This is a viewpoint editorial by Daniel Hinton, the head of financing and operations for sFOX, a bitcoin prime broker and custodian, and Steve Jeffress, developer of Bitcoin UTXO set visualizer UTXO.live.

We now understand how to presume the everyday cost of bitcoin within 1% by looking just at the unspent deal output (UTXO) set.

With this, we can develop decentralized applications that count on the UTXO set — instead of on relied on third-party oracles — for the USD cost utilized in discreet log agreements (DLCs) and wise agreements.

The possibilities for decentralized applications on Bitcoin utilizing this “UTXOracle” are massive.

When You Want To Know ‘The’ Price Of Bitcoin, Where Do You Look?

There is no single cost of bitcoin. Every second of the day, there are countless exchanges, brokers, OTC desks, payment business and other market individuals worldwide estimating the cost of bitcoin — and none is constantly right.

In this short article, we will check out a brand-new method of analyzing the Bitcoin UTXO set that properly shows a bitcoin cost at each block height and has the prospective to work as the structure for a brand-new age of trust-minimized, decentralized financing on Bitcoin.

What trust-minimized tools could you develop if you could determine a precise cost for bitcoin at each block height, utilizing just your Bitcoin complete node and an open-source design?

- DLC derivatives (choices, futures, continuous futures)

- On-chain loaning markets

- Peer-to-peer markets

- Bitcoin-backed USD stablecoins on Lightning

- Stable-worth USD accounts denominated in bitcoin

- Any utilize case that needs a USD element

Any among these principles, effectively carried out on the Bitcoin blockchain in a trust-minimized method, might provide significant worth to both Bitcoiners — making use of bitcoin for its remarkable financial residential or commercial properties — and individuals in the Bitcoin environment who require to stay partly connected to USD however wish to make use of Bitcoin as their settlement network.

On-Chain Transactions Encapsulate The Global Signal Of Economic Weight

During the 2016 to 2017 “Blocksize Wars,” the benefits of not just running a fully-validating Bitcoin node, however carrying out financial activity utilizing your node, were convincingly argued in assisting the network prevent a significant fork that might have postponed Bitcoin’s success.

For functions of our existing conversation, it can be stated that this troubled time in Bitcoin’s history stressed that, in the very same method that somebody can run 1 million “full nodes” on a cloud server that signal for a specific “upgrade” however not affect the network of financial stars in any method if they are not actively settling deals, central exchanges can produce volume and cost data that, in truth, do not bring financial weight, and which are not shown in the UTXOs that are settled onto the Bitcoin blockchain.

You can momentarily offer the look of having more bitcoin than you do within a closed system like an exchange, however as long as there is a reliable risk of withdrawal for settlement to the Bitcoin base layer, any mispricing within the closed system will ultimately solve itself back to balance with the external market.

For example, when Mt. Gox was insolvent in 2013 to 2014, however prior to it formally collapsed, the reported cost of bitcoin on the platform was noticeably various from other exchanges due to the truth that Mt. Gox did not have almost as much bitcoin as it declared. As an outcome, it required to attract brand-new users to deposit to the exchange in order to meet withdrawals from existing consumers. Within the Mt. Gox system, the cost might be controlled, however when users tried to arbitrage the cost back to the marketplace, Mt. Gox collapsed.

In contrast, the Bitcoin blockchain is the hardest journal worldwide to corrupt. It represents the whole history of financial settlement activity to have actually happened and is the last arbiter of fact with regard to the status of all bitcoin around.

Transactions that matter are picked the Bitcoin blockchain, not in closed systems. Final settlement is what matters.

UTXOs Are Created And Destroyed Each Time You Move Bitcoin

People have a tough time understanding Bitcoin, because it’s difficult for them to take a physical coin out of their pocket, indicate it, and state, “This is a bitcoin.”

