Recently, a couple of Bitcoin Cash (BCH) supporters have actually been composing a series of myth-busting articles that explain Bitcoin technicals normally believed to hold true however which are not. The articles published on the read.money blog site have actually evaluated subjects like 10-minute verification times, SPV wallets, PoW energy use, and increasing network charges.

Bitcoin Myth-Busters

BCH fans have actually been taking part in an editorial series called “Mythbusting” that intends to dispel incorrect info about the Bitcoin procedure that’s been articulated by sophists throughout the crypto neighborhood over the last years. The articles have actually been published to the BCH-centric blogging website read.money and equated into Spanish so the subjects can collect a broader audience.

BCH Fees Won’t Rise Like BTC Because the BCH Network Is Not Artificially Constrained by a 1MB Limit

One short article called “Mythbusting: BCH charges would also be high with increased use” composed by Mr. Zwets discusses how a great deal of individuals think that even if BTC charges increase with more use, the very same will occur to BCH too when use boosts. “This argument does not hold ground and originates from an absence of understanding,” Zwets composed. Basically, Zwets states the reason that BTC charges surge substantially when use increases is since of the 1MB block size limitation. “Keeping the limitation was the most significant modification to occur to bitcoin in its history, altering it was not,” Zwets’ post discusses. “Bitcoin Cash has a 32MB limitation so it will not need to run into the limitation in the foreseeable future.”

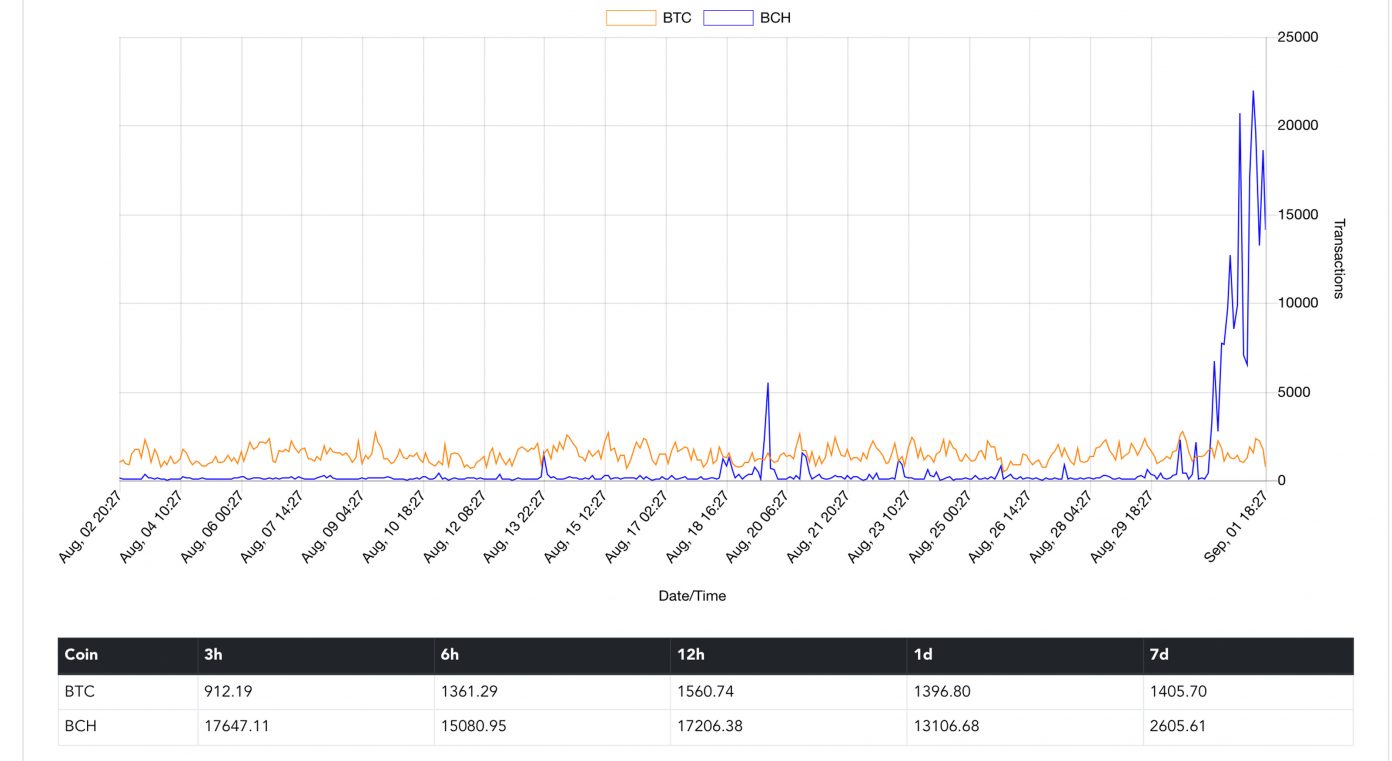

In reality, there is information that reveals charges won’t increase as they do on the BTC network when the chain is overwhelmed with deals. In 2018, the BCH neighborhood took part in a tension test that saw 2.4 million deals processed on September 1. Throughout the week, the BCH network continued to worry test day after day, processing 2-6x the everyday deal typical BTC produces. During today of tests, observers kept in mind that the network charge really moved from $0.003 to $0.001 per deal. Zwets’ post highlights the reality that the BTC network’s primary concern is because of the synthetically constrained block size limitation. Zwets’ short article tensions:

The hidden reason that there are high deal expenses to utilize BTC is since there is a synthetic limitation on the quantity of deals that can be processed and this limitation is lower than the quantity of deals individuals wish to make.

