Stablecoins have actually seen huge volume and development this month specifically after the marketplace carnage on March 12. Per normal, tether has actually been the king of stablecoins following the marketplace slump, however the 4.6 billion USDT wasn’t enough for all the liquidity required to protect the storm. Other tokens pegged to the U.S. dollar like USDC, TUSD, and PAX have actually profited also and a few of them have actually signed up with the leading trading couple with BTC.

Also Read: Bitcoin Cash IFP Debate: ABC Kicks Off Fundraiser, 3 Mining Pools Signal BCHN Support

Stablecoins See Increased Demand and Growth After Crypto Market Wrath

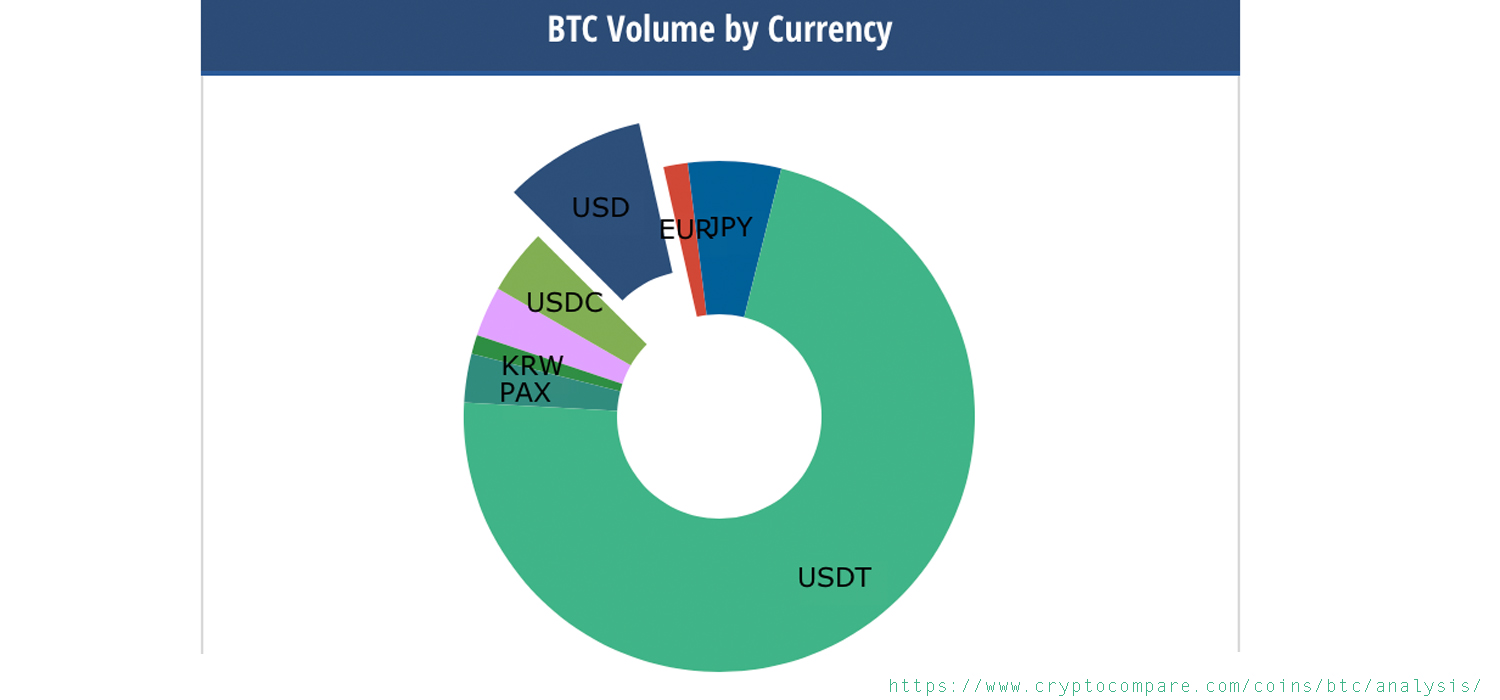

It’s a popular truth that great deals of traders like stablecoins and they end up being helpful hedges for individuals when crypto market value all of a sudden dive. Despite a variety of individuals not liking them and the debates surrounding stablecoins, they have actually continued to grow incredibly popular throughout the last couple of years. Tether (USDT) is one of the most utilized stablecoin and the token’s market capitalization is the biggest to-date. In truth, USDT is generally the leading trading couple with BTC and throughout the recently, the token recorded in between 60-75% of BTC trades.

