“I’m sorry, but there’s nothing more I can do to help you.”

Samara Asset Group (FRA: ECV) CEO Patrick Lowry had some option words when it pertained to describing simply just how much chance, and possibly myopia, exists in the monetary universe when it pertains to Bitcoin.

In a current Twitter Spaces, Lowry set out his vision for a future monetary system that makes use of the Bitcoin network at every level. From working as a shop of worth à la “digital gold”, to being “the provenance of global financial commerce in trade, in money, and in capital markets”, chances are plentiful.

Lowry thinks that bitcoin might end up being “infinitely more valuable than anything Satoshi ever imagined and anything the Bitscoins.netmunity is thinking about.” Despite that, capital allocators, in his view, are in some way failing, comparing them to horses being resulted in water. For the Samara CEO, that’s all the much better for those ready to start.

The MicroStrategy Copycats Are Coming

Having made a profession in Bitcoin in digital properties, initially at Deutsche Digital Assets followed by Cryptology (which went on to end up being Smara Asset Group), Lowry revealed a viewpoint that Bitcoin particularly is primed for a renaissance.

Primarily, he thinks that MicroStrategy was simply the very first in a long line of copycats to come, and he compared his Malta-based Samara Asset Group as one such company. “At [Samara], we have been acquiring as much bitcoin as humanly possible over the last couple of years.” For companies that wish to do the same, he thinks current reasonable worth accounting guideline modifications by the FASB are more impactful than the majority of in the market provide credit for, stating “I genuinely believe that the FASB’s ruling is more monumental, more forward for bitcoin, than the bitcoin ETF was.”

Joining the discussion, Dylan LeClair Bitcoin Magazine Institutional Lead and Director of Bitcoin Strategy at Metaplanet (TYO: 3350), echoed a comparable viewpoint. LeClair and Japan-based Metaplanet have actually begun as the very first equity to function as a bitcoin proxy in Japanese markets, providing financiers a method of getting bitcoin direct exposure in spite of what he referred to as an undesirable legal and tax environment for holding bitcoin itself.

LeClair thinks Metaplanet and MicroStrategy will not be the only ones to utilize a bitcoin method, however that those who are earliest will benefit most: “It’s the people and institutions at the fringe that have deep conviction that are the first movers. And I think that’s where the advantage is.”

LeClair applauded business like Jack Dorsey’s Block for their current statement in which they exposed strategies to invest 10% of the business’s gross revenues into bitcoin. Soon after, the Block CEO went on to anticipate a bitcoin cost of “at least $1 million” by the end of the years.

The Alpha Is Up For Grabs

For Lowry, it’s not simply the truth that bitcoin might increase in worth, however that a number of the companies who remained in position to record that gratitude were definitely annihilated in the bearish market of 2022 and 2023. “There was a complete washout of the marketplace. It might be higher than 90%, it might be 95% of crypto managers got wiped out.” In other words, the playing field is broad open thanks to the GBTC arbitrage mess that brought the crypto home of cards crashing down.

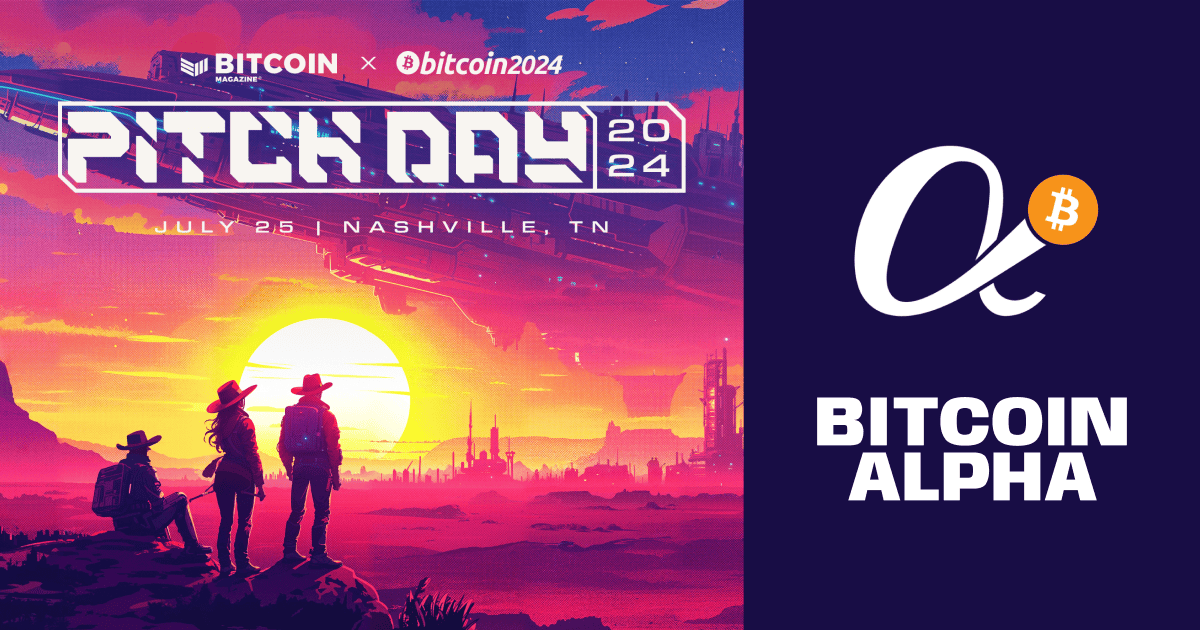

Samara Alpha Management, a United States-based subsidiary of Samara Asset Group, is working to fill that space in the market through the Bitcoin Alpha Competition in collaboration with Bitcoin Magazine Pro. As part of Pitch Day at Bitcoin 2024 in Nashville, the competitors looks for to award $1 million in seed capital to emerging bitcoin fund managers while also providing the facilities needed to get their fund off the ground.

For the inaugural Bitcoin Alpha Competition in 2023, Animus Technologies Inc. was picked for their method leveraging expert system to evaluate and capitalize upon modifications in market belief. Animus CEO Maximilian Pace kept in mind that the seed capital and Samara’s functional facilities allowed his company to “focus on what we’re best at, which is signal formation and creating value through research.”

Lowry sees the internationally dispersed hivemind of skilled digital property traders, such as Animus, as a mostly untapped resource. “You have some of the brightest and most talented managers in crypto that are just managing just a couple of assets via SMAs or frankly via Twitter. These are groups, and these are individuals, that I would like to empower by giving them the opportunity to have their own fund.

But these individuals don’t want to spend a quarter of a million or half a million dollars to become their own asset manager… These groups don’t know how to manage risk, they don’t know how to manage auditors. They might not even know what jurisdiction they should be setting up their general partnership or LP in… That’s [why] we started the Bitcoin Alpha Competition last year… [and now] we are very much looking forward to seeing what managers come from the competition for Bitcoin Nashville in July.”

Click HERE to make an application for the 2024 Bitcoin Alpha Compeition as part of Pitch Day at Bitcoin 2024, Nashville

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.