Statistics reveal that the decentralized financing (defi) economy has actually grown enormously this year as the total value locked (TVL) in defi just recently went beyond $4 billion. Between dex platforms, derivatives, stablecoins, financing, and non-fungible possession development the 2nd quarter of 2020 has actually moved the Ethereum network to brand-new heights.

Decentralized financing (defi) is a term utilized typically nowadays as it explains a disintermediation pattern in the world of financing. A large part of defi applications, tokens, and platforms are hosted on the Ethereum (ETH) network and defi’s enormous development has actually made the rate of ETH swell.

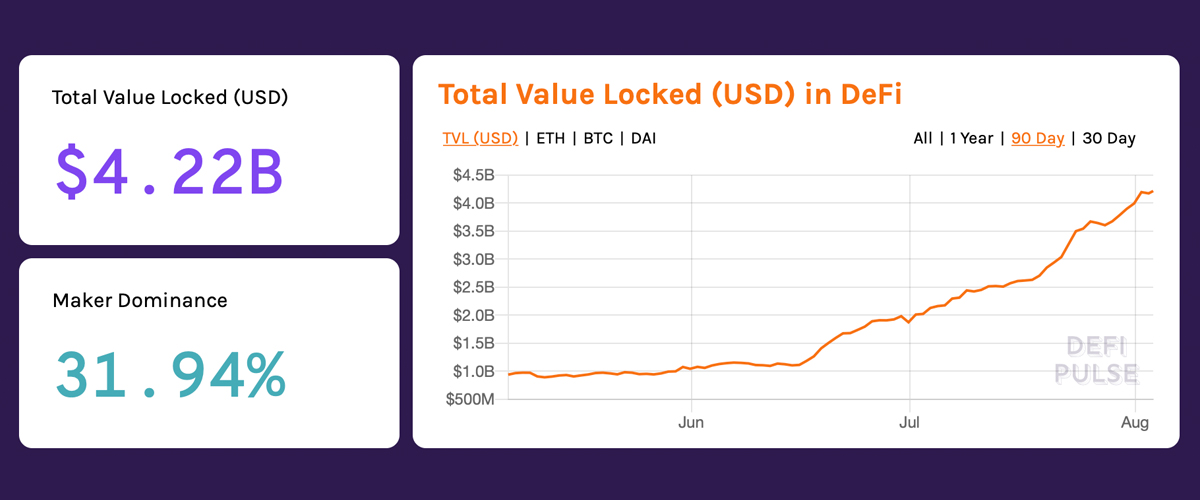

The defi environment simply commemorated a turning point as the total value locked (TVL) within the economy is $4.22 billion today.

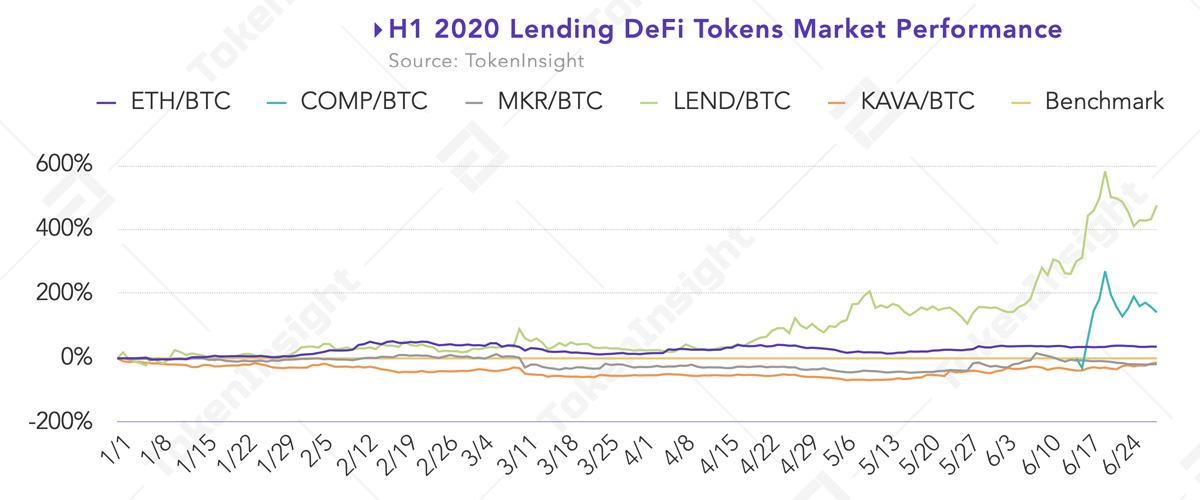

Most of the defi development happened in 2020 as a variety of tasks have actually seen substantial need. For circumstances, a report composed by Tokeninsight information that the defi TVL dropped to $500 million on March 12, otherwise called ‘Black Thursday.’