One example I’ve gravitated towards when explaining a particular quantity of bitcoin in an individual’s ownership is envisioning a private expense in a physical wallet. These expenses can represent any quantity and are just great for one usage. So, if you require to invest $3, and just have a $100 expense, you can’t dupe a corner of the expense. You would require to invest the whole $100 expense and get your modification back. In Bitcoin parlance, each of these expenses is a UTXO. Any time you send out bitcoin, you are investing (and ruining) a minimum of one UTXO while all at once developing a minimum of one brand-new one. If you run any variation of the Bitcoin software application, at any moment you can count up all the bitcoin included in existing UTXOs to figure out precisely just how much bitcoin presently exists.

In truth, when utilized together, the Bitcoin blockchain and UTXO set are completely precise in identifying the history and existing state of the Bitcoin network. This never-before-seen ability in a decentralized system assisted the 19 million bitcoin presently around grow to be worth numerous hundred billion dollars.

The Bitcoin software application utilizes systems of bitcoin (satoshis) for its internal accounting. While it might be apparent that 1 bitcoin equates to 1 bitcoin, this also implies that when somebody wishes to “send $100 of bitcoin,” the individuals in this deal require to settle on the cost of bitcoin at the time of the deal to understand just how much bitcoin this represents.

On Average, 15% Of All Bitcoin Transactions Are In Round USD Values

Did you understand that many individuals negotiate bitcoin in round USD quantities? Interestingly, since this is such a typical event, there are clearly-recognizable patterns that exist in the UTXO set that can be utilized to carefully presume the cost of bitcoin at any point in the previous or present (see the chart below).

Imagine that you are purchasing bitcoin at an ATM (or purchasing a present card online). Will you purchase $100 worth or $39.27 worth?

Round USD worths varying from $1 as much as numerous thousand dollars are really typical denominations in the Bitcoin blockchain. In truth, because 2014, there has actually been a growing on-chain footprint of these round-USD-value bitcoin deals which on some days can represent as much as 25% of everyday outputs produced.

The United States has without a doubt the biggest set up base of Bitcoin ATMs worldwide. U.S. Bitcoin ATM operators have actually grown considerably because 2019 and the Bitcoin UTXO set strongly shows this market’s development as more individuals select to hold or a minimum of negotiate in bitcoin over USD.

Also, as seen with customers at sFOX, Bitcoin ATM circulations are made from almost all consumer purchases (putting money into an ATM and getting bitcoin), so the on-chain footprint of this activity combines signals at round USD worths. Other big bitcoin markets, such as present cards, peer-to-peer exchanges, and numerous other, less typical usage cases, also add to this pattern of USD-denominated bitcoin use.

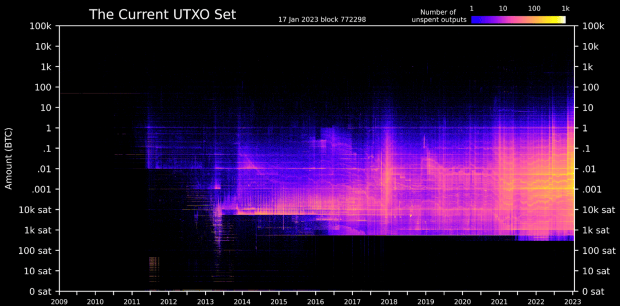

The Bitcoin UTXO Set As Of Block 772,298

There is just one bitcoin UTXO set at any offered block height. This photo portrays the whole, roughly 70 million UTXOs that make up all 19 million bitcoin around, since block 772,298.

With Bitcoin being genuinely permissionless, anybody running a fully-validating Bitcoin node has this precise very same information on their computer system and can individually duplicate this precise very same dataset for this moment. A live variation of this visualization can be seen and connected with at utxo.live.

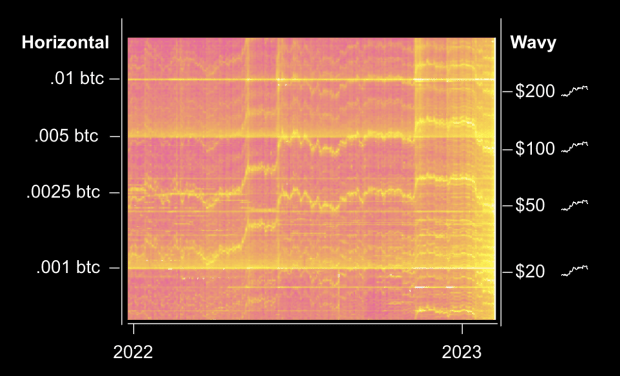

Zooming into the 2022 area of the chart highlights that there correspond patterns in the UTXO set. We’ll concentrate on 2 such patterns: Horizontal lines and wavy lines.

