The impressive change of Bitcoin from an unknown digital currency to a popular worldwide monetary property is notable. As it browses this brand-new period, a varied range of organizations, federal governments, and designers are actively working together to open its total capacity. Matt Crosby, the lead market expert at Bitcoin Magazine Pro, just recently taken part in a discussion with Rich Rines, a factor at Core DAO, to check out Bitcoin’s upcoming development stage, the growing field of Bitcoin DeFi, and its potential function as a worldwide reserve property. The complete interview can be seen here: The Future Of Bitcoin – Featuring Rich Rines.

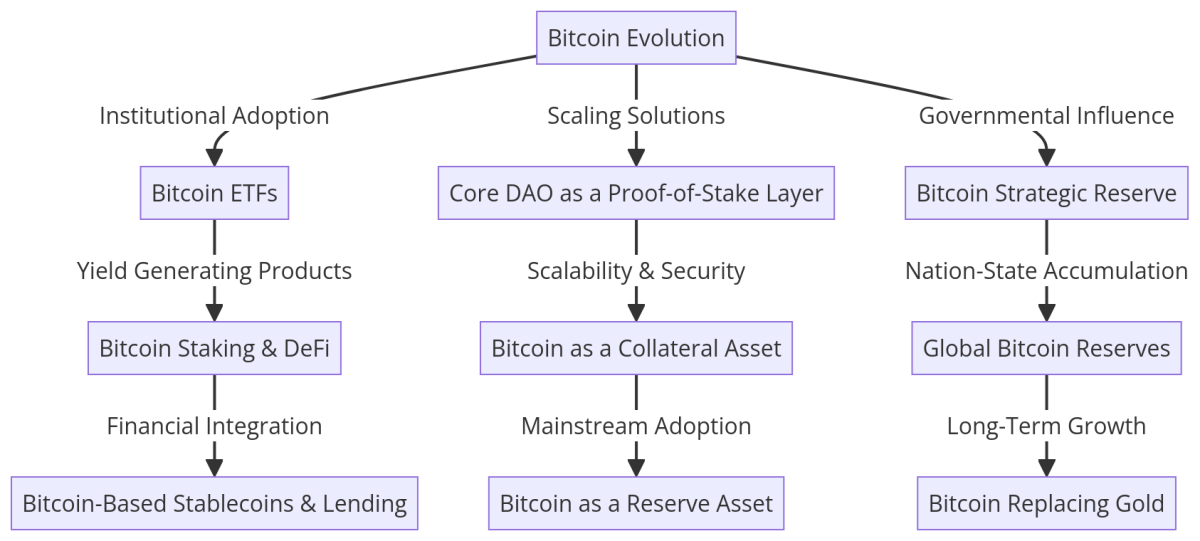

Bitcoin’s Evolution & Institutional Adoption

Rich Rines has actually been deeply associated with the Bitcoin community considering that 2013, enabling him a unique viewpoint on its development from a speculative endeavor to a universally recognized monetary instrument.

“By the 2017 cycle, I was pretty determined that this is what I was going to spend the rest of my career on.”

The discussion addresses Bitcoin’s increasing value within institutional financial investment portfolios, keeping in mind that area Bitcoin ETFs have actually currently collected inflows surpassing $41 billion. Rines presumes that Bitcoin’s combination into institutional financing will continue to change worldwide monetary landscapes, especially with the development of yield-generating items attracting financiers on Wall Street.

“Every asset manager in the world can now buy Bitcoin with ETFs, and that fundamentally changes the market.”

What is Core DAO?

Core DAO represents an ingenious blockchain community created to improve Bitcoin’s abilities through an evidence-of-stake (PoS) system. Distinct from standard scaling options, Core DAO makes use of a decentralized PoS structure to enhance scalability, programmability, and interoperability while securing Bitcoin’s fundamental security and decentralization.

Essentially, Core DAO functions as a Bitcoin-lined up Layer-1 blockchain, extending Bitcoin’s performances without modifying its hidden architecture. This technique helps with a variety of DeFi applications, clever agreements, and staking chances for Bitcoin holders.

“Core is the leading Bitcoin scaling solution, and the way to think about it is really the proof-of-stake layer for Bitcoin.”

