The post below is from a current edition of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be amongst the very first to get these insights and other on-chain bitcoin market analysis directly to your inbox, subscribe now.

Disinflation And Monetary Policy

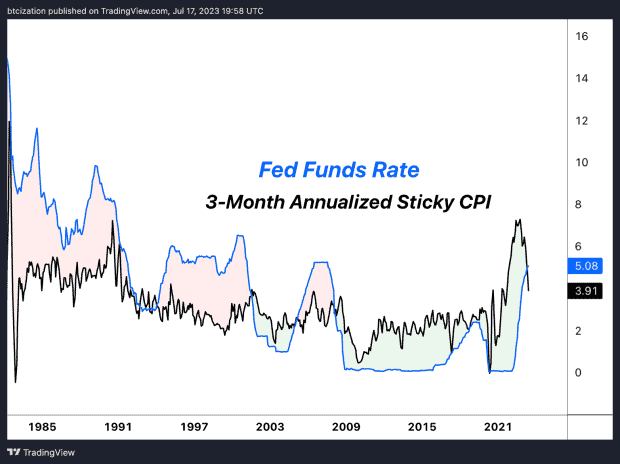

As we dive much deeper into 2023, the U.S. economy discovers itself at a crossroads. Disinflation appears to be embeding in as a direct outcome of the Federal Reserve’s tightening up financial policies. This policy shift has actually caused a noteworthy downturn in the annualized sticky Consumer Price Index (CPI) over current months. With this in view, the discussion amongst market individuals has actually slowly moved far from inflationary issues and towards attempting to comprehend the effect of the tightest financial policy in a years and a half.

The high inflation we’ve experienced, especially in the core basket (omitting food and energy), hid the impacts of the swiftest tightening up cycle in history. Inflation was partly sustained by a tight labor market resulting in increased salaries, and leading to a continual second-half inflationary impulse driven more by salaries than by energy expenses.

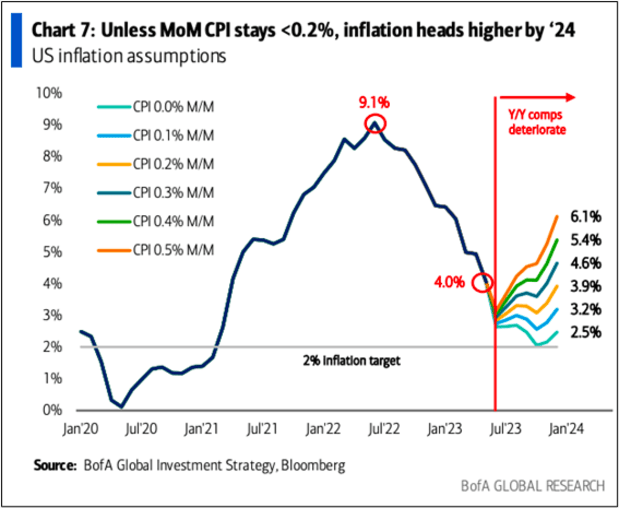

It’s worth keeping in mind that the base impacts for year-over-year inflation readings are peaking this month. This might result in a reacceleration of inflationary readings on a year-over-year basis if wage inflation stays sticky or if energy costs resurge.

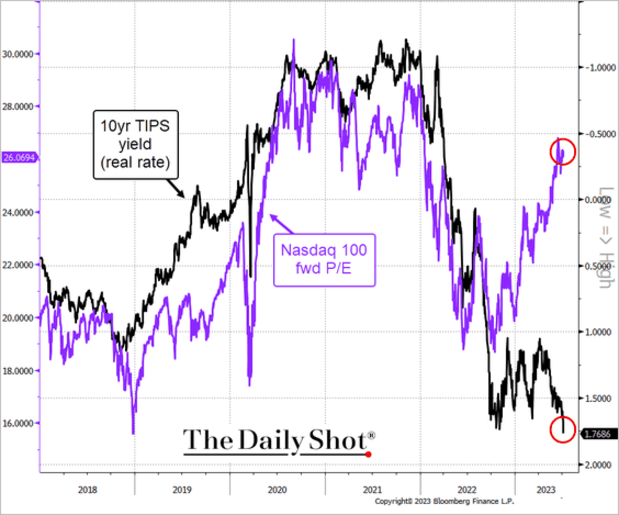

Interestingly, genuine yields — determined with both routing 12-month inflation and forward expectations — are at their greatest in years. The modern financial landscape is especially various from the 1980s, and existing financial obligation levels cannot sustain favorable genuine yields for prolonged durations without resulting in degeneration and possible default.

