The rate changes of Bitcoin frequently catch substantial limelights; nevertheless, a much deeper evaluation exposes that the real story surrounding BTC goes beyond simple market motions. Beyond technical analyses and speculative rates, on-chain data offers a unique insight into the detailed characteristics of supply, need, and financier habits as they unfold in genuine time. By utilizing these insights, traders and financiers can much better anticipate market patterns, display institutional activities, and make notified, data-driven choices.

For a thorough expedition of this subject, one can describe a current YouTube discussion entitled “Mastering Bitcoin On-Chain Data.”

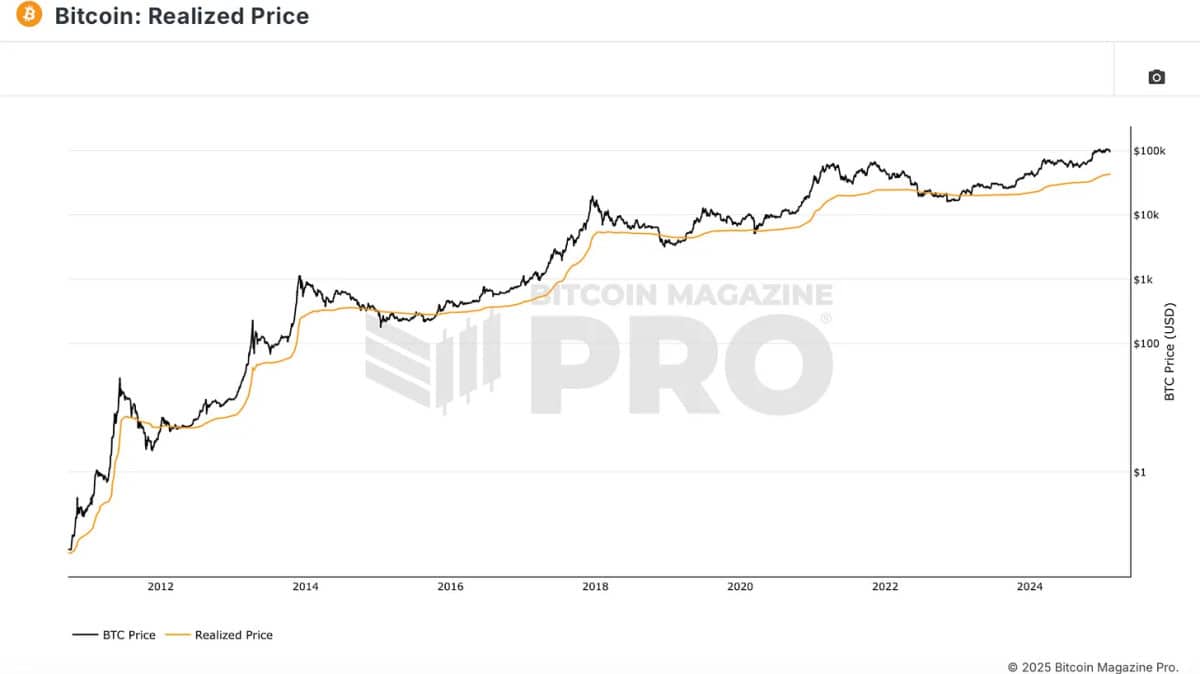

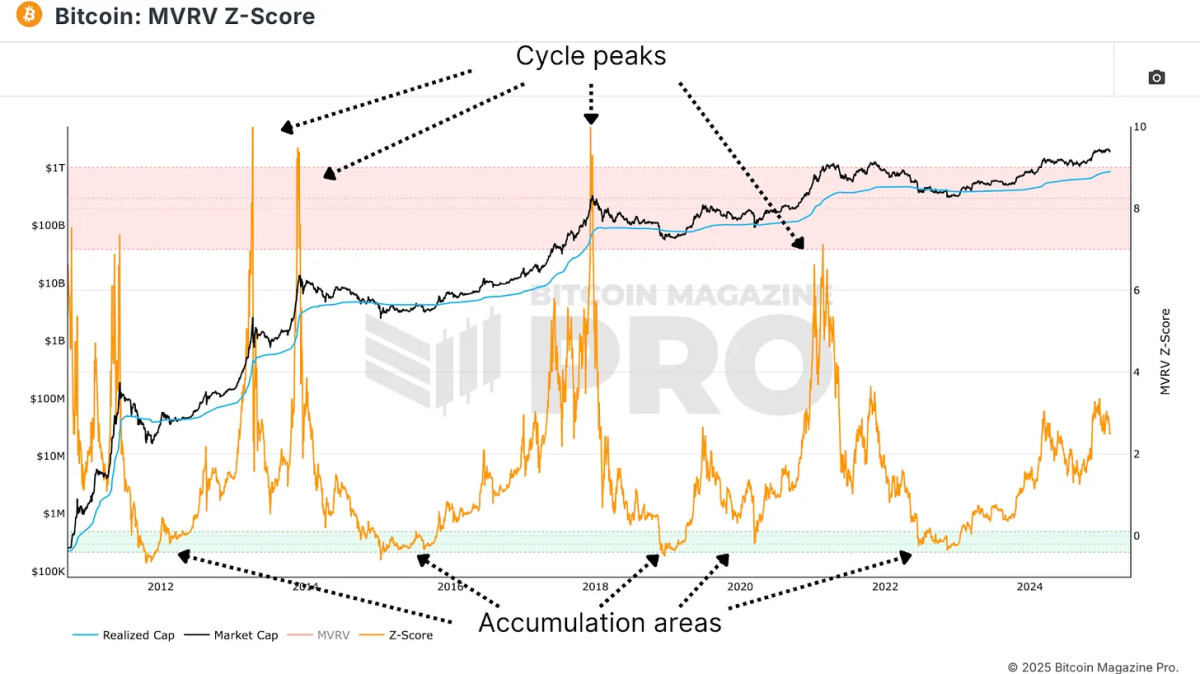

Realized Price & MVRV Z-Score

On-chain data includes the openly available deal records embedded within Bitcoin’s blockchain. Unlike standard monetary markets, where financier actions are frequently obscured, Bitcoin’s openness helps with real-time analysis of deals, wallet motions, and total network activity. This wealth of info allows financiers to recognize significant patterns, build-up zones, and possible rate inflection points.

Among the most essential on-chain metrics is the Realized Price, which suggests the typical expense basis for all Bitcoin in blood circulation. In contrast to traditional properties, where identifying the expense basis for financiers can show difficult, Bitcoin’s architecture offers clearness on the earnings or loss status for the bulk of holders.

View Live Chart 🔍

To enhance the performance of Realized Price, experts make use of the MVRV Z-Score, a metric that assesses the variation in between market price and understood worth, changed for Bitcoin’s intrinsic volatility. Historically, this indication has actually determined ideal purchasing chances when located within the lower variety, in addition to notifies to possible overvaluation when it intrudes upon the red zone.