Horizontal lines (the flat lines) represent:

- UTXOs denominated in round worths of bitcoin (e.g., 0.001, 0.005, 0.01, 1, and so on.)

- Flat at any USD cost since sending out 1 btc constantly equates to 1 btc

Wavy lines:

- Represent groupings of UTXOs denominated in round USD worths ($1, $20, $50, $100, $200, $500, $1,000, and so on.)

- Are really wavy, yet parallel to each other since individuals send out in numerous USD denominations and these denominations all relocation in percentage to each other as the BTC/USD cost modifications

- Move inversely to cost. BTC/USD cost boosts trigger the wavy lines to slope down because it takes less BTC to equate to a USD worth as cost go up and the other way around.

Making Sense Of The Lines

The truth that horizontal lines exist isn’t all that outstanding. People negotiating in bitcoin frequently negotiate in round quantities of bitcoin.

But the truth that the wavy lines exist plainly and regularly is a huge offer. It implies that, offered an open-source design, this could assist produce the capability to:

- Independently determine the cost of bitcoin utilizing just your complete node at any block height

- Develop authentic DeFi applications without the requirement for (or without sole dependence upon) relied on third-party cost oracles

The UTXOracle Price Model Has Native Logic Checks

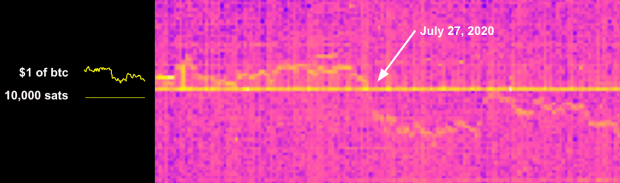

How can you quickly evaluate the hypothesis that the wavy lines represent motion of bitcoin denominated in USD? Simply select a date when you understand the BTC/USD cost crossed a round USD worth and see if the horizontal and wavy lines cross.

One such case is July 27, 2020. Bitcoin was recuperating from the March 2020 chaos and crossed over $10,000 per BTC.

The image below reveals the wavy line (USD) crossing down below the horizontal line (BTC) at the very same time that the cost increased above $10,000 per BTC. This specific image is the 10,000 sat (0.0001 BTC) line, however the very same pattern exists at numerous other BTC denominations as you advance up the UTXO chart.

Still don’t see it? Zoom in and check out a high-resolution image at utxo.live.

Clearly, the wavy lines on the chart program deals denominated in USD.

This has massive implications, because the wavy line pattern exists in differing degrees in every block, and is incredibly constant over rolling durations such as every 144 blocks (approximately 24 hr).

The UTXOracle USD Bitcoin Price Is Quite Accurate

Seeing the horizontal and variable lines cross at round USD worths is good, however a bulk of the time, the lines are not really near to one another. We require a method to prime a rates design from these crossing points that will presume a precise, existing cost at any block height after the design is primed.

Enter the UTXOracle design.

In this initial design, an input date of July 27, 2020, a day when bitcoin increased above $10,000, is utilized to prime the design to a finest suitable for that day’s cost. Using just this single day’s UTXOs, and an input of that single day’s volume-weighted typical cost (VWAP), we have the ability to develop a design that, when utilized with a future date’s UTXO set modifications, presumes the everyday cost of bitcoin with amazing precision from this day forward, making use of just the Bitcoin UTXO set without any referral to any external cost information after July 27, 2020.

The red line is the everyday VWAP from sFOX, an aggregator whose cost includes the filled trades from lots of exchanges and OTC desks.

The blue line is the UTXOracle everyday cost computation based upon every day’s UTXO modifications.

