The subtle shift in social networks discussions. The discusses in the mainstream media: “Bitcoin will now be available for Wall Street investors!”. All the text showing up with concerns about bitcoin from your no-coiner pals. Bitcoiners understand that this is the signal. The booming market is formally here before the 2024 halving. This is a letter and a quick guide with great tools for all those individuals who have actually been asking concerns about bitcoin in the last couple days.

“Bitcoin… Should I buy it?” “What is the best way to buy some?” “When should I buy it?” “How much do I buy?” “What strategy do I use to accumulate?” “Do I keep it? How long?”

Gradually and after that unexpectedly. That odd magic web cash you invest your downtime looking into is all anybody wishes to speak about now. Your colleague, typically unconcerned to anything outside his instant domain, begins peppering you with concerns about exchanges and wallets. Your high school and college pals text you requesting recommendations.

The no-coiner texts are more than simply a social phenomenon. They’re a barometer of market belief, a bellwether indicating the increase of a new age of interest. When the concerns shift from “What is Bitcoin?” to “How do I buy it?” you understand something basic has actually moved.

This isn’t simply FOMO (worry of losing out). It’s acknowledgment. People are beginning to see what we have actually seen the whole time: a financial transformation unfolding before our eyes. The restrictions of the old system, the fragility of fiat currencies, are ending up being painfully apparent. And Bitcoin, that beacon of sound cash and specific sovereignty, shines ever brighter in the growing darkness.

The concerns, obviously, are differed. “Should I buy now?” asks the careful one, still scarred by previous cost swings. “What exchange should I use?” queries the useful one, looking for a safe and secure course to entry. And the daring one, eyes shining with gold rush fever, wishes to know about take advantage of and trading techniques.

There’s no one-size-fits-all response, obviously. Each journey into Bitcoin is special, formed by specific scenarios and run the risk of tolerance. But for those drawn to the flight to quality, let’s go action by action.

“Should I Buy Bitcoin?”

This is not financial investment recommendations. Before investing any cash, I would recommend that you invest time doing your own research study about how to utilize the Bitcoin network properly. That stated, the world’s biggest property supervisor is really bullish on Bitcoin. According to a BlackRock paper from 2022, they think that an 84.9% bitcoin allotment is the ideal technique.

Additionally, Fidelity released a paper entitled Introduction to Digital Assets For Institutional Investors and they point out Bitcoin 73 times. After that, they released a paper entitled Bitcoin First: Why financiers require to think about Bitcoin independently from other digital possessions.

Again, that doesn’t suggest you need to trust them with your eyes closed. I motivate everybody to do their own research study. This is merely a little bit of context about what giants in the property management market are stating recently. There are open source tools that can assist you make your own conclusions. Any individual can access and comprehend how to utilize these tools for their individual wealth management. In reality, you can have fun with the designs and change anything if you understand some shows in Python. Finally, the Bitcoin network has a lot of special qualities that make it like no other property we have actually seen before. Bitcoin rocks!

“What Is The Best Way To Buy Some?”

It depends upon specific requirements, top priorities and trade offs. On one side, you require to select the level of duty that you’re comfy with. On another side, you require to choose the level of ownership that you wish to have more than your wealth.

For example, there will be people that choose to quit outright ownership due to the fact that they’d rather have a third-party as the custodian of the bitcoin. Long time bitcoiners worth outright ownership and for that reason they choose to be the custodians of their own bitcoins even if that indicates more duty for them. Holding your own secrets is the only method to actually own any bitcoin. That’s why they state: “Not your keys, not your bitcoin”. If you actually wish to be your own bank, you can’t hand over the duty of holding your secrets to anybody else.

There is no doubt that not everybody chooses the huge duty of holding their bitcoin. The exact same thing occurred with other possessions like gold. Not everybody feels comfy keeping gold in their homes and they send their gold to third-party custodians that have huge gold vaults. In the online world there are also technicalities that will make some people feel not able to stay up to date with the huge duty of holding worth without the assistance of a third-party.

