Does the world require more stablecoins? Yes according to VCs, who have tossed numerous countless dollars at tasks establishing steady or low volatility digital possessions. The $45 million dedicated in 2019 takes the previous 2 years of VC financial investment to over $200M.

A Stable Full of Stablecoins

Stablecoin tasks require equity capital companies, simply as VCs require crypto tasks that have a high opportunity of acquiring mass adoption – and stablecoins appear a more secure bet than altcoins. Given that the nature of fiat-pegged digital possessions prevents the possibility of cost gratitude, a public token sale is off-limits. Instead, equity capital from crypto-focused financial investment companies, which frequently look for equity, is the favored path to stablecoin financing. The following are simply a few of the steady or “stable-ish” digital currencies to have emerged this year through VC financing.

Saga

Saga (SGA) is a digital token created to act as a basic function worldwide currency. It’s backed by a basket of financial reserves, which it will slowly gravitate far from through a financial design that will restrict the flowing supply. Saga’s designers intend to develop a low volatility coin with “reputable worth,” governance, and compliance constructed in. The job, which is releasing this month, raised $30M in 2018 with support from Lightspeed, Mangrove Capital Partners, and Vertex Ventures.

Terra

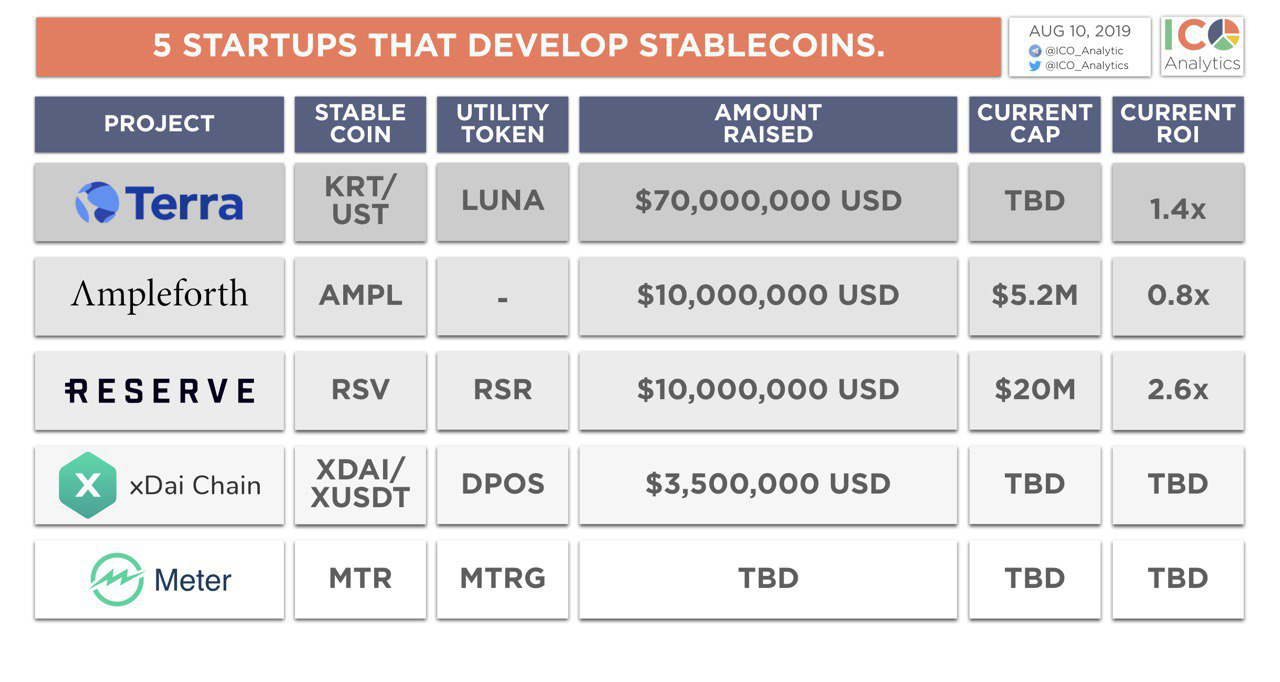

Stablecoin job Terra raised $32M in 2018 with seed financing from the financial investment department of 4 of the 6 biggest cryptocurrency exchanges consisting of Binance Labs, Okex, and Huobi Capital. Terra is dealing with a stablecoin and blockchain payment service which it’s incorporating into the Terra Alliance, a Libra-like consortium of worldwide ecommerce partners.

Ava Labs

Ava Labs, which left stealth mode in May this year, has actually raised $6 million in seed. Although not a stablecoin, its DLT payment network is created for quick possession settlement, consisting of stablecoins, and fiat redeemable possessions. Ava bridges personal and public blockchains and allows adjustable markets to be developed for releasing and exchanging possessions in a certified way. The job is the creation of crypto scholastic Emin Gün Sirer. The Ava Labs CEO, who has Turkish heritage, required to Twitter on December 4 to highlight another brand-new stablecoin – Bilira, a digital token pegged to the Turkish lira.

Ampleforth

Not a stablecoin and yet not a pure cryptocurrency, Ampleforth is created to have low volatility, attained through broadening and restricting the supply to manage cost. The job raised $9.8M in seed financing prior to holding an IEO in May and listing on Bitfinex.

Monerium

Blockchain-based e-money job Monerium raised $2 million this year, with involvement from Consensys and Hof Holdings. The Icelandic start-up means to release asset-backed e-money that’s moved onchain, and redeemable for fiat.

Paxos Standard

The Paxos Standard (PAX) stablecoin was established with the help of $65M in Series B financing from the similarity RRE Ventures, Liberty City Ventures, and Jay Jordan in 2018. This followed a previous Series A round of $28 million.

USDC

Circle raised $100 million in spring 2018, with a tranche of this financing going towards developing and providing its USDC stablecoin. The stablecoin has actually given that been contributed to lots of exchanges, wallets, and loaning platforms, discovering a location for itself in the cryptosphere, regardless of stopping working to land a punch on Tether, which still controls the stablecoin market. In March, Circle exposed that it was wishing to raise another $250M in financing.

Other stablecoin raises of note consist of xDai, which protected $500,000 in August from NGC Ventures, B-Tech, and Bixin Invest. Earlier this year, Kava Labs also protected $1.5 million for its USDX stablecoin, with financing from Ripple’s Xpring effort and Coil.

$200 Million and Counting

VCs have invested over $205 million in stablecoin tasks in the last 2 years, with $45 countless that overall arriving this year. While more cash was raised by stablecoins in 2015, the rate of brand-new tasks hasn’t reduced. Many of this year’s brand-new stablecoins have been provided by exchanges themselves, anticipating the requirement for VC financing. Moreover, the $205M figure doesn’t consist of the VC cash that’s being put into Facebook’s Project Libra: in April, it was reported that $1 billion was being looked for.

With brand-new steady and “stable-ish” coins set to introduce, Libra in the works, and 69% of reserve banks dealing with CBDCs, the phase is set for an approaching worldwide currency war. Instead of pitting fiat currencies versus the U.S. dollar, it will see digital tokens – some asset-backed, others collateralized, and others algorithmically managed – complete for supremacy. Their certified and regulated nature, nevertheless, indicates that whatever occurs, they will not can supplanting bitcoin.

Do you believe any of the upcoming stablecoins has an opportunity of taking on Tether? Let us understand in the comments area below.

Did you understand you can validate any unofficial Bitcoin deal with our Bitcoin Block Explorer tool? Simply total a Bitcoin address search to see it on the blockchain. Plus, see our Bitcoin Charts to see what’s taking place in the market.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.