At the time of composing, USDT has a market appraisal of around $4.63 billion. Coinmarketcap.com (CMC) information reveals reported traded volume for tether is $40.6 billion however messari.io’s “genuine volume” stats declare its only $1 billion. Either method, analytical aggregation websites like CMC, markets.Bitscoins.internet (6.4B), and messari.io both reveal that USDT has the most trade volume on March 15 out of 5,000+ coins.

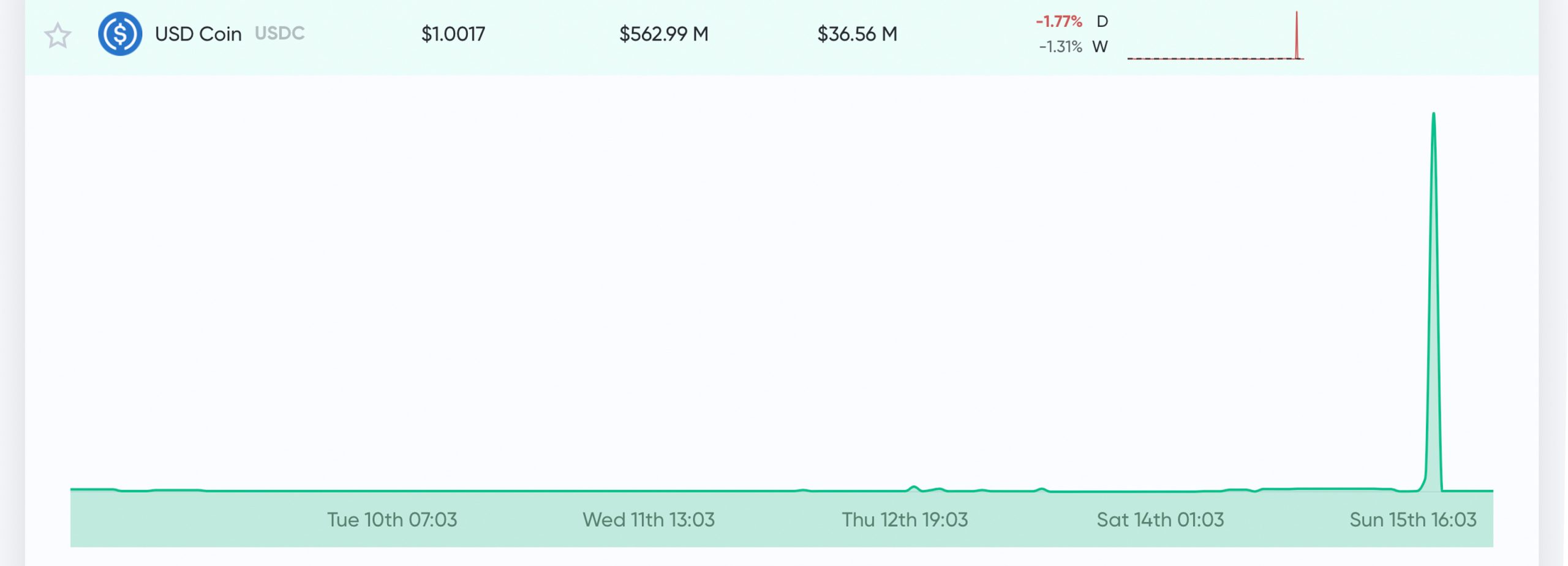