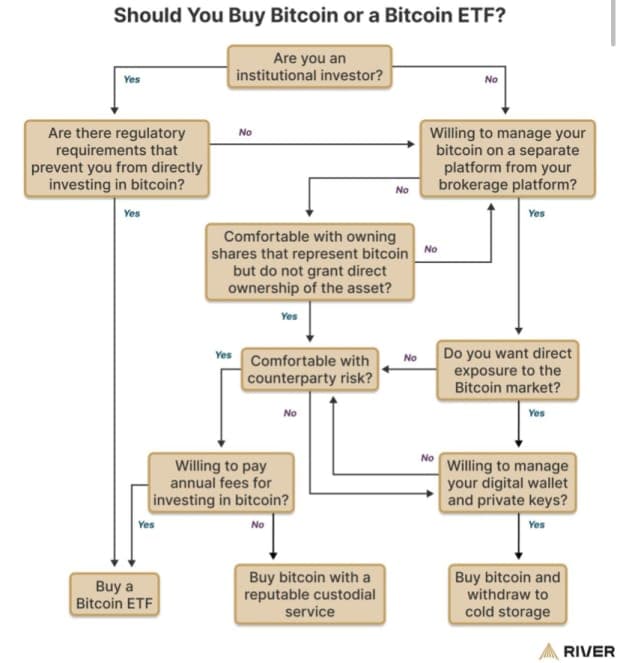

Ask yourself the following concerns: Do you worth outright ownerships? Do you worth personal privacy? Are you comfy with the duty of holding your secrets securely? How much trust do you have in a third-party to custody your wealth? Are you a specific or institutional financier? If you are an institutional financier, exist policies avoiding you from owning genuine bitcoin? The following diagram from River can assist you choose which is the very best method for you to purchase and hold bitcoin.

In conclusion, there are 3 various options depending upon specific requirements. First, owning genuine bitcoin with a hardware wallet that you own the secrets to. Second, purchasing paper bitcoin and having a third-party do the custody for you. Third, purchasing a Bitcoin ETF and having your broker keep it for you. After all, you can utilize a mix of various techniques either to diversify your direct exposure or invest from various platforms.

“When Should I Buy It?”

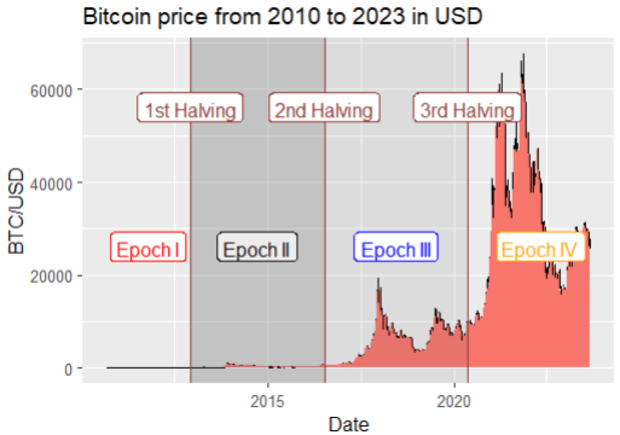

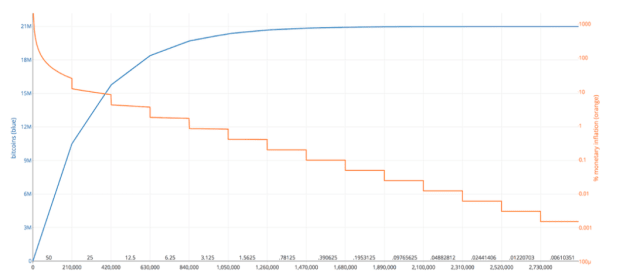

Approximately every 4 years there is an occasion called the Halving. A cutting in half indicates that the quantity of bitcoins took into flow is cut into half. This is referred to as the Block Reward or Block Subsidy. In 2023, the Block Reward was comparable to 6.25 Bitcoin coins. The Block Reward describes the variety of coins released every 10 minutes. This indicates that 900 bitcoins were produced every day.

