In the world of Bitcoin financial investment, understanding market cycles is important for acknowledging possible purchasing chances and rate peaks. One longstanding sign in this context is the Puell Multiple. Developed by David Puell, this metric assesses Bitcoin’s appraisal through the lens of miner profits, therefore supplying important insights into whether Bitcoin is underestimated or misestimated in relation to historic patterns.

This post intends to illuminate the Puell Multiple, guide its analysis, and examine the existing readings to notify financiers. For real-time access to this analytical tool, readers are motivated to check out the Puell Multiple chart on Bitcoin Magazine Pro.

Defining the Puell Multiple

The Puell Multiple works as an indication that compares the everyday profits of Bitcoin miners to its long-lasting average. As an essential element of Bitcoin’s financial structure, miners normally liquidate parts of their BTC benefits to fund functional costs such as energy and hardware. Consequently, miner profits plays a critical function in affecting Bitcoin’s rate characteristics.

Calculation of the Puell Multiple

The formula for computing the Puell Multiple is simple:

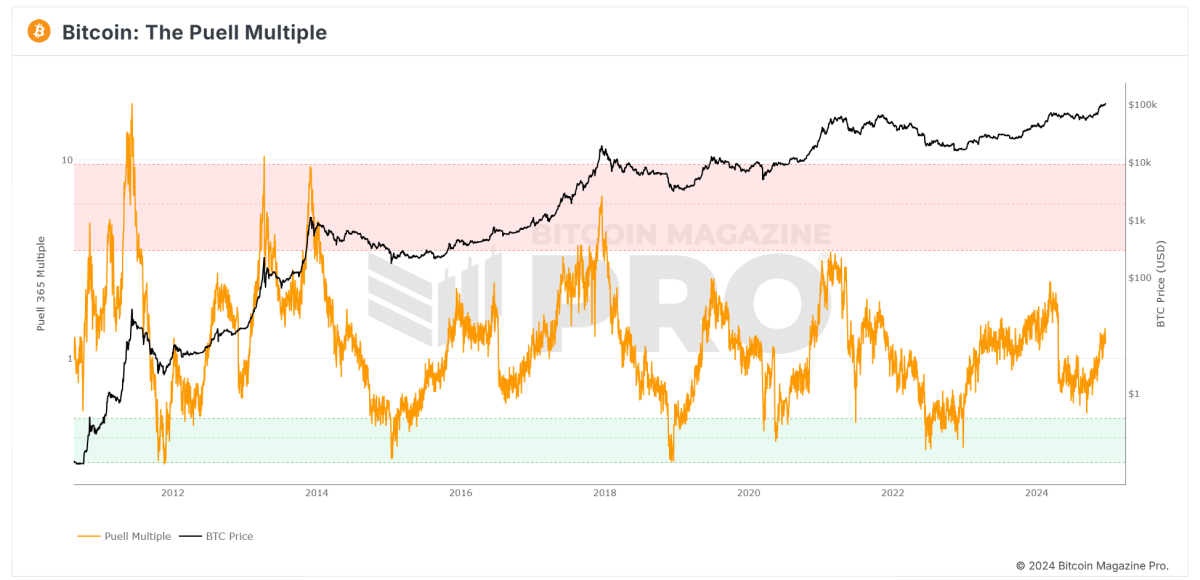

Puell Multiple = Daily Issuance Value of BTC (in USD) ÷ 365-Day Moving Average of Daily Issuance Value

By juxtaposing existing miner earnings versus their yearly average, the Puell Multiple recognizes stages where miner revenues are significantly high or low, showing possible market tops or bottoms.

Interpreting the Puell Multiple Chart

The Puell Multiple chart uses color zones to assist in analysis:

- Red Zone (Overvaluation)

- When the Puell Multiple rises into the red zone (above 3.4), it represents that miner earnings substantially go beyond normal levels.

- Historically, such conditions have actually associated with Bitcoin rate peaks, recommending possible overvaluation.

- Green Zone (Undervaluation)

- When the Puell Multiple comes down into the green zone (below 0.5), it shows that miner earnings are abnormally low.

- These periods have actually typically accompanied Bitcoin market bottoms, providing prime purchasing chances.

- Neutral Zone

- When the Puell Multiple hovers within neutral levels, Bitcoin’s rate typically experiences stability relative to historic criteria.

Current Insights: Decoding the Puell Multiple

An analysis of the existing Puell Multiple chart from Bitcoin Magazine Pro exposes:

- The Puell Multiple (shown by the orange line) is trending upwards yet stays substantially underneath the red overvaluation limit.

- This shows that Bitcoin is not presently in an overheated state, normally observed at rate peaks.

- Simultaneously, the metric stands substantially above the green undervaluation zone, recommending that the market is beyond its bottom stage.

Implications for Investors

Presently, the Puell Multiple reading recommends that Bitcoin lives in a mid-market cycle:

- Bullish Momentum: With constant boosts in the metric, the market seems advancing towards a bullish stage, albeit staying remote from “overheated” conditions.

- No Immediate Peak: The lack of a red zone reading indicates that more upside capacity might exist prior to a considerable correction.

Investors are encouraged to carefully monitor this chart in the upcoming months, particularly as Bitcoin approaches its awaited halving occasion in 2028, which is most likely to more effect miner earnings.

Significance of the Puell Multiple for Bitcoin Investors

The Puell Multiple offers a distinct viewpoint on Bitcoin’s market cycles by fixating the supply side (miner profits), instead of exclusively as needed elements. For long-lasting financiers, this metric can serve numerous essential functions:

- Identifying Buying Opportunities: The green zone signals durations defined by undervaluation.

- Spotting Market Peaks: The red zone has actually traditionally accompanied considerable rate tops.

- Navigating Market Cycles: By incorporating the Puell Multiple with extra signs, financiers can time their market entries and exits with higher tactical accuracy.

Staying Informed with Bitcoin Magazine Pro

For expert financiers and Bitcoin lovers looking for to boost their analytical abilities, resources such as the Puell Multiple chart on Bitcoin Magazine Pro provide vital insights into Bitcoin’s appraisal patterns.

By comprehending the ramifications of the Puell Multiple and its historic context, financiers can make cautious choices and efficiently browse the unique cycles of Bitcoin’s market.

Disclaimer: This post is meant for informative functions just and does not represent monetary guidance. Readers are motivated to perform their own research study prior to making any financial investment choices.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.