things. Greater liquidity, assisted by the ensured exchange listing that comes constructed into the IEO design, has also been an enhancement. Crowdfunding tasks are much better off this year, too: with the increase of token production platform Simple Ledger Protocol, start-ups have the alternative of introducing token sales on Bitcoin Cash, supplying an option to the ERC20 token requirement and the increasing network costs on Ethereum.

But what about the quality of the tasks themselves? This year, IEOs have actually brought us a great deal of clever contracting platforms, dapp scaling options, and crypto procedures, however there hasn’t been much creativity on display screen. Where the ICO age birthed forecast markets from Augur, a worldwide exchange in Binance and decentralized token trading from 0x, today we have Elrond and Emogi. It’s hard to shake the sensation that great concepts for tokenized tasks are now at a premium.

In the STO area, terrific development has actually been made this year – simply not in terms of fundraising. Blockstack amassed headings when it ended up being the very first STO to be given Reg A+ status by the SEC, opening its sale approximately the broader public. Other security token tasks have actually needed to leave out U.S financiers, nevertheless, or decrease the more limiting Reg D path. The facilities supporting the security token area is enhancing a minimum of, which ought to make things simpler for the next wave of striving STOs. This week, for instance, security token platform Harbor revealed that it was tokenizing $100M of property funds. CEO Josh Stein has actually revealed the objective of developing Harbor into “the Salesforce.com” of the security token market.

Crypto tasks presently raising capital have some hard choices to make. Do they stick to the traditional IEO/STO formula, or do they twist and opt for something various? News.Bitscoins.net talked to 4 tasks that have actually chosen to chance.

Roobee and Dreamr Take Different Routes

Investment platform Roobee is presently holding its IEO on Asian cryptocurrency exchange Liquid, which is best understood for hosting Telegram’s sale. What’s various about Roobee’s IEO is that it’s not the job’s initially: in June it effectively finished 2 token offerings on Bitforex and Exmo, raising around $5.5 million.

Artem Popov, co-founder of Roobee, informed news.Bitscoins.internet: “Fundraising in installations throughout several exchanges needs a lot more work, however our company believe it’s time well invested. The capability to cultivate a neighborhood on each platform, with the objective of turning these individuals into clever financiers on the Roobee platform, is important. Raising in phases also allows us to satisfy essential advancement turning points along the method, and to gain from the goodwill this brings, which feeds into our IEO.”

Meanwhile, Dreamr, a social networking application tailored towards business owners, is opting for an IEO-STO hybrid and preparing a Security Token Exchange Offering (STEO). The sale will be hung on crypto exchange IDCM, with regular financiers able to take part. Strategic advisory company Pirate Capital, led by Joseph Bar-Katz, prepared the offering under Regulation S, which leaves out U.S. homeowners from taking part. Bar-Katz asserts that this arrangement “ought to permit the DRMR Token to be quickly readily available worldwide.”

LiquidApps and Kleros Favor Smaller Raises

Because IEOs restrict the quantity that can be raised in a public sale, usually topping it around $2 million, tasks that want to pay out a higher percentage of tokens need to design alternative methods. For Liquidapps, a blockchain scaling start-up and interoperability procedure, that’s implied holding a continuous auction by itself website. The job, which supplies affordable vRAM for EOS designers, is carrying out a 12-month raise which is reminiscent of EOS’ own year-long crowdsale. So far, it’s raised around $2.8 million, with tokens offered in timed cycles.

