Crypto trading has constantly involved a mix of ability and good luck, however in the frothy markets of 2019, that weighting is manipulated greatly in favor of the latter. Fundamentals head out the window when there’s a surety that the current token is going to pump anytime. For traders with a low timeframe perseverance, bitcoin will constantly be the much safer and more lucrative bet. But when your pals are getting fleetingly abundant on altcoins, the temptation to FOMO in can show alluring.

Traders Are Betting Big and Losing Large at the Crypto Casino

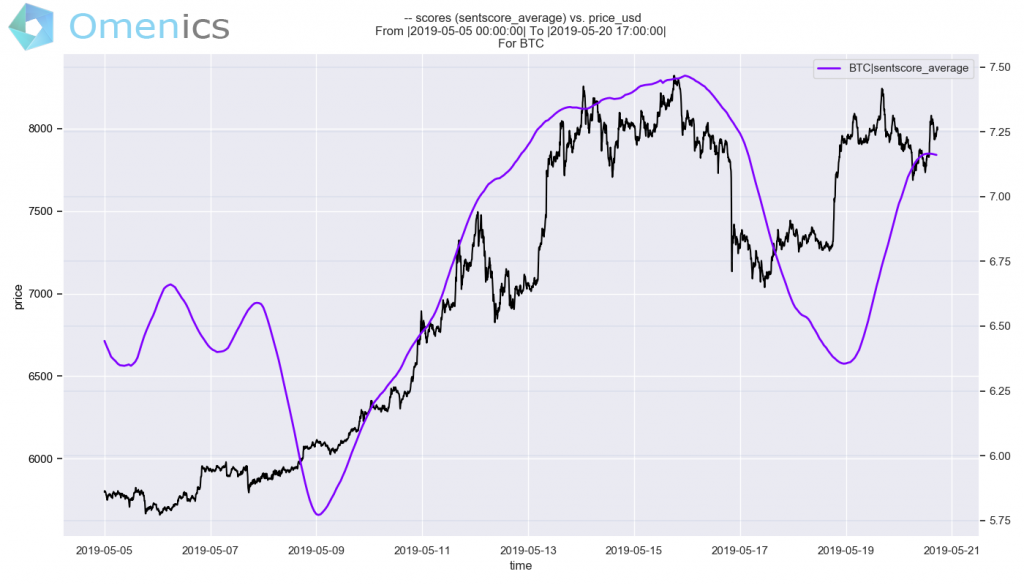

In the drawdown that followed the excesses of 2017, traders were taught a sobering lesson. Despite swearing to alter their methods, stop being greedy, and discover to take revenues along the method, it appears that old practices pass away hard. It was a little bit more than 2 months ago that BTC broke devoid of the $4,000 cost point it had actually been locked into, starting a mazy run that’s seen it double in cost and drag the remainder of the market up with it. This has brought considerable cheer to the beleaguered cryptosphere, as can be seen in the belief rating signs by information company Omenics, which maps the state of mind of the marketplaces together with the cost of the matching property.

Its social belief rating for BCH, displayed in purple, has broken its previous high and is heading to the favorable zone, according to information for the week ending May 21.

