This is a viewpoint editorial by Bitcoin Graffiti, a software application designer and graffiti artist.

In 1714, the British Parliament presented the Longitude Act, a law rewarding a £20,000 bounty (more than $1 million in today’s cash) to anybody who might precisely identify longitude at sea. Captains had actually been fighting with bad navigation because the start of international trade. Though sailors might quickly determine latitude by assessing the sun’s height, longitude was extremely difficult to identify and inapt methods diverted vessels obviously. Without visual bearings, people were cruising blind on the ocean blues. The increased travel time caused scurvy, hold-ups and ships smashing on the rocks — losing team and freight permanently to the deep.

Fortunately, a genius Brit developed the service — the chronometer, a clock that might keep its beat on the unpredictable seas. John Harrison was this genius and his development exceeded unrefined huge methods that count on clear skies, number tables and hours of estimation. There was no 2nd finest.

But his development wasn’t embraced!

According to “Longitude” by Dava Sobel, it took up until 1828 for the Board of Longitude to be dissolved and the chronometer to reach mass adoption.

Why on Earth did it take so long?

Going Beyond The S Curve

“…the diffusion of innovations is a social process, even more than a technical one.”

–Everett M. Rogers, “Diffusion Of Innovations”

Another timekeeping gadget was created in 2008 by Satoshi Nakamoto. Bitcoin is a decentralized clock in the online world making it possible for precise financial estimation and monetary navigation in the unsure waters of life. Though its residential or commercial properties transcend in the eyes of its users, the rate of adoption is not as amazing.

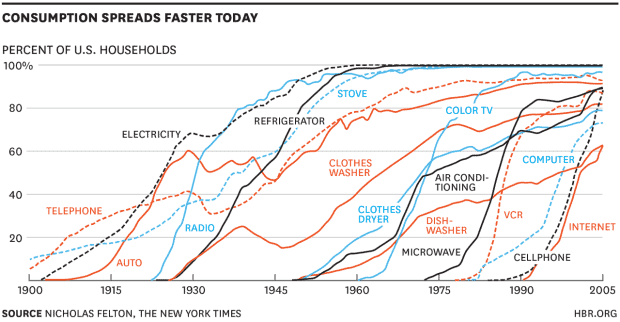

Many declare it’s at the verge of crossing the gorge: “This is the internet of 1995!” But in our bullishness, we anticipated an iPhone-like adoption. Certainly, concepts spread out faster than ever in the past, however to consider this pattern as the sole variable governing adoption rate is oversimplifying it. The longitude story reveals us that, even when a development is a total no-brainer, it might take longer than you believe to capture on.

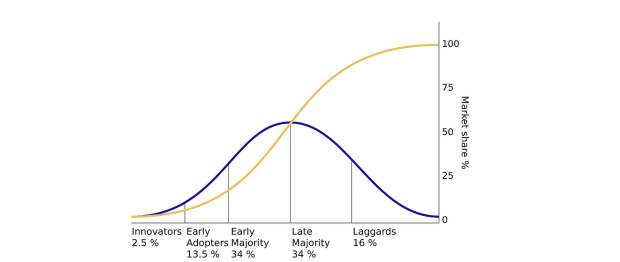

Everett Rogers was the social researcher who promoted the observation of how developments diffuse throughout the social medium by a typical circulation. By aggregating adopters with time, the uptake appears like an S curve that hockey-sticks up after a emergency of users has actually been reached. This design acquired appeal early this century as it discussed the rapid development of smart phones and the web.

But Rogers’ research study includes more than simply this remarkable design. In his book, “Diffusion Of Innovations,” he determined 5 criteria that govern an innovation’s adoption rate.

The Five Perceived Attributes Of Bitcoin

One: Relative Advantage

“Diffusion is a particular type of communication in which the message content that is exchanged is concerned with a new idea.”

–Rogers, “Diffusion Of Innovations”

Bitcoin’s viewed worth is figured out by 2 things: requirements and rate.

In order to have a requirement, one needs to experience an issue. The concerns with fiat cash have actually long been acknowledged within the cypherpunk and sound cash neighborhoods, and they were the very first to embrace. But beyond these social inner circles, the awareness of dollar debasement is low. An absence of monetary education and fiat immersion leads individuals not to look for services. Without a correct medical diagnosis, no one requires a remedy.

Bitcoin’s rate is slowing adoption and system predisposition makes the coin look costly. People don’t understand it’s subdividable. The rate is also unpredictable, obfuscating its store-of-value function. You can contrast this with other adoption cases. For example, smart phone users view worth immediately — calling anybody, anytime, anywhere. But with Bitcoin, 80% drawdowns and “number go down” for many years are not unusual. It takes a high level of abstraction to see Bitcoin’s worth and high conviction not to be cleaned of the marketplace.

Two: Compatibility

“Potential adopters may not recognize that they have a need for an innovation until they become aware of the new idea or its consequences.”

–Rogers, “Diffusion Of Innovations”

The initially variation of a brand-new innovation is hardly ever a best match for the whole market, catering just to a specific niche group of innovators. According to Rogers, a development requires to be transformed to discover product-market fit.

Bitcoin is presently suitable with the economically informed. But beyond this group, Bitcoin is not viewed to be in line with individuals’s worth and belief systems. It’s still a specific niche item in the innovator phase.

For Bitcoin to reach more early adopters, it needs to be transformed for various international markets. Currently, 2 unique courses are emerging: its story and medium-of-exchange (MoE) use. Here are 3 examples:

- “Banking the unbanked”: Bitcoin can assist individuals in establishing nations to leapfrog the tradition banking system. Starlink and mobile phones allow adoption where an MoE, system for remittances and a checking account in your pocket have high worth. Leaders in nations like El Salvador, Mexico and Indonesia utilize such stories to describe Nakamoto’s development.

