Bitcoin Magazine

USDT on Lightning: The Good, the Bad, and the Unknown

The saying, frequently credited to a misquote of a Chinese saying, “May you live in interesting times,” is thought about by lots of to be a curse. However, the author provides the concept that there exists an engaging option—a duration marked by stagnancy, as kept in mind in the Anglo-Saxon Chronicle, can also be seen negatively. Notably, Vivian Mercier defined the play Waiting for Godot as “a play in which nothing happens, twice.” An absence of occasions happening over 191 circumstances? The author asserts that he would rather accept the intricacies of “interesting times.”

The present minute certainly shows such intricacy, especially with Tether’s stablecoin, USDT, incorporating into the Lightning Network. The discourse surrounding Lightning as the lingua franca of the Bitcoin economy has actually prevailed, verifying Bitcoin’s function as a circulating medium, a claim that warrants better assessment. This merging unlocks for Bitcoin to engage with a range of innovations, consisting of USDT, anticipated to improve functionality and produce brand-new markets and difficulties formerly unencountered in the Lightning environment.

The author reveals a choice for venturing into the unidentified instead of staying in complacency, recommending that the most interesting advancements lie beyond the familiar landscape.

The combination of USDT into the Lightning Network provides a landscape of uncharted possibilities, triggering crucial examination of the ramifications, chances, threats, and unsolved inquiries.

Taproot Assets 101

Initially, Lightning was visualized entirely to improve the throughput of the Bitcoin blockchain, designating Bitcoin as its particular property. However, the development of Taproot Assets as a brand-new procedure enables the transmission of fungible possessions (e.g., stablecoins) over Lightning by making use of hashed metadata within the existing facilities generally booked for Bitcoin payments.

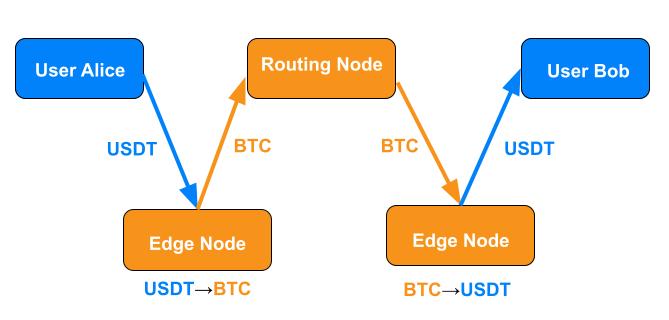

The mechanics are uncomplicated for those acquainted with the Lightning structure. The recipient creates a billing that queries edge nodes for present currency exchange rate in between Bitcoin and the property in concern—USDT in this circumstances. Upon accepting an edge node’s rate, the user develops a billing for the deal and interacts it to the payer. The payer moves the property to the edge node on their side, which consequently transforms it into a requirement Bitcoin payment. This payment traverses through routing nodes throughout the network, and the edge node on the recipient’s side transforms it back into USDT for shipment to the recipient.

Utilizing the special abilities of Lightning, Taproot Assets allows the transfer of numerous kinds of possessions through the network, with Bitcoin working as the universal circulating medium. One beneficial effect of this interoperability is that routing nodes in between the edge nodes just view Bitcoin in transit, streamlining the deal procedure.

Beyond the technical requirements lies the substantial truth that USDT works as a significant circulating medium, with 10s of billions altering hands daily throughout a wide variety of deals. Its trading volumes measure up to those of nationwide currencies such as the Brazilian genuine and the Indian rupee. The combination of Lightning raises essential concerns concerning its effect on USDT and the mutual ramifications for Lightning.

The Good

For Bitcoin

Historically, techniques to include Bitcoin into business practices have actually focused on broadening user adoption—what some describe as “orange pilling”—and cultivating a circular economy. While this method has actually seen considerable development over the last years and a half, it might now be reaching its scalability limitations. To attain more comprehensive adoption, the focus needs to move towards incorporating millions instead of simply people.

