The collapse of three rely on three various continents shows a new international crisis is developing. But it might also reveal that the last one never ever actually ended and the tools utilized to handle the international economy merely put on’t work.

United States Bank Fails for the First Time Since 2017

More than 10 years have actually passed considering that the collapse of Lehman Brothers, which burned nearly $10 trillion in market capitalization in international equities within a month. Back then, it was identified that banks, big and little, had actually gotten themselves into problem with mortgage-backed securities, the rate of which ended up being substantially overstated.

Now, following waves of quantitative easing and big bailouts for those considered “too huge to stop working,” signs have actually emerged that the conventional banking system is heading towards its next huge catastrophe. The primary concern that stays to be responded to is what the trigger will be.

Analysts have actually cautioned it might be the record high level of international financial obligation presently standing at well over $240 trillion, which is three times the size of the international economy. Others are indicating China’s deeply indebted financial system. Europe’s banking sector, as deleveraged as it might appear, still has its unsettled concerns, particularly intense and persistent in some nations of its southern flank.

When America sneezes, nevertheless, the world typically captures cold, as the stating goes. This year, the U.S. registered its very first bank failure considering that 2017. On the last day of May, the Texas Department of Banking closed Enloe State Bank. The Federal Deposit Insurance Corporation (FDIC) then took actions to set up the presumption of the bank’s guaranteed deposits by Legend Bank, N.A.

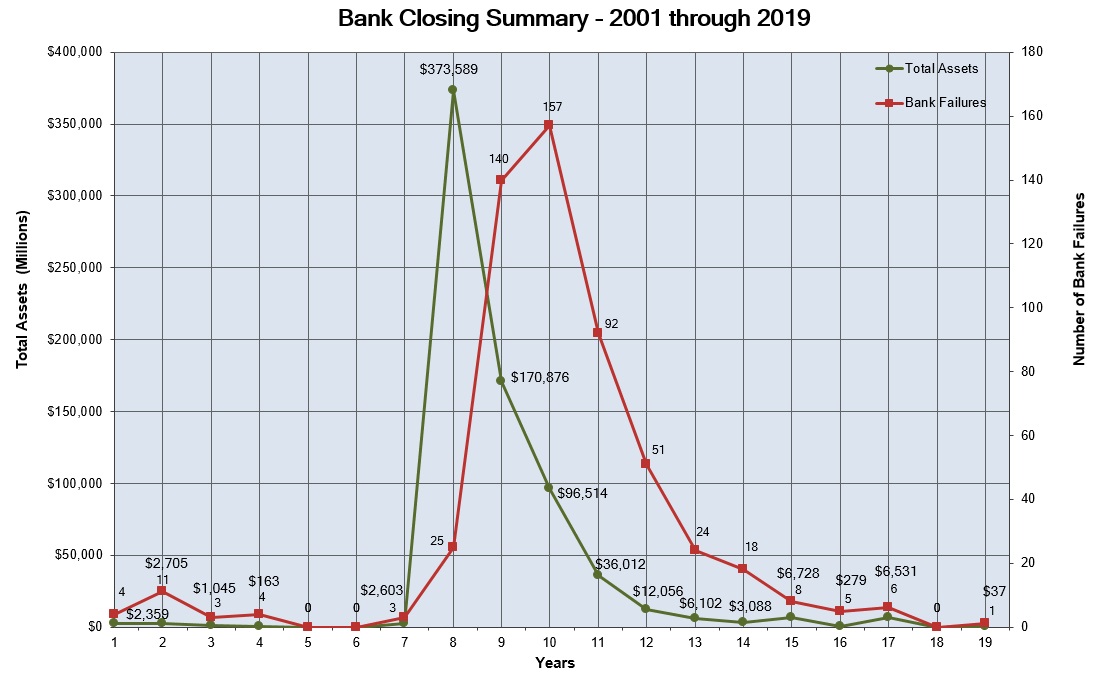

The Enloe State Bank is a little organization with just one branch. It managed a little over $36 million in possessions and just about $31 million in deposits. Nevertheless, its death is an occasion that should have a reference. Bank failures in the U.S. peaked in 2010, according to FDIC information, when 157 banks closed. Since then, the variety of stopping working financial organizations has actually been reducing – 92 in 2011, 51 in 2012, 24 in 2013, 18 in 2014, 8 in 2015, 5 in 2016, 6 in 2017, and most significantly – no in 2018.

The FDIC preserves a database of all U.S. banks that stopped working considering that Oct. 1, 2000. It’s a scary list to go through as it has 23 pages of organizations that for numerous factors were required to desert their service and look for rescue. The table includes the name of the struggling bank, the city and state it’s based in, its accreditation number, closing date, and the getting organization. The list currently has an incredible 556 entries included considering that the start of the centuries.

Undoubtedly, the truth that in 2018 no bank stopped working for the very first time considering that 2006 shows that the banking sector in the Untitled States has actually enhanced considering that what’s now typically called the Great Recession. But the truth that a bank decreased this year reveals there are still underlying issues and weak points in the marketplace that need to be dealt with.