PoW Energy Consumption Is a Non-Problem

Another misconception busted on read.money called “ Bitcoin is always energy-inefficient since of PoW” discusses how stating Bitcoin’s proof-of-work is a waste of energy is “useless” and the “just function of this claim is to put Bitcoin (BTC) and PoW in a bad light.” The short article was composed by read.money user Alanone and he states the very best method to examine the energy usage is by comparing it to other systems that take in energy.

“For example, the energy-consuming by computer game console has an expense more than bitcoin network, however obviously it is not for security functions, however for home entertainment functions,” Alanone’s post notes. The author concluded his post by including:

As we can see, the concern connected to the expense also to the Bitcoin (BTC) is a non-problem for the environment and to conclude this short article, an enjoyable reality reveals that the usage from an idle house gadget can offer the power for bitcoin network for over 3 years.

The 10-Minute Block Time and Replace-by-Fee Debate

BCH advocate Cain composed his ideas on the misconception that 10-minute verification times make the Bitcoin network hard to utilize for daily payments. In the post “Mythbusting: 10-minute verification time makes Bitcoin inappropriate as a ‘money’ technique of payment” Cain composes that “BTC fans state that Bitcoin isn’t indicated for purchasing coffee.” One factor some individuals promote this misconception is since they believe 10-minute block times make double invests much easier. Cain discusses the current double invest make use of video, where Hayden Otto utilized the Replace-by-Fee (RBF) procedure to demonstrate how simple it was to double invest in the BTC chain. BTC fans glossed over the RBF concern and declared it was because of the 10-minute block period. They also declared all zero-confirmation deals were risky. Cain’s post refutes this misconception by discussing that BCH doesn’t have RBF and what BTC fans stop working to acknowledge is that it’s much more difficult to demo Otto’s real-world example on the BCH network.

“Instead, the [Bitcoin Cash] network follows the ‘initially seen’ guideline where miners accept the very first deal they view as opposed to the deal with the greatest charge,” Cain’s post highlights. “This indicates that attempting to effectively carry out a double-spend on the BCH network is considerably harder.” Cain keeps in mind that since BCH doesn’t have RBF, an individual who wishes to double invest needs to send out the funds at essentially the very same time. If a deal is sent out simply simple seconds later on, the opportunities of a double invest drastically reduce. The RBF procedure baked into Bitcoin Core makes it so the miners are more incentivized to accept ‘greater charges’ rather than Nakamoto’s initial style which follows the ‘initially seen’ guideline.

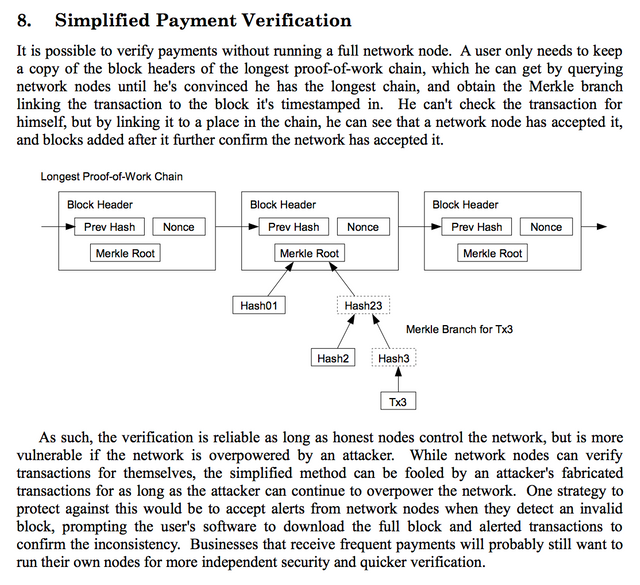

Dispelling the Belief That Simplified Payment Verification Is Unsafe

Then there’s the short article “Mythbusting: SPV is not protected” composed by Tomz (Thomas Zander maintainer of Flowee the Hub), which eliminates the misconception that Simplified Payment Verification is insecure. Zander thinks it’s a “pity” that individuals have “misunderstandings about SPV wallets” although the procedure is well explained in the Bitcoin whitepaper. “SPV wallets do verify, however they verify less,” Zander’s post information. “The misconception we hear is that this delayed monitoring is not safe — The concept that if you put on’t check 100% of the deals, in some way individuals can take your cash,” the designer includes. With complete nodes, Zander states that miners verify each and every deal and if they attempt to develop a block that invests UTXOs two times then the entire network will decline them. SPV wallets verify by following the chain and because SPVs put on’t check every deal they rely on the network of complete nodes to validate.