With USDT and Bitcoin attaining native interoperability on the Lightning Network, a more extensive environment is developed, promoting diverse user experiences. Each individual in a deal—the payer and the recipient—maintains the versatility to choose in between utilizing Bitcoin or USDT, independent of the other’s option. A client might choose to pay in Bitcoin, while the merchant gets USDT, or vice versa. The interexchangeability of both possessions, now belonging to Lightning, boosts deal fluidity, permitting users to take advantage of the unique advantages of each property without friction.

The combination stands to draw in countless brand-new users and considerable costs power, thus qualitatively improving Bitcoin’s energy. New utilize cases emerging from this combination might yield more beneficial results for Bitcoin than an expansion of private adoption projects, while also stimulating a quantitative rise for the Lightning Network. It is possible that lots of brand-new users might engage with Lightning’s abilities without complete awareness of the underlying innovation, a possibility that skilled professionals within the neighborhood discover especially satisfying.

Furthermore, the intro of USDT might help with gain access to for American users to Lightning, as present tax policies deal with Bitcoin similar to equity, making complex transactional tax ramifications. Allowing users to use a steady property like USDT, which does not set off capital gains, might allow them to take advantage of the advantages of Lightning while preventing particular regulative barriers.

For Tether

Tether has actually traditionally provided USDT on numerous blockchains that have actually shown substantial market sustainability, choosing not to start their own platform. USDT is presently offered on a number of blockchains, consisting of Algorand, Celo, Cosmos, Ethereum, EOS, Liquid Network, Solana, Tezos, Ton, and Tron, the majority of which run under proof-of-stake (PoS) procedures, usually leading to more central structures compared to Bitcoin.

Each blockchain provides its own special compromises; for example, while Ethereum has a particular degree of decentralization for a PoS blockchain, it is besieged by high deal costs. Conversely, Tron uses a more cost-efficient option however is defined by substantial centralization, developing a prospective vulnerability for USDT. By making it possible for deals through the decentralized Lightning Network, Tether reduces its dependence on less steady, central blockchains.

In addition, the Lightning Network might improve the functionality of USDT in the United States market. Certain exchanges have actually enforced limitations on USDT deals marked by blockchain; for example, Coinbase limits USDT deals solely to the Ethereum blockchain (ERC-20). Lightning supplies a decentralized option for significant exchanges such as Binance, Coinbase, and Kraken, allowing them to help with USDT payments better.

The Bad

With the brand-new American administration showing intent to control the whole stablecoin sector, the probability of increased examination surrounding stablecoins such as USDT is increased. As long as stablecoins stay pegged to the United States dollar, entities that wield impact over the dollar might look for to work out control over these digital possessions.

Regulators frequently presume that they can improve liberty through guideline, a concept that might hinder the really liberties they look for to safeguard. Consequently, as USDT’s energy on Lightning broadens, increased regulative oversight appears inescapable. The level of this oversight stays unpredictable, however it guarantees to present friction into the environment.

Particularly inspected might be the edge nodes performing deals. Traditional central exchanges frequently deal with Know Your Customer (KYC) and Anti-Money Laundering (AML) policies in numerous jurisdictions. The activities of edge nodes, which appear to help with the exchange of USDT and Bitcoin, may mirror those of standard exchanges—a circumstance regulators might withstand.

The Unknown

Costs versus Value

Although Lightning uses substantial benefits to users and USDT, it is not always a one-size-fits-all service for each deal including USDT. Users generally anticipate low costs on the Lightning Network, as do those making use of central blockchains. However, presenting a dual-asset design on Lightning requires cautious factor to consider of monetary ramifications for all celebrations included—routing nodes, users, and especially edge nodes.

First, edge nodes are entrusted not just with keeping connection to the network through enough channels and liquidity however also entrusted with property conversion, a service that needs appropriate settlement and includes intrinsic threats (gone over below).

Secondly, the addition of USDT is most likely to considerably magnify deal volumes, engaging Liquidity Service Providers (LSPs) and routing nodes to keep increased liquidity levels to help with these deals. Unlike custodial exchanges, which simply require to change internal balances, the economics of liquidity management stay crucial, albeit more noticable in this context.