For the measurement duration of July 2020 to January 2023, the design carries out remarkably well, with everyday typical and everyday average differences in between the real VWAP and the UTXOracle cost of 0.65% and 1.04%, respectively, both of which are within the typical variety of charges charged for bitcoin purchases at retail exchanges.

It’s been stated that all designs are incorrect, however some designs work. One crucial distinction in between the UTXOracle design and other designs that output a bitcoin cost is that the UTXOracle design does not look for to forecast a future cost. It simply tries to presume a precise existing cost based upon current blocks and matching modifications in the UTXO set. Given that the existing design has also not been tweaked for a finest fit and just utilizes a single guide date for its input, the design is plainly incorrect — ideally it can be helpful.

The UTXOracle Model Has Trade-Offs

If Bitcoin has actually taught me anything, it’s that compromises exist. The UTXOracle design is no various.

The Bitcoin UTXO set is a gorgeous, living monolith to the human spirit however attempt as we may, any design produced from it will not totally encapsulate the whole of the hidden activity which it represents. A map cannot be as precise as the area it represents.

The UTXOracle design depends on numerous principles to work properly:

- Bitcoin UTXO information (complimentary and widely-available information accessed by running a complete node)

- Bitcoin cost information to recognize a time or series of times upon which to prime the design (based upon complimentary and widely-available information)

- A design to use the guide date(s) usually to any date (there are numerous methods to enhance this)

- A method for users of the UTXOracle output cost to make use of the cost in DeFi applications (this requires substantial effort to establish)

People might develop UTXOs at quantities that would simulate the cost being another level than truth.

On centralized places, individuals have actually been understood to “spoof” big buy or offer orders in an order book to make it appear as though there is a big purchaser or seller in the market, just to later on get rid of these buy/sell orders without really having actually any trades filled. This can really move markets on central places, however you cannot spoof UTXOs. They either exist in a mined block or they do not.

It takes a long period of time to develop a phony cost signal and it’s apparent when somebody attempts to do so.

Currently, it looks as though utilizing an everyday UTXOracle signal, instead of a single block period, attains a cost precise sufficient to utilize in practice. This approach has actually the included advantage of considerably increasing the expense of attack in imitating or censoring deals which would be most helpful in producing the UTXOracle cost at any specific time.

Even if somebody produced numerous UTXOs at levels imitating a various bitcoin cost, there is no system to get rid of the genuine deals that show the precise cost. At best, an enemy would develop an extra set of wavy lines.

UTXOs are costly to phony. There is no such thing as “spam” in the Bitcoin blockchain. There are just deals that pay a charge to be consisted of in a block. This implies that blockchain information is costly to produce or censor and there is a genuine expense of capital in developing UTXOs to phony a cost signal.

Current design precision reduces after about 2 years, as shows up in the chart. In practice, it’s most likely that a design will require to be recalibrated after some amount of time. Changing the design to take into consideration various UTXO patterns brings much less danger than altering agreement guidelines in Bitcoin. Unless individuals are negotiating in multi-year options/futures agreements on chain, this is most likely not a significant barrier to utilize.

The existing design does not handle severe volatility well. Mempool variations and cost volatility develop circumstances where the UTXOracle cost can momentarily differ from the central exchange cost by more than 10%. While this can likely be surpassed with a more thorough design it does highlight a prospective major constraint of the useful usage of the design.

Then there is the AI echo chamber problem: If the design is really effective, it might end up being less efficient. In a world where many individuals are settling financial activity utilizing the cost presumed by a UTXOracle design, there will be numerous extra UTXOs settled in round USD worths. These UTXOs might lessen the design’s precision or misshape it in other methods comparable to how a large-language design (LLM) trained on LLM-generated material will not match the efficiency of one trained on human-generated material.

Using A UTXOracle Model In Practice

Love it or dislike it, you understand the word “Ordinal.” Ordinals taught me that individuals can coalesce around an approach of analyzing the UTXO set that is technically external to Bitcoin, however which can be strengthened at the social layer as an extra procedure on top of Bitcoin.

It is my hope that a sufficiently-accurate UTXOracle design will be produced by somebody which will permit individuals to utilize that variation of the design as a schelling point in structure decentralized applications on Bitcoin.

