Don’t concern, this isn’t a short article to either uphold or assault the present international climate change agenda. Debating whether the earth will die in a couple of years or not isn’t my strategy. While not just being a follower and financier in the Bitcoin environment, I am also a devoted fan of start-ups and innovators supporting green innovations to attend to a more energy effective future. Here I just wish to talk about how Bitcoiners must embrace the ideas rather efficiently used by the international climate change motion under their green financial investment propositions to also promote broadened Bitcoin adoption. These are methods that I have actually seen carried out first-hand amongst the climate change posse.

While there are definitely natural factors to embrace Bitcoin, particularly thinking about the world’s present chaos in banking and financial systems, Bitcoiners can’t just keep trusting these regular bouts of crisis as the primary driving force to broaden adoption. Bombastic shout-outs that the crisis is here under a Bitcoin lexicon are all frequently utilized and quickly can simply strike on deaf ears. Also, publishing that you spent for a latte at McDonald’s in Bitcoin or sending out a complete stranger on the street 100 sats to their brand-new wallet are not activities equivalent to the high level of professionalism utilized under the collaborated symphony of the climate change echo-system as they move their agenda forward. Further, just stating the “other side is evil” will just get us up until now and when I state “other side” I suggest the fiat world. Bitcoiners require to carry out more modern and organized approaches if we wish to reach the next level of adoption. We require to keep away from the similarity dancing wizards.

To attain this, Bitcoiners can follow and mix with other worldwide promoted programs like that of climate change to much better gain acknowledgment. The climate change motion is typically attempting to depict Bitcoin as a danger. If we acquire the very same techniques and methods used by the climate change motion to promote themselves, incorporating these techniques into our tool basket to assistance Bitcoin adoption, we can’t be disregarded, belittled, or omitted.

The timing to think about how Bitcoiners can broaden our techniques drawing from the climate change agenda cannot be more ideal as the present prepared United Nations Climate Change conference, described as COP28, will be held from 30 November to 12 December here in Dubai.

Time Preference for Bitcoin and Green Investments

The international climate change motion makes the case that purchasing green jobs today, despite the fact that present social expenses can be big, will lead to higher future advantages for everybody. To support this thesis, they loosely use the ideas used in financing and economics consisting of discount rate rates, present worths, cost-benefit analysis, and tendencies to conserve or invest. Bitcoin is also a natural case to use this thesis. We require to reveal that conserving today through investing in Bitcoin will lead to a bigger wealth result in the future and higher social advantages. Bitcoiners typically talk about time choices connected to costs or cost savings as is discussed in the “Bitcoin Standard”. To show this much better we must use the ideas of a Social Discount Rate (SDR) and a “Just Transition” as is used by the climate change motion.

Applying the Social Discount Rate to Bitcoin Adoption

In basic terms the SDR is the discount rate utilized to compute today worth of future social advantages recognized from green financial investments today. For the climate change motion, this uses to things like constructing electrical lorry (EV) charging stations, setting up solar selections, or maybe constructing bike-paths. With these kinds of social financial investments there are public advantages created that, to some degree, cannot be totally measured under a pure mathematical cost-benefit analysis, nor healthy into normal for-profit worth estimations.

Governments effort to mark down these future social advantages of financial investments utilizing the SDR. The rate is greater than conventional “risk-free” rates utilized in fundamental financing due to the included huge unpredictabilities present over the volume of intangible social advantage may be acquired. The SDR also varies depending upon the level of advancement of a nation. A more industrialized nation can have more certainty relating to the future social advantages recognized so the rate they use is lower.

The SDR is basically a rate that stabilizes the option of the general public to invest today versus invest for tomorrow to understand implicit social advantages. The tendency to conserve balances the tendency to invest when the SDR is used. I will call this a wealth transfer choice throughout generations. This example reveals that the ideas typically talked about relating to Bitcoin adoption and the ideas used within the international green motion are rather comparable. Bitcoiners frequently discuss producing generational wealth, protecting wealth versus de-basement and, in the words of Greg Foss to do it “for the kids”.

Bitcoin adoption today by a person is factor to consider of the present versus future compromises and cost-benefits. Invest today for prospective higher advantages in the future or invest today to please present requirements. The principle is usually provided through the memes published of a HODLer’s empty one-room flat with just a bed mattress on the flooring and a mining rig beside it, as they quit whatever to purchase their future.

A ”Just Transition” and Bitcoiners

How did the climate change posse so efficiently get the principle of social advantages and tendencies to conserve to press their agenda and why didn’t we Bitcoiners embrace and use the very same SDR principle as it is plainly a natural fit? Well, before I address this concern, I should describe a parallel principle being utilized within the climate agenda described as a “Just Transition”.

With climate change strategies, such as a shift far from nonrenewable fuel sources to renewables or the relocate to EVs, the concern develops about how typical individuals will be affected throughout the shift. Will the masses lose their tasks if a “dirty” market is unexpectedly shut? How will individuals support their households if they can’t pay for to purchase brand-new energy effectiveness requirements troubled their small company?