Whether Lightning can successfully take on central exchanges like Tron for USDT deals will mainly depend on private strengths and weak points intrinsic to each innovation. Ultimately, market characteristics will determine use, and a stage of rate discovery through trial and mistake is anticipated considered that this innovation was not clearly developed for these particular usage cases.

The Free Call Option Dilemma

An emerging obstacle that edge nodes deal with is the “free-call-option problem,” which needs additional assessment. This danger emerges in situations where 2 possessions are used in a single Lightning payment.

To total Lightning payments within the stated timeframe, a hashed time-locked agreement (HTLC) need to satisfy particular conditions before settlement. When edge nodes send their quotes for a USDT  BTC payment, their quotes are affected by present liquidity positions and market value. However, a user has a window of time in between quote approval and HTLC expiration to settle the deal, throughout which costs can vary. If a user chooses to start payment at a particular rate and hold-ups settlement till the rate shifts positively, the danger of non-completion might fall onto the edge node, who might then deal with prolonged and pricey procedures when trying to recover their possessions.

BTC payment, their quotes are affected by present liquidity positions and market value. However, a user has a window of time in between quote approval and HTLC expiration to settle the deal, throughout which costs can vary. If a user chooses to start payment at a particular rate and hold-ups settlement till the rate shifts positively, the danger of non-completion might fall onto the edge node, who might then deal with prolonged and pricey procedures when trying to recover their possessions.

This situation develops a prospective call alternative for users in asset-diverse deals on Lightning. Traditional financing systems reduce the threats connected to offering call choices through prices changes, which might not be used in the very same method throughout edge nodes in the Lightning Network. Insight from specialists like Kilian and Michael at Boltz has actually highlighted the need of resolving this problem proactively.

Additionally, edge nodes deal with prospective threats if routing nodes stop working to pass on the needed preimage, despite intention or technical breakdown, leaving the edge node accountable. Implementing a track record system for routing nodes might improve dependability; nevertheless, developing a similar system for end users provides substantial difficulties, especially as brand-new individuals continuously sign up with the network.

The problem of complimentary call choices has actually not been an issue for the Lightning Network so far, as it has actually mainly handled Bitcoin as a particular property. Should the ramifications of complimentary choices intensify, one might picture the development of numerous parallel Lightning Networks, segregated by currency—in which case, Bitcoin’s interoperability might be jeopardized. Thus, this warrants consideration about the ramifications of presenting USDT to the Lightning structure.

Navigating Interesting Times

Bitcoin has actually constantly been declared as an advanced force targeted at interfering with stopping working fiat systems. The momentum of modification is intrinsic, with the understanding that improvement frequently causes complex characteristics.

However, the author competes that development represents an invited modification. The combination of USDT into Lightning is viewed as a chance for development, cultivating development for USDT users, the Lightning Network, and Bitcoin itself.

This development requires thoughtful factor to consider, proficient preparation, and timely decision-making. Stepping into uncharted waters needs suitable preparation and asset-specific abilities. Stakeholders participated in Lightning liquidity will deal with noteworthy difficulties together with substantial potential customers for development.

Tether stands to gain from a decentralized circulation network along with enhanced access to the important United States market, while Lightning will experience an increase of liquidity and users. The native interoperability in between Bitcoin and USDT is the driver for enjoyment and optimism.

Nevertheless, watchfulness is called for as regulative attention heightens. Edge nodes will sustain their conversion services just if they stay financially rewarding, demanding a ready action to these characteristics. Thus, it ends up being crucial to browse this improvement with the utmost care, keeping focus on the overarching goal of cultivating a universally incorporated Bitcoin economy.

This is a visitor post by Roy Sheinfeld. The views revealed herein represent his own and do not always show those of BTC Inc. or Bitcoin Magazine.

This post, USDT on Lightning: The Good, the Bad, and the Unknown, initially appeared on Bitcoin Magazine and was authored by Roy Sheinfeld.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.