No stranger to unusual milestones, the cryptocurrency sector might quickly see a historic first, one that would upend long-held perceptions of its market.

Branded ‘The Flippening’ by market observers, this new hypothetical is outlined loosely as the purpose at which a competing blockchain community may exchange bitcoin as the most important and greatest capitalized blockchain. Sparked by rising inflows in cryptographic property, the idea has already seen a devoted hashtag and website.

Given that bitcoin invented and popularized blockchain techniques, the event may herald a time of recent range and experimentation for the nascent sector that, till just lately, was largely outlined in context of bitcoin.

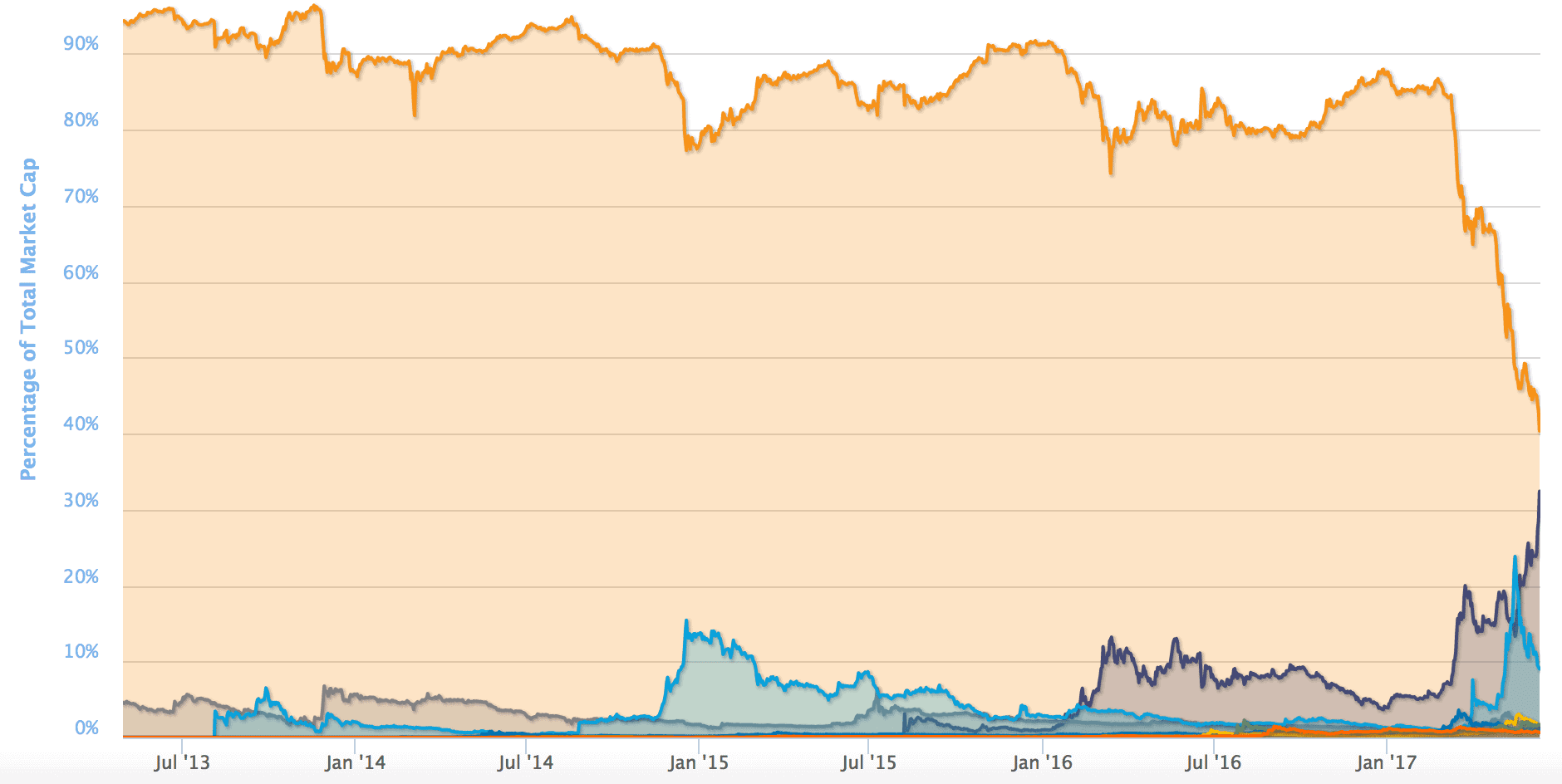

At earlier factors in 2017, bitcoin accounted for greater than 80% of the overall cryptocurrency market share, although this determine has been increased than 90% at instances.

