A just recently released file exposes that the U.S. Securities and Exchange Commission (SEC) has plans to hire professionals to run particular cryptocurrency complete nodes for the federal government firm. According to the SEC documents, the regulator desires third-party professionals to run nodes for Bitcoin Core (BTC), Ripple (XRP) and Ethereum (ETH) in order to display compliance threats.

Running a Full Bitcoin Node for the SEC

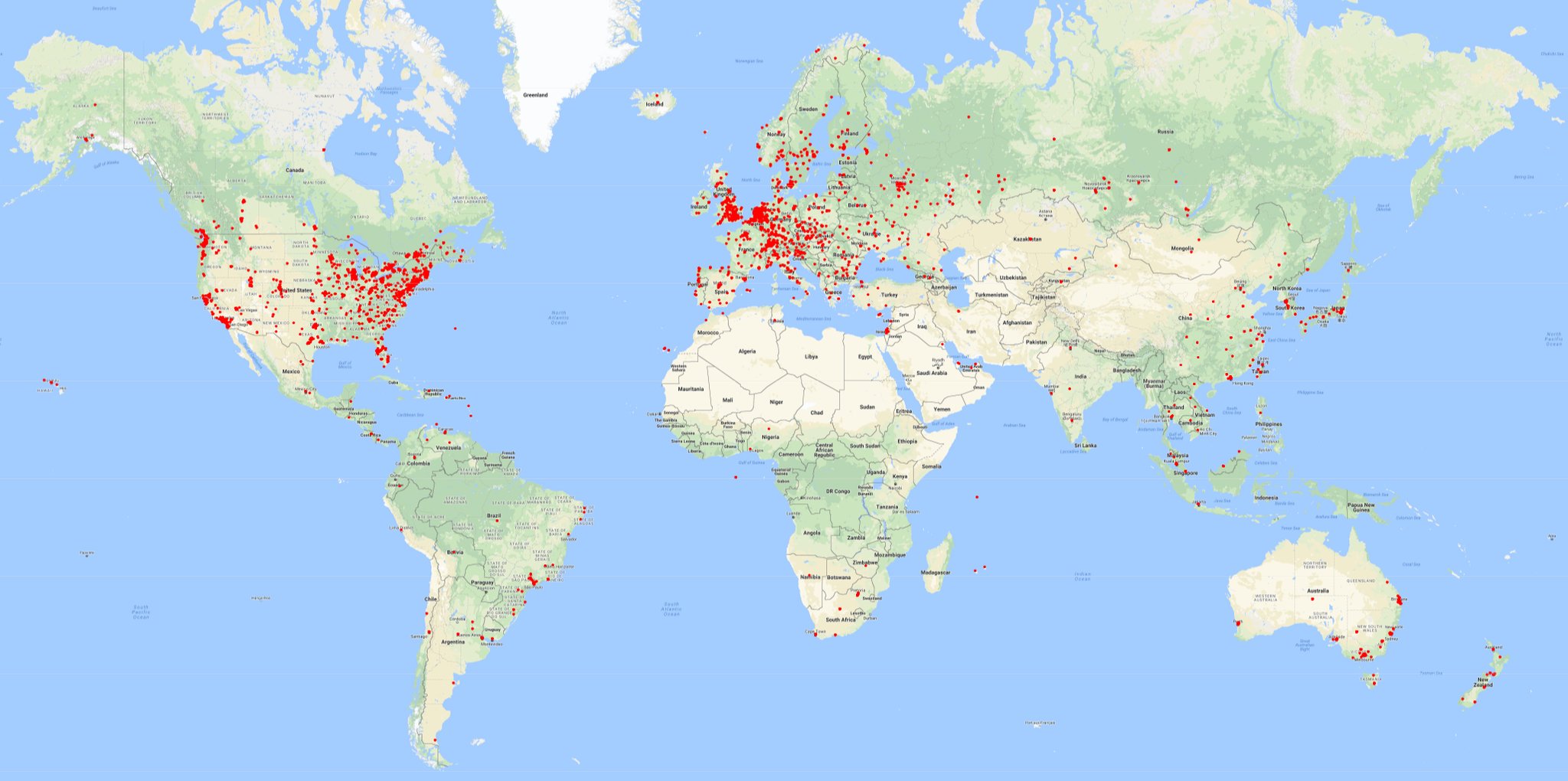

Depending on whom you ask, the news of the SEC getting professionals to run complete cryptocurrency network nodes might be viewed as either favorable or unfavorable. The federal government file was very first identified by Trustnodes news outlet. Despite the reality that there’s a large range of blockchain explorers out there, the firm desires to pay professionals to run nodes for BTC, ETH, and XRP. In the future, the SEC might also agreement others to run nodes for Stellar, Zcash, Bitcoin Cash, EOS, and NEO. The file doesn’t actually describe specifically why the SEC desires to outsource professionals to run these complete node executions, however the notification does highlight that it’s implied “to support its efforts to display threat, enhance compliance, and notify commission policy with regard to digital possessions.”

