Until just recently, Bitmex, Deribit and a handful of recognized exchanges were the only locations where traders might get their utilize repair. This has now altered with the development of lots of exchanges offering utilize and plenty more on their method. Binance and Kucoin – 2 platforms renowned for driving this year’s other exchange pattern, the IEO – are thought to be mulling the intro of margin trading. In 2019, it appears, whatever’s being served with utilize.

Margin Trading Is so Hot Right Now

Margin trading and preliminary exchange offerings (IEOs) have actually shown to be the dominant patterns amongst cryptocurrency exchanges this year. Bibox is the ideal case in point: the exchange, which provides to 3x utilize on BTC, just recently got in the IEO video game, revealing the launch of no less than 4 tasks on Bibox Orbit concurrently to begin on April 22: The Force Protocol (FOR), Ludos (LUD), Staking (SKR), and X-Block (IX).

FTX is another platform that encapsulates one of 2019’s specifying crypto exchange patterns, in this case for utilize. The derivatives exchange, backed by trading company Alameda Research, provides futures, leveraged tokens at approximately 3x, and OTC trading. With utilize of anywhere from 2-100x, these exchanges increase the excitement – and the threat – of going long or short on bitcoin and other digital possessions. Where when traders had a handful of alternatives, now there are lots, as the number of platforms offering margin and derivatives items has multiplied.

The Perils of Offering Leverage

On market information websites such as Coincodex, Coinlore, and Coinpaprika, the number of exchanges offering utilize now goes to more than 50. Some supply margin trading on leading coins such as BTC, ETH, and BCH, while others have actually gotten more daring, offering items such as leveraged futures on Telegram’s still unreleased gram token. For traders tempted by the possibility of tripling their loan through bit more than cranking up a slider and letting the multiplier result make sure of the rest, there are a couple of dangers to be mindful of – aside from the apparent threat of being liquidated.

Bitmex takes pride in the size of its insurance coverage fund, which presently stands at near 24,000 BTC, however the bulk of leveraged exchanges aren’t almost so well geared up. With smaller sized exchanges, a big trader’s account declaring bankruptcy can result in clawbacks from other accounts to cover the loss. Poorly created threat management systems intensify this threat. The intricacies of offering utilize are considerable, necessitating security to be published for different margin wallets for each digital possession. Newly introduced futures exchanges also normally experience low volume and bad liquidity due to a little consumer base, which in turn makes it harder to bring in consumer circulation and market makers.

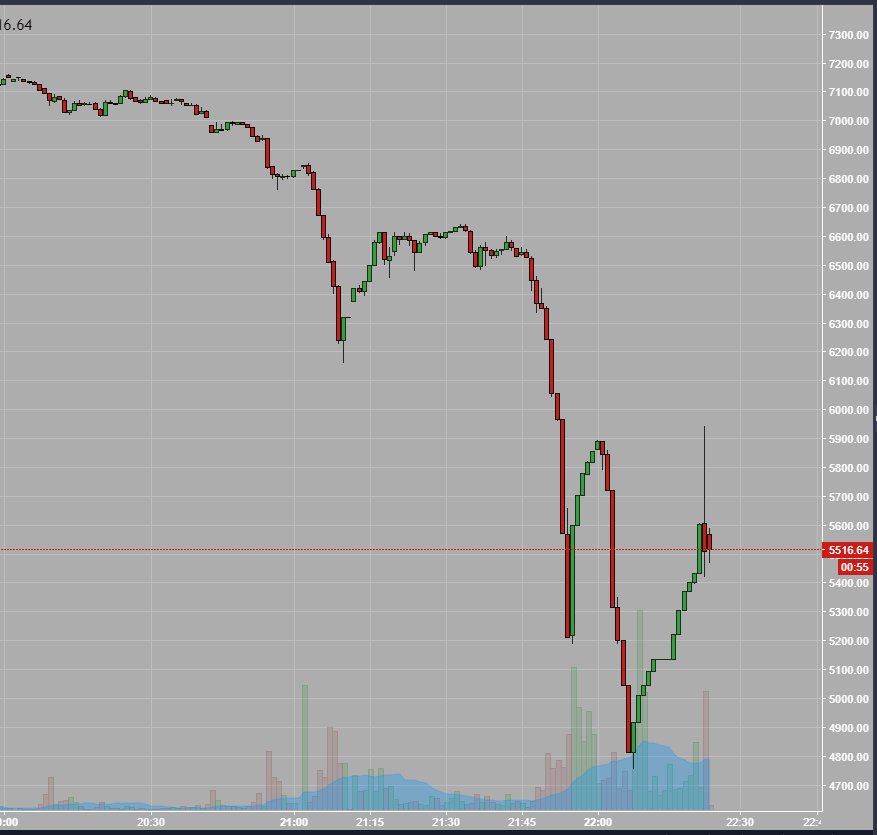

It’s not simply brand-new exchanges that can get things from when it concerns handling margin, either: in 2015 Okex suffered a $9M clawback after a trader positioned a big BTC order and was then liquidated after the possession crashed. As FTX notes, “If a user has a leveraged futures position on and markets move against their account enough that their net asset value is negative, then someone has to pay for that loss.” It continues:

In crypto you can’t reclaim possessions from the insolvent account’s owner from outside the system, so you’re stuck to other users — the users who aren’t getting liquidated — paying the bill.

With the general public’s cravings for leveraged whatever and IEOs for whatever revealing no indications of being sated, anticipate to see plenty more of both in 2019. In a progressively competitive market, with hundreds of platforms scrambling to get a grip, margin, regardless of its risks, is viewed as a crucial method to bring in traders and remain pertinent.

What are your ideas on the expansion of exchanges offering margin trading? What’s your preferred platform for leveraged trading? Let us understand in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.