Two current flash loans on the defi platform Bzx have actually begun an intense argument about the topic of utilizing uncollateralized loans in a fast trade. Essentially these flash loans are supplying individuals with the capability to obtain crypto without giving up any security. The plan was utilized to make use of funds from the Bzx platform two times, as a private or group collected around $954,000 in a matter of 4 days from well-executed flash loans.

Also Read: Get Ready for the Bitcoin Halving – Here Are 9 Countdown Clocks You Can Monitor

Flash Loans: Attack or Innovative Forms of Defi?

Decentralized financing (defi) flash loans is a hot subject today, after the financing platform Bzx saw $954,000 siphoned from 2 flash loans. The initially one happened on February 14 and then another Bzx ‘attack’ took place on February 18. The technique of execution called a “flash loan” has actually been a controversial topic since individuals wear’t always concur that flash loans are an “attack,” “hack,” or “make use of,” since the plan simply follows the guidelines of the stated agreement and loan system. A variety of Ethereum supporters think flash loans work and open brand-new opportunities of decentralized financing.

discover the flash lending institutions:

👩🏻👩🏼👩🏽👩🏾👩🏿👩🏻👩🏼👩🏽👩🏾👩🏿

👨🏻👨🏼👨🏽👨🏾👨🏿👨🏻👨🏼👨🏽👨🏾👨🏿

👧🏻👧🏼👧🏽👧🏾👧🏿👧🏻👧🏼👧🏽👧🏾👧🏿

👦🏻👦🏼👦🏽👦🏾👦🏿👦🏻👦🏼👦🏽👦🏾👦🏿can’t discover them?

that’s since they live amongst us, appearing like regular individuals. the only genuine distinction is they now have the access to whale-like liquidity.

— stani.eth ’Flash Loans Maximalist’ Kulechov 👻 (@StaniKulechov) February 20, 2020