By protecting 75% of the Bitcoin hash rate, Core DAO enhances Bitcoin’s security concepts while offering boosted performance for designers and users. With a growing community consisting of over 150+ jobs, Core DAO is leading a brand-new chapter in Bitcoin’s monetary development.

Core: Bitcoin’s Proof-of-Stake Layer & DeFi Expansion

One of Bitcoin’s primary obstacles is scalability. High deal costs and sluggish processing times, while strengthening its status as a robust settlement layer, limit its useful application in daily deals. Core DAO addresses this problem efficiently.

“Bitcoin lacks scalability, programmability. It’s too expensive. All these things that make it a great settlement layer is exactly the reason that we need a solution like Core to extend those capabilities.”

Core DAO works as an evidence-of-stake layer for Bitcoin, empowering users to create yield without third-party threats. This community enables Bitcoin holders to participate in DeFi applications while maintaining security requirements.

“We’re going to see Bitcoin DeFi dwarf Ethereum DeFi within the next three years because Bitcoin is a superior collateral asset.”

Bitcoin as a Strategic Reserve Asset

In a shift towards watching Bitcoin as a strategic reserve property instead of simply a currency, federal governments and sovereign wealth funds acknowledge its prospective effect. The facility of a U.S. strategic Bitcoin reserve, along with wider worldwide approval at the nation-state level, might lead the way for a brand-new monetary paradigm.

“People are talking about building strategic Bitcoin reserves for the first time.”

The idea of Bitcoin supplanting gold as a main shop of worth is getting traction. Rines asserts that Bitcoin’s fundamental deficiency and decentralized nature position it as an exceptional option to gold.

“I think within the next decade, Bitcoin will become the global reserve asset, replacing gold.”

Bitcoin Privacy: The Final Frontier

Despite Bitcoin’s praise for decentralization and censorship resistance, personal privacy stays a substantial issue. The openness of Bitcoin’s public journal exposes all deals to anybody with the capability to access the blockchain.

Rines highlights that improving Bitcoin’s personal privacy functions will be an essential element of its advancement.

“I’ve wanted private Bitcoin transactions for a really long time. I’m pretty bearish on it ever happening on the base layer, but there’s potential in scaling solutions.”

While improvements such as CoinJoin and the Lightning Network supply some personal privacy improvements, extensive privacy continues to be an evasive objective. Core is examining brand-new approaches that might help with private deals without jeopardizing Bitcoin’s core concepts of security and openness.

“On Core, we’re working with teams on potentially having confidential transactions—where you can tell that a transaction is happening, but not the amount or counterparties involved.”

As regulative analysis of digital monetary activities heightens, the vital for enhanced Bitcoin personal privacy functions will end up being significantly noticable. Whether through first-layer procedure improvements or second-layer options, the trajectory of Bitcoin’s personal privacy enhancements stays a critical location for advancement.

The Future of Bitcoin: A Trillion-Dollar Market in the Making

During their discussion, Rines elaborates on how Bitcoin’s financial structure is broadening from speculative practices into efficient monetary tools. He expects that within the next years, Bitcoin’s market capitalization might reach $10 trillion, with DeFi applications representing a considerable section of its financial structure.

“The Bitcoin DeFi market is a trillion-dollar opportunity, and we’re just getting started.”

This viewpoint resonates with the wider market pattern where Bitcoin shifts from being simply a shop of worth to ending up being an active monetary property operating within decentralized networks.

Rich Rines’ Roadmap for Bitcoin’s Future

Final Thoughts

The conversation in between Matt Crosby and Rich Rines uses an informative viewpoint into the future trajectory of Bitcoin. With the velocity of institutional approval, the growth of Bitcoin DeFi, and an increasing recommendation of Bitcoin as a strategic reserve, it appears that Bitcoin’s most appealing years lie ahead.

In Rines’ words:

“Building on Bitcoin is one of the most exciting opportunities in the world. There’s a trillion-dollar market waiting to be unlocked.”

For financiers, designers, and policymakers, the significant takeaway is indisputable: Bitcoin has actually transcended its status as a speculative property and now works as the structure for an emerging monetary community.

For extensive Bitcoin analysis and advanced functions consisting of live charts, customized sign signals, and thorough market reports, please check out Bitcoin Magazine Pro.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.