In a current filing with the Securities and Exchange Commission (SEC), Wells Fargo, among the largest banks in the United States, revealed its direct exposure to spot Bitcoin Exchange-Traded Funds (ETFs).

SIMPLY IN: 🇺🇸 Wells Fargo bank exposes it has spot #Bitcoin ETF direct exposure in brand-new SEC filing 👀 pic.twitter.com/H1iY9puKVb

— Bitcoin Magazine (@BitcoinMagazine) May 10, 2024

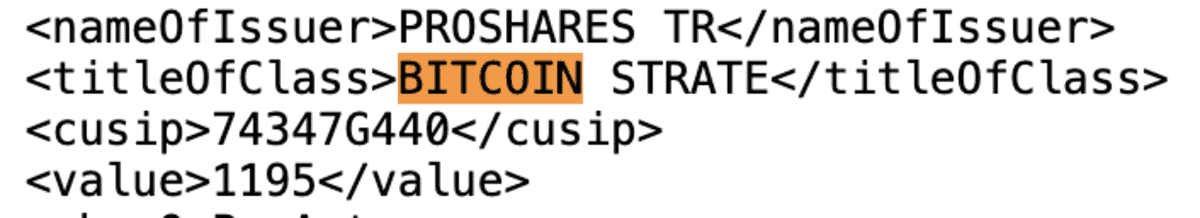

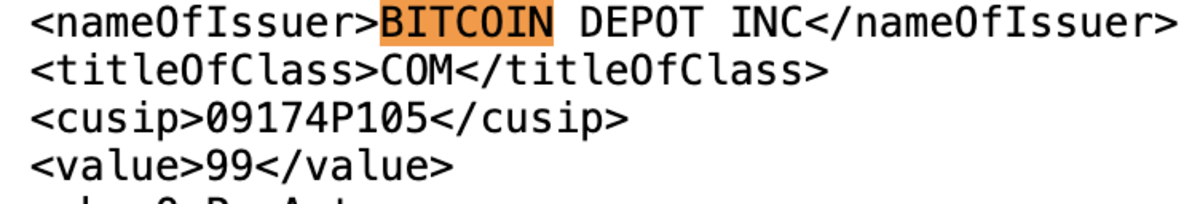

According to the filing, Wells Fargo holds positions in Grayscale’s spot Bitcoin ETF, ProShares Bitcoin Strategy futures ETF, and shares in Bitcoin Depot Inc., marking a significant entry into the Bitcoin market. Spot Bitcoin ETFs make it possible for financiers to get direct exposure to Bitcoin’s rate motions without straight owning the possession, making them a popular option amongst institutional financiers looking for a more regulated financial investment car for BTC.

The news of Wells Fargo’s spot Bitcoin ETF direct exposure comes amidst a more comprehensive pattern of institutional adoption of Bitcoin, with numerous significant banks and banks checking out methods to integrate BTC into their offerings and get direct exposure to the possession.

Earlier today, financial investment company giant Susquehanna International Group, LLP exposed in an SEC filing that it holds $1.8 billion in spot Bitcoin and other Bitcoin ETFs, signing up with the wave of enormous banks revealing their direct exposure to BTC.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.