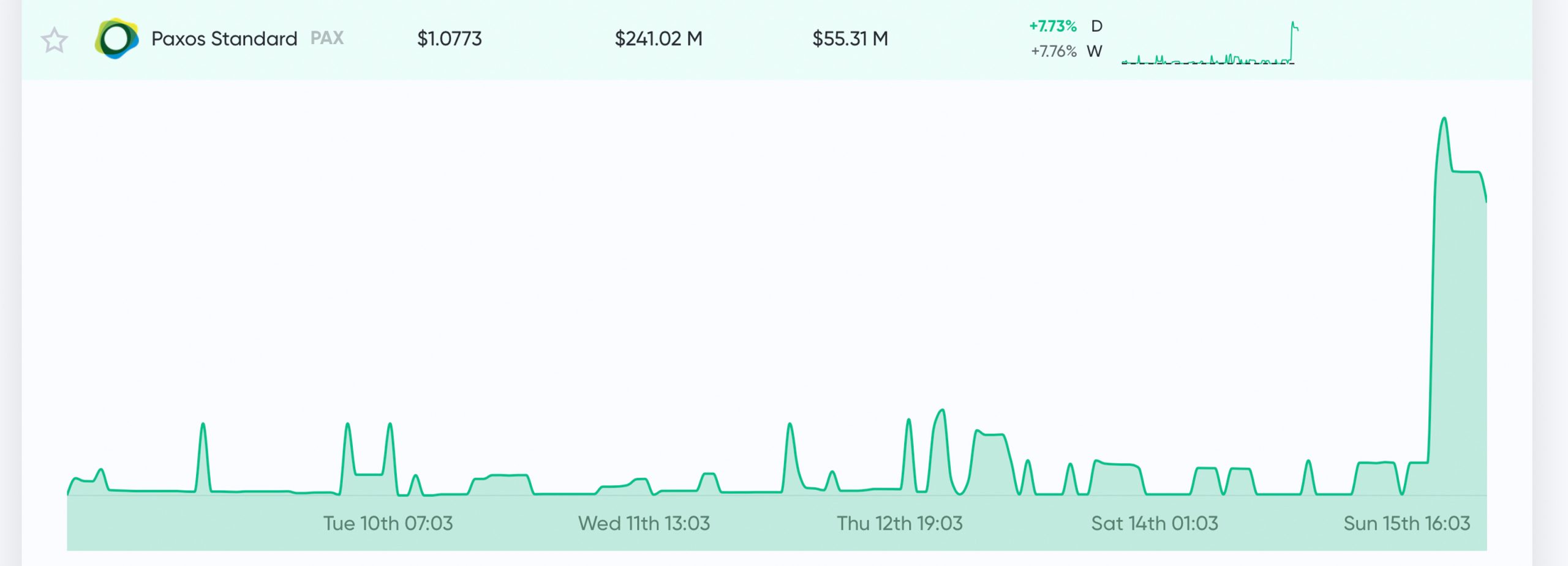

Even though tethers have and still are recording 60-75% of BTC trades throughout the last couple of days, other stablecoins have actually seen development from the crypto rate slump also. Cryptocompare.com statistics reveal that stablecoins like USDC and PAX have actually been leading 5 trading couple with BTC. USDC is recording 4.1% of BTC trades and PAX has around 3% according to cryptocompare.com information.