The market has actually been combining as a lot of bothered banks have actually been purchased by larger organizations. On the background of financial growth, business tax cuts and new precaution, it’s been reported that the 6 biggest of them are anticipated to reach a record earnings of more than $100 billion. The concern is, will larger be much better when the next crisis hits?

World’s Oldest Bank Bailed Out Against Europe’s Rules

Despite some favorable modifications carried out in the previous years, the conventional banking system is still dealing with many difficulties that are installing when again. Europe, where a more conservative technique to handling the 2008 difficulties produced a normally much safer environment, is still having a hard time to conquer the issues that have actually dogged banks in a number of the southern member states of the European Union which took a difficult blow from the international financial bust 10 years back.

After federal governments commissioned big bailouts and presented more stringent policies, the capital balances of lots of European banks enhanced. Countries such as Greece and Italy, nevertheless, continue to sign up a high percentage of bad loans. At the exact same time, unlike the United States, bigger banks in these and more steady economies are experiencing low revenues due to not just the big share of non-performing loans, however also the extraordinary low rate of interest throughout the Eurozone and the bigger EU.

Between 2007 and 2009, banks, from Ireland to Austria, needed to be conserved by federal governments or obtained by banks in much better financial condition. The increased requirements gamers in the market were required to fulfill and the new guidelines they now need to abide by enhanced the stability of enduring banks, increased their capital ratios and decreased the share of bad loans in subsequent years. Still, when the European Central Bank carried out a medical examination in 2014, 25 out of the 130 biggest Eurozone banks stopped working the tension test. The capital deficiency approximated by the ECB totaled up to €25 billion.

Again, unlike the U.S., 2018 was not a great year for rely on the Old Continent. Towards completion of the summer season and throughout the last quarter they ended up to have a few of the worst carrying out stocks. The losses reported by mainstream media were exceptional. In simply 4 months, the rate of Dankse Bank shares decreased by nearly 32%, Commerzbank over 31%, Deutsche Bank near to 30%, Unicredit and BNP Paribas around 24%.

However, it’s not a lot about the suffering banks, which can make it through, however about those banks that might not make it by themselves and needed to be conserved with taxpayer cash. The case with the Italian Banca Monte dei Paschi di Siena MEDICAL SPA is a symbolic one. Two years back, the earliest operating bank in the world, established in 1472, required nearly $6.2 billion to prevent insolvency. The federal government in Rome approved it state help to prevent activating an across the country banking crisis. The bailout was performed regardless of a report by a group of ECB inspectors, estimated just recently by Bloomberg, who questioned the bank’s solvency even back in 2015.

The banks was moneyed no matter the professionals’ issues that the effort to keep it running may not prosper. The rescue also breached the European Union’s own guidelines on bailout eligibility. Monte Paschi’s resurrection, considering its bad shape, is a relocation that weakens ECB’s reliability as a banking regulator and raises concerns about responsibility and openness, when it concerns investing public funds on conserving stopped working personal business. Are we visiting more rule-violating bailouts? That’s an essential concern to contemplate if a new financial crisis is on its method.

Small Bank Collapse Triggers Credit Crunch in China

A growing variety of experts think the next financial crisis is most likely to begin with China and its indebted banking system. A current occurrence corroborates these worries. Baoshang, a little lending institution based in the Inner Mongolia Autonomous Region, collapsed in completion of May, regardless of its numbers from a couple of weeks having actually offered no sign that this was going to occur. According to its newest report submitted with financial authorities, the bank signed up a $600 million earnings in 2017. It also had roughly $90 billion in possessions, while its bad loans were under 2%.

But then Baoshang unexpectedly stopped working and Chinese regulators took the bank – the very first act of this kind in the People’s Republic this century – rapidly blaming its owner of misappropriation of funds. Observers note, nevertheless, that the significance of Baoshang’s collapse originates from the truth that it was brought on by the nation’s very first default on interbank commitments. It has actually considering that ended up being really hard for smaller sized organizations to access the interbank lending market, on which they are greatly dependent.

And while the collapse of an Inner Mongolian bank might not seem like a Lehman-size occasion, in China amount has a quality all of its own. Numerous little and medium-sized Chinese banks integrated are in truth as big as the huge gamers. All of them are now dealing with problems when attempting to encourage bigger banks they are steady sufficient to get new loans.

This scenario required the People’s Bank of China to step in and inject 600 billion yuan ($125 billion) to sustain liquidity while presenting complete assurances for all retail deposits. Nevertheless, credit has actually currently ended up being harder to get and far more pricey for little banks in a time of getting worse financial potential customers in the middle of a continuous trade conflict with the U.S.

Under these situations, something makes certain: trust in the international financial system, based upon continuously inflated fiat currencies, will continue to lessen. And while new barriers are being raised to totally free financial interaction, typically out of geopolitical factors to consider, the requirement for an independent automobile for international cash circulations will continue to grow. Whether cryptocurrencies can meet that function stays an open concern, the response to which might show up faster than lots of believe.

What do you think of the collapse of these banks and the steps taken by federal governments and reserve banks to handle the financial crisis? Share your ideas on the topic in the comments area below.

Do you require a trusted Bitcoin mobile wallet to send out, get, and save your coins? Download one totally free from us and after that head to our Purchase Bitcoin page where you can rapidly purchase BCH and BTC with a charge card.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.