Bitcoin Magazine

This Rare Bitcoin Buy Signal Could Ignite Next BTC Rally

Recent patterns in Bitcoin’s rate have actually raised issues amongst financiers concerning the possibility of a shift into a significant bearishness. However, an uncommon information signal connected with the United States Dollar Strength Index (DXY) suggests that a substantial modification in market conditions might be on the horizon. This specific Bitcoin buy signal, which has actually emerged just 3 times throughout Bitcoin’s history, recommends a possible bullish turnaround in spite of the dominating bearish belief.

For a more extensive expedition of this topic, a current YouTube video entitled “Bitcoin: This Had Only Ever Happened 3x Before” is offered for seeing:

Table of Contents

- BTC vs DXY Inverse Relationship

- Bitcoin Buy Signal Historic Occurrences

- Equity Markets Correlation

- Conclusion

BTC vs DXY Inverse Relationship

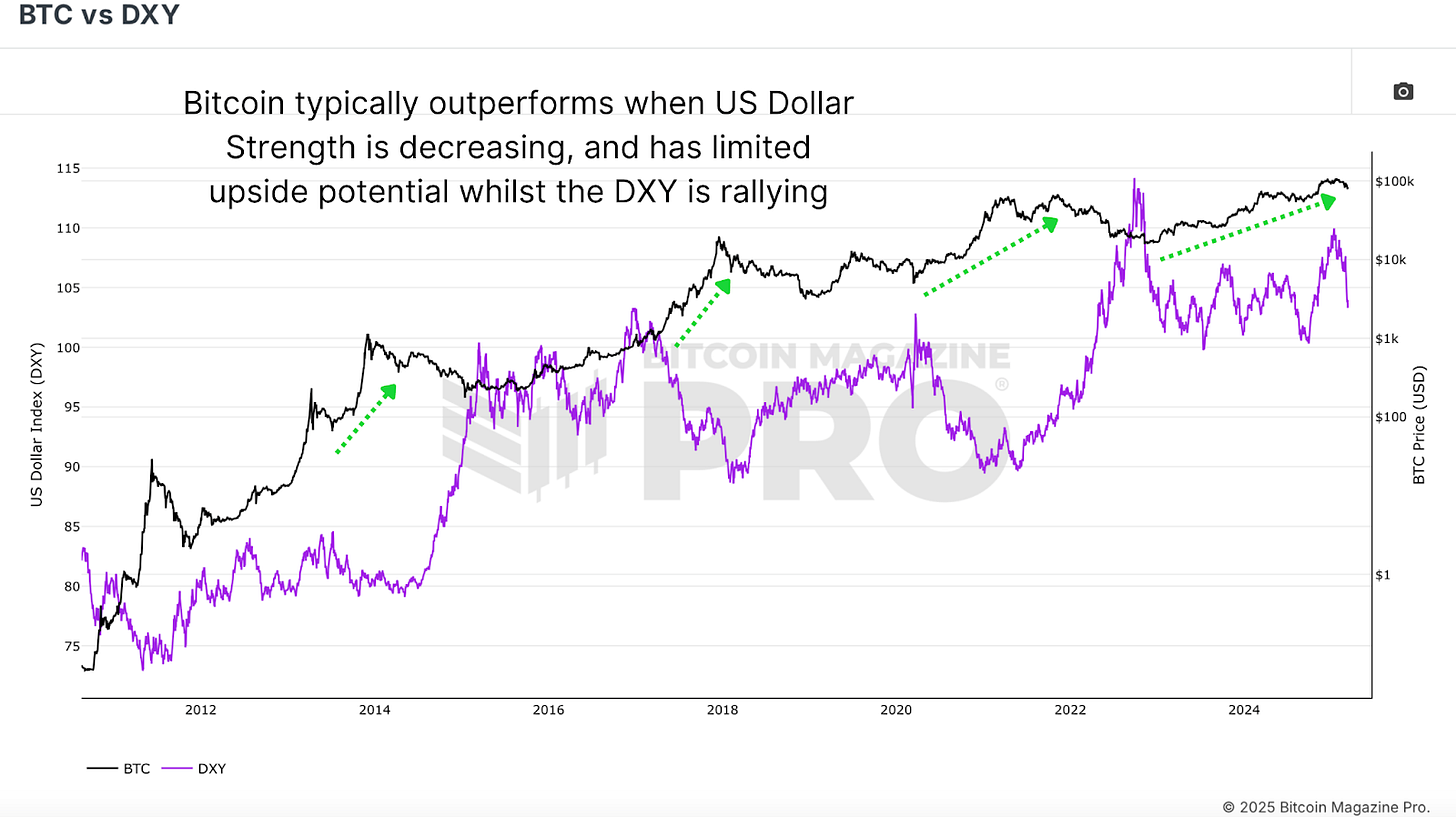

The rate motions of Bitcoin have actually traditionally shown an inverted connection with the United States Dollar Strength Index (DXY). Generally, an enhancing DXY is connected with battles in Bitcoin’s rate, while a decreasing DXY tends to produce beneficial macroeconomic conditions that promote Bitcoin rate gratitude.

Despite this historic propensity towards bullish impact, Bitcoin’s rate has actually continued its down trajectory, just recently falling from over $100,000 to below $80,000. Nevertheless, previous circumstances of the DXY retracement suggest that a substantial rebound in Bitcoin’s worth might be upcoming.

Bitcoin Buy Signal Historic Occurrences

At present, the DXY is experiencing a substantial decrease of more than 3.4% within a single week, a rate of modification that has actually just been recorded 3 times given that Bitcoin’s creation.

To much better comprehend the possible implications of this DXY signal, it is helpful to evaluate the 3 previous incidents marked by sharp decreases in the United States Dollar Strength Index:

- 2015 Post-Bear Market Bottom

The initially circumstances followed Bitcoin’s rate bottoming out in 2015. After a duration of stabilization, Bitcoin’s rate rose considerably, accomplishing over 200% gains within a couple of months.

- Post-COVID Market Crash

The 2nd circumstances took place in early 2020 following the market recession caused by the COVID-19 pandemic. Echoing the patterns observed in 2015, Bitcoin at first experienced volatility before getting in a fast upward trajectory that led to a multi-month rally.

