The SEC has actually been hectic, conference with all of the possible providers of area Bitcoin ETFs with active applications in December. These conferences have actually led to the universal adoption of a cash creation approach by those providers instead of “in kind” transfers, as is common for other ETFs. Much has actually been stated about this modification, varying from the unreasonable to the major. The TLDR, nevertheless, is the general effect will be very little to financiers, fairly significant to the providers and it shows improperly on the SEC overall.

In order to supply context, it is essential to explain the fundamental structure of Exchange Traded Funds. ETF providers all engage with a group of Authorized Participants (APs) that have the capability to exchange either a predefined quantity of the funds properties (stocks, bonds, products, and so on) or a specified quantity of cash or a mix of both, for a repaired quantity of ETF shares for an established cost. In this case, were “in kind” creation to be permitted, a relatively common creation system would have been 100 Bitcoin in exchange for 100,000 ETF shares. With cash creation, nevertheless, the Issuer will be needed to release the cash quantity, in real time as the cost of Bitcoin modifications, to obtain, in this example, 100 Bitcoin. (They also need to release the cash quantity that 100,000 ETF shares can be redeemed for in real time.) Subsequently the company is accountable for buying that 100 Bitcoin for the fund to be in compliance with its covenants or offering the 100 Bitcoin in the event of a redemption.

This system holds for all Exchange Traded Funds, and, as can be seen, suggests that the claims that cash creation suggests the fund wont be backed 100% by Bitcoin holding is incorrect. There might be a really brief hold-up, after creation, where the Issuer has yet to purchase the Bitcoin they require to obtain, however the longer that hold-up, the more danger the company would be taking. If they require to pay more than the priced estimate cost, the Fund will have an unfavorable cash balance, which would reduce the Net Asset Value of the fund. This will, of course effect its efficiency, which, thinking about the number of providers are contending, would likely hurt the providers capability to grow properties. If, on the other hand, the company has the ability to purchase the Bitcoin for less than the cash transferred by the APs, then the fund would have a favorable cash balance, which might enhance fund efficiency.

One might assume, for that reason, that providers will have a reward to price quote the cash cost well above the real trading cost of Bitcoin (and the redemption cost lower for the exact same factor). The issue with that, is the larger the spread in between creation and redemption cash quantities, the larger the spread that APs would likely price quote in the market to purchase and offer the ETF shares themselves. Most ETFs trade at extremely tight spreads, however this system might well suggest that some of the Bitcoin ETF problems have larger spreads than others and general larger spreads than they might have had with “in kind” creation.

Thus, the providers need to stabilize the objective of pricing estimate a tight spread in between creation and redemption cash quantities with their capability to trade at or much better than the priced estimate quantities. This needs, nevertheless, access to advanced innovation to accomplish. As an example of why this holds true, think about the distinction in between pricing estimate for 100 Bitcoin based upon the liquidity on Coinbase alone, vis a vis a technique that utilizes 4 exchanges that are controlled in the U.S. (Coinbase, Kraken, Bitstamp and Paxos). This example utilized CoinRoutes Cost Calculator (readily available by API) which reveals both single exchange or any customized group of exchanges cost to trade based upon complete order book information kept in memory.

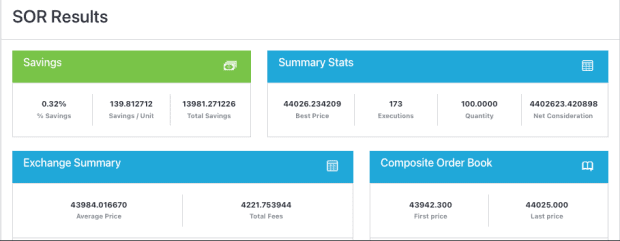

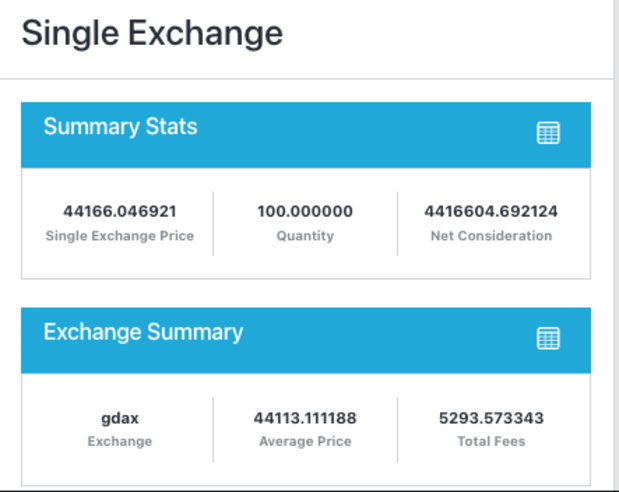

In this example, we see that an overall purchase cost on Coinbase alone would have been $4,416,604.69 however the cost to purchase throughout those 4 exchanges would have been $4,402,623.42, which is $13,981.27 more costly. That relates to 0.32% more expenditure to purchase the exact same 100,000 shares in this example. This example also reveals the innovation difficulty dealt with by the providers, as the estimation needed passing through 206 specific market/price level mixes. Most standard monetary systems do not require to look beyond a handful of cost levels as the fragmentation in Bitcoin is much bigger.

It deserves keeping in mind that it is not likely the significant providers will choose to trade on a single exchange, however it is most likely that some will do so or choose to trade over-the-counter with market makers that will charge them an extra spread. Some will choose to utilize algorithmic trading suppliers such as CoinRoutes or our rivals, which are capable of trading at less than the priced estimate spread typically. Whatever they select, we do not anticipate all the providers to do the exact same thing, indicating there will be possibly substantial variation in the rates and expenses in between providers.

Those with access to exceptional trading innovation will have the ability to use tighter spreads and exceptional efficiency.

So, thinking about all of this problem that will be borne by the providers, why did the SEC efficiently require the usage of Cash Creation/Redemption. The response, regrettably, is basic: APs, by guideline are broker dealerships controlled by the SEC and an SRO such as FINRA. So far, nevertheless, the SEC has actually not authorized controlled broker dealerships to trade area Bitcoin straight, which they would require to do if the procedure was “in kind”. This thinking is an even more basic description than numerous conspiracy theories I’ve heard, that do not be worthy of to be duplicated.

In conclusion, the area ETFs will be a significant advance for the Bitcoin market, however the devil remains in the information. Investors ought to investigate the systems each company picks to price quote and trade the creation and redemption procedure in order to forecast which ones may carry out finest. There are other issues, consisting of custodial procedures and costs, however overlooking how they prepare to trade might be a pricey choice.

This is a visitor post by David Weisberger. Opinions revealed are totally their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.