The 2nd quarter of 2019 is concerning an end and for those who bought cryptocurrencies this year, market value are a lot greater than they were a year prior. Since the substantial lows in December 2018, a lot of digital currencies have actually caught amazing gains.

Digital Assets Post 350-550% Gains

Throughout 2018, numerous crypto supporters and traders described the year as the ‘crypto winter season’ after costs fell from their all-time highs to vital lows. That whole year revealed a bearish decrease and there were a lots of bull traps along the method. However, in 2019 the story has actually altered completely as an excellent bulk of digital currencies have actually gotten significant worth throughout the last 2 quarters.

In truth, a lot of coins, a few of which are reasonably unidentified, have actually gotten in between 350-550% throughout the last 6 months. Binance coin (BNB) is the leading competitor this year after it acquired 521% throughout Q1 and Q2. This is followed by chainlink (LINK 510%), ravencoin (RVN 379%), Ignis (IGNIS 357%) and litecoin (LTC 345%). However, even with these noticable gains, litecoin, for instance, is still down 64% from its all-time high (ATH).

Bitcoin Cash the Year’s 24th Biggest Gainer Gathers 158%

Other significant coins that took the lead this year as far as gains are worried consist of holo (HOT), everex (EVX), monacoin (MONA), enjin (ENJ), ripio (RCN), and zcoin (XZC). All of the previously mentioned cryptos have actually gotten 169-282% this year alone. The top 10 digital properties by market capitalization have actually all gotten a minimum of 100% or more in the last 2 quarters. The next competitor behind BNB and LTC in the leading 10 is eos (EOS), which has actually seen a 164% boost.

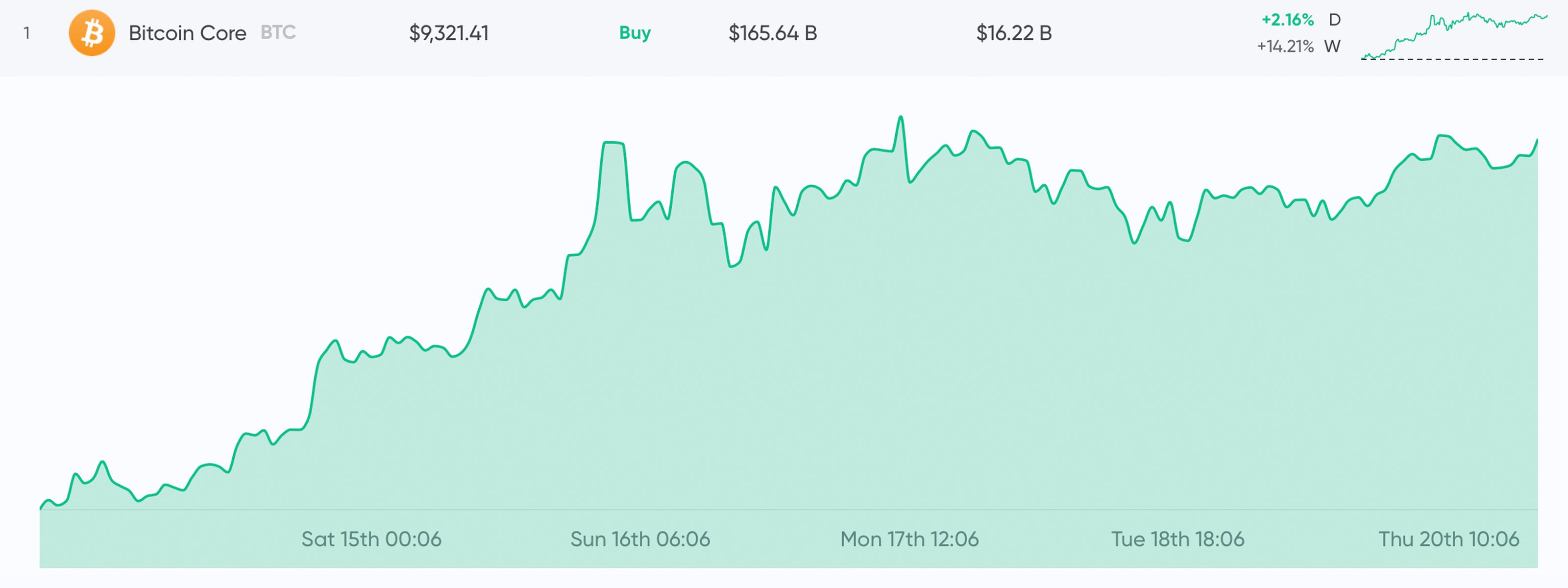

This is followed by bitcoin money (BCH +158%) which is the 24th finest gainer this year. Trailing behind BCH is bitcoin core (BTC) which is up 150% year-to-date. The worst 2 gainers of 2019 in the top 10 market evaluation positions are ripple (XRP 21%) and outstanding (XLM 9%). Most of these coins besides ripple and outstanding have actually outmatched conventional financial investments in products, stocks, rare-earth elements, and barrels of oil.

