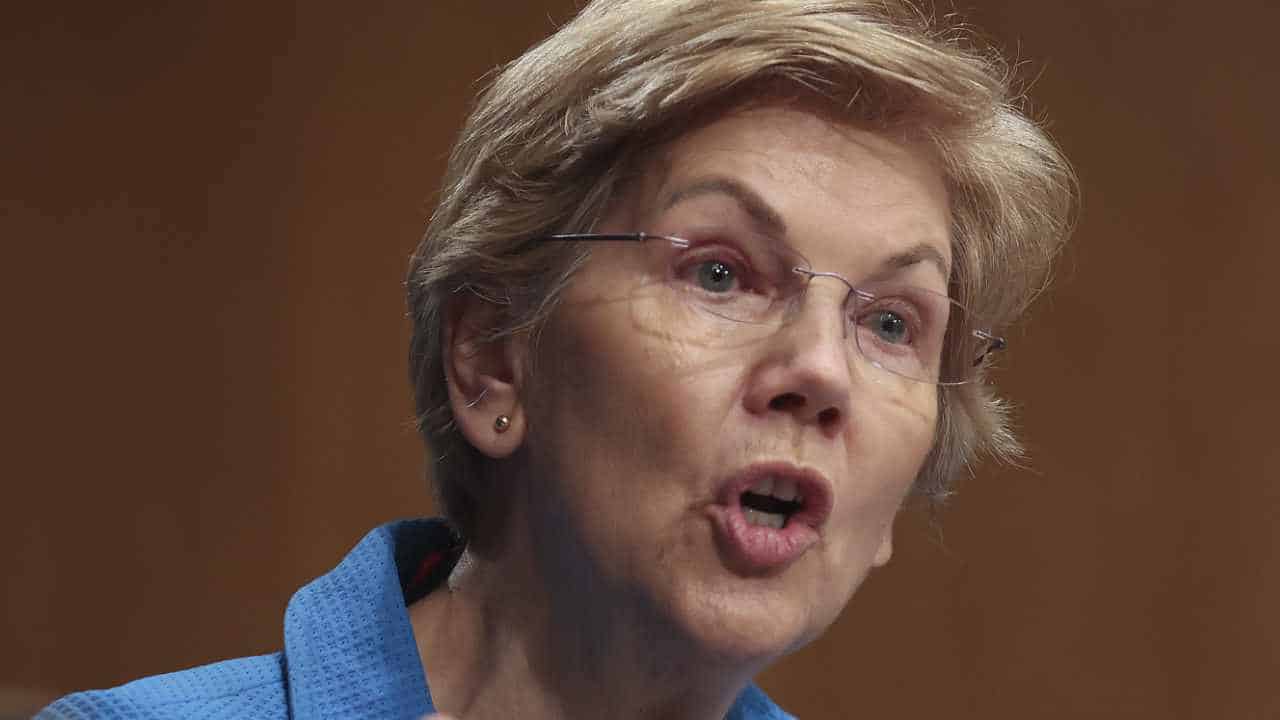

U.S. Senator Elizabeth Warren says that “a lot of crypto firms have actually been able to scam customers and leave normal financiers holding the bag while experts swipe their cash.” She worried the requirement for more powerful guidelines, prompting the Securities and Exchange Commission (SEC) and Congress to act on crypto policy.

U.S. Senator Says Crypto Needs Stronger Regulation

U.S. Senator Elizabeth Warren (D-MA) voiced her issues about cryptocurrency buying an interview with Yahoo Finance Live recently after numerous crypto firms applied for personal bankruptcy defense.

Calling on the U.S. Securities and Exchange Commission (SEC) to act, she highlighted:

Congress requirements to act, however the SEC has an obligation to utilize its authorities to put guardrails in location and punish crypto stars that break the guidelines.

“I’ve been calling the alarm bell on crypto and the requirement for more powerful guidelines to safeguard customers and monetary stability,” the senator included.

Last week, crypto lending institution Celsius Network applied for personal bankruptcy defense after freezing withdrawals. A week prior, another crypto lending institution, Voyager Digital, applied for personal bankruptcy defense. The business pointed out contagion in crypto markets and insolvent crypto hedge fund Three Arrows Capital‘s loan default as the factors.

Warren worried:

Too many crypto firms have actually been able to scam customers and leave normal financiers holding the bag while experts swipe their cash.

SEC Commissioner Hester Peirce revealed issues in May that the securities guard dog has actually faltered on the policy of cryptocurrencies. “We can pursue scams and we can play a more favorable function on the development side, however we have to get to it, we’ve got to get working … I sanctuary’t seen us ready to do that work up until now,” she suggested.

Gary Gensler, the chairman of the SEC, has actually been slammed for taking an enforcement-centric technique to crypto policy. In May, the securities guard dog stated it will nearly double the size of its enforcement department’s crypto system. Last week, Gensler detailed what financiers can anticipate from the SEC on the crypto regulative front.

Senator Warren has actually been pushing Gensler to step up crypto oversight on numerous events. In July in 2015, she cautioned of the growing threats of cryptocurrency trading, contacting the securities regulator to “utilize its complete authority to address these threats.” She also stated decentralized financing (defi) is the most hazardous part of crypto, prompting regulators to secure down on stablecoins and defi platforms “prior to it is far too late.”

In May, she required responses from monetary services company Fidelity Investments concerning the business’s choice to permit bitcoin financial investments in 401K strategies. Fidelity’s move has actually bothered the Labor Department. “We have serious interest in what Fidelity has actually done,” stated Ali Khawar, Acting Assistant Secretary of the Labor Department’s Employee Benefits Security Administration. The senator has also consistently slammed bitcoin’s ecological effect.

What do you consider the comments by U.S. Senator Elizabeth Warren? Let us understand in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.