Over the final a number of years, the variety of digital currencies has skyrocketed. While a few of these have developed substantial market capitalizations and carved out their very own distinctive niches, few have proven promise for providing customers a excessive stage of privateness and fungibility.

Bitcoin, which had its genesis block mined in 2009, was the primary digital currency to scale. While many early adopters took curiosity in bitcoin due to its promise of privateness, the digital currency failed to offer this profit, as events can study the transactions recorded on bitcoin’s blockchain to get a way of precisely what an individual or entity has bought.

In the years following bitcoin’s launch, builders have created privacy-oriented digital currencies together with Dash and Monero. Both of those use revolutionary applied sciences to assist enhance the probabilities of their customers remaining nameless.

Dash leverages a way referred to as “CoinJoin”, through which a number of customers put funds into the identical transaction as a way to enhance the probabilities of privateness. Alternatively, Monero harnesses ring signatures to scale back the possibility of detection.

Both of those cryptocurrencies have made nice progress towards realizing the aim of nameless transactions, and Monero has acquired widespread adoption in the dead of night net.

However, Zcash’s expertise seemingly offers customers the power to get pleasure from a fair better stage of privateness. By permitting customers to stay nameless, Zcash can present them with better fungibility.

This is as a result of many digital currency transactions depend on the usage of private keys – strings of letters and numbers that establish a consumer. An tackle can develop into hooked up to a number of transactions over time, making it straightforward for associates, household, entrepreneurs and even authorities authorities to be taught extra about an individual’s buying traits.

And if a consumer’s personal secret is hooked up to sure transactions, some events could refuse to simply accept his or her cash. This is the place Zcash is available in.

What is Zcash?

Zcash leverages zero-knowledge proof constructions referred to as zk-SNARKs, which permit two customers to alternate info with out revealing their identities. While the bitcoin blockchain incorporates information of the individuals in a transaction, in addition to the quantity concerned, Zcash’s blockchain exhibits solely transaction happened, not who was concerned or what the quantity was.

Zcash is the results of steady efforts by builders to create cryptographic protocols that supply better privateness. Zooko Wilcox has based and served as CEO of each Zcash and the Zerocoin Electric Coin Company, which created a protocol named Zerocoin between 2013 and 2014.

The builders concerned began the Zerocoin venture to handle the safety limitations of bitcoin. The protocol they created allowed customers to transform bitcoin to zerocoins, which offered a better stage of anonymity by concealing the origin of a cost. The protocol allowed customers to separate up or alternatively merge zerocoins, and likewise convert them again to bitcoins.

More lately, the aforementioned builders collaborated with cryptographers from MIT, Tel Aviv University and The Technion (Israel Institute of Technology) to create Zerocash – an improved protocol that offered funds with better privateness than provided by Zerocoin and has since been developed into the cryptocurrency Zcash.

Zerocash affords zerocoins, which assist customers insure privateness, in addition to basecoins, which would not have the additional privateness options.

Under the Zerocash protocol, customers have the power to hide each the senders and recipients concerned in transactions, in addition to the quantities transmitted. The Zcash employees refrain from describing the brand new expertise as nameless, though generally, the expertise has that high quality.

One main profit that has stemmed from this larger stage of anonymity is larger fungibility.

Why fungibility issues

Fungibility, the benefit with which models of a sure asset might be substituted for each other, is vital as a result of it ensures that one individual’s cash is nearly as good as one other’s. When historical past exists for cash, that cash might not be accepted for all types of transactions.

For instance, if a vendor accepts digital currency as cost for his or her items, however can simply monitor the historical past of the currency it accepts, the seller can merely reject cost from sure would-be prospects based mostly on their prior buying habits.

‘Blacklisting’ cash

Bitcoin customers have already encountered challenges stemming from the general public nature of the blockchain. Some bitcoin exchanges have “blacklisted” or refused to simply accept sure bitcoins after vital quantities of the cryptocurrency have been stolen from wallets.

When sure cash are blacklisted on this method, customers are given an extra burden of confirming the origin of those cash. Past that, requiring customers to confirm a coin’s consumer historical past might produce extra issues, for instance customers discovering themselves unable to make use of a selected coin due to another person’s previous actions.

Security issues

While Zcash’s cryptography is bleeding-edge, it’s “highly experimental” and “relatively weak,” Bitcoin Core developer Peter Todd wrote in a blog post. He additional elaborated on his skepticism, writing:

“[I]f zk-SNARKS turned out to be totally broken, unlike more mainstream crypto, it just wouldn’t be all that surprising.”

Todd went into additional element:

“There appears to be uncertainty about the strength of the actual parameters chosen for Zcash’s crypto,” he stated. “The menace right here is that an attacker might be able to create pretend zk-SNARK proofs by breaking the crypto straight, even with out getting access to the trusted setup backdoor.

Technologists have additionally identified that challenges might come up on account of the ‘ceremony’ that was used to create SNARK public parameters. Developing these parameters, that are numbers with a “particular cryptographic construction which are identified to the entire individuals within the system,” basically requires making a public/personal keypair after which destroying the personal key.