Since then, nevertheless, the defi TVL leapt 744% from mid-March to August 3. Tokeninsight’s report reveals defi’s “explosive development” came from the yield farming environment. Alongside this, the TVL was also strengthened by defi tasks with high financing interest.

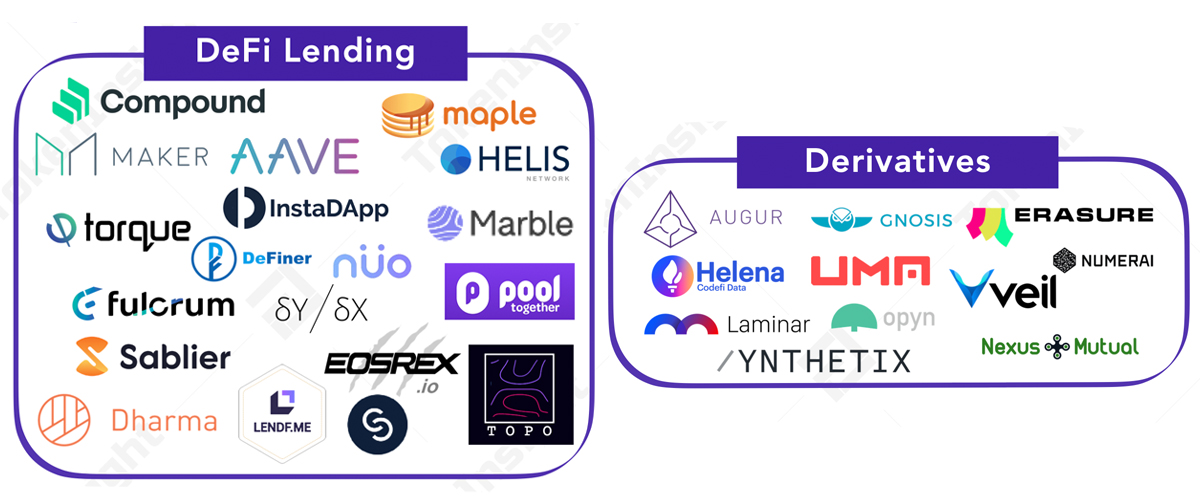

According to statistics from Defi Pulse, the leading 6 defi platforms consist of Maker (financing), Compound (financing), Synthetix (derivatives), Aave (financing), Instadapp (financing), and Curve Finance (dex).

Out of the $4.22 billion, the job Maker has a supremacy of around 31.9% today. Tokeninsight’s 2020 Q2 Defi Industry Research Report also exposes the variety of defi users has actually swelled exceptionally from 100,000 users in January to 230,000 users by the mid-year-end.

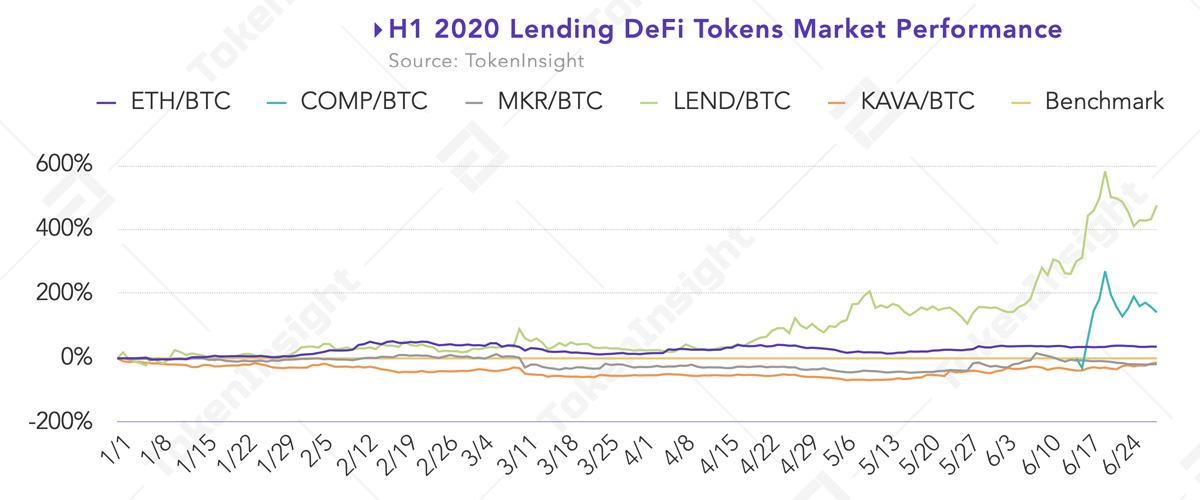

The research study findings show that derivatives and oracle tasks swelled in 2020 also and Synthetix (SNX) has actually been the “most effective derivatives concept up until now.” Furthermore, decentralized exchanges (dex) saw a boost in need also in the 2nd quarter of 2020.

