A current letter from the U.S. House of Representatives to social networks giant Facebook has actually crypto users hypothesizing feverishly. The ramifications of the letter, and Calibra CEO David Marcus’ current action, will notify the future of cash not just in America, however worldwide. House Chairwoman Maxine Waters and accomplices took objective today not just at Facebook’s Libra coin, however also at the banking practices of Switzerland where the Libra Association lies. Some state Facebook will eliminate the U.S. dollar. Others state Libra will stop working. Still others think greater level geopolitical engineering behind the scenes. Regardless, what is at stake is big, and Switzerland is onto something that constantly stimulates flexibility: decentralization.

An Ominous Message

Failure to stop execution [of Libra] … threats a brand-new Swiss-based monetary system that is too huge to stop working.

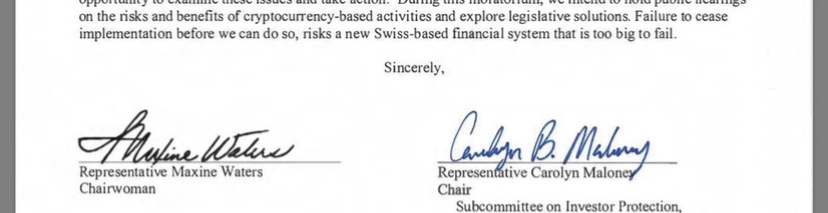

The United States federal government has actually released a letter to social networks giant Facebook, asking it to put a moratorium on its upcoming cryptocurrency and wallet, Libra and Calibra, respectively. Dated July 2, 2019, the letter from the House Committee on Financial Services to Mark Zuckerberg, Sheryl Sandberg (COO), and David Marcus (Calibra CEO), states in part:

It appears that these items might provide themselves to a totally brand-new worldwide monetary system that is based out of Switzerland and planned to competing U.S. financial policy and the dollar. This raises major personal privacy, trading, nationwide security, and financial policy issues for … the wider worldwide economy.

It appears like U.S. federal government monetary interests have something versus competitors, and in specific competitors from a social networks business dealing with a job in Switzerland. If the entire thing appears a little weird, wear’t concern, you’re not alone. Donald Trump is finest pals with Kim Jong Un, Iran is mining bitcoins in mosques, and quantum physicists are informing us this is all a simulation. But sim or not, something amazing is certainly afoot.

Who Is the Libra Association?

With Visa, Mastercard, Paypal, Uber, Lyft, Spotify and 21 other business currently onboard, the Libra Association is no little beans. Such gamers being included makes up a multi-billion-dollar business juggernaut. The relatively alarmed tone of the letter from Congress raises some concerns.

Huge entities in the monetary world do interact with one another. Companies like Visa, Mastercard and Paypal are quite ingrained in central, regulative banking and political lobbying. It’s all a part of the video game for any significant service in the field. But things may not be so cut and dried, after all. The release of this threatening House caution mean a component of decentralized turmoil having actually sneaked into the system.

Switzerland: A Threat to Global Financial Security?

Switzerland has actually probably been the nation that has actually most assisted hold together worldwide monetary security over current centuries. In a world of statist violence and coercion-based financial systems—which does also consist of the Swiss federal government—this isn’t stating much, however it’s notable nevertheless.

The Libra Association is based in Geneva, and among the most fascinating elements of the scary message from Congress is the truth that narrowed focus is offered particularly to Switzerland. Focus on yet another particular nation as the brand-new opponent to the dollar. Libra is a prospective hazard to world security and is “planned to competing U.S. financial policy and the dollar.” It is a hazard to “worldwide monetary security.”

But wait a 2nd. Isn’t the U.S. federal government the group that has regularly, constantly, and methodically been a hazard to the dollar? To itself? Isn’t it the U.S. military maker that has methodically plunged economy after foreign economy into the void of wartime damage?

Departure from the gold requirement, continuously pumping up the currency to fund unlimited war and developing huge credit bubbles all takes its toll. It looks like the Facebook team need to possibly be composing a letter to the Feds informing them to search in the mirror and to stop threatening “worldwide monetary stability” themselves.

How the United States Handles ‘Threats’

The reasonably current U.S. military intervention in Libya and Iraq are illustrative of something crucial. Current saber-rattling politics in the media about Iran are too. These occasions all have a weird commonness. They include countries or politicians who have currently, or are presently trying to, desert the U.S. dollar as a world reserve currency.