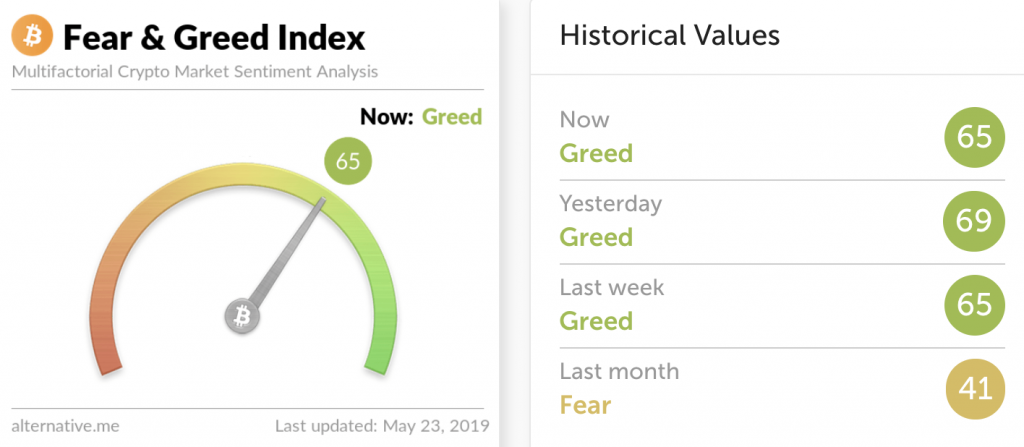

BTC is revealing comparable favorable indications, though there is a significant drop illustrated on May 9, which Omenics credits to the Binance hack and the reorg dispute this triggered. Even though BTC has backtracked a little bit from the year’s high of $8,300, the state of mind of the marketplaces stays clearly greedy, according to an alternative belief analysis service.

Day Traders Are Going for Broke

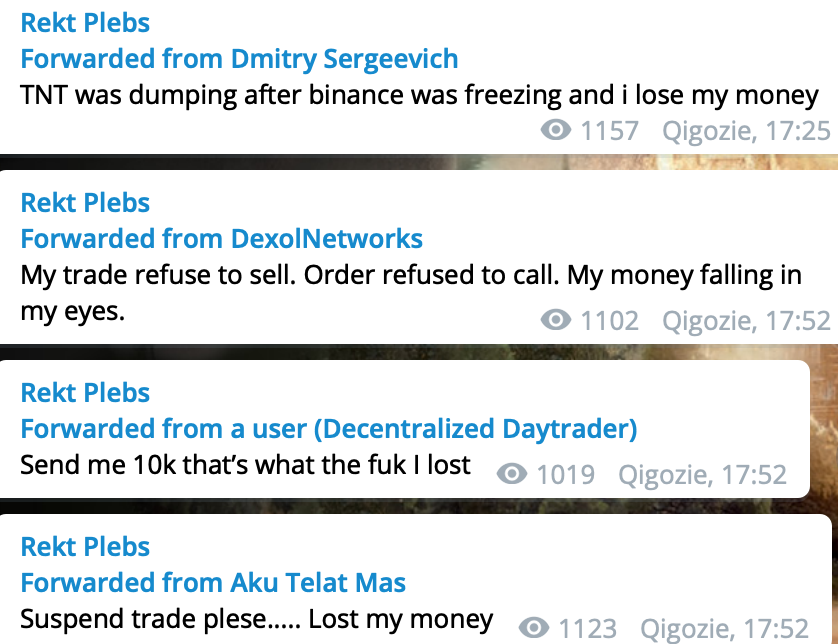

With IEOs releasing throughout ratings of exchanges, there’s rarely time to consent to the T&Cs and send out funds, not to mention carry out DD on the job and the token metrics. Meanwhile, Binance tokens are carrying out outstanding, albeit unsustainable, tasks of reproduction; matic did 8X in a little bit over 10 days, helped by market makers, triggering trading volume to go beyond 50,000 BTC and causing extraordinary FOMO. The crash, when it showed up, was nearly as dizzy, cleaning 30% off the balance of traders who showed up late to the celebration.

Bitcoin is not unsusceptible to adjustment, as revealed a week earlier, when a substantial sell order on Bitstamp was activated to cause a wave of liquidations on Bitmex, and healthy revenues for whoever shorted with high utilize. Such habits, nevertheless, is restricted to whales with the methods to participate in such mischief. For the retail rest, little fortunes can be won and lost on freshly noted IEO tokens and illiquid altcoins coming from near-abandoned tasks, which can be quickly pumped and discarded.

It’s hard to work out restraint and use danger management when crypto Twitter is shilling shitcoins and boasting of the ill gains they made in a day. To price estimate the New York Times’ notorious heading, “Everyone is getting hilariously abundant and you’re not.” When the music stops, the majority of the existing crop of crypto tokens will be as dead as those that released in 2015, and every year prior to that, all the method back to 2014. In the meantime, however, it’s hard to withstand the brilliant lights and bumper payments of the crypto casino.

Do you believe basics have much bearing on trading technique throughout market mania? Let us understand in the comments area below.

Did you understand you can confirm any unofficial Bitcoin deal with our Bitcoin Block Explorer tool? Simply total a Bitcoin address search to see it on the blockchain. Plus, check out our Bitcoin Charts to see what’s occurring in the market.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.