The ceremony, which is formally referred to as a multi-party computation protocol, concerned six individuals creating particular person “shards” of the personal/public keypair after which burning them to DVDs.

Participants, together with Todd, adopted directions contained in a document referred to as “Zcash Multi-party Computation Instructions” to create these particular person shards. This doc, which was acquired by CoinDesk, gives technical necessities for the used, in addition to directions for downloading the wanted software program and burning the shards to DVDs.

After following this course of, the six individuals destroyed their shards of the personal key and mixed the shards of the general public key to create the SNARK public parameters. ZCash referred to the personal key shards as “toxic waste”.

In reference to the ceremony, Zcash stated that:

“If that process works – i.e. if at least one of the participants successfully destroys their private key shard — then the toxic waste byproduct never comes into existence at all.”

Following the ceremony, the individuals proceeded to destroy the computer systems used to create the shards with the intention of stopping anybody from utilizing the keystrokes entered into these computer systems to create counterfeit Zcash currency (which works by the token image ZEC) that customers can not establish as being pretend.

This strategy comes with a number of drawbacks. For starters, there isn’t any solution to show that the six individuals didn’t conspire collectively to maintain the general public key. Past that, they may have been compromised in some way, leading to an outdoor occasion receiving the knowledge wanted to create one other public key.

Individuals all for creating counterfeit Zcash tokens might doubtlessly recuperate the keystrokes from the computer systems used within the ceremony by means of conventional cameras, radio alerts, satellites and different strategies, said Todd.

If they may recreate the aforementioned ceremony with out lacking something, it might give them the power to create counterfeit currency. Because all Zcash transactions contain zero-knowledge transfers, customers can be unable to tell apart between counterfeit Zcash cash and ones created by means of respectable mining.

How the market works

While ZEC is much newer to the scene than some digital currencies like bitcoin, its market features similarly. Traders can purchase and promote it outright by means of exchanges like Poloniex and Kraken.

ZEC has been obtainable for commerce since 28th October, 2016, when the Zcash genesis block was mined and the primary tokens grew to become alternate listed.

Before ZEC tokens started buying and selling on exchanges, buyers might purchase or promote Zcash futures on BitMEX, the place they commerce underneath the ZECZ16 contract. This contract, which went live on BitMEX 15th September, makes use of ZEC/XBT because the underlying currency pair. Traders can use these futures to both speculate on the long run worth of Zcash or hedge their current holdings of ZEC tokens.

Before futures buying and selling grew to become obtainable, events might achieve publicity to Zcash tokens by mining them.

Mining Zcash

Like many different digital currencies, Zcash affords events the power to mine blocks. The Zerocash protocol harnesses a proof-of-work algorithm which depends on how a lot RAM a miner owns.

On ninth September, Zcash introduced the first beta release of the Zcash reference implementation (v1.Zero.Zero-beta1), which it deployed to the testnet. All cash mined utilizing this software program remained testnet cash, and due to this fact had no financial worth, till Zcash’s official launch in October.

Following this launch, the digital currency attracted a tight-knit group of builders. On 27th September, Zcash introduced that it was hosting a problem whereby opponents might submit new methods for mining the currency. These individuals got till 27th October to offer new potential strategies.

On fifth October, hosted mining agency Genesis Mining confirmed its assist for the privacy-focused digital currency when it announced that it might quickly permit prospects to buy miners operated by Genesis for the sake of mining Zcash.

Unique mining mannequin

Zcash’s provide mannequin is moderately just like that of bitcoin, though it has some key variations. Like bitcoin, the Zcash protocol caps the full variety of tokens at 21 million. In addition, its mining reward is minimize in half roughly each 4 years, similar to bitcoin.

One main distinction that units Zcash mining aside is that 10% of the 21m models mined utilizing the Zerocash protocol will go to Zcash’s stakeholders, ie: its founders, staff, buyers and advisors. This is named the “Founder’s Reward“.

The stakeholders won’t obtain this reward in a linear vogue. In the start, the protocol ends in the creation of 50 ZEC each 10 minutes, with 20% going to the founders and the rest going to the miners. Every 4 years, this mining incentive might be minimize in half, however 100% of this reward will go the miners after the primary 4 years.

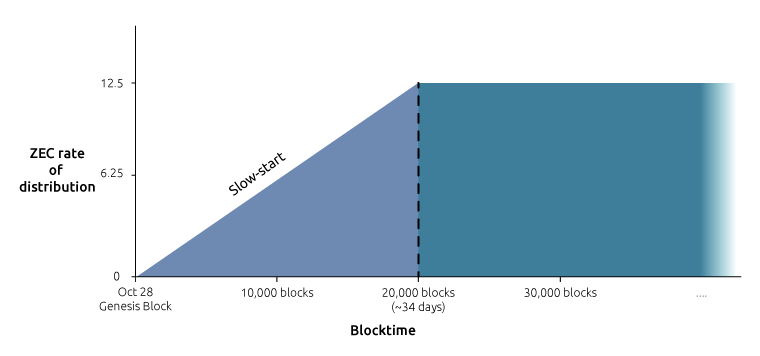

Slow-start mechanism

Another vital distinction is that the Zerocash protocol harnessed a slow-start mechanism, which impacted the inducement offered for the primary 20,00Zero blocks (mined over roughly 34 days). The rationale behind taking this strategy was managing the danger of the protocol having a “major bug or security vulnerability.” If such an issue was found, the slow-start mechanism would assist scale back its influence.