Libyan leader Muammar Gaddafi was preparing a desertion of the USD in favor of the gold-backed Dinar prior to being eliminated by U.S. and NATO-backed forces in 2011. Iraq revealed it would discard the dollar in 2000. Soon after, that exact same nation would be ravished by a unilaterally introduced and relatively unlimited U.S. military rampage in the desert. Just last month, Iran’s Foreign Minister, Mohammad Javad Zarif, called for nations to stop utilizing the USD too:

America’s power rests on the dollar; a terrific part of America’s financial power will disappear if nations get rid of the dollar from their financial systems.

Calling this all simple coincidence appears ignorant at finest.

Decentralized Swiss Government

Officially, Switzerland is a semi-direct democratic federal republic. This is a long, tiresome string of words which might be more just equated as: more decentralized than numerous other federal governments. In Switzerland, a Federal Assembly, the leading legal body, is divided into 2 groups called the National Council and Council of States (cantons). Another body called the Federal Council holds executive power and is made up of 7 members, sharing power.

What’s truly interesting is that Switzerland’s constitution can be altered by means of referendum, and that any single resident can challenge brand-new legislation simply by collecting signatures. 50,000, to be precise. If this quantity of signatures is reached, a vote is set up and approval or rejection of a specific law is chosen. In other words, though still a really central and coercion-based system, the Swiss design is more direct, open, and decentralized than similar others, especially those in the U.S.

The Cutting Edge: Watches, Particle Accelerators and Swiss Banks

This relative governmental decentralization might be the factor Geneva, and Switzerland as an entire, are such centers for development, clinical development, and quality workmanship. Not to point out a banking tradition unequaled by that of any other country. This superior center of world service and financing has actually sufficed to bring both the Swiss state—and Facebook’s Libra task—under fire from U.S. geopolitical financial interests.

Back in March 2016, Barack Obama provided a speech at the South by Southwest (SXSW) celebration where he discussed issues he saw relating to emerging cryptographic innovations:

Because if, in truth, you can’t fracture that at all, federal government can’t get in, then everyone is walking with a Swiss Bank account in their pocket.

The belief of numerous in the crypto area at the time was “Yeah, that’s the entire point!” It’s fascinating that of all the banks in the world, the ones now coming under fire from Congress are a few of the most personal and safe and secure. This truly appears to aggravate political leaders and legislators.

A Brief History of Banking in the Alps

Banking is emblematic of Switzerland. Since the early 1700s, Swiss banks have actually stowed away gold in underground bunkers for rich foreign powers and recognized service interests alike. Using their formally stated neutrality, Switzerland’s banks have actually apparently safeguarded whatever from Jewish possessions to Nazi gold.

As competitors with big banks in London, Paris, and Berlin was practically difficult in the early 20th century, Swiss banks started to promote themselves as tax sanctuaries for anybody who required personal privacy. In truth, this has actually been a mindful, tactical relocation according to some. Swiss historian Sébastien Guex notes:

This is what the Swiss bourgeoisie are believing: ‘That’s our future. We will use the contradictions in between the European powers and, safeguarded by the guard of our neutrality, our arm will be market and financing.’

Privacy Under Attack

Like Bitcoin and Libra, Swiss banks have actually come under attack by regulators and foreign interests consistently throughout history. Even throughout World War II, when numerous believed personal privacy should be compromised for global security, Swiss banking organizations kept their lips sealed. It’s not just a main crime to leakage customer details in Switzerland, it’s something of a famous—if often mythologized—unmentioned oath.

Obama’s comments about cryptography hearken back to an essential truth. Namely, that personal privacy in Swiss banking has actually been, and continues to be, used for both ethical and dishonest factors. Just like bitcoin. Just like any other tool.

This does not nevertheless, validate ripping away the personal privacy of any specific even if they might possibly do something unpleasant with stated tool. Unlike London, Switzerland does not have an age requirement to buy a butter knife. Unless the U.S. is to wind up in a likewise infantile state, more personal privacy and decentralization of governance will be required.

Decentralization: A Model for Progress Everywhere

U.S. interests and quasi-private organisations in Geneva are locking horns. What occurs next is any person’s think, and the worldwide market appears to be seeing and waiting too. Grabbing some popcorn, relaxing, and seeing 2 leviathan—most likely both similarly sociopathic—entities fight on the world phase is going to be enjoyable. Especially for those in crypto and libertarian circles. Fun, however concurrently really upsetting.

Switzerland, for all its excellent, is no safe kitty either. Also in Switzerland there is a federal government, which is a violent, central mob guideline, blood cash maker – like any other. Aiding Nazis, propagandizing themselves as heroes by also seemingly assisting maltreated Jews, and providing a picture of tranquil neutrality the entire time is no genuine factor to boast. But that’s not what matters.