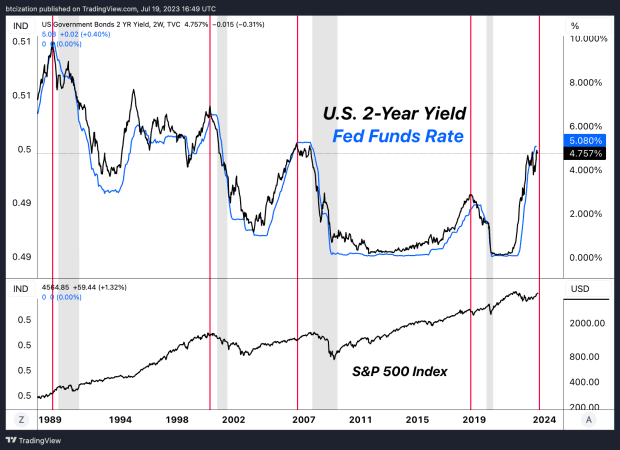

Historically, significant shifts in the market happen throughout Fed tightening up and cutting cycles. These shifts frequently result in distress in equity markets after the Fed starts rate cuts. This isn’t deliberate, however rather the adverse effects from tight financial policy. Analyzing historic patterns can offer important insights into possible market motions, specifically the 2-year yields as a proxy for the average of the next two years of Fed Funds.

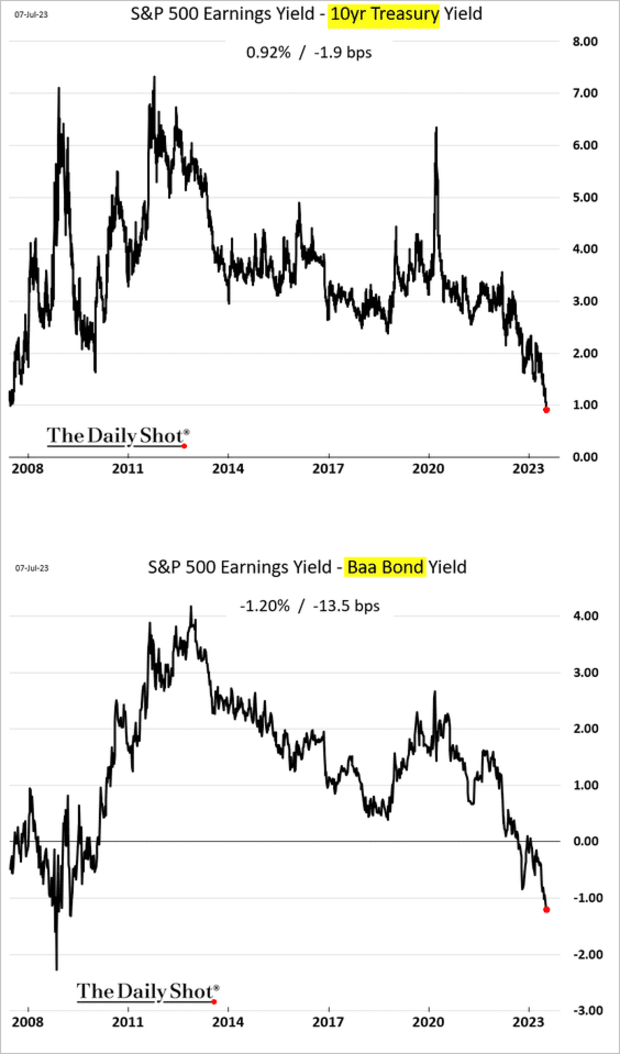

Bonds And Equities: The Growing Disconnect

Currently, there’s a large and growing disconnect in between bond and equity markets. It’s not uncommon for equity revenues to outshine bonds throughout an inflationary routine due to equities’ remarkable prices power. However, with disinflation in movement, the growing divergence in between equity multiples and genuine yields ends up being a vital issue. This divergence can also be observed through the equity danger premium — equity yields minus bond yields.