Pursuant to this mechanism, the mining incentive slowly elevated till it reached 12.5 BTC on the 20,000th block. The charge of enhance was akin to the primary 20,00Zero blocks would create a complete mining reward of 125,00Zero, half as a lot because the 250,00Zero it might be if all of them offered an incentive of 12.5 ZEC every.

The Zerocash protocol scheduled the following halving for the 850,000th block, at which level the reward would lower to six.25 ZEC.

Price volatility

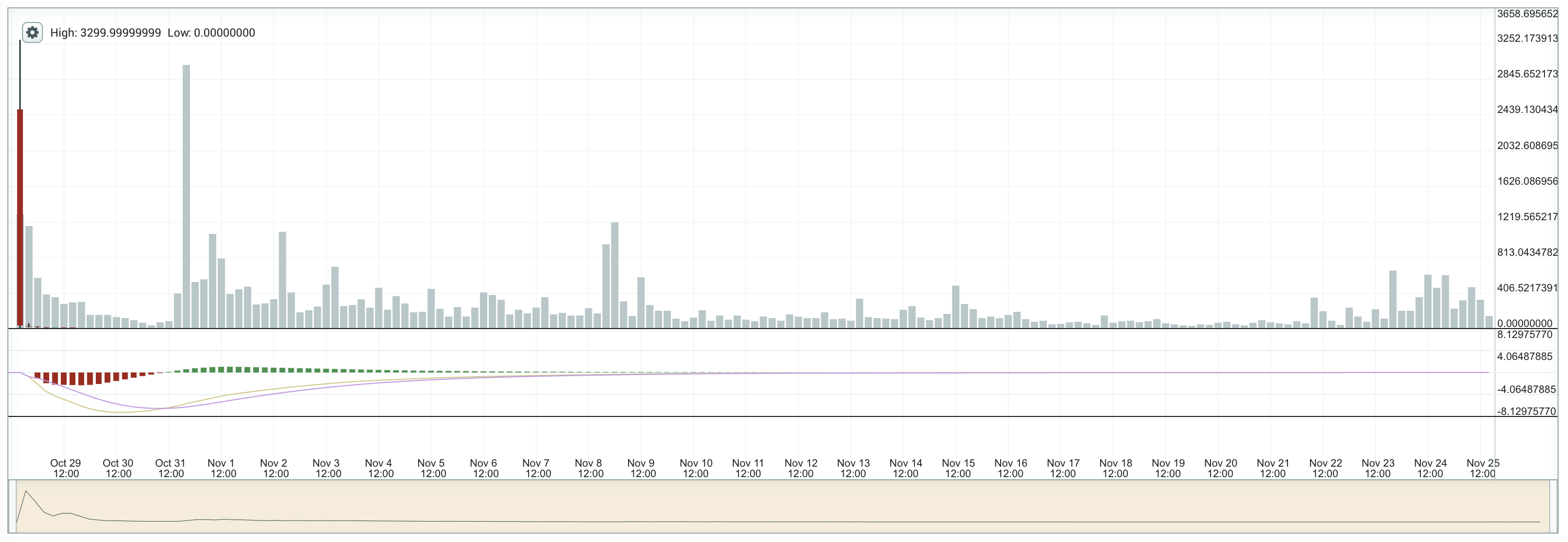

Several elements have mixed to assist gasoline value volatility in ZEC. The cryptocurrency loved very sturdy demand shortly after its launch, leading to its value surging to roughly three,300 BTC (greater than $2 million) on its first day of buying and selling, in keeping with Poloniex. However, ZEC shortly moved within the different course, falling to 48 BTC the identical day.

By 20:15 UTC on 23rd November, ZEC was buying and selling at Zero.097 BTC ($71.82), lower than one-tenth of a bitcoin, in keeping with extra Poloniex information.

These sharp value fluctuations happened after BitMEX Zcash futures skilled sharp appreciation main as much as the digital currency’s 28th October launch, which surged from as little as Zero.Zero27 BTC ($18.50) on 15th September to Zero.78 BTC ($535) on 28th October, BitMEX figures reveal. However, the futures had plunged to Zero.049 BTC ($36.17) as of 15:00 UTC.

In addition to the Zerocash protocol’s zk-SNARKS being largely untested, the digital currency had but to be adopted by any platforms which may use it as a currency. As a outcome, its worth was purely speculative on the time.

Going ahead, Zcash costs will rely on provide and demand, with the previous steadily rising and the latter unsure. Fortunately, the volatility that goes together with hypothesis has created alternatives for merchants, who may put money into Zcash in an try to show a revenue.

Disclosure: CoinDesk is a subsidiary of Digital Currency Group, which has an possession stake in Zcash.

This article will not be supposed to offer, and shouldn’t be taken as, funding recommendation.

Coins picture through Shutterstock

Source link

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.