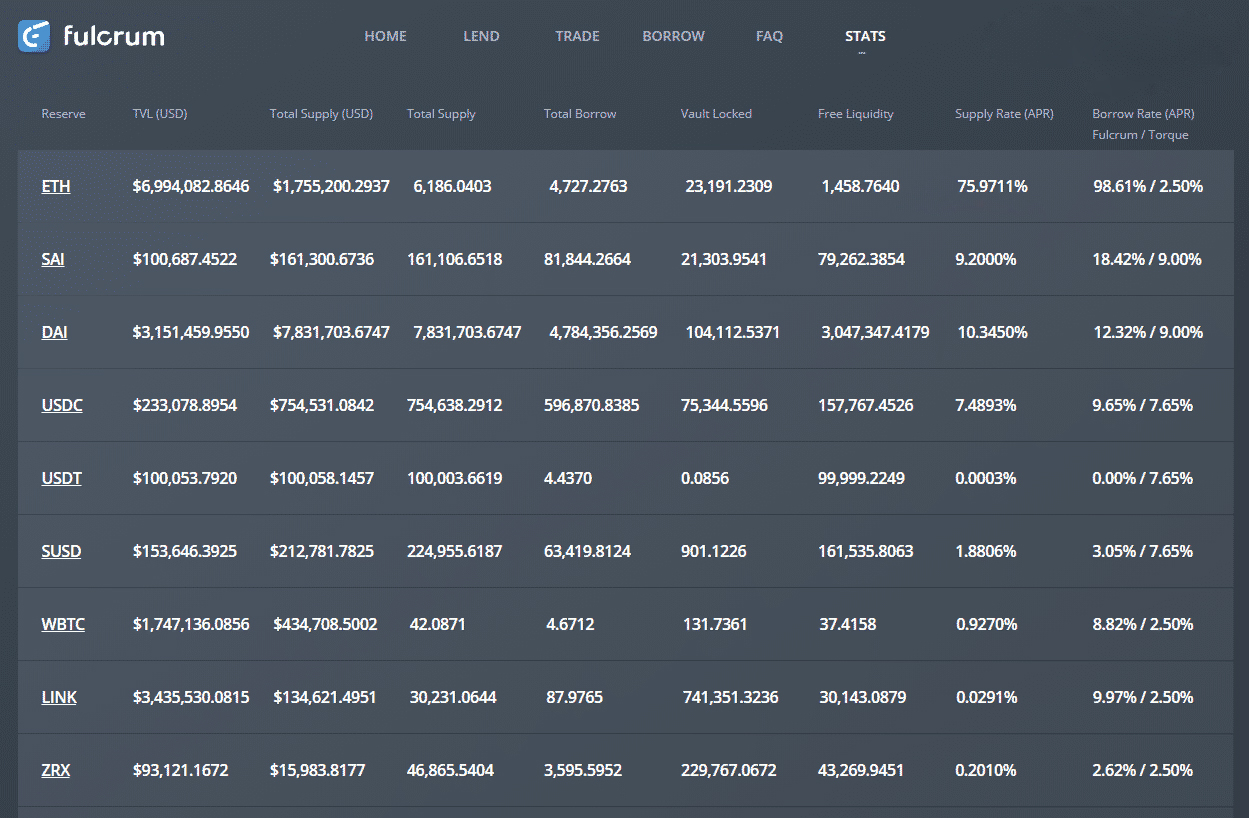

During the very first huge flash loan, the so-called hacker got 10,000 lent ETH from the application Dydx and snagged 112 covered bitcoin (WBTC) from the defi procedure Compound. The specific then sent out around 1,300 ETH to Bzx’s Fulcrum trading platform and then obtained 5,637 ETH through Kyber’s Uniswap for around 51 WBTC. From here, that specific relocation triggered substantial slippage (the distinction in between the anticipated rate of specific trades and the rate of trade execution) within the marketplace. After that, the person earned a profit from the 112 WBTC loan they initially acquired from Compound and generated approximately $318,000 in earnings. This single deal permitted the specific to quickly repay the 10,000 ETH from Dydx.

1/ WHAT We Understand UP UNTIL NOW: There was a 2nd attack. This attack was entirely various from the very first. This time it was an oracle control attack, a customized variation of the initial exploit we worked carefully with @samczsun to repair: https://t.co/lDcyDQf44i

— bZx (@bzxHQ) February 18, 2020

Now as puzzling as all that sounds, generally a flash loan is the capability to take advantage of uncollateralized defi capital in order to make money from a well-executed dex trade. The procedure is done really rapidly and effectively in order to suppress the danger of losing funds throughout execution. The individual carrying out a flash loan can utilize their possessions to drop the rate throughout markets in order to activate defi apps with oracles to cost the wanted area rate. Defi apps like Bzx, Dydx, and Compound utilize rate oracles to identify the rates throughout numerous decentralized exchanges (DEX) like Kyber’s Uniswap.