The SEC also stressed that the “membership will source all blockchain information from hosted nodes, instead of supplying this information as a secondary source (e.g., by means of blockchain explorers).” Node operators can work from another location and utilize the SEC’s electronic email billings and an initial base duration of one year. The agreement can be extended up to 4 years, the firm’s documents discusses. Interested professionals might send a rate quote with a total information plan, dictionary, and sample information file to be evaluated. The SEC “means to acquire a commercially offered off-the-shelf (COTS) enterprise-wide information membership for blockchain journal information,” its documents information. The ad states:

The [SEC] means to award a firm-fixed-price agreement in accordance with FAR Subpart 13.5 in combination with FAR Part 12, Acquisition of Commercial Items, for a commercially offered enterprise-wide information membership for blockchain journal information in accordance with the connected requirements list.

Crypto Community Debates the Meaning and Importance of SEC’s Node Advertisement

Of course, the crypto neighborhood has a lot to state about the U.S. firm desiring to hire professionals to run nodes. “It took them this long?? Welcome to the play ground, kids — Hopefully, they’re not the bullies in the sandpit,” L.A.-based crypto news reporter Omar Bham wrote on Twitter. “Never believed I’d see the day,” Etoro expert Mati Greenspan tweeted. “The SEC is looking for quotes from professionals to run Bitcoin and Ethereum nodes on its behalf — Great, I invite it — These are public blockchains that can be queried by any standard blockchain explorer,” another crypto supporter discussed today, seeing the news as “bullish.”

Coinmetrics creator Nic Carter stated that he didn’t think the headings that state the SEC will be running nodes and, on the other hand, he referred to the ad as contracting out node-running. “You’d never ever see the day since it’s not taking place — They are looking to outsource node-running,” Carter responded to Mati Greenspan’s tweet. “They will never ever run nodes (not according to this timely a minimum of), they are contracting out whatever and simply consuming the information. Your moms and dad tweet is not truthful,” he claims. Carter more tweeted:

‘SEC to run … nodes’ is simply incorrect — It’s like employing mercenaries and declaring it’s your own army. It’s simply not the case. The XRP army is now utilizing the heading to declare the SEC is a recognition — It ain’t real.

ETFs & Nodes

The SEC has actually been really included with the cryptocurrency market as numerous business have actually used to launch bitcoin exchange-traded funds (ETF), however the U.S. regulator has actually not authorized any yet. It formerly rejected the Winklevoss ETF effort and delayed its choice on the Vaneck/Solidx bitcoin ETF proposition in May. The regulator also has problems with Ripple and whether the task’s XRP tokens are thought about securities. However, William Hinman, Director of SEC Division for Corporate Finance, just recently exposed that the firm might send out “no-action” letters to tasks that adhere to its standards and needs. Letters like these assure token companies that the SEC will not look for legal action versus them moving forward unless any disobediences occur.

In addition to the leniency used by no-action letters, the SEC authorized 2 token offerings under Regulation A+ in mid-July for “Props” tokens by the Props Project and “Stacks” tokens by Blockstack PBC. The SEC’s strategy to hire professionals to run complete nodes is a completely various animal and the file appears to address 3rd party blockchain security operations. The regulator desires information like “hashing algorithms, hashing power, mining trouble and benefits, deals amount and size, coin supply and blockchain size.” Additionally, the specialist ought to be able to “show the level of rigor of information cleaning and normalization fulfills requirements of monetary declaration audit screening.” At completion of the ad, the SEC states that the information provider might be approved another blockchain task with sophisticated notification.

What do you consider the U.S. Securities and Exchange Commission getting professionals to run complete cryptocurrency nodes? Do you see this as a favorable advancement or do you see it as a net negative? Let us understand what you consider this topic in the comments area below.

Image credits: Shutterstock, SEC, Wiki Commons, and Pixabay.

Do you require a reputable bitcoin mobile wallet to send out, get, and keep your coins? Download one totally free from us and after that head to our Purchase Bitcoin page where you can rapidly purchase bitcoin with a charge card.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.