The bitcoin house is a continuing battle of fact versus untruth, rumor versus reality and optimism versus pessimism. With market manipulators as much as their regular tips and salty altcoiners crying FUD, it may be exhausting to inform what’s actual and what’s faux. This week really had all of it: keks, lies, and videotape beamed dwell from the U.S. Senate. Throw in the compulsory multi-million greenback hack, and also you’ve acquired all of the makings of one other seismic week in bitcoin.

The Rumor Mill Goes Into Overdrive

The week began with rumors that China was banning bitcoin – sure, once more. Not solely that however they might be cracking down on mining too and laying the banhammer in Hong Kong into the cut price. It seems the story was precise faux information, however that didn’t cease a few lesser publications from working with it. It was an elaborate hoax that confirmed far more sophistication than the typical Nigerian phishing e-mail, and was clearly an try at shorting the markets for financial achieve. As we reported:

The goal of the bogus e-mail’s senders was to unfold rumours and panic, in the hope of manipulating the value of bitcoin, after taking brief positions on bitcoin futures and betting that the value of bitcoin will fall, mentioned Leonhard Weese, president of the Hong Kong bitcoin affiliation.

Discrediting faux information is one factor, however what about information that’s but to happen? Who do you consider in relation to predicting bitcoin’s future actions? Two very completely different sources gave their views on the place bitcoin’s headed this yr, one pessimistic, the opposite largely optimistic. While a central banker was trotting out the regular apocalyptic proclamations about bitcoin being a Ponzi and a catastrophe, a bunch of luminaries have been predicting extra constructive worth actions for the yr forward.

Bitcoin Gets The Hero It Deserves

Tuesday noticed the Senate listening to on cryptocurrencies, which was interpreted as largely constructive for bitcoin, regardless of SEC chairman Jay Clayton opining that each ICO thus far has issued tokens that represent a safety, not a utility. The listening to was also noteworthy for the primary recorded utilization of the phrase “HODL” in the U.S. Senate, a feat which made an on the spot hero of CFTC chairman Chris Giancarlo, whose Twitter follower depend “did a bitcoin” and grew exponentially in the aftermath of the listening to.

Other main tales that acquired heads speaking this week embody Forbes’ Crypto Rich List which is both innocent enjoyable or a gross invasion of privateness relying in your perspective. Weiss Ratings defended its resolution to offer bitcoin a C+, and there was excellent news from Korea, the place the PM confirmed that crypto exchanges are in no hazard of being shut down offered they play by the foundations. As all the time, you’ll catch one of the best of this week’s tales in the This Week in Bitcoin podcast, embedded below.

Bitcoin Springs a Bear Trap

It regarded like bitcoin was again on monitor after a wonderful inexperienced candle despatched it scurrying above $9k, however the pleasure was to be brief lived. Possibly feeling the results of the worldwide stoop induced by the sliding inventory market, bitcoin was dragged again into the low $8k territory, the place it’s been floundering each since. Eric Wall sees a clear correlation between the crypto markets and the U.S. inventory market. Watching the bitcoin worth ticker rise and fall will be heart-stopping stuff; you’ll be able to’t blame Steve Wozniak for tapping out and promoting the majority of his BTC.

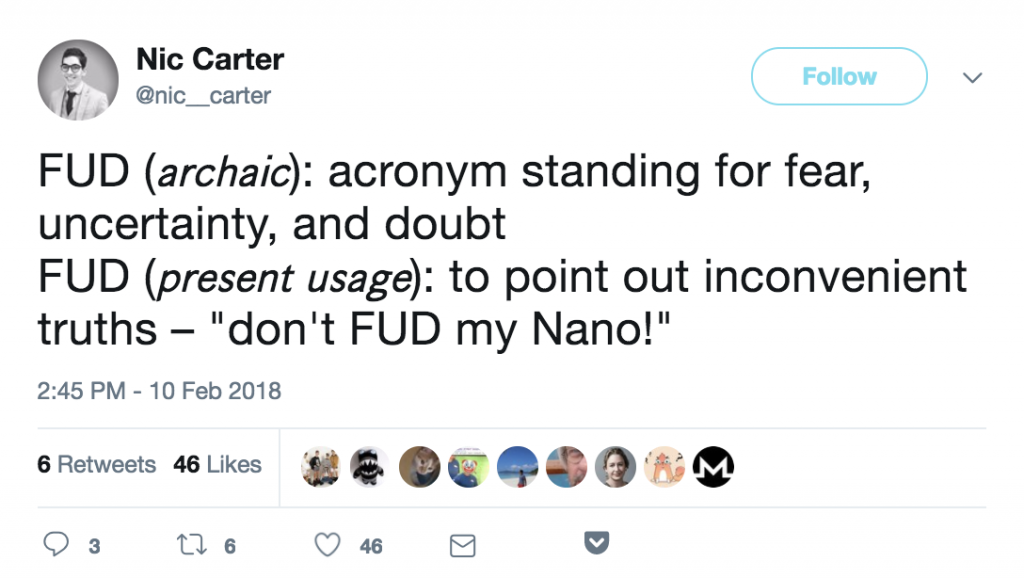

Finally, Ripple got here in for scrutiny after Bitmex Research revealed simply how centralized the XRP is, and the IOTA mafia have been out in pressure after Andreas Brekken dared to ship just a few dwelling truths in his newest shitcoin evaluate. Still, higher to be an irate IOTA holder than a Nano holder together with your XRB in Bitgrail. $170 million of cryptocurrency misplaced attributable to a withdrawal bug that was mercilessly exploited for months. Next week can we please haven’t any hacks, no phishing assaults, no bulls, and no baseless cries of “FUD”?

What was your favourite story from this week in bitcoin? Let us know in the comments part below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.