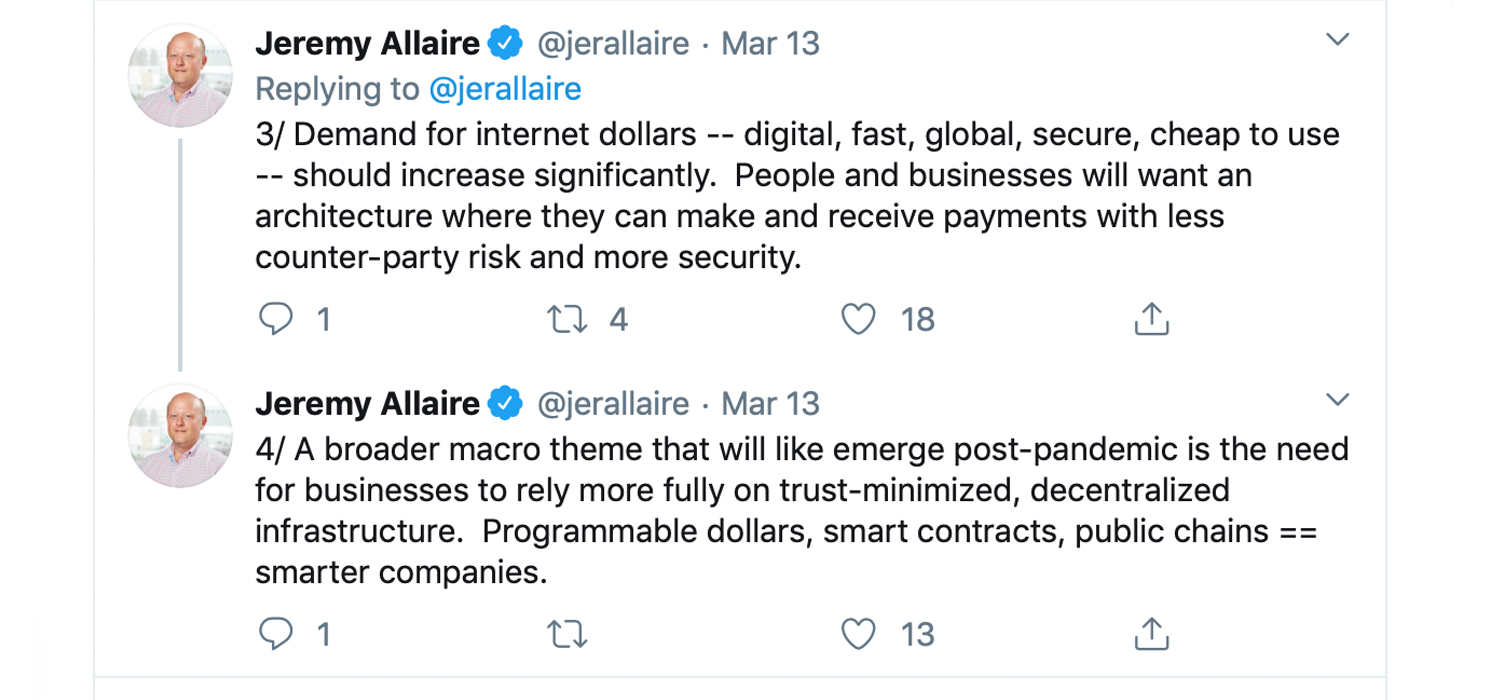

Usually, these stablecoins are not even close to making it into the leading set trading positions with BTC. On March 14, Circle cofounder Jeremy Allaire described how USDC saw development over the last number of days. “USDC rising in market demand over the previous days, reaching brand-new ATH at $568M in blood circulation,” Allaire tweeted. “Fascinating to see ‘flight to security’ within the crypto macro market, however also demand for top quality USD liquidity for markets.” Allaire continued:

While not as amazing to see markets so crushed, it’s still rewarding to see that this totally brand-new, totally digital, blockchain-based financial facilities is working.