What matters here is the evidence of principle. Decentralization works, despite the intent of this or that market star, federal government, or federal government body. Regardless of the nature of the user of the tool. Privacy works. Innovation is stimulated, cash maintains higher stability and worth, and lifestyle is enhanced.

Educating the Next Generation of Crypto Lovers

There is an exceptionally important takeaway from all of this. If relative decentralization of power differentials can lead to such excellent banks, watches, cyber innovation, and development for Switzerland, perhaps complete decentralization and complete flexibility might do a lot more.

Would it resemble that current Citystate video game video published to Youtube? Where the user sets all state guideline and taxes to practically no, and a mega-metropolis laissez-faire damp dream emerges? It might be that higher decentralization might open the door to development and development so out of this world, it would be tough to even develop, a minimum of now, in this existing paradigm.

The Economic Simulation Continues

Since the release of the questionable federal government letter, Calibra CEO David Marcus has actually released a note on Facebook, obviously in action, stating:

This is why our company believe in and are devoted to a collective procedure with regulators, reserve banks, and legislators … At the core, our company believe that a network that assists move more money deals — where a great deal of illegal activities occur — to a digital network that includes managed on and exit ramps with correct know-your-customer (KYC) practices, integrated with the capability for police and regulators to perform their own analysis of on-chain activity, will be a huge chance to increase the effectiveness of monetary criminal offenses keeping an eye on and enforcement.

More monitoring. More control. Less personal privacy. This doesn’t seem like anything the U.S. federal government need to have an issue with. The feline and mouse video game being experienced with Facebook and the U.S. federal government is fascinating in part for this factor. As with the President of the United States of America himself in fact Tweeting “BORING!” throughout the current Democratic disputes, things simply appear to get weirder and weirder.

The Move Toward a Cashless Society

It might be that there is a sort of predictive programs playing out here. Potentially for the intro of an around the world, cashless truth. It’s something that’s been spoken about by elite banking interests for a very long time now, and Hegelian dialectical methods have actually typically been utilized to attain numerous political ends. Take the Gulf of Tonkin event and Vietnam, for example. Or the disaster of 9/11 being utilized to validate military intervention in a nation absolutely unassociated to the event, Iraq.

Maybe a standard thesis, reverse, and synthesis has actually been developed. Zuckerberg obstacles Fed (thesis). Fed presses back (reverse). Fed and Zuckerberg then interact and make a delighted compromise (synthesis). To explore this totally now, nevertheless, would take things too far afield.

Perhaps adequate enough is this 1998 excerpt from The Economist, a publication owned in big part by the mega-powerful, centuries-old Rothschild banking dynasty:

So here is a concept: worldwide currency union. Let no one call it boringly practical, or politically practical. Yet, like all the finest unimaginable concepts, it has more going for it than you may believe—in concept, a minimum of. The concept is not brand-new. Richard Cooper of Harvard University proposed a single world currency in Foreign Affairs in 1984, and he was not the initially to think about it. It appeared an over-the-top concept, and still does. But much has actually occurred recently to make it worth a minute’s believed.

Crypto: Solid as Gold, Liquid as Water

It’s clear that digital possessions are the instructions innovation and society are moving. To withstand the pattern would be almost difficult. And where digital possessions are the next level future of financing, individuals wish to ensure the ones they hold are safe and secure, personal, and noise. Like gold stacked deep underground at the foothills of the Swiss Alps. Only now, transferable and spendable with the touch of a little screen.

Whether Maxine Waters and her coworkers are truly that up in arms about Facebook’s huge relocations, or whether the Swiss federal government truly did effort to assist maltreated Jews out of compassion doesn’t matter. None of this matters. It doesn’t even matter what the quantum physicists state about the really nature of truth itself. It’s all talk.

The factor none of these things matter is basic: Because mad Waters or not, kindhearted lenders or not, simulation or not, personal privacy and decentralization are the confirmed, utilize case-tested methods by which sound cash and a much better, more “Swiss” lifestyle can be developed right here, today.

What’s your view on the dispute in between Facebook and U.S. monetary interests? Let us understand in the comments area below.

OP-ed disclaimer: This is an Op-ed short article. The viewpoints revealed in this short article are the author’s own. Bitscoins.internet is not accountable for or accountable for any material, precision or quality within the Op-ed short article. Readers needs to do their own due diligence prior to taking any actions connected to the material. Bitscoins.internet is not accountable, straight or indirectly, for any damage or loss triggered or declared to be triggered by or in connection with the usage of or dependence on any details in this Op-ed short article.

Did you understand you can validate any unofficial Bitcoin deal with our Bitcoin Block Explorer tool? Simply total a Bitcoin address search to see it on the blockchain. Plus, check out our Bitcoin Charts to see what’s taking place in the market.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.