- “Cyber warfare”: In his book, “Softwar,” Jason Lowery utilizes military language to transform bitcoin as a geopolitical property to be contested by states in the online world, developing a brand-new domain of war. Through the military lens, he recoins Bitcoin as “Bitpower,” developing a vision in which ASICs transform energy to raise a cryptographic wall, increasing the expense of attack on monetary information. Lowery is a modification representative, somebody who equates Bitcoin to make it suitable with the U.S. army.

- “Grid balancing”: This is the language for the energy sector inner circle. Proof-of-work mining can be utilized to make energy grids more resistant, balance supply and need and make a profit out of stranded energy sources.

These stories are developed to make Bitcoin more suitable with particular social groups that speak various languages. With increased understanding, these groups will drive the development of brand-new usages and applications.

Three: Complexity

The chronometer was far ahead of its time and it took years prior to crafty business owners copied and made the gadget. Similarly, Nakamoto needed to present his development to its very first adopters on the Bitcoin Talk online forum. Since then, business owners have actually needed to sign up with and develop services on top of the procedure, consisting of freezer services, mnemonic seed expressions and exchanges. These upgrades enhanced the user experience, however compared to the smart phone, Bitcoin’s still fairly made complex.

This also applies at Bitcoin’s advancement level. New software application designers experience a high barrier of entry executing Bitcoin in applications — the environment is not also established as routine web advancement. And while it’s true that Bitcoin is not what it was back in 2008, and upgrades continue to make it more available — with groups like Spiral and Breeze having just recently released software application advancement sets to make combination simpler, for example — where is the Steve Jobs “boom” minute?

We are still awaiting the out-of-the-box killer app.

Four: Trialability

“One must learn by doing the thing, for though you think you know it, you have no certainty until you try.

–Sophocles, “The Trachiniae”

The chronometer had a long trial duration. By the time captains might upgrade their peers on enhanced navigation, months of trial and travel had actually passed. The gadget was considered excellent just if it was precise along the complete cruising journey. On top of that, a ship was underway for months, slowing down the word of mouth.

The Bitcoin journey requires time, too. Since rate is unpredictable, it is not unusual to be “under water” for a long time. This can have an impact on the benefits viewed by the user, however might also prevent peers from embracing. The trial duration might be as long as the benefit halving, and real supporters are just minted after adequate time in the marketplace.

Though trialability of Bitcoin is simple — one can simply purchase a little — the total net advantage is just fantastic with a bigger purchase, showing the point that the complete trial duration may be as long as one halving.

Five: Observability

Bitcoin is digital and therefore improperly noticeable. It is not like a Ford Model T racing over the roadways with its benefits on display screen. Most individuals just learn more about Bitcoin in report when it has actually broken through its all-time highs, which can last just for a relatively-short period.

Adoption accelerate with more noticeable applications. Perhaps in the not too long run, Bitcoin miners might be important parts of power plants and houses. People may send out Bitcoin with their phones to buddies on the street. Or they see the Lightning buttons on a Nostr customer and find it’s possible to zap satoshis to their preferred influencers.

Also, increased wealth through bitcoin is difficult to area. Unless Bitcoiners begin using Gucci and driving orange Lambos, abundant HODLers are difficult to observe. But using a giga-chad tee shirt may not fail and might possibly accelerate the spread.

Reward

Harrison toiled away at his timekeeper alone for twenty years. His development got obstructed and slowed down by administration, however he lastly got his £20,000 bounty. Smart business owners had the ability to scale his innovative style to mass production, bringing chronometers aboard ships where they conserved time, freight and lives. It took a very long time, however the chronometer ultimately drifted to the top.

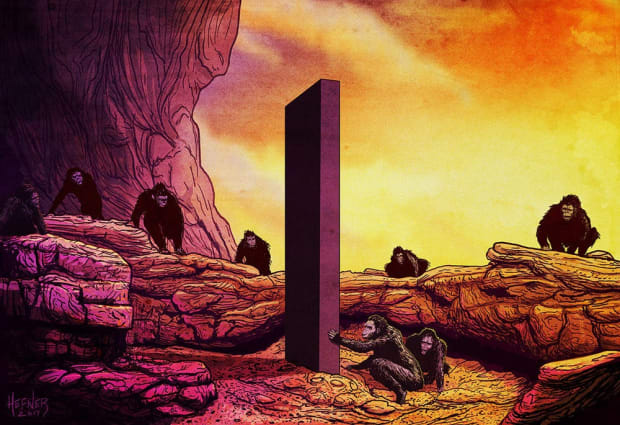

Today, individuals of Earth are economically adrift. Like ships oblivious of longitude, they cruise blindly through the treacherous waters of life, not able to economically determine. We are barbarians residing in the pre-science Stone Age of cash. Future generations will take a look at us in discouragement.

But this has to do with human psychology and how individuals welcome originalities. In hindsight, world-changing innovations all appear self-evident. You’re ideal in the middle of a paradigm shift, the ignition of clinical transformation, and it is difficult to see where things are going.

Bitcoin won’t diffuse quickly like Facebook, the web or the iPhone. Much requires to be developed, transformed and equated prior to the masses get onboard. Like with electrical energy, base layers are difficult to grok without the real devices.

We will arrive.

But it will take longer than you think.

This is a visitor post by Bitcoin Graffiti. Opinions revealed are totally their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.