However, so-called various cryptocurrencies have drawn strong inflows this 12 months, inflicting their whole market cap to succeed in a document excessive of roughly $117m right now, a greater than 500% year-to-date enhance, based on CoinMarketCap.

So, will the occasion come to move? And in that case, what is going to it imply?

Analysts queried by CoinDesk largely imagine ethereum’s ether token is more than likely to spur the change, given it has elevated 3,000% this year with no indicators of slowing.

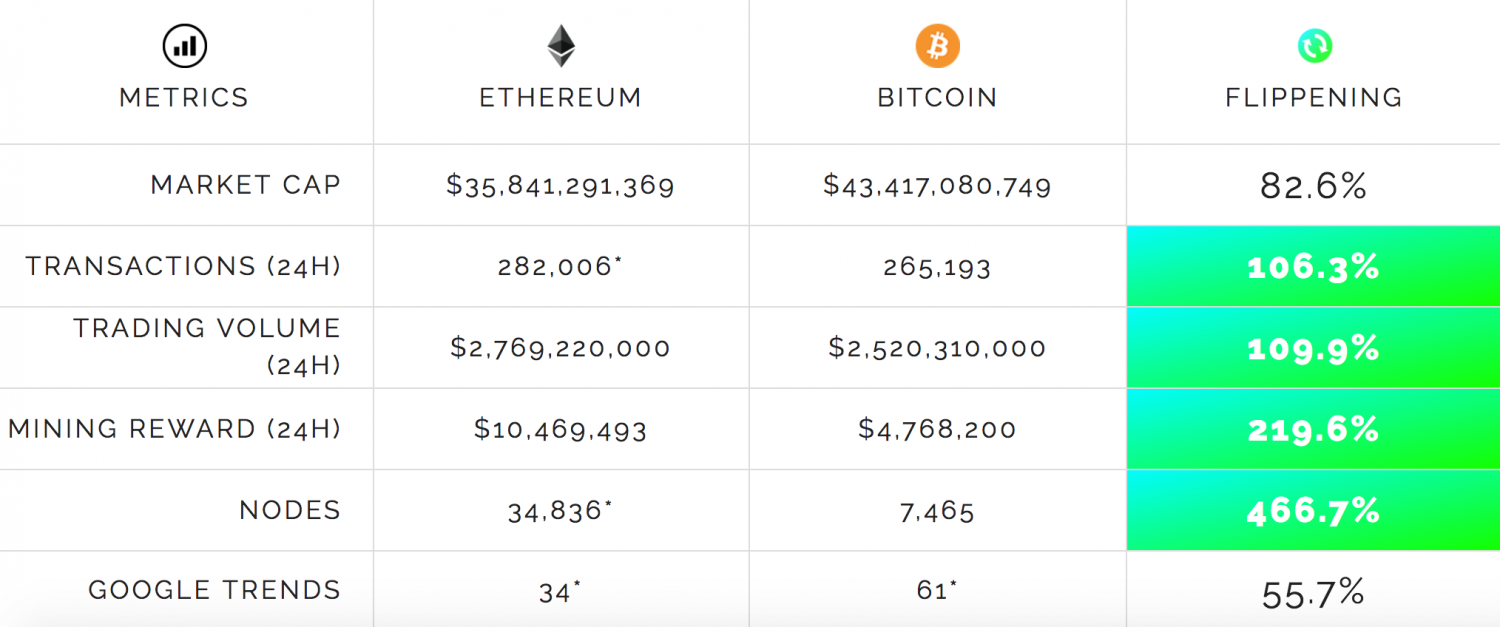

Indeed, ether’s market cap has been drawing steadily near bitcoin’s amid a broader uptick in curiosity for so-called ‘tokens’ based on the platform, with the 2 cryptocurrencies value $35.9bn and $43.7bn on the time of report.

Bitcoin’s governance issues

Still, whereas some analysts targeted on the promise of the ethereum community, others emphasised the perceived difficulties bitcoin has encountered of late as the rationale this improvement might be possible.

