Federal Reserve guv Christopher Waller has actually detailed he is prepared to support 50 bps rate hikes until the severe inflationary pressures pestering the U.S. economy subsides. Waller worried that until inflation is minimized he doesn’t “see the point of stopping” 50 bps rate hikes. Furthermore, stats from the U.S. Bureau of Economic Analysis reveal that American savings have actually plunged to levels not seen because the ‘Great Recession’ in 2008.

Christopher Waller Advocates for 50 Bps Rate Hikes at Every Fed Meeting Until Inflation Is Under Control

Inflation is ruining the wallets of daily Americans as the expense of items and services has actually increased throughout the previous couple of months. Inflation is so bad that president Joe Biden will host an uncommon Oval Office conference on May 31, with Federal Reserve chair Jerome Powell to talk about inflation and the state of the U.S. economy. Meanwhile, Federal Reserve guv Christopher Waller believes that raising the benchmark rate of interest by 50 bps at every conference is required to stop inflation.

Waller described his viewpoint while speaking at the Institute for Monetary and Financial Stability in Frankfurt, Germany. Waller even more detailed that he is favorable about the labor market having the ability to handle the increased rates without stimulating greater levels of joblessness. “If we can get joblessness to simply 4.25%, I would think about that a skillful efficiency,” Waller mentioned throughout his speech. Waller states he can visualize the Fed increasing by 50 bps all the method until inflation is tamed. Waller suggested:

I am promoting 50 [basis point hikes] on the table every conference until we see significant decreases in inflation. Until we get that, I wear’t see the point of stopping.

Waller worried that in time, the Fed’s financial policy will provide outcomes and demonstrate how things are working. “Over a longer duration, we will find out more about how financial policy is impacting need and how supply restraints are progressing,” he kept in mind in his speech. “If the data recommend that inflation is stubbornly high, I am prepared to do more.”

Waller Believes an Inflation Rate of 2% per Annum Is Still Attainable — Peter Schiff Says Savings Data From the Bureau of Economic Analysis Indicates the US Economy Is Not Looking (*50*)

In reality, Waller appears to believe the Fed can be well above neutral and he completely thinks the reserve bank can get the benchmark rate pull back to 2%. “In specific, I am not taking 50 basis-point hikes off the table until I see inflation boiling down more detailed to our 2 percent target,” Waller stated. “And, by the end of this year, I support having the policy rate at a level above neutral so that it is lowering need for items and labor, bringing it more in line with supply and therefore assisting check inflation.”

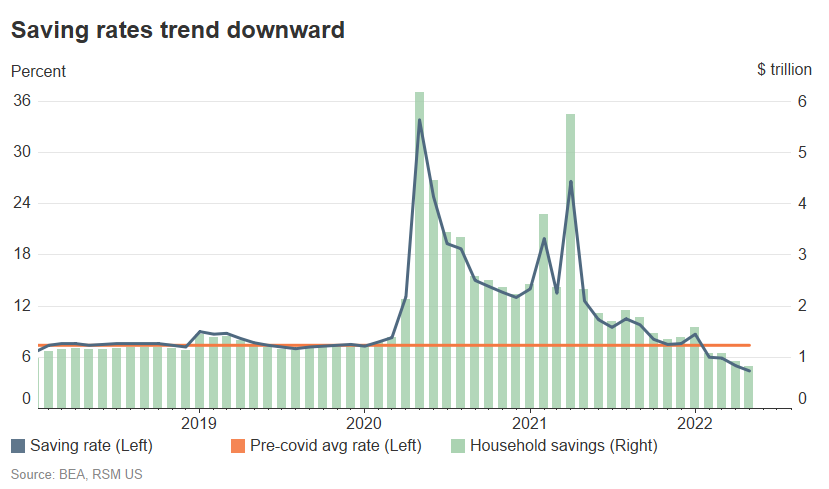

Meanwhile, the gold bug and financial expert Peter Schiff is not so enthusiastic about the Fed doing its task and he doesn’t think Jerome Powell’s strong balance sheet claims. Schiff raised the reality that Americans are taking advantage of their savings to handle the struggling economy. The U.S. Bureau of Economic Analysis has actually launched data that reveals individual savings in the U.S. has actually dropped to the most affordable levels because September 2008.

“If the U.S. economy and home balance sheets are as strong as Powell claims, Schiff stated. “Why did the savings rate simply plunge to its most affordable level because the middle of the worst economic downturn because The Great Depression? When times are difficult individuals use what they conserved when they were flush,” the financial expert included.

What do you consider the Federal Reserve guv Christopher Waller’s viewpoints? What do you consider the current U.S. savings data and Peter Schiff’s comments? Let us understand what you consider this topic in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.