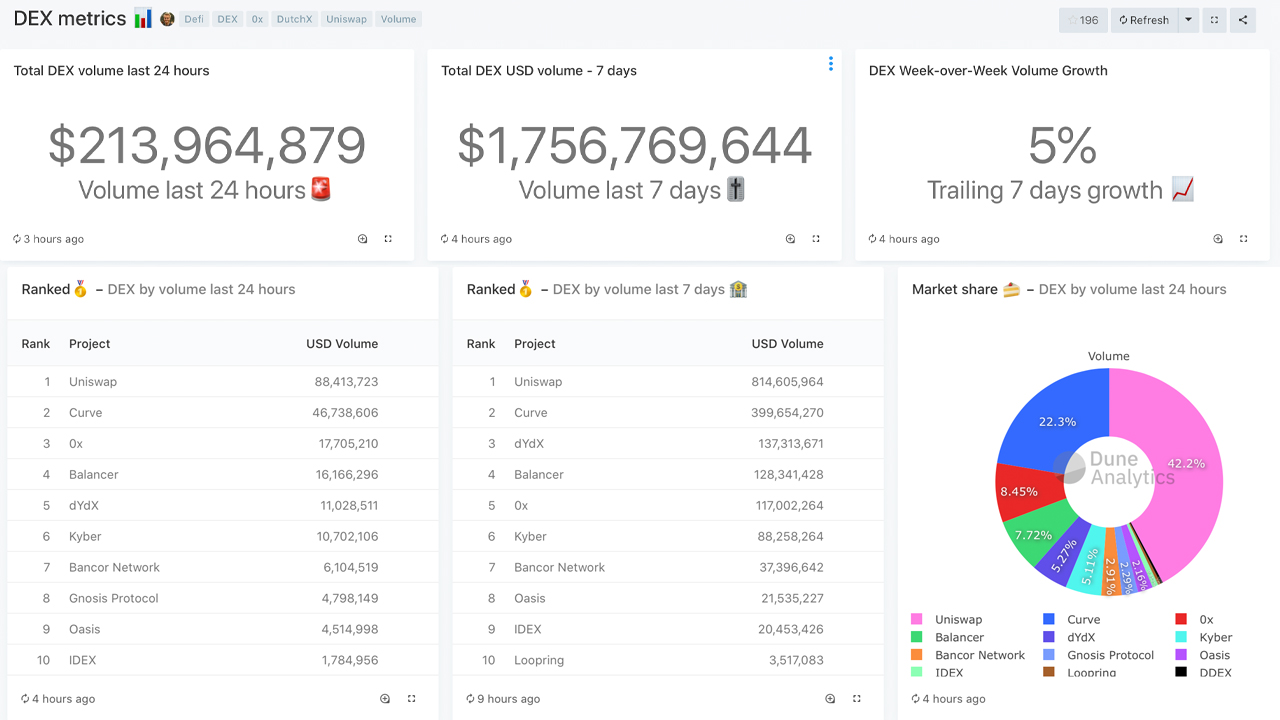

Right now the most popular dex platforms consist of Curve, Balancer, 0x, Dydx, Kyber, Bancor, IDEX, Oasis, and the Gnosis Protocol.

Dune Analytics information reveals that dex platforms saw $213 million trades throughout the last 24 hours. There’s been $1.7 billion in trade volume throughout the last 7 days and development has actually leapt 5% today up until now.

A variety of defi tasks have actually cushioned the TVL today, however a big part of the current need originates from yield farming and flash loan ideas.

Yield farming is a fairly brand-new method to utilize applications like Aave or Compound in order to conjure up a yield-generating pasture. A flash loan is the capability to utilize uncollateralized defi capital in order to make money from a well-executed dex trade.

The experts at Tokeninsight Research Johnson Xu, Norah Song, Harper Li, and Fanger Chou think that defi provides a “substantial development” in the crypto area.

The report also worries that the economy is still gaining from standard equivalents. The scientists believe that the defi area has a “special value proposal” moving forward.

“Strong development capacity and ingenious ideas can drive the more comprehensive cryptocurrency market to another level,” the scientist’s report concludes. “At some point, proof-of-stake, centralized financing, and decentralized financing will come together to form a huge cryptocurrency monetary environment to accomplish the capacity of ‘cash legos.’”

What do you consider the defi economy exceeding $4 billion? Let us understand in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.