Developers and entrepreneurs constructing on bitcoin are nonetheless making an attempt to determine one of the simplest ways to resolve its ongoing scaling dilemma, a matter which some allege is limiting the cryptocurrency’s use as a medium of alternate. (Though, maybe benefitting its use as a retailer of worth).

Currently, blocks in bitcoin’s blockchain can solely embody as much as 1 MB of transaction date, that means that they’ll solely course of a hard and fast variety of exchanges. Thus far, proposals to extend the block dimension have failed, and efforts to implement Segregated Witness – an answer that would cut back the overall dimension of every particular person transaction and permit extra of those to suit into blocks – have failed to achieve the wanted assist.

Other proposals have largely proved short-lived or polarizing.

“Bitcoin is still stuck at [the] scaling dilemma,” stated Marius Rupsys, cryptocurrency dealer and co-founder of fintech startup InvoicePool. “If some kind of agreement were achieved, [bitcoin] could regain much of its dominance.”

However, the bitcoin neighborhood has not but discovered an answer, so ether is benefiting from the scenario, he stated. As markets reply to those developments, Rupsys expects ether’s market capitalization, or the overall worth of its accessible token provide, to surpass bitcoin’s.

Bitcoin, the primary cryptocurrency to scale, has to an extent change into “a victim of its own success,” stated Tim Enneking, managing director of the cryptocurrency hedge fund Crypto Asset Management.

He additionally famous that ether has benefited from coming into existence after bitcoin, telling CoinDesk:

“Ether has learned and has fewer problems – as well as a comprehensive, coherent (more or less) roadmap going forward. It also has leadership. Bitcoin has none of that. And first-mover advantages dissipate if one doesn’t continue to innovate.”

Charles Hayter, co-founder and CEO of cryptocurrency alternate service CryptoEvaluate, was additionally optimistic that ethereum may change into the dominant blockchain.

“Ether has a strong chance of surpassing bitcoin due to its strong network effect and ability to negate the governance issues that bitcoin has been subject to,” he stated.

ICOs essential

Some market observers emphasised the important thing function performed by token gross sales (or ICOs) when explaining why ether’s market cap may surpass that of bitcoin’s.

As these choices enable individuals to alternate bitcoin and ether for digital ‘tokens’ that grant publicity to new ventures, buyers buying these tokens (contracts on the ethereum community) steadily use ether as a result of they do not need to miss out.

Further, the focus of ether within the palms of a smaller set of startups is creating new financial pressures on the community.

“This keeps many ethers locked up in new projects and [fewer] ethers are available for trading,” Rupsys famous.

Bitcoin entrepreneur Charlie Shrem provided an identical sentiment, noting: “Right now, an immense supply of ETH gets locked up due to [ICOs].” This “severely reduces supply,” and with every providing, extra tokens are “locked up”, he defined.

Still, tasks utilizing this methodology of fundraising are going to promote a number of the ether tokens they increase to pay for improvement, he stated, that means promote stress may enhance in ought to this start in earnest.

Bubbles and potentials

While many analysts offered optimistic assessments of ether’s future, some expressed issues that the cryptocurrency is in bubble territory.

Petar Zivkovski, COO of leveraged cryptocurrency platform Whaleclub, asserted that ether’s value is tied closely to the ICOs that use the choice asset protocol.

“I personally think ether price is incredibly overpriced, and that many of the ICOs funded will not deliver on all their promises. When that unravels, it’s likely to cause a substantial crash in the ether price,” he stated.

However, he did go away open the likelihood that ether’s market cap may surpass bitcoin’s, relying on how a lot success ether-based ICOs produce.

Still, analysts additionally emphasised the affect each networks may have on the world.

While bitcoin may revolutionize the world of currency, ether may have extra a wide-ranging affect by means of its use of good contracts.

Mati Greenspan, senior markets analyst at asset buying and selling platform eToro, spoke to this potential.

He added that, given its expansive objectives, it is likely to be possible for ether to surpass bitcoin by way of market cap and value, although it could not have the most important community impact by different means.

Greenspan concluded:

“The development of both bitcoin and ethereum have far-reaching implications for our future world. Respectively, bitcoin and ethereum represent the future of money and the future of the internet.”

Markets picture through Shutterstock

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.