It is my additional hope that Bitcoiners can establish a technique of utilizing these several contending designs in a trust-minimized method to broaden how Bitcoin has the ability to bring monetary peace to the world.

A effective execution would be one in which:

- Model inputs are openly understood and results are proven

- DLC individuals can object to deceptive results by determining their own cost utilizing the design inputs. (An sophisticated service to this concern stays an unsolved obstacle.)

And one in which any of these security designs is possible:

- Peer to peer: Two or more common individuals can make use of the UTXOracle design without 3rd parties

- Verifiable, central oracle attestations: A centralized oracle indications a message with a specific UTXOracle prices design that the oracle will utilize and individuals have the ability to confirm results and penalize misbehavior

- UTXOracle as a quorum member: Use the UTXOracle cost as a reasoning check in a standard, central oracle design or in a two-of-three or three-of-five multi-oracle setup

UTXOracle Use Cases

DLC Derivatives (Options, Futures, Perpetual Futures)

This would make it possible for users to purchase or offer agreements in an open market where results are administered by individuals utilizing a UTXOracle cost.

For example: Alice deposits a quantity of bitcoin to a DLC-governed address. Bob pays Alice a quantity of bitcoin denominated in USD (as evidenced by the UTXOracle cost). At the time of settlement, Alice or Bob might produce a signature from an oracle attesting to the cost computed under the UTXOracle design to figure out the settlement circulation of funds as ended or worked out.

On-Chain Lending Markets

Users can obtain or provide in an open market where the loan life process is administered by individuals utilizing a UTXOracle cost.

For example: I have 1 BTC (at a $100,000 worth) and wish to take a partial loan of $30,000 without offering my bitcoin. I can collaborate with a market-maker to transfer my 1 BTC and the marketplace maker’s 0.3 BTC (at a worth of $30,000) to an address governed by a DLC. Upon financing, I might invest the 0.3 BTC for my wanted usage case.

Normal Loan Repayment

In this usage case, the customer has the alternative to sign a deal giving the marketplace maker $30,000 in worth of the initial 1 BTC or to transfer $30,000 in worth (as evidenced by the UTXOracle cost) and withdraw the initial 1 BTC.

Upon liquidation, if the worth of the 1 BTC in the DLC-governed address is up to someplace near $30,000 (as evidenced by the UTXOracle cost), the marketplace maker can purge the whole 1 BTC to liquidate the loan and recover their principal.

StableSats

The UTXOracle design also uses an intriguing usage case around “stablesats,” describing bitcoin-backed USD stablecoins or stable-value USD accounts denominated in bitcoin on Lightning.

For circumstances, envision that you wish to hold $1,000 worth of bitcoin for the next month. You do not wish to or cannot hold the $1,000 in money, at a bank, in Ethereum- or Tron-based stablecoins or on an exchange. You might participate in an arrangement with a market maker on the Lightning Network to stream the everyday net cost modification in worth to you. You would have the ability to individually confirm that the right quantities are being paid by utilizing the UTXOracle design you consented to. At completion of the month you will have a various quantity of bitcoin in your Lightning channel, however it will deserve $1,000.

Peer-To-Peer Marketplaces

As a seller in an online market, it’s presently hard to cost products in bitcoin due to the volatility along with the truth that your expenditures are most likely in USD. But accepting payments in USD implies accepting chargeback danger, scams and the charges and intricacy fundamental in modern-day payment systems. Pricing items in USD, however having the versatility to accept a USD worth in bitcoin through the UTXOracle design, might motivate more bitcoin-denominated commerce.

The Next Steps For UTXOracle

As described in this short article, I think the UTXOracle design might be an effective tool beforehand Bitcoin utilize cases and extending monetary flexibility to more of the world. While it has compromises, I think it represents an amazing frontier that can surpass existing services that need more rely on 3rd parties.

If you are delighted about the possibility of UTXOracle, I motivate you to sign up with the conversation on Telegram and Twitter.

This is a visitor post by Daniel Hinton and Steve Jeffress. Opinions revealed are completely their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.