In 2010, the Block Reward was 50 coins. During a Halving, the Block Reward is cut in half, marking considerable dates in the life of the Bitcoin network. We are presently in the fourth date (Epoch IV), which started in 2020 and will end in 2024.

Therefore, with the Halving in 2024, the financial issuance will reduce to 3.125 coins every 10 minutes. This halving is anticipated to happen around April and to put it simply, a cutting in half triggers an expected reduction in the development rate of the financial base. The cutting in half and the Epoch are important factors to consider for those thinking about buying Bitcoin. In the following chart you can picture this:

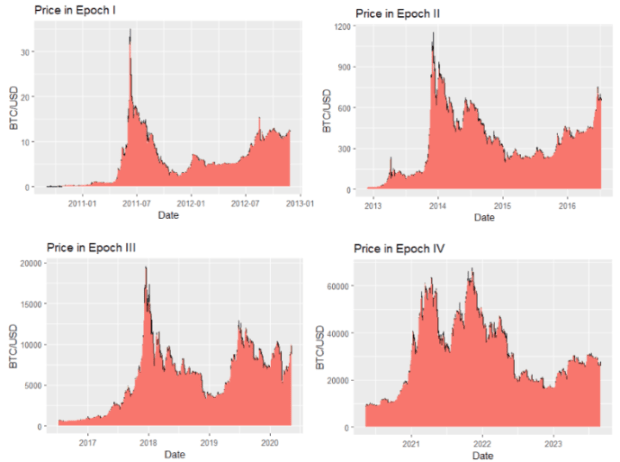

The following charts include Bitcoin cost information for each date independently (from Epoch I to Epoch IV, respectively). What’s interesting about these 4 charts is that they assist us picture a clear pattern that duplicates in each date. These charts can be important to anybody thinking about buying Bitcoin, as they help us in imagining an extremely unique cycle that duplicates every 4 years.

It is necessary to point out that we do not understand if the 4 year cycle will continue permanently. In the last couple of years there have actually been brand-new discussions that recommend that the 4 year cycle will not constantly resemble that. A popular argument is that the halving will be priced in with anticipation for future dates when individuals end up being more knowledgeable about this phenomenon.

There are presently 19.7 billion bitcoins in flow out of the 21 million that there will ever exist. This indicates that 93% of the overall bitcoins currently exist and there is less than 7% of them to be mined. However, the last bitcoins will be mined around the year 2140 and miners will live off of deal charges after that.

*Source: https://medium.com/swlh/the-mathematics-of-bitcoin-89e7ab59edc

“How Much Do I Buy?”

Once you have actually chosen to purchase bitcoin, the next action is to ask yourself just how much you wish to invest. Remember the recommendations from that Blackrock publication? You do not need to be that aggressive and invest 84% of your portfolio in bitcoins. You can start gradually. In this area, I will utilize a terrific open-source tool produced by Raphael Zagury (Chief Investment Officer of Swan Bitcoin) and I would recommend everybody to have fun with the designs in the platform on your own. You can discover this control panel at https://nakamotoportfolio.com/.

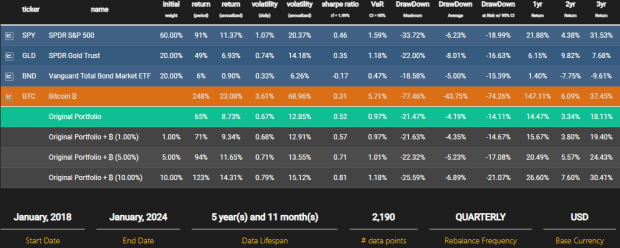

In the Nakamoto Portfolio site, you can customize a portfolio to fulfill your requirements or you can take a look at default portfolios design templates that are currently there for you to evaluate. Let’s take a look at an extremely basic and conventional portfolio:

This portfolio has 60% of its wealth bought the S&P 500 Index (SPY), 20% in a routine gold trust (GLD), and the other 20% in a Vanguard Bond Market ETF (BND). The amount of time utilized to evaluate this portfolio is in between January 2018 and January 2024. The green line reveals us the real outcomes that this portfolio would`ve had throughout that time period. The results inform us that this portfolio would have had a yearly return of 8.73%. The overall return for the 6 year duration is 65%. The day-to-day volatility of this portfolio is 0.67% and the annualized volatility is 12.85%.

