As 2024 ends, Bitcoin financiers are excitedly considering the last quarter of the year, generally understood for positive cost action. With lots of hypothesizing that a bullish rally might be on the horizon, let’s break down the historic information, examine patterns, and weigh the possibilities of what BTC’s cost action may appear like by the end of this year.

Historical Performance of Bitcoin in Q4

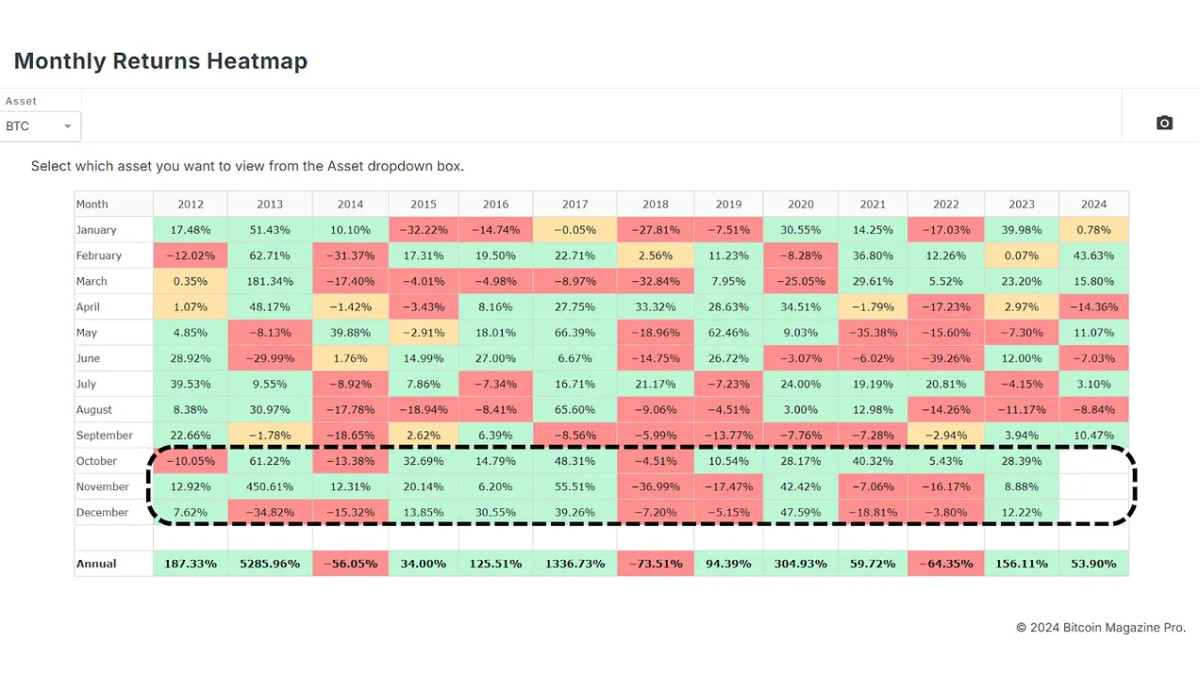

Looking at the previous years on the Monthly Returns Heatmap, Q4 has actually often provided remarkable gains for Bitcoin. Data reveals that BTC typically ends up the year strong, as evidenced by 3 successive green months in 2023. Not every year follows this pattern nevertheless, 2021 and 2022 were less beneficial, with Bitcoin ending the year on a more bearish note. Yet, years like 2020 and 2015 through to 2017 saw significant cost rises, highlighting the capacity for a bullish surface in Q4.

Analyzing Potential Q4 2024 Outcomes Based on Historical Data

To much better comprehend prospective results for Q4 2024, we can compare previous Q4 efficiencies with the existing cost action. This can provide us a concept of how Bitcoin may act if historic patterns continue. The variety of prospective results is broad, from considerable gains to small losses, and even sideways cost motion. The forecast lines are rainbow color coded going from 2023 in red back to 2015 in a light violet shade.

For example, in 2017 (purple line), Bitcoin experienced a considerable boost, recommending that in a positive situation, Bitcoin might reach rates as high as $240,000 by the end of 2024.

However, more conservative price quotes are also possible. In a more moderate Q4, Bitcoin might vary in between $93,000 and $110,000, while in a bearish situation, rates might drop as low as $34,000, as seen in 2018 (blue line).