- 2022 Bear Market Recovery

The newest incident occurred at the conclusion of the 2022 bearishness. Following a stabilization stage, Bitcoin experienced a noteworthy healing, relocating to considerably greater rate levels and starting the existing bull cycle over the subsequent months.

In each of these historic contexts, the noticable reduction in the DXY was been successful by a combination stage, which eventually resulted in a significant bullish stage for Bitcoin. Analyzing the rate motions observed throughout these circumstances offers insight into possible future advancements in the existing market environment.

Equity Markets Correlation

Interestingly, this observed pattern extends beyond Bitcoin; a comparable relationship can be seen in conventional equity markets, especially within the Nasdaq and the S&P 500 indices. A considerable retracement in the DXY has actually traditionally referred significant outperformance in equity markets relative to their standard returns.

The historic typical 30-day return for the Nasdaq following a comparable decrease in the DXY stands at 4.29%, considerably exceeding the basic 30-day return of 1.91%. When the timespan is encompassed 60 days, this typical return for the Nasdaq increases to almost 7%, nearly doubling the normal efficiency of 3.88%. This connection strengthens the idea that Bitcoin’s efficiency following a sharp retracement in the DXY remains in line with more comprehensive market patterns, recommending a postponed yet significant favorable reaction.

Conclusion

The observed decrease in the United States Dollar Strength Index makes up an uncommon and traditionally bullish signal for Bitcoin purchasing chances. While Bitcoin’s instant rate trajectory stays suppressed, historic patterns suggest that a combination duration is most likely to precede a substantial rally. Additionally, the positioning of patterns observed in equity indices such as the Nasdaq and S&P 500 supports a beneficial macroeconomic outlook for Bitcoin.

Investors are motivated to check out live information, charts, indications, and extensive research study to stay educated about Bitcoin’s rate motions at Bitcoin Magazine Pro.

This analysis on the capacity for a Bitcoin rate rise was initially released on Bitcoin Magazine and authored by Matt Crosby.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.