It can be an uncommon week in bitcoin the place there weren’t glum tidings to report, be it an trade hack, regulatory clampdown, or edict from the east. It simply so occurs that this week witnessed all three – and on the identical day, no much less. You might name it dangerous luck, or you could possibly name the occasion, which despatched bitcoin below $9,000, the place it’s flirted ever since, a black swan: a random prevalence that’s inconceivable to foretell.

A Triumvirate of Black Swans Descend

They say that dangerous luck comes in threes, and on Wednesday bitcoin was struck by a triple whammy which despatched costs tumbling. This excellent storm of unfavourable information got here in the type of an SEC assertion on unregulated exchanges, experiences of Japanese regulators shutting down exchanges, and a serious incident at Binance in which compromised consumer accounts have been used to control the worth of viacoin. As is commonly the case, these tales weren’t as gloomy because the market initially interpreted them.

The SEC has been bumping its gums about crypto for weeks, as regulators are wont to do, and there was nothing in its newest report which heralded impending doom for cryptocurrency exchanges. Similarly, it seems that the Japanese watchdog wasn’t wielding the banhammer indiscriminately; relatively it was specializing in a few small, unlicensed exchanges whose existence has little bearing on the nation’s cryptocurrency commerce. Finally, the Binance incident ended fortunately, with the fraudulent trades reset and balances restored. Not solely did the attackers fail to revenue, however they really wound up shedding out on the rip-off.

The SEC has been bumping its gums about crypto for weeks, as regulators are wont to do, and there was nothing in its newest report which heralded impending doom for cryptocurrency exchanges. Similarly, it seems that the Japanese watchdog wasn’t wielding the banhammer indiscriminately; relatively it was specializing in a few small, unlicensed exchanges whose existence has little bearing on the nation’s cryptocurrency commerce. Finally, the Binance incident ended fortunately, with the fraudulent trades reset and balances restored. Not solely did the attackers fail to revenue, however they really wound up shedding out on the rip-off.

East v West

Regulatory tales have dominated the information cycle as soon as once more, and most of them have been American. The tone coming from the west versus that from the east has been tangibly completely different. This week alone, Asia has introduced us information of a South Korean journey website accepting a dozen cryptos as cost and a Taiwanese airline following go well with. When was the final time we had a serious U.S. or European retailer announce assist for bitcoin? Instead of service provider adoption, all we appear to listen to is pronouncements on how ICOs are liable for sophistication motion lawsuits and cryptocurrencies are commodities. But what about all the nice issues bitcoin did?

In equity to regulators, they’re simply doing their job, even when their overzealousness is inflicting buyers to turn into extra confused than ever about what precisely they’re shopping for into. The fact is, officers from competing companies don’t know what to make of crypto, and till they will multilaterally attain a consensus, maybe they need to chorus from issuing contradictory decrees.

If You Can’t Join Them, Beat Them

One of this week’s extra in style tales involved Paypal submitting an “expedited cryptocurrency transaction system”. We’re beginning to see this form of factor lots: “enemies” of bitcoin submitting bitcoin-like patents as a way of hedging their bets and staying related. It’s no coincidence that Paypal shares jumped 5% off the information. Whatever the cost processing firm are plotting, a proprietary cryptocurrency appears unlikely at this stage, with CEO Dan Schulman declaring, in a current discuss:

Regulations must be sorted out and a complete variety of different issues. [Crypto is] an experiment proper now that may be very unclear which course it’ll go.

One experiment which didn’t go down properly was the choice of Mt Gox’ creditor to dump a ton of BTC onto exchanges. The cash have been liquidated over a interval of a number of months, however in every case their launch induced the worth of bitcoin to drop, such was the quantity of cash being bought at market costs. As a consequence, a few of Gox’ unique victims discovered themselves rekt once more after their lengthy positions have been all of a sudden worn out. Why couldn’t the cash have been bought in an OTC deal? It’s a query that many individuals, together with Kraken CEO Jesse Powell, have been questioning.

Some Light Relief and Not Before Time

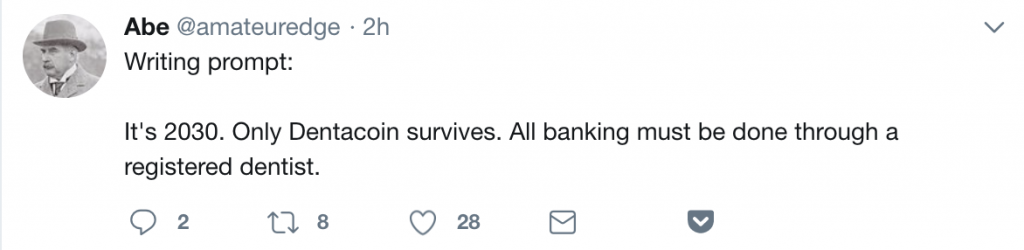

In these weeks the place bitcoin, alts, and each different crypto asset is getting pummeled to loss of life, any mild reduction is gratefully acquired. It got here from the story of decentralized banking ICO Miroskii and its intriguing mission crew, led by Ryan Gosling. That, and the story of Bitcoin.org co-owner Cobra, who was accused of switching sides after declaring his assist for bitcoin money, have been the closest we received to humor – until you depend the surprising efficiency of Chinese shitcoins, which is just humorous in the event you’re not holding Asian alt luggage.

This is crypto, so who is aware of what subsequent week’s gonna convey, but when we needed to wager a number of satoshis, we’d say regulation, extra regulation, and one other bearish assertion from the SEC. Only Silk Road children will keep in mind this, however there was as soon as a time when the one factor officers have been getting scorching and bothered over was the potential for bitcoin getting used to buy medication. How time flies and priorities change.

What was your favourite story from this week in bitcoin? Let us know in the comments part below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.