A Bundle of Coins and the Long Stretch Before Returning Back to All-Time Highs

If you bought a package of coins like the Coinbase bundle the exchange provided in September 2018, you would have seen some good gains too. At the time, the trading platform provided a market-weighted tasting that included BTC, ETH, BCH, LTC, and ETC (+67.81%).

Bitcoin core (BTC) is still 54% below the ATH on December 17, 2017 and ripple (XRP) is down 89%. The third biggest market evaluation held by ethereum (ETH) is still down 81% given that the coin’s ATH. This is followed by LTC (-64%), BCH (-81%), EOS (-70%), and XLM (-87%) as BNB and BSV were not around throughout those ATH costs.

2019’s Worst Crypto Market Performers

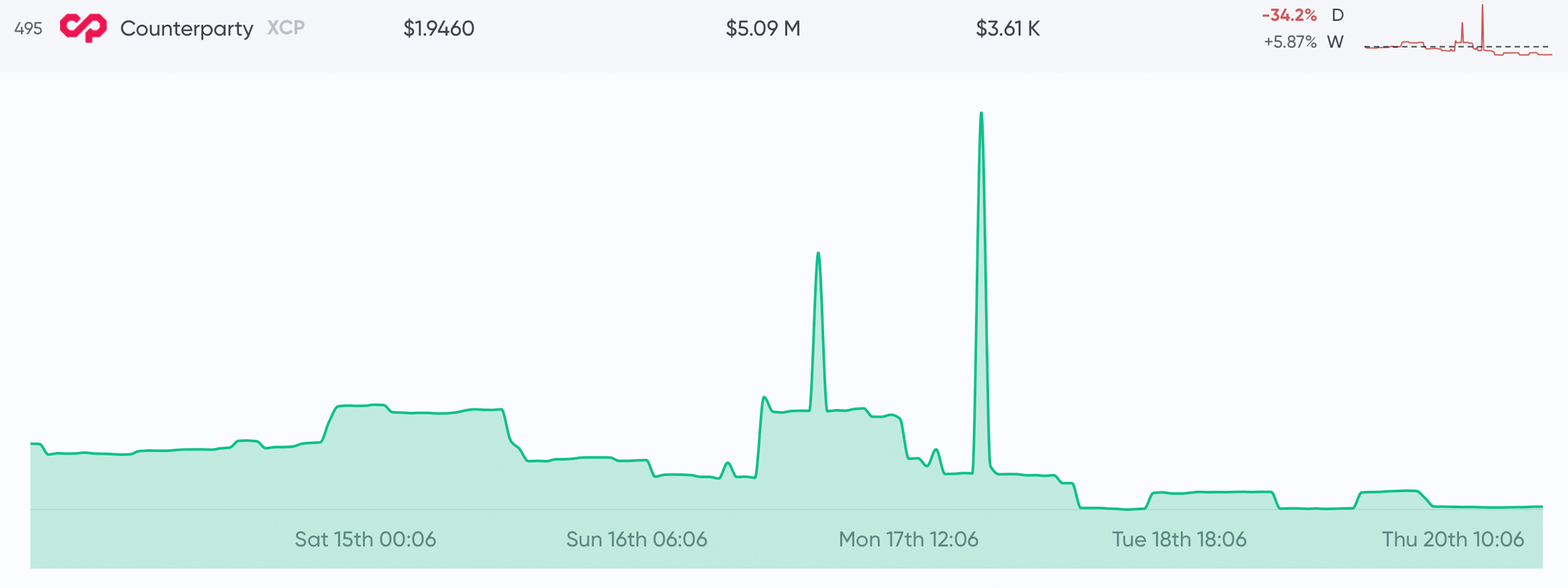

The worst entertainers of 2019’s initially 2 quarters consist of a range of unidentified and well recognized digital properties. Counterparty (XCP) was the year’s biggest loser so far, down 77%.

Other coins that sanctuary’t done so well in 2019 consist of dentacoin (DCN -70%), salt (SALT -54%), substratum (SUB -50%), namecoin (NMC -49%), quarkchain (QKC -47%), hxro (HXRO -45%), and factom (FCT -42%). Other coins that lost greatly over the last 2 quarters include properties like waves, bitcoin personal, electroneum, stratis, pivx, and spankchain.

Where Will the Cryptoconomy Go From Here?

The initially 6 months of 2019 have actually been interesting for cryptocurrency lovers as the majority of the digital economy is beginning to actually recuperate from 2018’s market losses. The whole cryptoconomy has a market capitalization of more than a quarter of a trillion dollars to date and there have actually been $40-100 billion in international trade volume day after day over the last 2 months. There’s been a great deal of speculation regarding why there’s brand-new loan streaming into this economy and the factors differ depending upon who you ask. Some think that there’s institutional interest focusing in on cryptocurrencies and others believe it might involve the failing economies in many nations worldwide. Whatever the case might be, digital property costs in basic have actually tape-recorded remarkable gains this year.

What do you think of the gains cryptocurrencies have seen this year? Let us understand what you think of this topic in the comments area below.

Image credits: Shutterstock and Markets.Bitscoins.web.

Are you feeling fortunate? Visit our authorities Bitcoin gambling establishment where you can play BCHslots, BCH poker, and much more BCH video games. Every video game has a progressive Bitcoin Cash prize to be won!

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.