Now let’s concentrate on the 3 lines below the green line that represents the initial portfolio. These lines provide us the outcomes of the initial portfolio if they would have had 1%, 5% and 10% of the portfolio in Bitcoin for those 6 years. Just by having 1% in Bitcoin, the overall returns of the portfolio would go from 65% to 71%. The annualized volatility would just increase to 12.91%. A position of 5% in Bitcoin would increase the returns all the method to 94% with the volatility at 13.55%. Finally, a position of 10% in Bitcoin would take the returns all the method to 123% and the volatility would just increase to 15.12%. This workout shows completely why direct exposure to Bitcoin (even minimum direct exposure) is perfect for any portfolio.

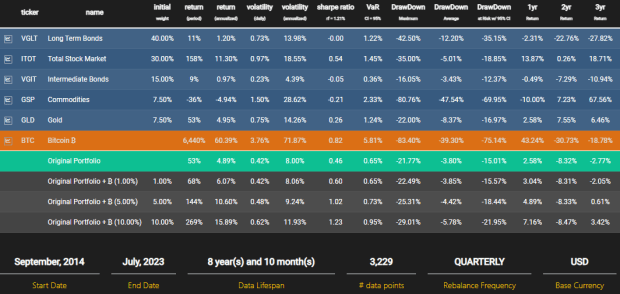

Ray Dalio, the popular financier from Bridgewater Associates, produced a portfolio created to carry out well throughout various financial conditions. This financial investment technique is referred to as the All Weather Portfolio. This portfolio design template is offered on the Nakamoto Portfolio site to evaluate the outcomes of Bitcoin direct exposure. The following image shows the advantages of including Bitcoin to a portfolio like this one.

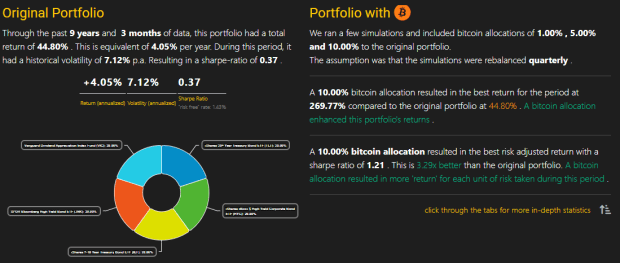

Another intriguing portfolio to take a look at is the Diversified Bond Portfolio. This is a conservative financial investment technique for risk-averse people. This portfolio consists of a mix of Treasury with High Yield ETFs. According to Mr. Zagury, “a Bitcoin allocation is the perfect implementation of a bond portfolio. Even at small amounts, it has the potential to increase risk-adjusted returns.” The following image consists of a quick summary of the effect that Bitcoin direct exposure can have on the Diversified Bond Portfolio. I recommend for everybody to experiment with the Nakamoto Portfolio on their own to have fun with various numbers, portfolios, techniques, and so on. There are YouTube tutorials and Twitter Threads to assist anybody that has an interest in utilizing this terrific tool.

“What Strategy Do I Use To Accumulate?”

Once you have actually chosen that you wish to purchase some bitcoin and you have actually selected the quantity of direct exposure that you desire, the next action is to choose how you wish to approach this build-up stage. What technique do you wish to purchase bitcoin? On one hand, you can purchase it simultaneously. On the other hand, you can purchase gradually.

