Bitcoin miners have actually constantly been a reputable sign of the total belief within the marketplace. By tracking their revenues and actions, we can get a sense of where the cost of BTC may head next. In this post, we’ll check out the current patterns in Bitcoin mining, how miners are responding to existing market conditions, and what we can gain from crucial signs to determine how Bitcoin miners are placing themselves for the coming weeks and months.

State of Miner Earnings

One of the very best methods to evaluate Bitcoin miner belief is to analyze their revenues in relation to historic information. This can be done utilizing The Puell Multiple, which determines existing miner revenues versus the annual average from the previous year.

As of the current information, the Puell Multiple is hovering around 0.8, suggesting miners are making 80% of what they were making typically over the previous year. This is a significant enhancement from a couple of weeks ago when the multiple was as low as 0.53, showing miners were making simply over half of their previous year’s average.

This considerable drop previously in the year likely put monetary pressure on numerous miners. However, regardless of these difficulties, the truth that the Puell Multiple is recuperating recommends that the outlook for miners may be enhancing.

Hashrate and Network Growth

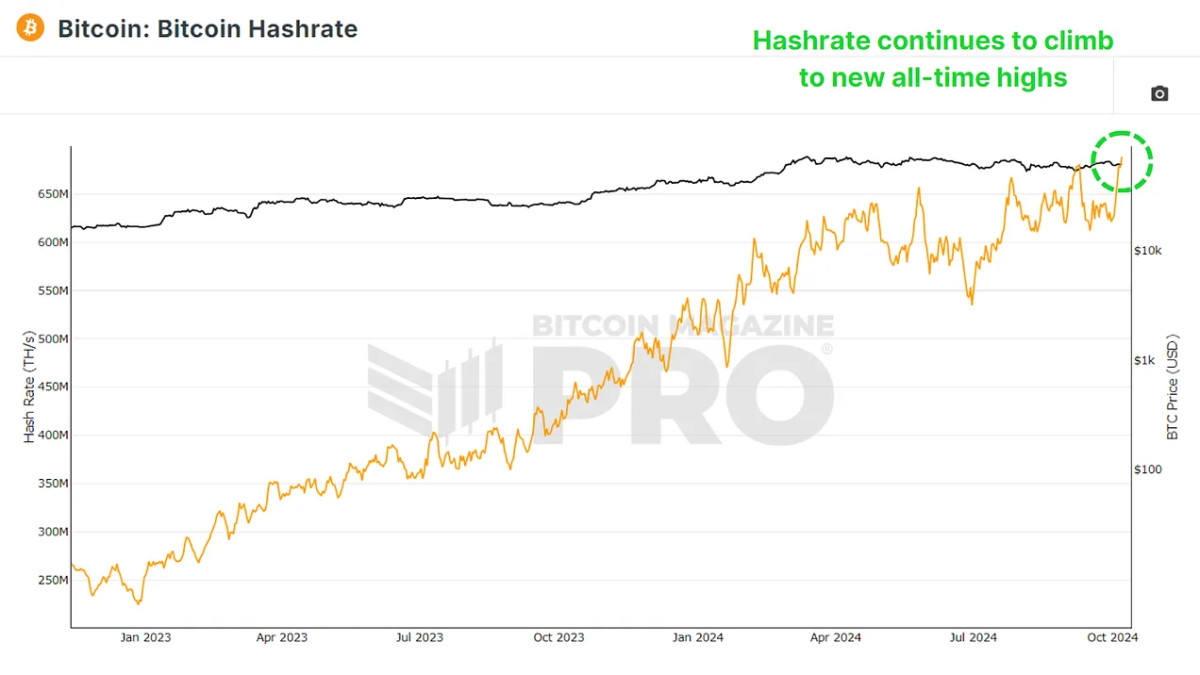

Even though revenues are down, there are no indications of miners leaving the network. In truth, Bitcoin’s hashrate, which is the overall computational power utilized to protect the network, has actually been gradually increasing. This rise in hashrate suggests that more miners are going into the network or existing miners are updating their devices to complete for block benefits.

