The Lightning Network represents a transformative scaling option for Bitcoin, assisting in quick and economical deals that boost the usefulness of daily Bitcoin use. As the network continues to broaden, it ends up being significantly important to examine its health and effectiveness in order to completely harness its abilities.

While standard metrics such as node count, channel count, and total capability have actually been utilized to assess the Lightning Network, they supply just a partial understanding of its efficiency. A more extensive insight into this second-layer option demands a concentrate on circulation characteristics—particularly, the Max Flow metric, which boasts an enduring application in the optimization of complex systems.

Max Flow: The Crucial Metric for Assessing the Lightning Network’s Vitality

Max Flow acts as a robust metric that measures the theoretical circulation of worth through a network while accounting for restrictions such as channel capability and liquidity. This tool is vital for evaluating the network’s efficiency and dependability, specifically in situations where unrestricted circulation is important to success.

Historically, Max Flow has actually discovered energy throughout different sectors, consisting of:

- Telecommunications: The application of Max Flow allows effective bandwidth allotment, guaranteeing smooth information transmission throughout the web.

- Supply Chain Management: Businesses make use of Max Flow algorithms to boost the transport of products throughout worldwide circulation networks, decreasing hold-ups and taking full advantage of functional effectiveness.

- Transportation Systems: Urban organizers use Max Flow concepts to traffic management, enhancing car motion through roadway networks by refining circulation at important crossways.

These circumstances highlight how Max Flow adds to enhancing effectiveness in detailed systems needing swift and efficient resource motion. Its current application to the Lightning Network, as evidenced by information science research study performed by René Pickhardt on possible lightning payments, highlights its importance in promoting the smooth circulation of Bitcoin deals amongst users, even as the network scales.

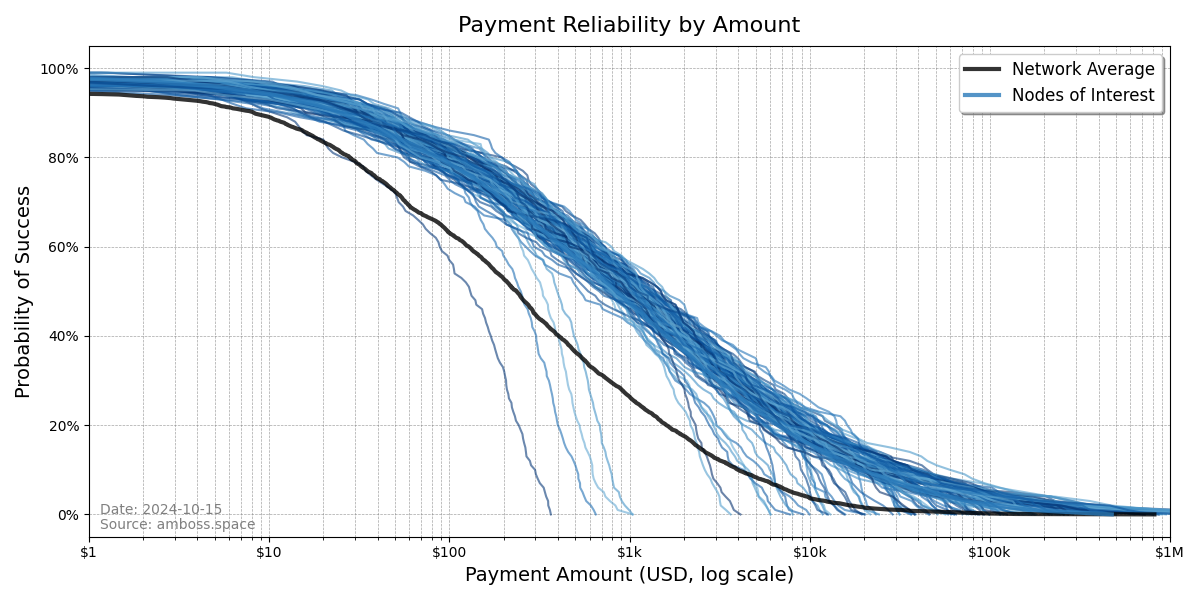

Importantly, Max Flow goes beyond simple measurement of real worth motion; it clarifies the probabilistic understanding of possible payments passing through the network. By stressing Max Flow, stakeholders get a more exact grasp of the Lightning Network’s total health, moving beyond simple counts of channels and capability to comprehend the possibility of effective deals. This insight permits node operators to enhance their liquidity and improves the network’s total efficiency.