Stablecoin Arbitrage and Liquidity

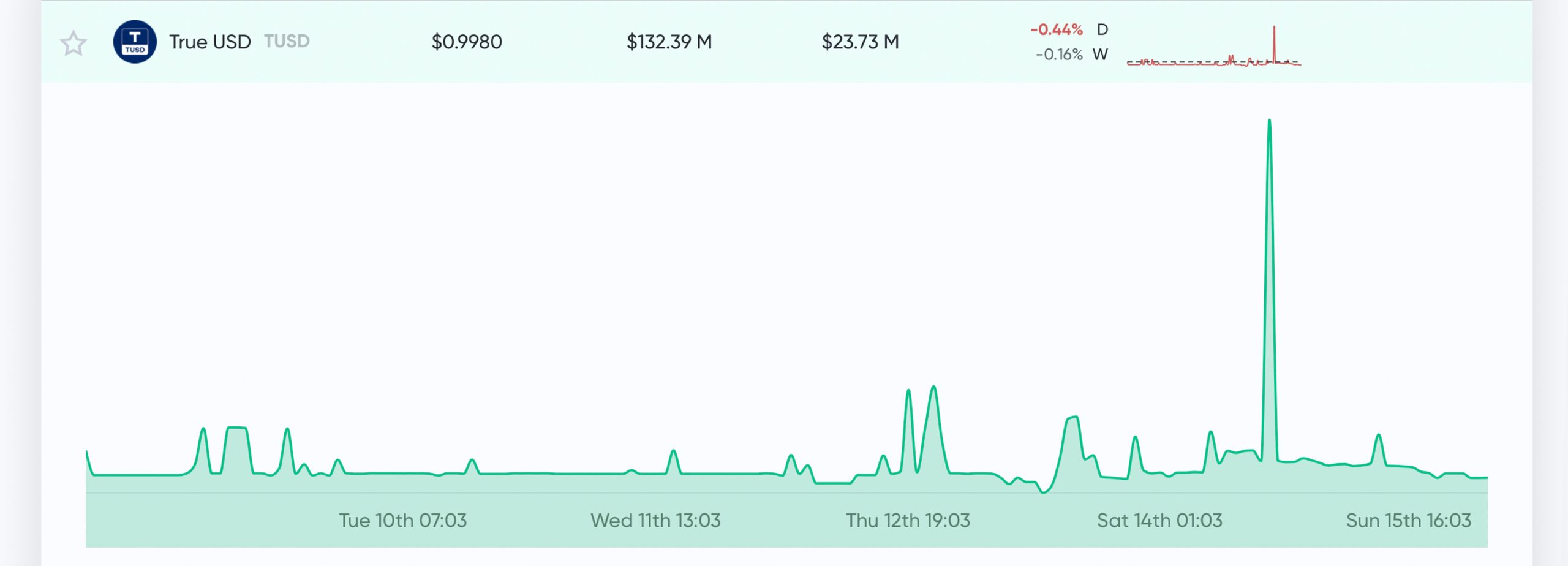

While Allaire talked about the scenario after the rage on March 12, Paxos Global’s authorities Twitter account also tweeted about the numerous stablecoins they use custody for and kept in mind that the combined jobs had a market capitalization of “more than $395 million since March 12, 2020.” The stablecoin TUSD has also seen an uptick in volume and the approximate overall worth of TUSD’s market cap at press time is $132 million.

Paxos is a Trust business, suggesting we are a certified custodian for USD-backed #stablecoins. We power $PAX @PaxosStandard, $HUSD @Stablecoin_HUSD and $BUSD @binance Dollar, with an overall market cap of more than $395 million since March 12, 2020. https://t.co/ZWpJ2LUNkw

— Paxos (@PaxosGlobal) March 12, 2020

News.Bitscoins.internet just recently reported on the event that accompanied the Makerdao defi job after ETH costs dropped more than 40% on Thursday. At that time $4-4.5 million worth of Makerdao’s stablecoin DAI were undercollateralized. However, ever since single security DAI tokens have actually been doing far better and on March 15 they are priced at $1.06 per token.

Even though the majority of the stablecoins are expected to stay valued at one U.S. dollar after March 12, liquidity demand made costs vary for all of the stablecoins around. At times costs have actually been a touch greater and in some cases stablecoin costs have actually been a hair lower than the USD peg. Crypto traders have actually discovered methods to take advantage of the present stablecoin arbitrage, which permits them to offer the tokens for greater revenues utilizing various markets. Traders have actually been utilizing stablecoins for arbitrage for several years and there are numerous post and guides on the topic.

It’s most likely that traders will continue to utilize stablecoins and ‘tether off’ in order to hedge the present storm. On Sunday, March 15, cryptocurrency markets have actually been dull and there sanctuary’t been any big relocations. If coins like BCH, ETH, BTC, and numerous others see better costs and gains quickly then it’s most likely traders will slowly leave their stablecoin hedge. However, if markets fall lower in the future the ‘flight to security’ within the cryptoconomy may be put to the test with considerable tension. If crypto costs drop even more liquidity concerns might make dollarized tokens worth a lot more than the 5-10 cents greater we’re seeing today.

What do you consider the present market demand for stablecoins? Let us understand what you consider this topic in the comments area below.

Image credits: Shutterstock, Markets.Bitscoins.internet, Twitter, Fair Use, Wiki Commons, and Pixabay.

Do you desire to optimize your Bitcoin Mining capacity? Plug your own hardware into the world’s most successful Bitcoin mining swimming pool or begin without having to own hardware through among our competitive Bitcoin cloud mining agreements.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.