View Live Chart 🔍

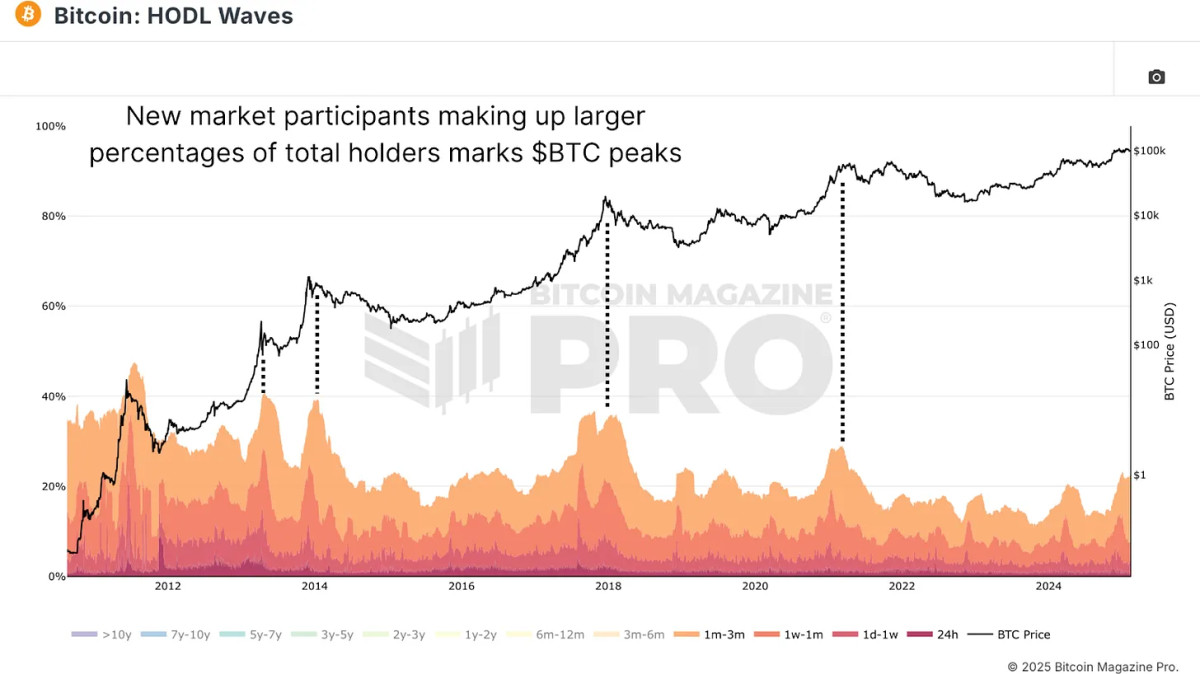

Monitoring Long-Term Holders

Another substantial metric is the 1+ Year HODL Wave, which keeps track of Bitcoin addresses that have actually maintained funds for a minimum of one year. An boost in the HODL wave recommends that financiers are deciding to hold their properties, leading to a decrease of distributing supply and subsequent upward pressure on rates. Conversely, a decrease in this metric might suggest profit-taking habits and possible circulation of properties.

View Live Chart 🔍

The HODL Waves metric visualizes the circulation of Bitcoin ownership classified by holding durations. Filtering this data to consist of brand-new market individuals who have actually held for 3 months or less exposes common retail engagement levels. Peaks amongst short-term holders normally signify market tops, whereas low levels recommend beneficial build-up zones.

View Live Chart 🔍

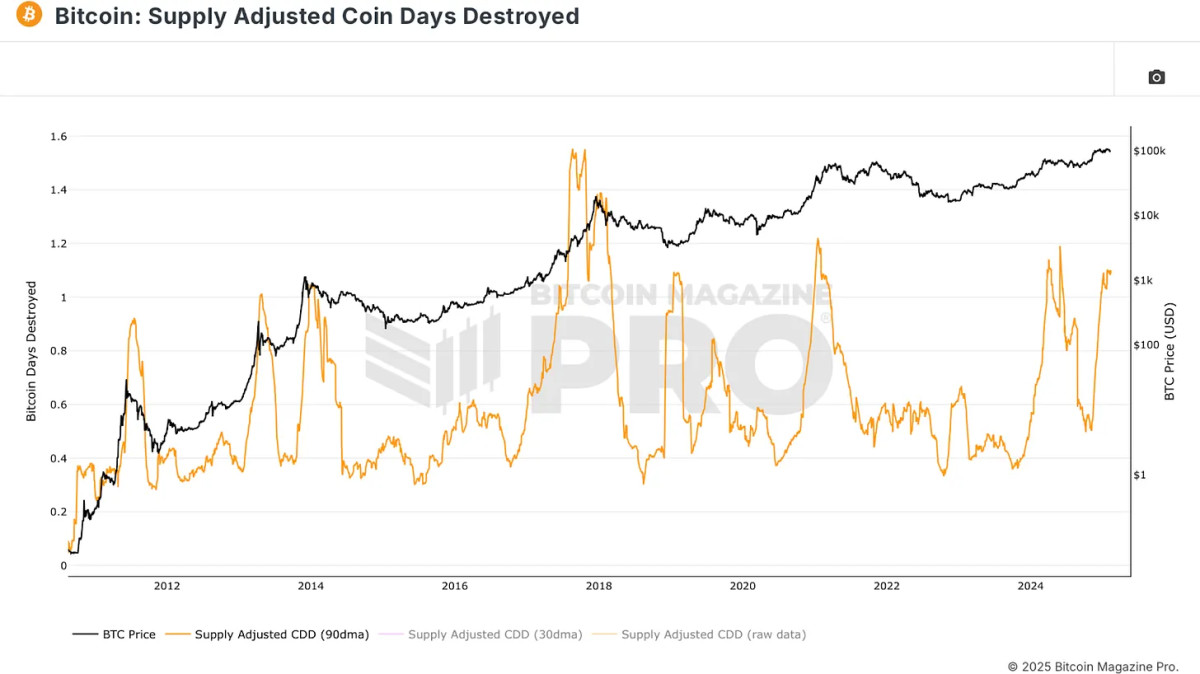

Spotting Whale Movements

The Supply Adjusted Coin Days Destroyed metric quantifies the overall Bitcoin negotiated, weighted by the period each coin has actually been held, while standardizing this data versus the distributing supply at that time. For circumstances:

- 1 BTC held for 100 days → 100 Coin Days Destroyed

- 0.1 BTC held for 1,000 days → 100 Coin Days Destroyed

This specific metric shows important for identifying motions by big holders or institutional entities. Instances of formerly inactive coins moving can symbolize that significant holders are liquidating their positions. Historical patterns suggest that rises in this data associate with substantial market tops and bottoms, highlighting its value in examining market cycles.