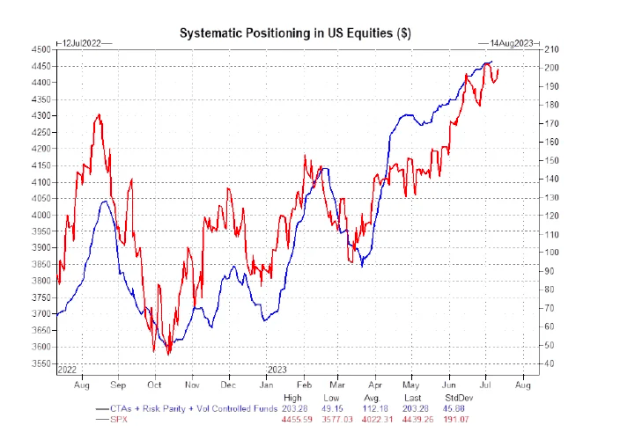

Research from Goldman Sachs reveals organized financial investment methods, specifically Commodity Trading Advisors (CTA), volatility control and risk-parity methods, have actually been progressively utilizing take advantage of to magnify their financial investment direct exposure. This ramp-up in leveraging has actually can be found in tandem with a favorable efficiency in equity indices, which would be required to relax throughout any relocate to the disadvantage and/or spikes in volatility.

Research from JPMorgan Chase reveals their combined equity placing indication remains in the 68th percentile, implying equities are overheated, however extension greater is possible compared to historic requirements.

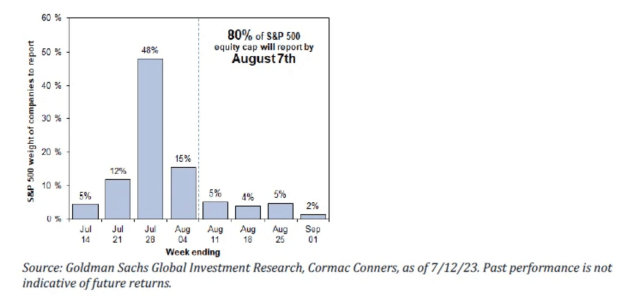

The fate of equity markets in the short-to-medium term will be figured out by revenues, with 80% of S&P 500 business set to finish their reporting by August 7.

Any frustration throughout revenues season might result in a reversion in equity assessments relative to the bond market.

Another fascinating note is from a current Bank of America study, where customer issue around the health of financial markets has actually increased in current months at the very same time as equity markets continue their uptrend.

Headwinds Ahead For The U.S. Consumer?

The robust revenues surprises and the U.S. customer market’s durability are being underpinned in part by excess cost savings from the COVID-era financial stimulus. However, it’s worth keeping in mind that these cost savings are not evenly dispersed. A current BNP Paribas report approximates that the leading earnings quintile holds simply over 80% of the excess cost savings. The cost savings of the lower-income quintiles are currently invested, with the middle quintile likely doing the same quickly. With elements like the resumption of trainee financial obligation responsibilities and emerging weak points in the labor market, we must brace ourselves for possible tension in customer markets.

Despite possible customer market stress factors, the efficiency of the U.S. economy in 2023 has actually exceeded expectations. Equity markets have actually placed on an excellent program, with the booming market appearing relentless. Amidst these market events, we should keep a well balanced point of view, comprehending that the course forward might not be as clear cut or uncomplicated as it appears.

Final Note

We emphasize advancements in equity and rates of interest conditions as we discover it essential to acknowledge the growing liquidity interaction in between bitcoin and conventional possession markets. To put it clearly:

It signals significant need when the world’s biggest possession supervisors are completing to release a financial item that provides their customers direct exposure to bitcoin. These future inflows into bitcoin, primarily from those presently bought non-bitcoin properties, will undoubtedly link bitcoin more carefully with the risk-on/risk-off circulations of worldwide markets. This isn’t a harmful advancement; on the contrary, it’s a development to be welcomed. We anticipate bitcoin’s connection to risk-on properties in the conventional financial markets to increase, while exceeding to the advantage and in a risk-adjusted way over a longer amount of time.

With that being stated, reversing to the primary material of the post, the historic precedent of substantial lag in financial policy, integrated with the existing conditions in the rates of interest and equity markets does necessitate some care. Conventionally, equity markets decrease and a technical economic downturn happens in the United States after the Fed starts to cut rate of interest from the terminal level of the tightening up cycle. We haven’t reached this condition yet. Therefore, although we’re very positive about the native supply-side conditions for bitcoin today, we stay alert to all possibilities. For this factor, we stay open up to the concept of possible down pressure from tradition markets in between now and mid-2024, a duration marked by essential occasions such as the Bitcoin cutting in half and possible approval of an area bitcoin ETF.

That concludes the excerpt from a current edition of Bitcoin Magazine PRO. Subscribe now to get PRO short articles straight in your inbox.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.