For years, Bitcoin lovers have actually been anticipating a considerable modification in the worth due to the participation of institutional investors. The idea was basic: as business and big monetary entities buy Bitcoin, the marketplace would experience explosive development and a continual duration of increasing costs. However, the real result has actually been more complex. Although organizations have actually certainly invested considerable capital in Bitcoin, the prepared for ‘supercycle’ has actually not unfolded as forecasted.

Institutional Accumulation

Institutional involvement in Bitcoin has actually substantially increased over the last few years, marked by considerable buy from big business and the intro of Bitcoin Exchange-Traded Funds (ETFs) previously this year.

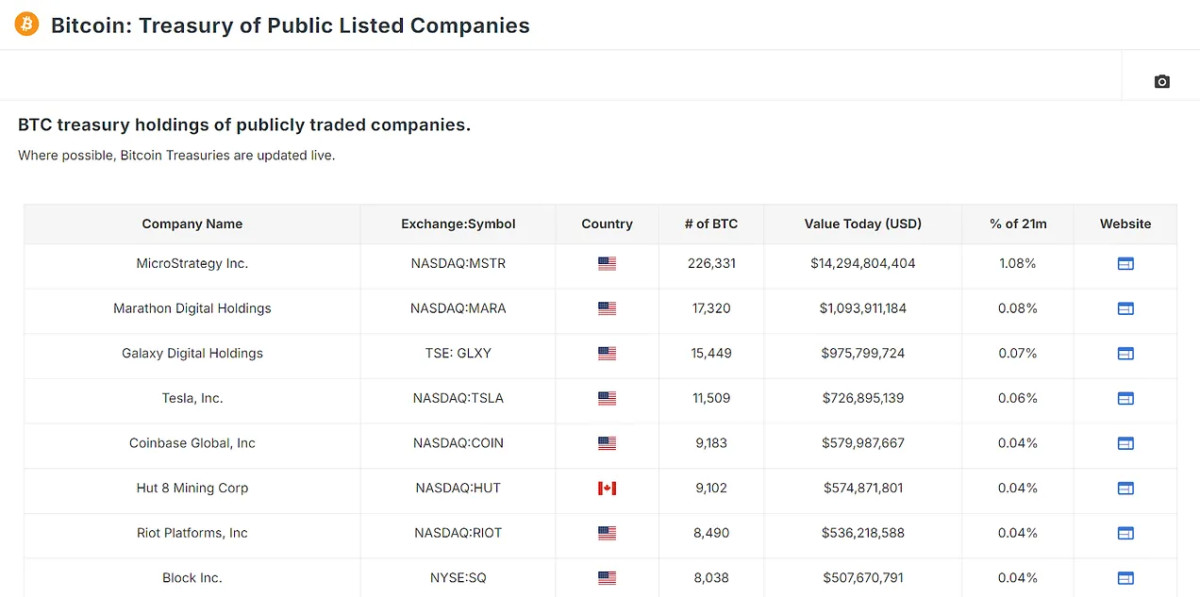

Leading this motion is MicroStrategy, which alone holds over 1% of the overall Bitcoin supply. Following MicroStrategy, other popular gamers consist of Marathon Digital, Galaxy Digital, and even Tesla, with considerable holdings also discovered in Canadian companies such as Hut 8 and Hive, along with global business like Nexon in Japan and Phoenix Digital Assets in the UK; all of which can be tracked through the brand-new Treasury information charts offered on website.

In overall, these business hold over 340,000 bitcoin. However, the genuine game-changer has actually been the intro of Bitcoin ETFs. Since their creation, these monetary instruments have actually drawn in billions of dollars in financial investments, leading to the build-up of over 91,000 bitcoin in simply a couple of months. Together, personal business and ETFs manage around 1.24 million bitcoin, representing about 6.29% of all flowing bitcoin.

A Look at Bitcoin’s Recent Price Movements

To comprehend the possible future impact of institutional financial investment, we can take a look at current Bitcoin cost motions because the approval of Bitcoin ETFs in January. At the time, Bitcoin was trading at around $46,000. Although the cost dipped soon after, a traditional “buy the rumor, sell the news” circumstance, the marketplace rapidly recuperated, and within 2 months, Bitcoin’s cost had actually risen by around 60%.

This boost associates with institutional investors’ build-up of Bitcoin through ETFs. If this pattern continues and organizations keep purchasing the existing or increased rate, we might witness a continual bullish momentum in Bitcoin costs. The crucial element here is the presumption that these institutional gamers are long-lasting holders, not likely to sell their possessions anytime quickly. This continuous build-up would minimize the liquid supply of Bitcoin, needing less capital inflow to drive costs even greater.