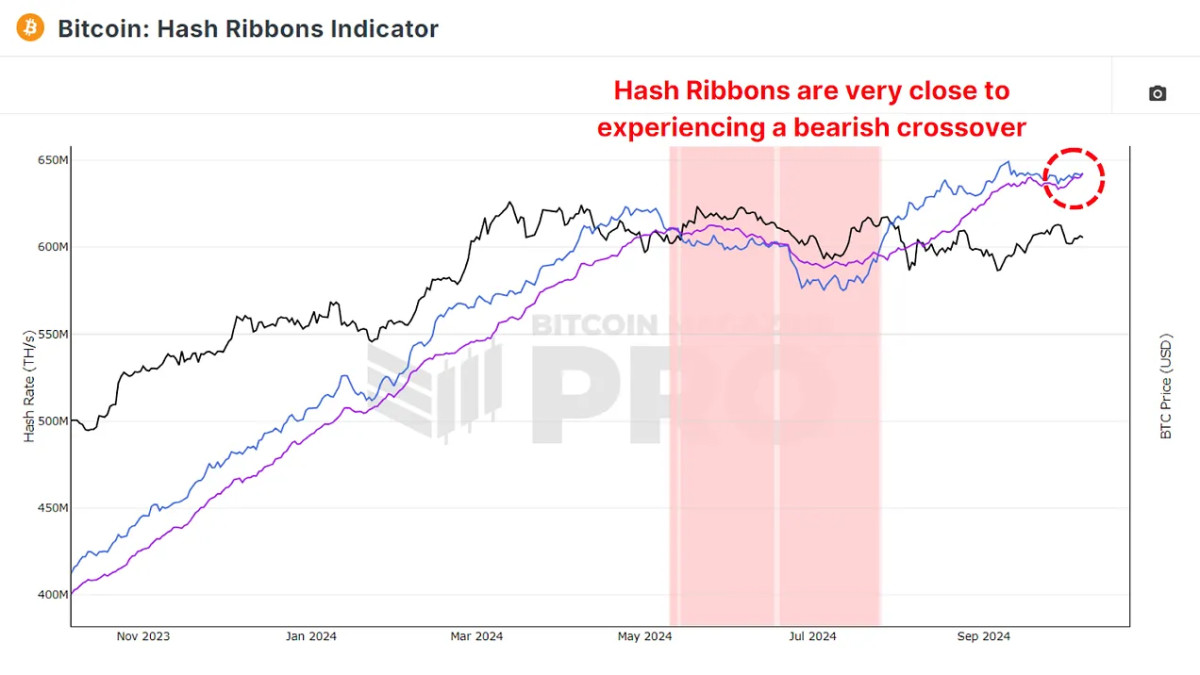

However, taking a look at the Hash Ribbons Indicator, which tracks the 30-day (blue line) and 60-day (purple line) moving averages of Bitcoin’s hashrate, these 2 averages have actually been getting closer to crossing, which might possibly show a bearish outlook for the short-term. When the 60-day average increases above the 30-day average, it traditionally indicates miner capitulation, a time when miners, under monetary tension, shut down their devices.

Until we see a bearish crossover, there’s no instant indication of bearishness. One favorable is that each time this occurs, it has actually been followed by a duration of build-up, which normally precedes an increase in Bitcoin costs. Investors typically think about these capitulation durations fantastic chances to purchase BTC at lower costs.

How Much Are Miners Making?

While we’ve gone over miner revenues in relation to Bitcoin’s cost, another crucial aspect is the Hashprice, the quantity of BTC or USD miners can make for each terahash (TH/s) of computational power they add to the network.

Currently, miners make roughly 0.73 BTC per terahash, or about $45,000 in USD terms. This quantity has actually been gradually reducing in the months following the current Bitcoin cutting in half occasion, where miners’ block benefits were halved, lowering their success. Despite these difficulties, miners are still increasing their hashrate, which recommends they’re banking on future BTC cost gratitude to make up for their lower revenues.