View Live Chart 🔍

Realized Gains & Losses

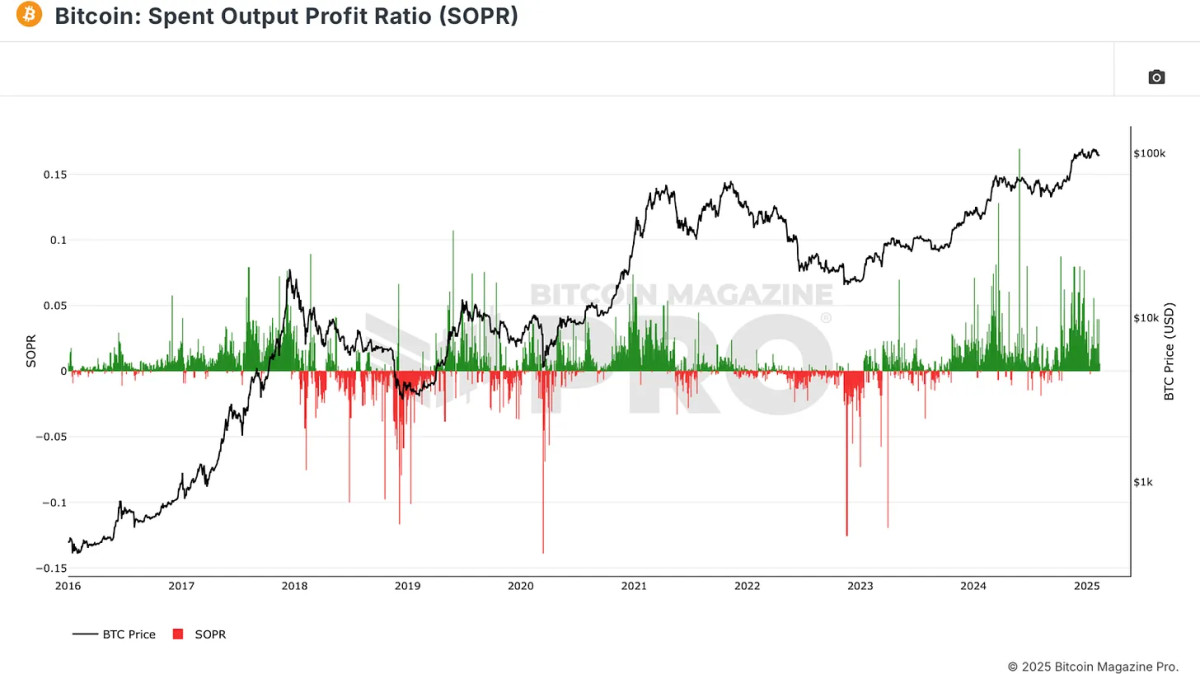

The Spent Output Profit Ratio (SOPR) offers insights into the success of Bitcoin deals. A SOPR worth above 0 suggests that the typical Bitcoin being negotiated remains in earnings, while a worth below 0 recommends that typical sales are happening at a loss. By keeping an eye on spikes in SOPR, traders can recognize durations of abundant profit-taking, while decreases in SOPR regularly accompany capitulation throughout bearish market.

View Live Chart 🔍

Relying entirely on a single metric might cause incorrect conclusions. To boost the possibility of precise market signals, financiers must look for positioning amongst numerous on-chain signs.

For circumstances, when the list below conditions are observable:

- The MVRV Z-score is located within the green zone (showing undervaluation)

- The SOPR shows high understood losses (recommending capitulation)

- The HODL waves show a decrease in short-term holders (showing offering fatigue)

This confluence traditionally indicates ideal build-up zones. Similarly, when thinking about profit-taking from Bitcoin holdings, keeping an eye on for opposing signals from the previously mentioned metrics is suggested to recognize possibly overheated market conditions.

Conclusion

Bitcoin’s on-chain data uses an unrivaled viewpoint on market characteristics, gearing up financiers with a considerable benefit in their decision-making procedures. By tracking supply patterns, comprehending financier psychology, and acknowledging build-up and circulation cycles, Bitcoin lovers can tactically place themselves for continual success in the market.

For even more insights, consisting of live data, charts, and extensive research study, see Bitcoin Magazine Pro to stay educated about Bitcoin’s rate advancements.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.