The Money Multiplier Effect: Amplifying the Impact

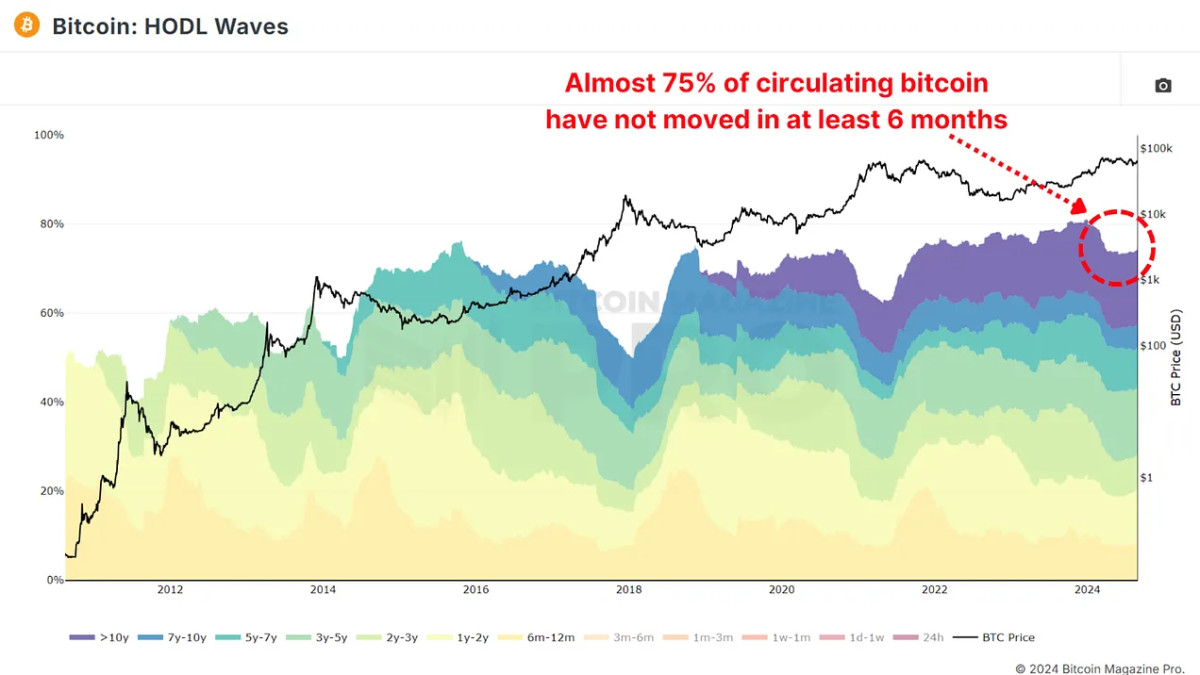

The build-up of possessions by institutional gamers is considerable. Its possible impact on the marketplace is a lot more extensive when you think about the cash multiplier impact. The concept is simple: when a big part of a possession’s supply is eliminated from active flow, such as the almost 75% of supply that hasn’t relocated a minimum of 6 months as described by the HODL Waves, the cost of the staying flowing supply can be more unpredictable. Each dollar invested has actually an amplified impact on the general market cap.

For Bitcoin, with approximately 25% of its supply being liquid and actively traded, the cash multiplier impact can be especially powerful. If we presume this illiquidity leads to a $1 market inflow boost in the market cap by $4 (4x cash multiplier), institutional ownership of 6.29% of all bitcoin might successfully affect around 25% of the flowing supply.

If organizations were to start unloading their holdings, the marketplace would likely experience a considerable decline. Especially as this would likely activate retail holders to start unloading their bitcoin too. Conversely, if these organizations continue to purchase, the BTC cost might rise considerably, especially if they preserve their positions as long-lasting holders. This vibrant highlights the double-edged nature of institutional participation in Bitcoin, as it gradually then all of a sudden has a higher impact on the property.

Conclusion

Institutional financial investment in Bitcoin has both favorable and unfavorable elements. It brings authenticity and capital that might drive Bitcoin costs to brand-new heights, particularly if these entities are dedicated long term. However, the concentration of Bitcoin in the hands of a couple of organizations might result in increased volatility and considerable drawback threat if these gamers choose to leave their positions.

For a more thorough check out this subject, take a look at a current YouTube video here:

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.