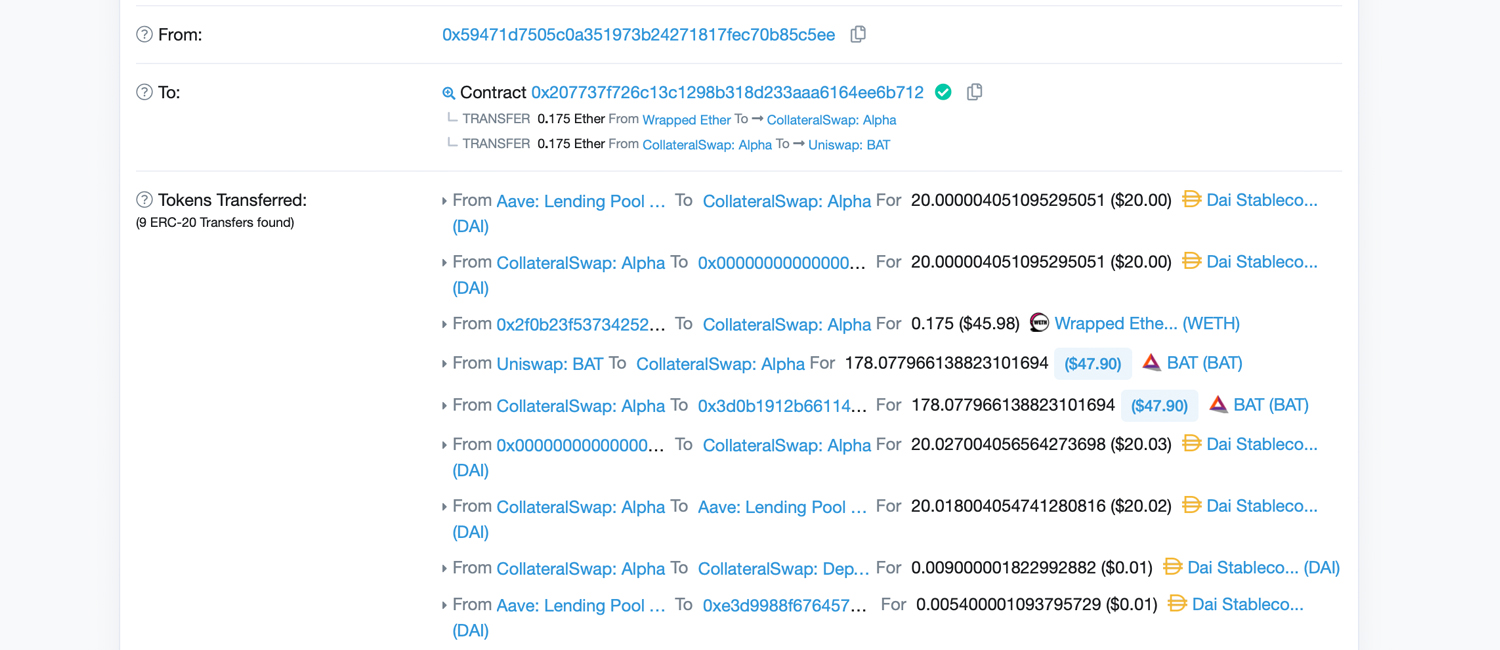

Behind the scenes of a @MakerDAO security swap utilizing @AaveAave Flash Loans, @UniswapExchange and @chainlink oracles 📸 @daveytea @RyanSAdams @econoar @nanexcool @EthereumMemes $LEND $LINK $ETH #Woah pic.twitter.com/NyKo1JHV6x

— Jordan LG 👻 (@JordanLzG) February 20, 2020

The rates info frequently has big inconsistencies throughout exchanges, which enable market abnormalities like slippage and arbitrage. The speed of a flash loan’s execution is so quickly since the loan, trade, settlement, and earnings are performed all at once in a single deal. The person who carried out the very first enormously sized flash loan versus Bzx just obtained funds from the defi platform’s wise agreement with no security and they had the ability to pay the loan back in a single deal.

Flash Loan Demos, Inflation and Deflation, and the Flavors of Flash Loans

Following the 2 huge flash loans that happened on Bzx’s Fulcrum trading platform, the crypto neighborhood continues to dispute the subject on social networks and online forums with fantastic eagerness. There has actually been deep analysis and studies done on the topic of flash loans and individuals disputing about whether the acts are harmful. Moreover, some people have actually revealed the general public how simple it is to perform a flash loan utilizing a defi platform and DEX.

Flash loans are communism. Only abundant ppl are permitted to control markets

— Joseph Delong (@josephdelong) February 18, 2020

On Twitter, Fiona Kobayashi revealed crypto lovers how she performed a little flash loan. In a single deal, Kobayashi got a loan of ETH from the platform Aave without any security. She then exchanged it for BAT tokens on Uniswap and moved the BAT to Makerdao platform as security and withdrew ETH security from Maker. After that, Kobayashi repaid her loan on Aave and utilized Rosco Kalis’ withdraw.cash platform to “revoke the initial vault’s ERC allowances.”

“Not sure why I wound up with an additional $4.70 worth of DAI, it was expected to be a net neutral flash loan,” Kobayashi tweeted.

A couple of individuals believe flash loans can trigger inflation, comparable to how reserve banks lower distributing supply and then they just change rates. “Inflation takes place, however so does deflation too, [the] Fed can decrease distributing supply at any time and raise rate of interest,” a person remarked after the Bzx flash loan. “Flash loan make use of inflation is insane,” another individual tweeted on February 18. The factor individuals think that flash loans might trigger unpredictable inflation and deflation is since when a flash loan is performed, the earnings are being drawn from someplace within the chain of occasions in the single deal. Oracles are quickly being gamed and designers might need to develop originalities to collect proven rate information.

Can somebody flash loan attack ProgPoW?

— eric.eth (@econoar) February 22, 2020

Emilio Frangella from the Aave Protocol composed a blog site post about the topic on February 12 and he stated that flash loans were ingenious. “Flash Loans have actually specifically recorded the attention of the defi crowd and we anticipate other defi procedures to follow our lead and execute their tastes of flash loans also. Like any other foundation of Ethereum composability, flash loans rapidly permitted brand-new innovative concepts to end up being truth,” Frangella composed. The Aave Protocol employee even more included:

Prime examples of this are Arbitragedao (a DAO with the objective to market make arbitrage chances by leveraging the flash loans) and the Maker Vault security swapper (which enables you to switch your security from ETH to BAT in one deal).

What do you think of flash loans in the crypto world? Let us understand what you think of this subject in the comments area below.

Disclaimer: This short article is for informative functions just. It is not a deal or solicitation of a deal to purchase or offer, or a suggestion, recommendation, or sponsorship of any items, services, or business. Neither the business nor the author is accountable, straight or indirectly, for any damage or loss triggered or declared to be brought on by or in connection with using or dependence on any material, products or services pointed out in this short article.

Image credits: Shutterstock, Etherscan, Twitter, Fair Use, Bzx Fulcrum, and Pixabay.

Did you understand you can confirm any unofficial Bitcoin deal with our Bitcoin Block Explorer tool? Simply total a Bitcoin address search to see it on the blockchain. Plus, check out our Bitcoin Charts to see what’s taking place in the market.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.