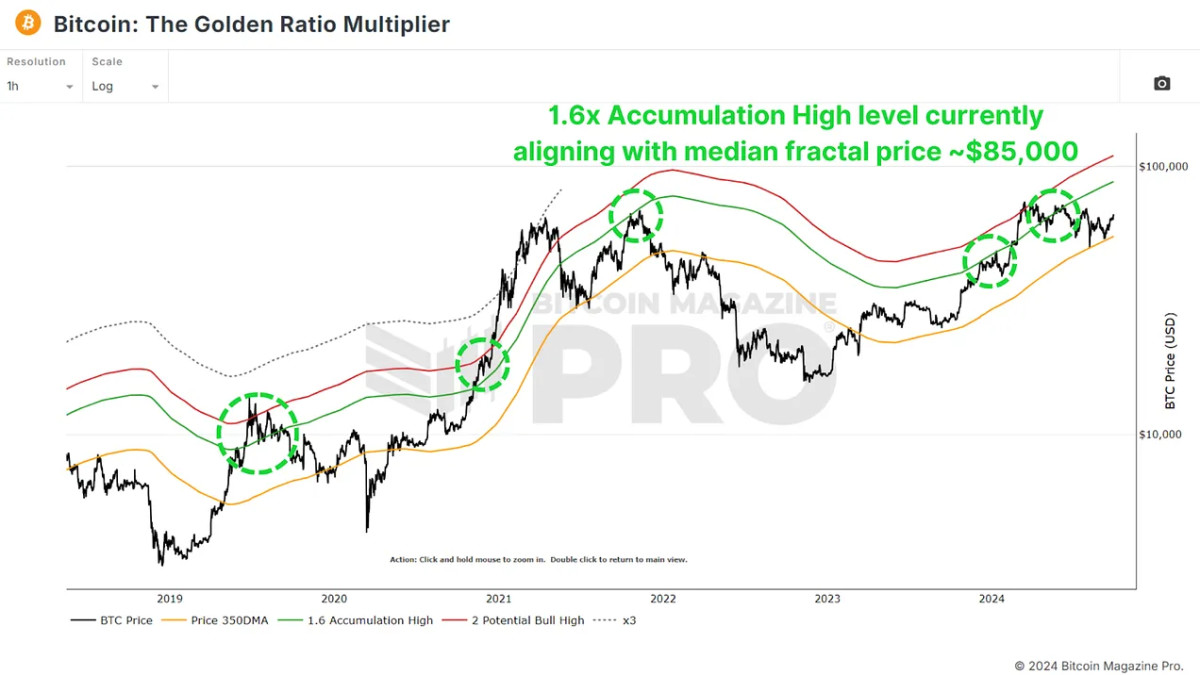

The average result based upon this information appears to be around the $85,000 cost point. Although this is based upon the year end cost from these forecasts, years such as 2021 (yellow line) led to significantly greater cost before significant pullbacks to end the year.

Is The Median Outcome A Possibility?

Whilst an $85,000 in around 3 months time might appear positive, we just need to recall to February of this year to see a single month in which BTC experienced a 43.63% boost. We can also aim to metrics such as The Golden Ratio Multiplier which are revealing confluence around this level as a possible target with its 1.6x Accumulation High level.

Is $240,000 Even Possible?

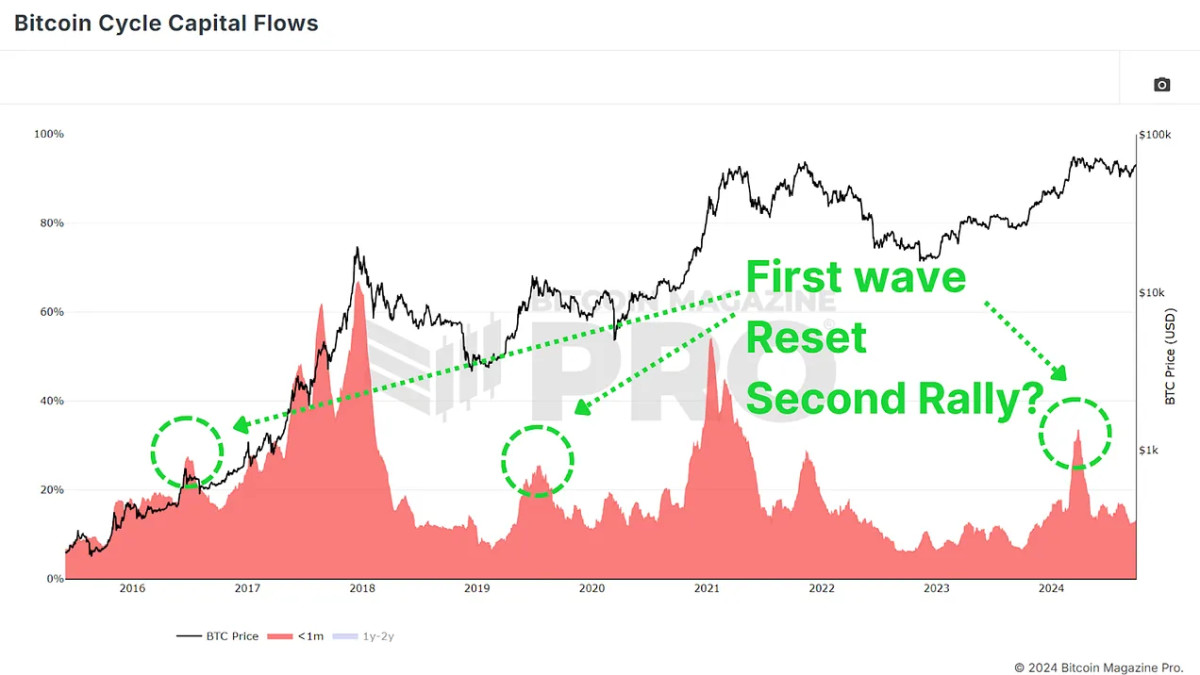

Whether Bitcoin can accomplish such high worths will depend upon numerous aspects. An boost in need combined with restricted supply might move Bitcoin to brand-new all-time highs. Furthermore, advancements such as Bitcoin ETFs, institutional financial investments, or significant geopolitical occasions might even more improve need. We’re also seeing a comparable pattern in this cycle as we have actually seen in the previous 2, with a very first wave of big scale market inflows before a cool-off duration; possibly establishing a 2nd rally in the future.

This is most likely over-ambitious, Bitcoin’s market cap has actually grown enormously considering that 2017 and we’d need 10s of billions of cash putting into the marketplace. But Bitcoin is Bitcoin, and absolutely nothing runs out the concern in this area!

Conclusion

Ultimately, while historic information recommends optimism for Q4, anticipating Bitcoin’s future is constantly speculative. A 3rd of all of these forecasts led to sideways cost action, with one forecasting a big scale decrease. As constantly, it’s important for financiers to stay impartial and respond to, instead of forecast Bitcoin information and cost action.

For a more extensive check out this subject, take a look at our current YouTube video here:

Bitcoin Q4 – A Positive End To 2024?

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.