Of course, to be reasonable, we should also think about how some individuals might also be negatively impacted by climate modifications if, for instance, their farms are affected by desertification. The evaluation goes both methods.

The point is not whether climate, weather condition or natural catastrophes can have an influence on individuals, their incomes, or their wealth (or do not have thereof), however the concern is that individuals who have lower earnings, less wealth, or less resources offered will be less able to reduce life’s regular threats and also the altering conditions developed throughout a green shift. As if individuals today don’t currently have enough to stress over, contribute to their issues the effect of policies enforced by federal governments under the climate change agenda.

The principle being used under a “Just Transition” policy is that the unfavorable, temporal effects of those climate change policies must not harm typical individuals, particularly those at the lower earnings levels of society. Governments should in some way fulfill their international climate change dedications under their Nationally Determined Contributions without making things like the wealth space and hardship even worse in the interim. Basically, safeguard those individuals least able to presume danger and deal with the shift so that they can much better protect their present earnings and wealth for the future. Doesn’t this noise extremely comparable to the principle of Bitcoin adoption where we are attempting to assist individuals safeguard their wealth for the future?

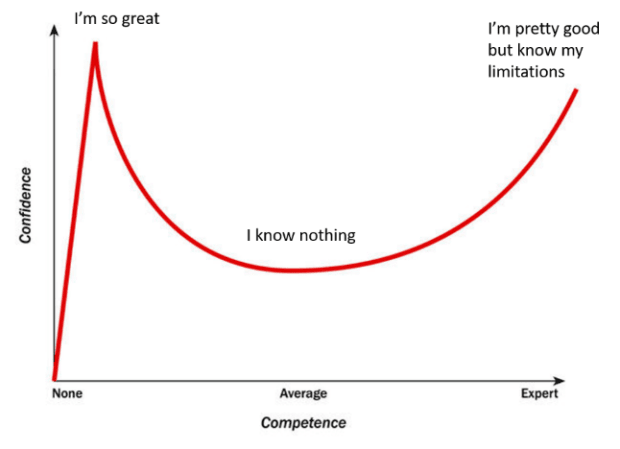

The climate change motion thinks there is an expectation of increased social advantages in the future, and this outweighs all present expenses and difficulties presumed by changing an economy. The advantages exceed the expenses even when the needed SDR is used. The issue for an individual with lower wealth and earnings is whether a dollar got today supplies them with more energy now versus if they invested that dollar to acquire more wealth in the future. The climate motion will state that everybody will be much better off in the future if they compromise now. However, to many people, present issues and requirements will definitely predominate life. Therefore, they will put a greater worth on present day costs versus investing for the future. Most individuals believe that that they are outstanding monetary danger supervisors. Are all of us poster-children for the Dunning-Kruger impact? More likely, easy fundamental human character uses where individuals simply concentrate on everyday survival. They have more tendency and require to invest their wealth and earnings today. This contradiction impacts the level of assistance for and conformance with the climate change agenda in addition to affecting Bitcoin adoption.

Dunning-Kruger Effect

Applying the principle of “Just Transition” to Bitcoiner lexicon would suggest asking something like: “What is the future value of being able to retain your individual sovereignty today?” I am drawn here to coin Mastercard’s terminology and just state that it’s “Priceless”. This example demonstrates how difficult it is to really put a worth on something intangible and in the future, no matter your state of present success to invest or conserve. Applying practical factors to consider, the basis for the compromise in between an individual’s present and future well-being differs depending upon their present capability to handle and presume danger whether thinking about Bitcoin investing or their prospective assistance for any green social financial investment.

Planning for the Societal Benefits of Bitcoin

There are lots of commonness in between what Bitcoin promotes and the marketed advantages of the climate change agenda. Bitcoin adoption is a social advantage. Saving today in Bitcoin will assist develop wealth for the future. Bitcoin’s advantages are not just for the person, however also for society. The underlying ideas raised and utilized by the international climate change motion to amass assistance can quickly be utilized by Bitcoiners to back more adoption. Bitcoin uses security versus de-basement, or to put it simply conservation of your present wealth and its purchasing power for the future. Everyone, no matter their wealth level can use it to much better support their future income.

Bitcoiners require to much better use the ideas of social advantages better through the principle of the SDR. Through this we can much better reveal the positives for adoption and lead more individuals into conserving and investing for the future safeguarding next generations, their kids, and grandchildren. Without reliable preparation to generate the SDR and the much deeper ideas of social advantages, even more Bitcoin adoption will be a difficulty.

This foundation preparation supports what even Benjamin Franklin stated centuries ago that “By failing to prepare, you are preparing to fail.” So, let’s not stop working future generations.

This is a visitor post by Enza Coin. Opinions revealed are totally their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.