King Ferdinand of Spain, sponsor of Christopher Columbus, had just one command for the conquistadors: “Get Gold! Humanely, if possible, but at all hazards!”

500 years later on this belief still appears to be the very same, with the addition of brand-new threats. Gold bugs and Bitcoin supporters share the typical belief that the fiat currency system is on the verge of collapse, while continually debasing itself to survive. The service? A commodity-based option that guarantees the conservation of accumulated worth, invulnerable to debasement.

With the upcoming fourth halving of the block aid from 6.25 to 3.125 BTC in April 2024 the inflation rate (yearly development rate of overall supply) of Bitcoin will be 0.9%. Additionally to its greater mobility and divisibility than standard gold, the “digital gold’s” inflation rate will be lower than gold’s inflation rate (~ 1.7%) and continue to drop to lower rates in the future.

But when requested for their option of a shop of worth, numerous financiers state things like:

“I’d choose gold. Not Bitcoin, because of the environment!” Really?!

Contrary to that understanding, research study informs us that Bitcoin mining can improve renewable resource growth (Bastian-Pinto 2021, Rudd 2023; Ibañez 2023; Lal 2023) and incentivize methane emission decrease (Rudd 2023, Neumüller 2023) while having half of the carbon footprint (70 Mt CO2e) of gold mining (126 Mt CO2e).

When individuals believe of gold, they believe of a pure and tidy compound. The truth of gold production, nevertheless, looks really various. As I have actually viewed environmental researchers establishing water toxin adsorbers, I have actually discovered that gold mining is one of the most contaminating markets worldwide. Further digging into the subject results in the list below realities.

Gold mining ranks 2nd after coal mining (7200 km2) in land protection. Gold mining websites (4600 km2) cover more than the next 3 metal websites integrated (copper: 1700 km2, iron: 1300 km2 and aluminum: 470 km2).

As numerous high yield cash cow have actually been tired, chemical procedures, like cyanide-leaching or amalgamation, with substantial usage of hazardous chemicals are being utilized today. The infected water from gold mining called acid mine drain is a poisonous mixed drink for marine life and works its method into the food cycle.

Colorado’s Animas River turned yellow after the Gold King Mine spill of 3 million gallons of hazardous waste water in August 2015. From:

In the U.S., 90% of the cyanide is utilized entirely to recuperate hard-to-extract gold. The hazardous product and its production and transportation remains in direct relationship with the gold market. It is approximated that cash cow utilize more than 100,000 loads of cyanide each year. That suggests enormous production and transportation of a substance with a human deadly dosage of a couple of milligrams.

In 2000, a tailings dam at a cash cow in Romania stopped working and 100,000 m3 of cyanide-contaminated water entered into the Danube River watershed. The spill triggered a mass die-off of marine life in the river community and infected the drinking water of 2.5 million Hungarians. Mines in Brazil and China commonly utilize the historical amalgamation technique that develops mercury waste. Roughly 1 kg mercury is produced for 1 kg of mined gold.

Gold production from artisanal and small mines, primarily in the worldwide South, represents 38% of worldwide mercury emissions.

Thousands of loads have actually been released into the environment in Latin America given that 1980. 15 million little scale mine employees were exposed to mercury vapor and the locals of downstream neighborhoods consumed fish greatly infected with methylmercury.

Mercury poisoning amongst these populations triggers extreme neurological concerns, such as vision and hearing loss, seizures, and memory issues. Similarly, in the areas of Johannesburg in South Africa, bad neighborhoods are paying the rate for the nation’s abundant gold mining past.

Knowing about the dangers, western mining business have actually moved progressively to establishing nations as a reaction to more stringent environmental and labor guidelines in your home. Surprisingly, just 7% of mined gold is utilized for product residential or commercial property functions in market (e.g., in electronic devices). The rest is processed for precious jewelry (46%) or straight bought as a shop of worth by retail or reserve banks (47%). That’s why durations of high financial debasement are enhancing the rate of gold. Last year reserve banks purchased 1000 loads of bullion, the most ever tape-recorded, while gold has actually been hovering near its small all-time high (status: December 2023).

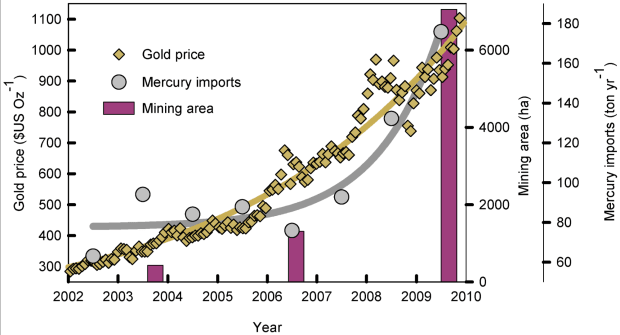

The last time gold need increased its rate considerably was the financial debasement following the 2008 worldwide monetary crisis. During that time gold mining in western Amazonian forests of Peru increased by 400%, while the typical yearly rate of forest loss tripled.

As essentially all of Peru’s mercury imports are utilized in gold mining, the gold rate referred a rapid boost in Peruvian mercury imports.

As an outcome of the artisanal mercury handling, big amounts of mercury were being launched into the environment, sediments and waterways.

The enormous mercury direct exposure can be found in birds in main America. An area that supports over half of the world’s types.

Figure 1: Gold rate, Peruvian mercury imports and mining location, from “Gold Mining in the Peruvian Amazon: Global Prices, Deforestation, and Mercury Imports.” 2011, PLoS ONE 6(4): e18875.

Other natural locations enhanced with gold deposits like the Magadan Region in Northeast Russia are experiencing comparable broadening mining activity over the previous years consisting of environmental damage in reaction to high gold rates.

Gold mining, mainly driven by need for a shop of worth, triggers prevalent eco-friendly and social damage throughout the world. It is the coal of worth storage mediums.

At least half of today’s gold mining might be avoided by utilizing a various shop of worth – a digital product with greater mobility, divisibility and deficiency.

So, next time an environmental mindful financier argues for gold vs. Bitcoin, inform them:

A 21st century shop of worth need to not count on big taken fields of damage and toxic threats however on electrical energy from non-rival energy, funding eco-friendly growth.

This is a visitor post by Weezel. Opinions revealed are totally their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.