Limitations of Traditional Metrics

Metrics such as node count, channel count, and capability provide a shallow summary of the Lightning Network’s facilities. However, comparable to counting roadways or crossways within a city, these figures stop working to show the effectiveness of traffic circulation. In the context of the Lightning Network, the important metric is the efficiency of Bitcoin routing through the system.

Critics who solely focus on these standard metrics typically reach narrow conclusions concerning the network’s efficiency. While it is essential to think about the measurements of the facilities, a more substantial focus depends on understanding the possibility of effective deals.

Max Flow offers that much deeper level of insight. By evaluating the success possibility of payments, it determines locations with well-distributed liquidity and prospective traffic jams, empowering operators to make educated choices that boost the network’s efficiency and guarantee dependable payment routing.

Max Flow Correlates with Performance as Bitcoin Value Increases

The Lightning Network is tactically created to scale in tandem with Bitcoin, providing profitable and economical deals without enforcing extra concerns on the Bitcoin blockchain. As the cost of Bitcoin increases, the network’s capability to accommodate bigger payments naturally broadens.

For circumstances, if a channel consists of 0.1 BTC and Bitcoin is valued at $50,000, that channel can process a payment of $5,000. Should Bitcoin’s cost double to $100,000, the exact same channel would then help with a $10,000 deal—all without demanding modifications to the underlying facilities. As the digital economy developed on Bitcoin flourishes, so too will the abilities of the Lightning Network. The merging of increasing Bitcoin rates and data-driven adjustments to the Lightning Network is anticipated to widen its functional capacity.

Max Flow contributes in this context, helping in the evaluation of payment dependability as the network broadens. It stands as an important tool for tracking transactional dependability, guaranteeing that the network stays effective in the face of increasing need for Bitcoin deals.

Max Flow: Pioneering Future Monitoring of the Lightning Network

Max Flow stands as an ingenious metric poised to move the Lightning Network forward. By going beyond shallow steps such as capability or node count, it gears up node operators and financiers with a clearer understanding of the network’s efficiency. This improved clearness, in turn, assists in more educated choices concerning liquidity allotment and payment routing.

For financiers, Max Flow provides a more reputable gauge of network vigor, unveiling the hidden prospective within the Lightning Network. Those who focus on Max Flow will open much deeper insights into the scalability and effectiveness of the Lightning Network, consequently placing themselves to take advantage of future development chances.

For node operators, an understanding of Max Flow allows them to enhance channel efficiency efficiently. This understanding help in much better liquidity management, guaranteeing that deals circulation dependably and improving the total user experience for those engaging with the network.

Conclusion: The Significance of Max Flow

As the Lightning Network advances, Max Flow will end up being significantly important to its total health and performance. Although standard metrics such as node count and channel capability yield a restricted point of view on the network, Max Flow clarifies the effectiveness of worth motion within the system—a vital understanding as Bitcoin’s footprint within the worldwide economy broadens and requires for dependable payments rise.

Max Flow is not simply an unique technique to network measurement; it is the key to understanding the complete capacity of the Lightning Network. By focusing on the pertinent metrics, node operators and financiers alike can add to the network’s smart scaling, guaranteeing Bitcoin’s continual development and prominence in the worldwide economy.

TL;DR

- Traditional metrics such as node count, channel count, and capability stop working to completely encapsulate the efficiency of the Lightning Network.

- Max Flow becomes the suitable metric for evaluating network health, evaluating the possibility of possible payments and enhancing liquidity.

- As Bitcoin worths increase, the Lightning Network’s capability to manage bigger deals increases naturally, with Max Flow working as an important tracking tool in this procedure.

- Max Flow has actually shown its efficiency in enhancing complicated networks in sectors such as telecoms, supply chain, and transport.

- Max Flow will be essential in allowing the Lightning Network to scale effectively, marking it as a vital resource for both financiers and node operators.

This post represents a visitor contribution from Jesse Shrader. The views revealed herein are the author’s own and do not always show those of BTC Inc or Bitcoin Magazine.

About Amboss:

Amboss is establishing the facilities required for the Bitcoin Lightning Network, assisting in instant, real-time deals throughout different markets. Through maker learning-enhanced routing and liquidity optimization systems, Amboss assurances that billions of inexpensive deals take place safely and effectively. As AI-driven economies take shape, Amboss stands as the fundamental structure supporting self-governing systems taken part in high-volume deals.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.