There are 2 primary techniques for bitcoin build-up: Lump-amount Investing and Dollar Cost Averaging (DCA). A lump-sum technique indicates investing all offered funds simultaneously. The DCA technique assigns funds over routine periods. For example, somebody that chooses to purchase $100 worth of bitcoin weekly (no matter the cost) is following a DCA technique. This is a popular technique amongst bitcoiners that wish to stack sats regularly. Each technique has its own advantages and disadvantages. However, the very best technique depends upon the specific requirements and choices of each person.

The Nakamoto Portfolio site also has a tool where anybody can run the numbers and compare which technique works much better for their specific circumstance. Check out the BTC Cost Averaging Simulator. According to Swan´s Nakamoto Portfolio, “lump-sum investing has historically outperformed DCA strategies. This is primarily due to Bitcoin’s explosive upward price movements. But DCA can lead to significant outperformance during bear markets. For instance, investors who bought at all-time highs but employed DCA afterward were able to break even significantly quicker. While DCA has potential drawbacks, such as reduced returns in consistently rising markets, it remains a popular method for managing risk and promoting disciplined investing.” After all, the majority of people utilize a mix of both of these techniques which may be the very best method to go.

“Do I Keep Tt? For How Long?”

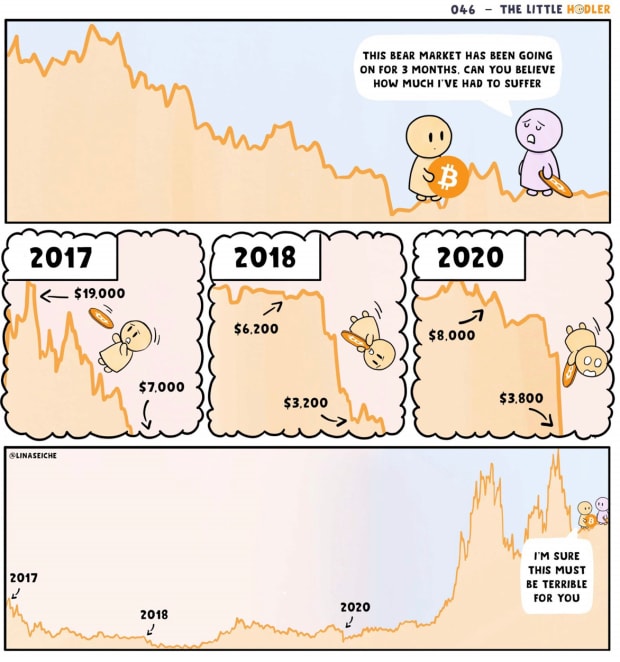

Again, that boils down to specific requirements, top priorities, details, and so on. However, this property must be thought about a long-lasting financial investment technique. That indicates holding your bitcoin for a long time, despite cost changes. Many Bitcoin lovers think that bitcoin will ultimately end up being an international reserve currency, and for that reason, they want to hold it through the ups and downs of the marketplace. There is a popular stating among bitcoiners that modifications “hold” into “HODL” (Hold On For Dear Life!). Take a take a look at amazing bitcoin comics that may also provide you some recommendations…

Other financiers choose trading their bitcoin on a regular basis. This technique includes purchasing bitcoin throughout the dips and offering throughout the highs. It sounds too cool however in truth this decentralized market is really tough to forecast. Very hardly ever do traders get to outmaneuver the market. Time in the market is more vital than timing the marketplace.

I motivate readers to take the next action, whether it’s looking into Bitcoin by themselves, beginning a Bitcoin financial investment strategy, or signing up with the Bitscoins.netmunity. Start your Bitcoin journey today! Dive into the resources, check out the Nakamoto Portfolio, and do not be reluctant to ask concerns. Bitcoin waits for those who attempt to enter the future. As Bitcoin continues its climb, how will the world adjust to this brand-new paradigm of sound cash and specific sovereignty? Only time will inform, however something is particular: the future is orange.

This is a visitor post by Santiago Varela. Opinions revealed are completely their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.