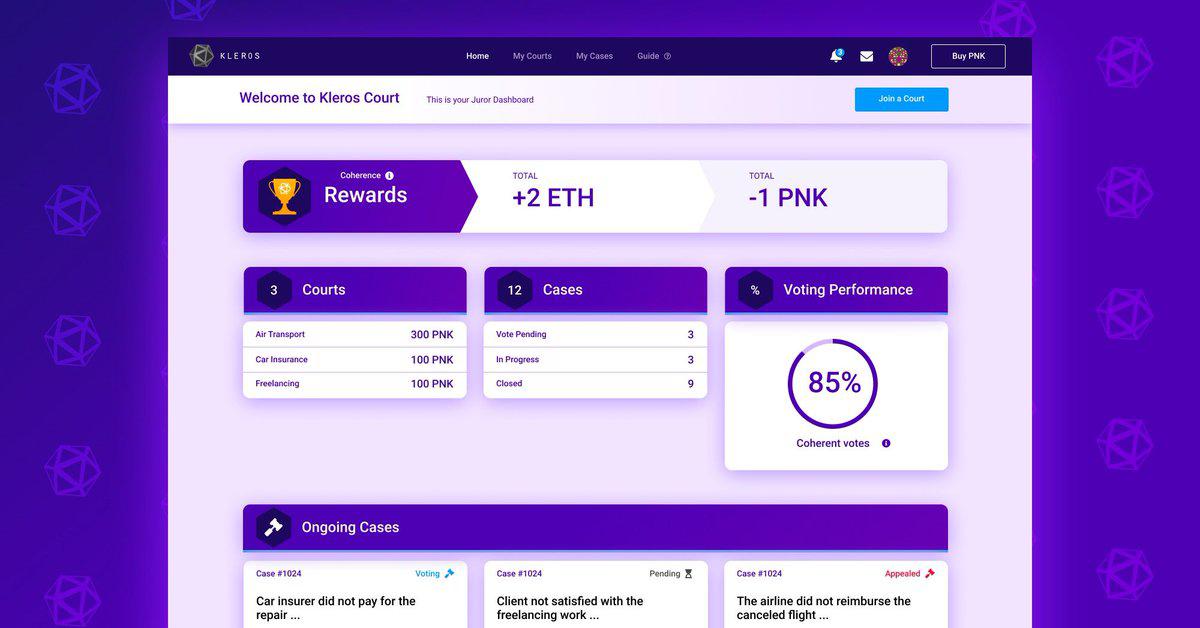

And then there’s decentralized justice procedure Kleros, which offered 16% of its PNK tokens to the general public in 2015, with the rest allocated for future sale, either OTC or through a milestone-based crowdsale. “In mid 2018 we concluded our IICO (Interactive Initial Coin Offering) which was at first proposed by Vitalik and Jason Teustch as a more egalitarian method to carry out a token offering,” described Kleros Operations Manager Stuart James. He included:

At that time, we were seeing insane gas costs being paid by whales to corner token sales (BAT being the most significant). With the Kleros IICO, prospective factors had more fined-tuned control over how they wished to manage the compromise in between the certainty with which they might take part in the sale and the certainty they had more than the evaluation identified.

Like Liquidapps, Kleros has actually kept hectic this year, finishing an effective trial of crowdsourced adjudication in action, and signing up with the blossoming defi motion by supplying its services to Market Protocol to settle cost oracle disagreements. Keeping hectic in the months to come while constructing a neighborhood will be important for those crypto tasks that have yet to end up raising funds. There are indications that financier interest in IEOs is subsiding, as exhibited by the decreasing need for Binance Launchpad tokens.

The crowdsale is not disappearing at any time quickly, however the acronym and form it takes might alter when again. With each brand-new tokenized funding system, there’s a window of chance for introducing while interest is high. Catching that wave at simply the correct time requires a mix of luck, instinct and development. If the job’s ingenious and the token metrics are great, it needs to prosper, in theory, whatever shape its crowdsale might take.

What are your ideas on IEOs – have they satisfied financier expectations up until now? Let us understand in the comments area below.

Did you understand you can validate any unofficial Bitcoin deal with our Bitcoin Block Explorer tool? Simply total a Bitcoin address search to see it on the blockchain. Plus, go to our Bitcoin Charts to see what’s occurring in the market.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.