Bitcoin’s “most professional mining pool” has become its most controversial.

Following months of debate over how to scale bitcoin’s transaction capacity, the conversation has become newly contentious as progress on much-hyped solutions continue to face the kinds of delays that perhaps should be expected when working with novel technologies.

This lack of progress (real or perceived) has so far most affected bitcoin’s business community, many of which are dependent on technical improvements in the network for additional growth. Indeed, while bitcoin’s primary development group has its share of detractors, the majority of startups and service providers continue to support Bitcoin Core and its work.

But if one, relatively new bitcoin mining pool has its way, a much anticipated scaling solution could be dead on arrival.

In recent weeks, China’s ViaBTC became one of the first providers of mining software to switch its client from the official version provided by Bitcoin Core to an option provided by Bitcoin Unlimited, a rival development group that supports alternative methods of scaling that is focused on creating a more variable bitcoin block size.

But unlike Bitcoin Core, Bitcoin Unlimited does not have support for that developer group’s signature scaling solution, Segregated Witness, a planned technical fix that would effectively make bitcoin’s block size about 1.8 times larger than it is today by changing how information is counted toward this total.

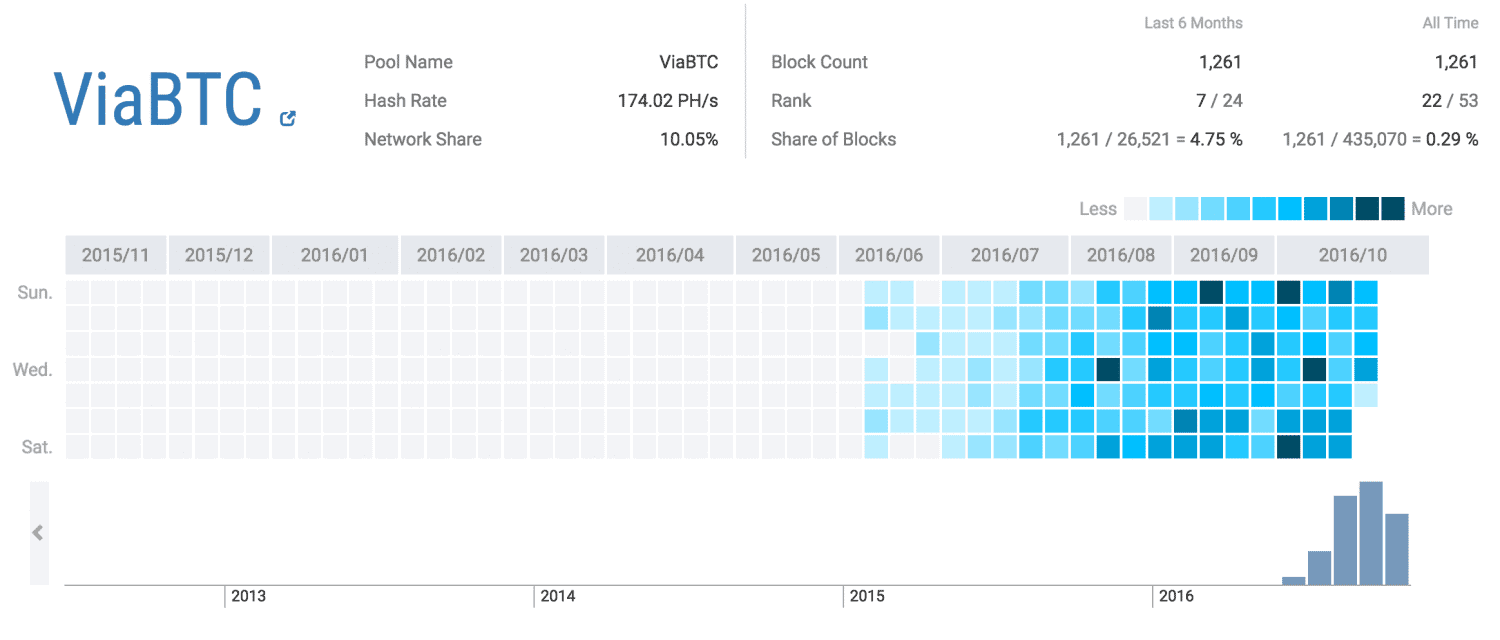

Further, because the rules for Segregated Witness require 95% of bitcoin’s hashing power to approve the transition, ViaBTC could effectively block its wider release. According to blockchain.info, over the past 24 hours, ViaBTC has accounted for 7.3% of the blocks discovered, though this has been as high as 9.6% in recent days.

Complicating matters is that despite a consensus of developers suggesting Segregated Witness is the best way to scale bitcoin, ViaBTC remains unconvinced.

In a blog post issued last week, ViaBTC criticized the proposal, suggesting that it would “fundamentally alter” the structure of bitcoin transactions.