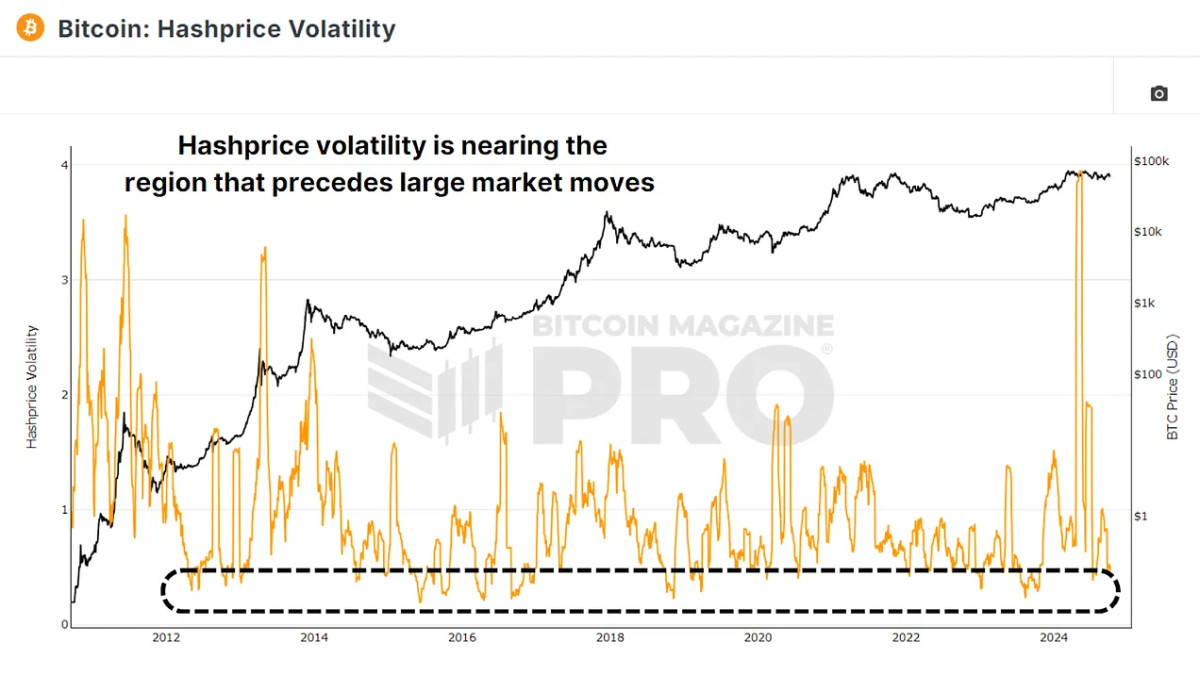

One of the most fascinating metrics to see is the Hashprice Volatility, which tracks how steady or unpredictable miner revenues are over time. Historically, durations of low hashprice volatility have actually preceded considerable cost motions for Bitcoin. As of the current information, hashprice volatility has actually started to drop once again, recommending we might be nearing a duration of significant cost motion for Bitcoin.

Conclusion

Bitcoin miner revenues are down compared to a historic average post-halving, however they’re recuperating from a current considerable low. Bitcoin’s hashrate is still climbing up; suggesting miners are putting more computational power into the network regardless of lower success. The hashprice continues to drop, however miners stay positive, most likely due to anticipated future cost gratitude. Hashprice volatility is falling, traditionally showing that a big relocation in BTC’s cost might be impending.

Bitcoin miners appear to be bullish about the long-lasting capacity of BTC, regardless of existing difficulties. If existing metric patterns hold, we might be on the brink of a substantial cost motion, with the majority of signs pointing towards a favorable outlook.

For a more thorough check out this subject, take a look at a current YouTube video here:

What Do Bitcoin Miners Expect Next?

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.