“SPV wallets put on’t simply rely on miners, they trust every business observing those miners to have adequate self-centered factors to keep the chain healthy and sane,” Zander’s post highlights. “Because the minute among those 1000s of miners begins to cheat, it is less expensive to eject that a person miner from the community than to simply state all your cash because chain lost due to the worth and trust drop that would follow.” The Flowee the Hub designer continues:

An SPV wallet owner, then, rely on a coin’s community. Which, honestly, is no various than any other business or individual utilizing that coin. The just distinction is among danger — The danger is not about a single payment being taken from you, the danger has to do with the whole chain ending up being damaged and declining. A scenario that is extremely simple to prevent by running a complete node and running your organisation on it. As exchanges and business like Bitpay do. The just run the risk of for an SPV wallet is when there are inadequate individuals keeping miners in check.

Bigger Blocks Do Not Equal Lesser Nodes

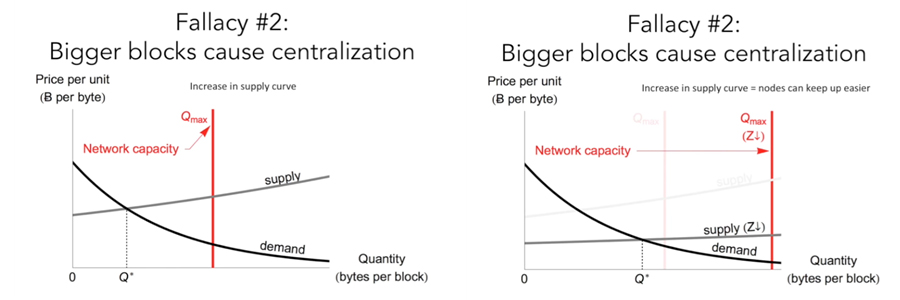

Lastly, Mr. Zwets also composed another counterclaim called “Mythbusting: Bigger obstructs mean less complete nodes,” which dismisses the belief that bigger blocks will harm the complete node count. Essentially since the blocks are so big followers of the misconception believe that users will pull out of running a complete node since the chain will be too big. Zwets utilizes Bitcoin Unlimited’s primary researcher Dr. Peter Rizun’s talk “Block Propagation and the Z-parameter” to assist argue his case. Basically, Zwets highlights that users run complete nodes since the expense is low and “since they discover them beneficial and appreciate the network.”

“This indicates the more individuals the network works to the more complete nodes. This may sound incredibly apparent however some individuals appear to believe the only method to get more bitcoin nodes is to decrease the expense of running one,” Zwets’ short article firmly insists. He also includes that procedure designers shouldn’t disregard a quick decrease of complete nodes if expense ends up being rapid. One example of this is the “big node expense” connected with 200+MB obstructs “which triggers nodes to crash and forces operators to update to more pricey hardware.” Zwets states the BSV chain is a perfect example of this kind of “node expense” as a mega-sized block “crashed lots of BSV block explorers and needed Bitmex to double the memory of their node.”

Santa to Reward Myth-Busting With a 1 BCH Prize

Overall, the BCH neighborhood appears to value the editorials developed to dispel myths and historic revisionism. The authors on read.money have actually been getting BCH suggestions and much of them got feedback on their essays. Moreover, authors have actually been getting an SLP-based token called “Mythbuster” as all the counterclaims were conjured up by a post composed by Btcfork called “A roadmap to busting little blocker myths about Bitcoin.” Btcfork’s post notes a range of ‘little blocker’ myths and there are lots of unclaimed essays that can still be composed.

Positive factors might get Mythbuster tokens for their efforts and Btcfork hopes that the work supplies a thorough list of editorials that refute these untruths. Btcfork has also composed some posts of his own, that include “Mythbusting: huge blocks => no charges => boundless spam,” and “Mythbusting: “Controversial hard-forks cannot occur.” Lastly, to incentivize authors a lot more, Btcfork stated that “Santa” has actually revealed that he will reward 1 BCH to the short article he likes best after December 27. Santa Claus will also benefit 0.666 BCH to his runner up preferred, and 0.333 BCH to his 3rd location favorite.”

What do you think of all the Mythbusting posts composed by BCH supporters? Let us understand what you think of this topic in the comments area below.

Image credits: Shutterstock, BCH logo design, Pixabay, Fork.lol, Block Propagation and the Z-parameter slides, read.money, Mythbusters logo design, the Bitcoin white paper, and Fair Use.

Did you understand you can validate any unofficial Bitcoin deal with our Bitcoin Block Explorer tool? Simply total a Bitcoin address search to see it on the blockchain. Plus, check out our Bitcoin Charts to see what’s occurring in the market.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.