In interview with CoinDesk, Haipo Yang, the founder and CEO of ViaBTC, said that there was nothing that would change his mind about continuing to support multiple developer groups.

He said:

“I believe bitcoin needs more development teams and I’ve decided to support Bitcoin Unlimited.”

Big vs small

First discussed in September 2015, Bitcoin Unlimited is a proposal whereby every individual node operator and miner would be able to choose a block size that they prefer rather than having to stick to the 1MB limit enforced by bitcoin’s consensus rules. As a result, the argument goes, a kind of block size market will emerge that meets the demands of the network at that time.

The argument set forth by Bitcoin Unlimited is that blocks are beginning to fill up, making it slower for people’s transactions to process. In turn, the argument is that fees are rising as well, which is stifling bitcoin adoption and prohibiting user growth.

Changing the bitcoin block size, though, does requires a hard fork, which Bitcoin Core has been resistant to do. Complicating matters is that in a hard fork, two blockchains with different rule sets are created, with bitcoin miners and node operators choosing their preferred option.

If a node does not upgrade to the new software, they are cut off from the network until they upgrade, and if allowed to continue, this new blockchain could even develop into its own self-sustaining network.

Segregated Witness, by contrast, requires only a soft fork, meaning nodes are still a part of bitcoin even if they don’t upgrade. They just won’t be able to broadcast SegWit transactions.

Bitcoin Core has also taken the approach that bitcoin is simply a settlement layer, and that most of the small transactions should take place on top-layer platforms, such as the in-development Lightning Network.

The Bitcoin Unlimited community, including ViaBTC, disagree with this.

“Bitcoin is first and foremost a digital currency; its settlement capabilities are secondary to its monetary properties. When bitcoin loses its monetary attributes it thereby loses all utility as a settlement network,” ViaBTC wrote in its blog post.

And with more than 7% of the total network hashrate, the mining pool can have a significant say in the direction bitcoin goes. Yang also believes that more hashrate will ultimately side with Bitcoin Unlimited.

He said:

“As far as I can tell, Bitcoin Unlimited is gaining more and more support, or at least interest, including from several large pools. I believe Bitcoin Unlimited will probably succeed.”

Origins of ViaBTC

The story doesn’t quite stop there, however.

As mentioned earlier, ViaBTC is a relatively unknown mining pool, and at nearly 10% of the network, it commands a lot of power for a mining pool that only launched last June.

However, Yang’s explanation is that the quality of his team’s software is simply a cut above what is offered by the market.

He said:

“It is the fastest pool for finding and broadcasting blocks. Since [the] beginning we have had zero orphan blocks.”

As for how he’s able to achieve the feat, Yang said he used to work for Chinese Internet giant Tencent and that he did work for Zeusminer maintaining a large litecoin mining farm. Other members of the company are current Tencent employees, he added.

Yang also argued that, due to the pool’s unique payment method, the bitcoin transaction fees are distributed in a more equitable nature, thus allowing miners to generate more profit.

Despite all of its innovation, however, it remains largely unprecedented for a new mining pool to launch with approximately 100PH of hashing power, and other miners have called attention to the strange traction the pool has seen.

In a tweet, BTCC’s Samson Mow asserted that ViaBTC is backed by Chinese mining giant Bitcoin.

“It’s well known in China that ViaBTC’s backer is Bitmain. Mining pools with substantial hashrate don’t just appear out of thin air,” he said.

Bitmain is the creator of the well-known Antminer mining hardware as well as the operator of both Antpool and BTC.com mining pool.

Jihan Wu, co-founder of Bitmain, has argued in the past that small blocks are dangerous to bitcoin, and he appeared at a protest event earlier this month that saw talks on alternative scaling solutions, including Bitcoin Unlimited.

When asked about Wu’s involvement, Yang offered no comment, though he did hint that some relationship between the two firms might be disclosed.

Room for compromise

As for what to make of the developments, it remains clear that the road to a bitcoin scaling solution isn’t yet cut and dry.

Eric Lombrozo, a Bitcoin Core developer and CEO of Ciphrex, expressed disappointment in how the scaling debate has become so politicized.

He explained that the launch of SegWit is in the economic best interest of miners because it will enable greater transaction throughput, allowing bitcoin to remain competitive in a market that increasingly offers a diverse array of blockchain solutions.

But, time will tell whether ViaBTC will follow the pack should SegWit see broad adoption. For example, as the interview went on, Yang’s stance on the issue softened.

When asked whether ViaBTC would be willing to compromise if Bitcoin Unlimited did not gain further hashrate, he offered an opportunity for conversation.

He said:

“If we do remain at a standstill, I think both sides should sit down and open friendly discussions to find compromise or make concessions, so that bitcoin can keep moving forward.”

Tarot card image via Shutterstock

Bitcoin CoreBitcoin ProtocolMiningScalingSegregated Witness

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.